Palantir Stock: A 2024 Investment Analysis

Table of Contents

Investing in Palantir stock in 2024 presents a compelling yet complex proposition. While the company boasts a unique position in the big data analytics market, recent market performance has been volatile. Understanding Palantir's strengths and weaknesses is crucial before considering a 2024 Palantir investment. This article provides a comprehensive analysis of Palantir Technologies and its stock, aiming to help you determine if it's the right investment for your portfolio. Palantir stock, with its focus on government and commercial clients, has shown significant growth potential, but also carries inherent risks. This 2024 Palantir analysis will explore these aspects in detail.

2. Main Points:

2.1 Palantir's Business Model and Revenue Streams:

Palantir's business model revolves around providing advanced data analytics platforms to government and commercial clients. This dual-pronged approach creates diverse revenue streams, but also presents specific challenges.

H3: Government Contracts: Government contracts form a substantial part of Palantir's revenue. These often involve long-term agreements, providing revenue predictability. However, reliance on government spending can introduce political and budgetary risks.

- Key government clients: Numerous agencies within the US Department of Defense, intelligence communities, and other government bodies globally.

- Contract renewal rates: Palantir has demonstrated a strong track record of contract renewals, indicating client satisfaction and a recurring revenue base.

- Potential for increased government spending on data analytics: The increasing emphasis on national security and data-driven decision-making suggests continued growth in this sector. This directly impacts Palantir government revenue and the overall Palantir investment outlook.

H3: Commercial Partnerships: Palantir's push into the commercial sector is crucial for long-term growth. While initially slower than government adoption, commercial partnerships are showing promising signs of scaling.

- Examples of successful commercial partnerships: Partnerships across various sectors, including finance, healthcare, and manufacturing, demonstrate the platform's adaptability.

- Industry sectors targeted: Palantir is actively pursuing opportunities in sectors with large data sets and complex operational needs.

- Challenges faced in the commercial market: Competition is fierce, and convincing businesses to adopt a new data analytics platform can be challenging. This is a key aspect to consider when evaluating a Palantir investment.

H3: Foundry Platform: Palantir Foundry, the company's flagship platform, is central to its future. It's a comprehensive data integration and analytics solution that powers both government and commercial offerings.

- Explanation of Foundry's capabilities: Foundry facilitates data integration from diverse sources, enabling advanced analytics and improved decision-making.

- Its role in data integration and analytics: Foundry's capabilities are key to Palantir's value proposition, allowing clients to unlock insights from their data.

- Potential for future platform expansion: Ongoing development and expansion of Foundry's functionalities will be crucial for attracting new clients and enhancing existing partnerships. This is a major driver of future Palantir revenue growth.

2.2 Financial Performance and Growth Prospects:

Analyzing Palantir's financial performance is crucial for any Palantir investment strategy.

H3: Revenue and Profitability: Palantir has demonstrated consistent revenue growth, though profitability margins remain a focus area. Analyst forecasts vary significantly, highlighting the uncertainty surrounding future financial performance.

- Key financial metrics (revenue, earnings, growth rates): Review publicly available financial statements to access the most up-to-date metrics.

- Comparison to industry competitors: Benchmarks against competitors like Snowflake, Databricks and other data analytics companies are needed for a complete picture.

- Analyst forecasts for future performance: Examine predictions from reputable financial analysts, but remember these are not guarantees.

H3: Debt and Cash Flow: Palantir's financial health is relatively strong with significant cash reserves. However, understanding its debt levels and cash flow generation is vital.

- Analysis of debt-to-equity ratio: A low debt-to-equity ratio indicates financial stability.

- Free cash flow: Positive free cash flow suggests Palantir's ability to generate cash from operations, funding growth and potentially returning value to shareholders.

- Capital allocation strategy: How Palantir manages its capital will impact future growth and profitability.

2.3 Risks and Challenges:

Investing in Palantir stock involves navigating several potential risks.

H3: Competition: The data analytics market is highly competitive. Palantir faces significant competition from both established players and emerging startups.

- Analysis of major competitors: Identify key competitors and their market share, evaluating their strengths and weaknesses relative to Palantir.

- Potential for market share erosion: This is a significant risk, requiring close monitoring of competitive dynamics.

H3: Dependence on Government Contracts: Palantir's reliance on government contracts exposes it to political and budgetary risks. Changes in government priorities or budget cuts could significantly impact revenue.

- Discussion of political risks: Changes in government administration or policy could affect contract awards and renewals.

- Potential for contract cancellations: While unlikely, the possibility of contract cancellations exists and should be considered.

- Diversification strategies: Palantir's efforts to diversify into the commercial sector are critical to mitigating this risk.

H3: Valuation: Determining Palantir's fair market valuation is challenging, given its rapid growth and the volatility of the technology sector.

- Price-to-sales ratio: Compare Palantir's valuation to industry peers using relevant metrics.

- Price-to-earnings ratio: Analyze the price-to-earnings ratio to assess the stock's valuation relative to its earnings.

- Comparison to industry valuations: Benchmark Palantir's valuation against similar companies to gauge its relative attractiveness.

3. Conclusion: Investing in Palantir Stock in 2024 – A Final Verdict

Palantir presents a compelling investment opportunity, fueled by its innovative platform and growing market presence. However, its reliance on government contracts and intense competition introduce significant risks. A balanced approach is needed, considering both the potential for high growth and the inherent uncertainties. While the 2024 Palantir outlook appears promising, thorough due diligence is crucial. Based on our analysis, a cautiously optimistic outlook is warranted. While we don't provide specific buy/sell recommendations, this Palantir stock analysis should empower you to make informed decisions.

Conduct your own thorough research, considering your individual risk tolerance and investment goals. Investing in Palantir, or any stock for that matter, should be part of a well-diversified investment portfolio. Remember to carefully consider a Palantir investment strategy based on your own financial assessment and risk profile. Conducting further research on Palantir Stock Analysis and considering various 2024 Palantir investment scenarios is highly recommended.

Featured Posts

-

Wynne Evans Hints At Showbiz Return After Revealing Serious Illness

May 09, 2025

Wynne Evans Hints At Showbiz Return After Revealing Serious Illness

May 09, 2025 -

Investigation Leads To Nc Daycare License Suspension

May 09, 2025

Investigation Leads To Nc Daycare License Suspension

May 09, 2025 -

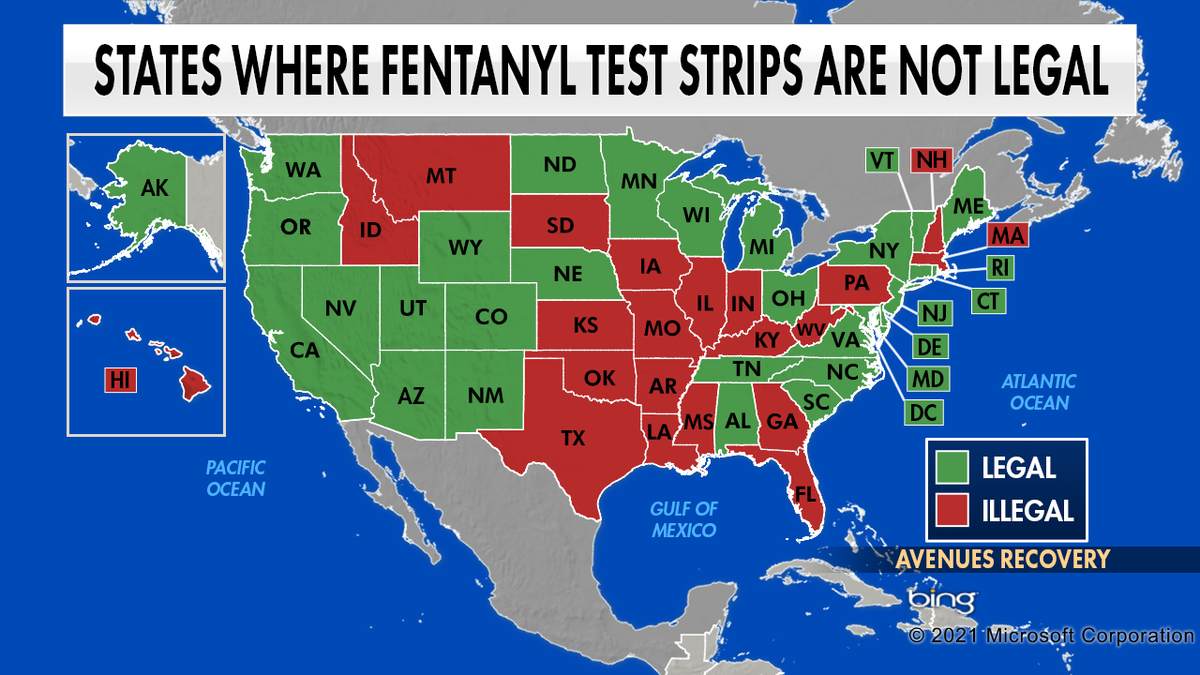

U S China Trade Talks The Unexpected Role Of The Fentanyl Crisis

May 09, 2025

U S China Trade Talks The Unexpected Role Of The Fentanyl Crisis

May 09, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 09, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 09, 2025 -

Is Young Thugs New Music A Public Apology

May 09, 2025

Is Young Thugs New Music A Public Apology

May 09, 2025