Palantir Stock: Assessing The Risks And Rewards Of A Potential 40% Gain By 2025

Table of Contents

Palantir's Growth Potential and Market Opportunities

Palantir's growth trajectory hinges on several key factors. Its success depends on navigating a complex landscape of government contracts, commercial market penetration, and continuous technological innovation.

Government Contracts and Expanding Government Spending: Palantir's substantial reliance on government contracts is a double-edged sword. Future projections for government spending on data analytics and national security are crucial. Increased budgets and a growing need for advanced data solutions could significantly benefit Palantir.

- Key Government Contracts: Palantir has secured significant contracts with various government agencies, including the CIA and other defense departments. Analyzing these contracts' renewal rates and potential extensions is vital for assessing future revenue streams.

- Government Budget Allocations: Analyzing government budget allocations for intelligence, defense, and cybersecurity technologies will reveal insights into the potential growth of this sector. Increased spending would translate into increased opportunities for Palantir.

- Competitive Landscape: Understanding Palantir’s position against competitors vying for similar government contracts is critical. Analyzing their strengths and weaknesses helps determine Palantir’s competitive advantage and potential for market share growth.

Commercial Market Penetration and Adoption: Expanding its commercial client base is vital for Palantir's long-term sustainability. The rate of adoption of its data analytics solutions in the private sector will directly impact future growth.

- Successful Commercial Partnerships: Examining successful commercial partnerships and their impact on revenue and brand recognition provides a valuable indication of market penetration success.

- Market Trends and Adoption Rates: Market research and analysis of adoption rates of similar data analytics solutions provide a benchmark for assessing Palantir's commercial progress. Faster-than-expected adoption would significantly boost the projection for a 40% gain.

- Potential for New Commercial Clients: Identifying potential new commercial clients in sectors like finance, healthcare, and manufacturing helps assess the scalability and long-term growth potential of Palantir’s commercial arm.

Technological Innovation and Product Development: Continuous innovation is key to maintaining a competitive edge. Palantir’s R&D efforts and potential for new product releases will play a significant role in its future performance.

- New Product Features and Releases: The launch of innovative features and new products strengthens Palantir's value proposition, attracting new clients and increasing revenue.

- Competitor Analysis: Keeping a close eye on technological advancements from competitors is crucial. Palantir needs to continually innovate to stay ahead of the curve.

- Intellectual Property: Protecting and leveraging its intellectual property is crucial for maintaining a competitive edge and maximizing profitability.

Risks Associated with Investing in Palantir Stock

Despite the potential for growth, investing in Palantir stock involves significant risks. A thorough understanding of these risks is crucial before making any investment decisions.

Dependence on Government Contracts: Palantir's heavy reliance on government contracts exposes it to significant risks. Budget cuts, shifting political priorities, and regulatory changes can dramatically impact its revenue.

- Contract Cancellations or Delays: Analyzing past instances of contract cancellations or delays will illuminate the potential impact of such events on Palantir’s financial stability.

- Political Risk Factors: Political changes and shifts in government priorities can create uncertainty and risk for government contracts.

- Diversification Strategies: Palantir needs to actively pursue diversification strategies to mitigate this risk.

Competition and Market Saturation: The data analytics market is becoming increasingly competitive. New entrants and existing players could challenge Palantir's market share.

- Key Competitors: Identifying key competitors and their strengths allows for a comprehensive assessment of the competitive landscape.

- Market Share and Competition Intensity: Analyzing market share trends and competition intensity reveals Palantir’s competitiveness and potential for market growth.

- Potential for Price Wars: The possibility of price wars or market consolidation could negatively impact Palantir's profitability.

Financial Performance and Profitability: Palantir's financial performance and profitability are critical factors in assessing its stock's potential. Analyzing key financial metrics is essential.

- Key Financial Metrics: Scrutinizing revenue growth, profit margins, and cash flow provides a comprehensive picture of Palantir’s financial health.

- Industry Benchmarks: Comparing Palantir's financial performance to industry benchmarks helps assess its relative strength and potential.

- Potential for Increased Profitability: Analyzing the potential for increased profitability through cost optimization and revenue growth is essential for a realistic projection of future performance.

Valuation and Price Target Analysis

To assess the potential for a 40% gain, a detailed valuation analysis is necessary.

Current Market Valuation and Stock Price: Understanding Palantir's current market capitalization and stock price provides a baseline for future projections.

Projected Growth Rates and Future Stock Price: Based on the analysis of growth potential and risks, a reasoned projection of Palantir's future growth rates can be developed. This projection should incorporate the various factors discussed above to justify – or refute – the potential for a 40% gain. Discounted Cash Flow (DCF) and comparable company analyses are valuable tools for creating these projections.

Comparison to Industry Peers: Comparing Palantir's valuation and growth potential to its competitors provides valuable context and allows for a more informed assessment.

Conclusion

Investing in Palantir stock presents a compelling opportunity with the potential for significant returns, including the possibility of a 40% gain by 2025. However, this potential is intertwined with substantial risks stemming from its reliance on government contracts, competitive pressures, and financial performance. Careful consideration of these factors is paramount. Before investing in Palantir stock, or any other volatile stock, conduct thorough due diligence, analyze the latest financial reports, and consider consulting with a qualified financial advisor. Remember, this analysis is not financial advice; responsible investment requires careful assessment of your own risk tolerance and investment goals. Investing in Palantir stock requires a keen understanding of the inherent volatility and the company’s long-term prospects.

Featured Posts

-

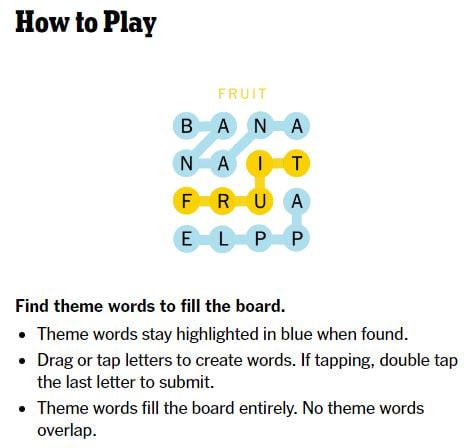

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025 -

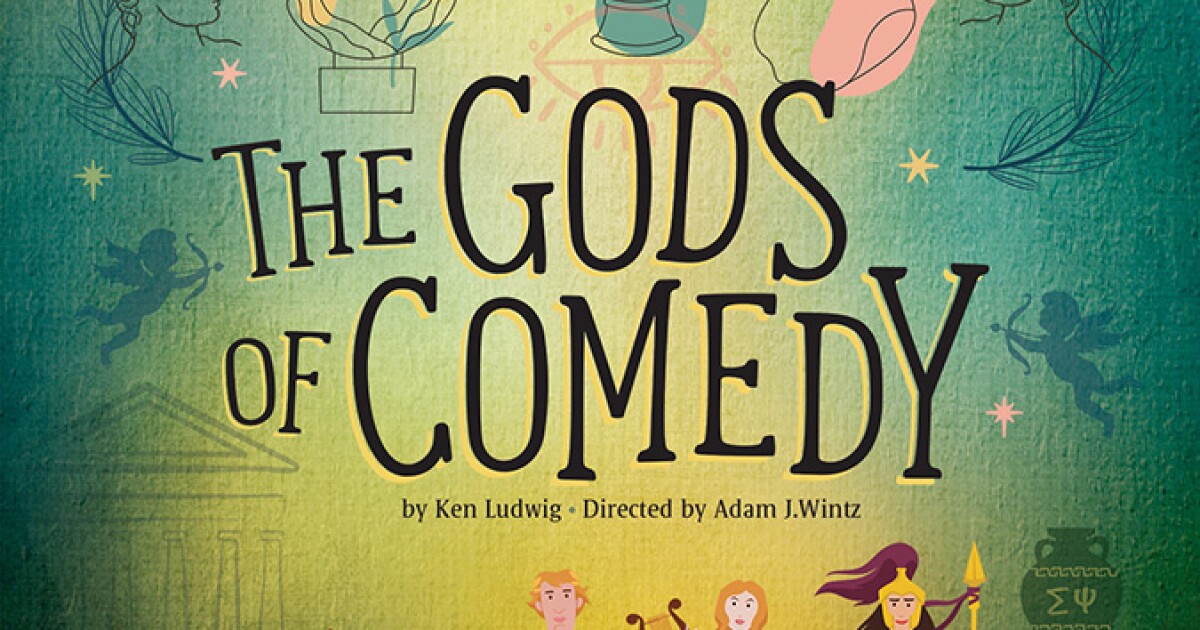

A Hilarious Farce St Albert Dinner Theatres Latest Production

May 10, 2025

A Hilarious Farce St Albert Dinner Theatres Latest Production

May 10, 2025 -

Show Of Support For Wynne Evans As He Addresses Accusations

May 10, 2025

Show Of Support For Wynne Evans As He Addresses Accusations

May 10, 2025 -

New Pope Leo Condemns Spread Of De Facto Atheism

May 10, 2025

New Pope Leo Condemns Spread Of De Facto Atheism

May 10, 2025 -

Predicting The Top Storylines For The Remainder Of The 2024 25 Nhl Season

May 10, 2025

Predicting The Top Storylines For The Remainder Of The 2024 25 Nhl Season

May 10, 2025