Palantir Stock: Buy Or Sell Before May 5th? Wall Street's Opinion

Table of Contents

Recent Palantir Stock Performance and Key Financial Indicators

Palantir Technologies (PLTR) has experienced a volatile ride recently. Its stock price has shown periods of significant growth punctuated by corrections, reflecting the inherent risks and rewards associated with investing in a growth-oriented technology company. Analyzing key financial metrics offers valuable insights into the company's performance and future potential. Understanding Palantir financials is key to any investment decision.

-

Q4 2023 earnings report highlights: (Insert actual data when available – e.g., revenue figures, EPS, and any significant announcements). Look for trends in revenue growth, profitability, and any changes in guidance provided by management.

-

Year-over-year revenue growth comparison: Compare Q4 2023 revenue to Q4 2022 and analyze the percentage growth. A consistently strong year-over-year growth in revenue growth Palantir signals a positive trajectory.

-

Profitability trends and future projections: Examine Palantir's profitability, focusing on metrics like operating margin and net income. Consider the company's projected profitability for the coming quarters and years. Are they on track to achieve their goals?

-

Key performance indicators (KPIs) and their impact on stock price: Consider key KPIs like customer acquisition cost, customer churn rate, and average revenue per user (ARPU). Analyze how these metrics correlate with the PLTR stock price fluctuations.

Wall Street Analyst Ratings and Price Targets

Wall Street's opinion on Palantir stock is far from unanimous. Analyst ratings vary, creating a diverse range of perspectives on the company's future performance. Tracking Palantir analyst ratings from major financial institutions offers valuable insights.

-

Analyst ratings from top firms like Goldman Sachs, Morgan Stanley, etc.: (Insert actual analyst ratings and their rationale from reputable sources, citing the sources). Note the divergence in opinions and the reasoning behind the ratings.

-

High and low price targets for Palantir stock: (Insert a range of price targets from different analysts). This range highlights the uncertainty surrounding the future stock price, emphasizing the need for thorough due diligence.

-

Reasons behind different analyst opinions (bullish vs bearish sentiment): Identify the factors contributing to bullish and bearish sentiment. Bullish analysts might point to strong growth prospects and government contracts, while bearish analysts might highlight profitability concerns or competitive pressures within the data analytics market. Understanding the "why" behind the Wall Street on Palantir consensus is essential.

Factors Influencing Palantir Stock Before May 5th

Several factors could significantly influence Palantir stock before May 5th. Investors need to carefully weigh these to make an informed decision.

-

Upcoming news or events impacting Palantir: Are there any anticipated product launches, partnerships, or regulatory changes that could affect the company's prospects? This includes upcoming earnings calls which can heavily influence the PLTR price target.

-

Geopolitical factors affecting the company's performance: Palantir's business is significantly tied to government contracts. Geopolitical events could influence government spending and thus impact the company's revenue streams.

-

Competitive landscape analysis within the data analytics market: Analyze the competitive landscape. How does Palantir stack up against its competitors? What are its strengths and weaknesses in this intensely competitive space?

Impact of Government Contracts on Palantir Stock

Government contracts represent a substantial portion of Palantir's revenue. Understanding the impact of these contracts is crucial for assessing the future of Palantir stock.

- Palantir Government Contracts: Analyze the current portfolio of government contracts and the potential for future contracts. Are there any risks associated with relying heavily on government contracts? Changes in government spending or shifts in political priorities can impact this revenue stream significantly. The influence of defense spending Palantir relies on is a key factor.

Conclusion

Whether to buy or sell Palantir stock before May 5th requires careful consideration of its recent performance, Wall Street's divided opinions, upcoming catalysts, and the inherent risks and opportunities associated with the company. The impact of Palantir Government Contracts is also a critical factor in this decision. While the potential for growth is evident, the volatility inherent in the tech sector necessitates thorough due diligence. Ultimately, whether to buy or sell Palantir stock before May 5th depends on your individual investment strategy and risk tolerance. However, by considering the factors outlined above, you can make a more informed decision regarding your Palantir stock investment. Remember to conduct thorough independent research before making any investment decisions.

Featured Posts

-

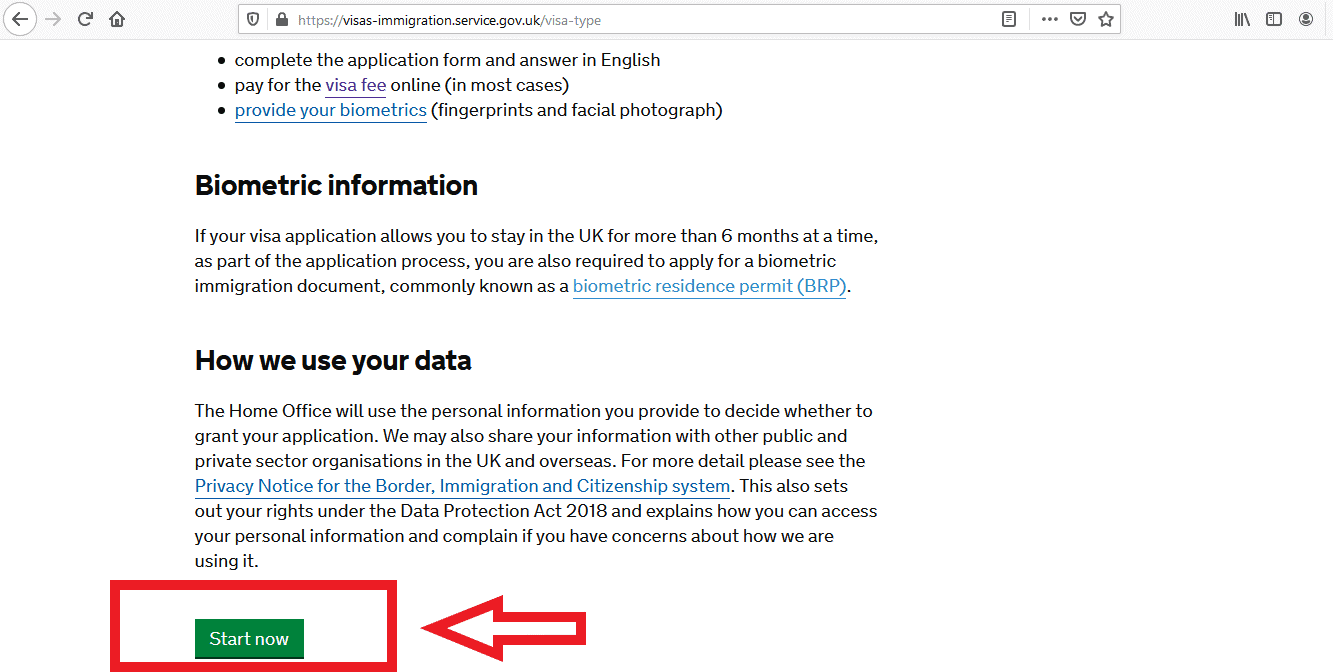

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 09, 2025

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 09, 2025 -

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 09, 2025

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 09, 2025 -

Pre May 5th Palantir Stock Analysis Should You Invest Now

May 09, 2025

Pre May 5th Palantir Stock Analysis Should You Invest Now

May 09, 2025 -

Knights Edge Wild In Overtime Barbashev The Hero Series Tied 2 2

May 09, 2025

Knights Edge Wild In Overtime Barbashev The Hero Series Tied 2 2

May 09, 2025 -

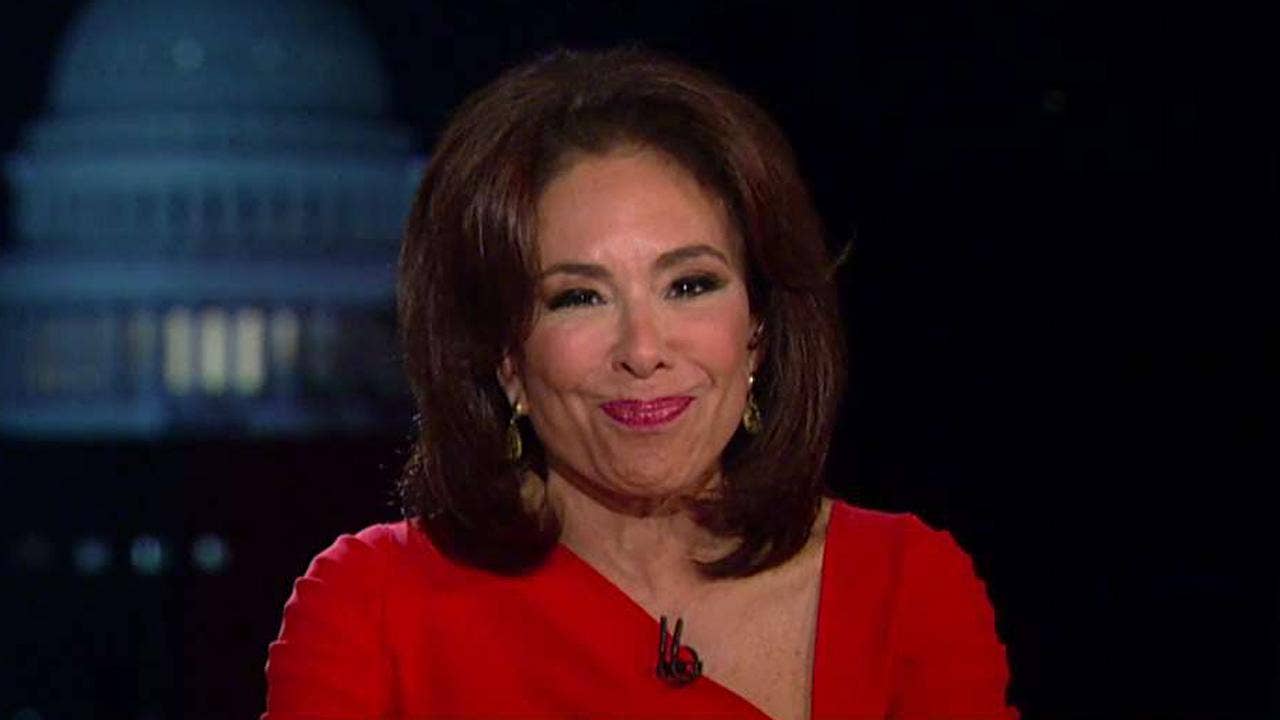

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 09, 2025

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 09, 2025