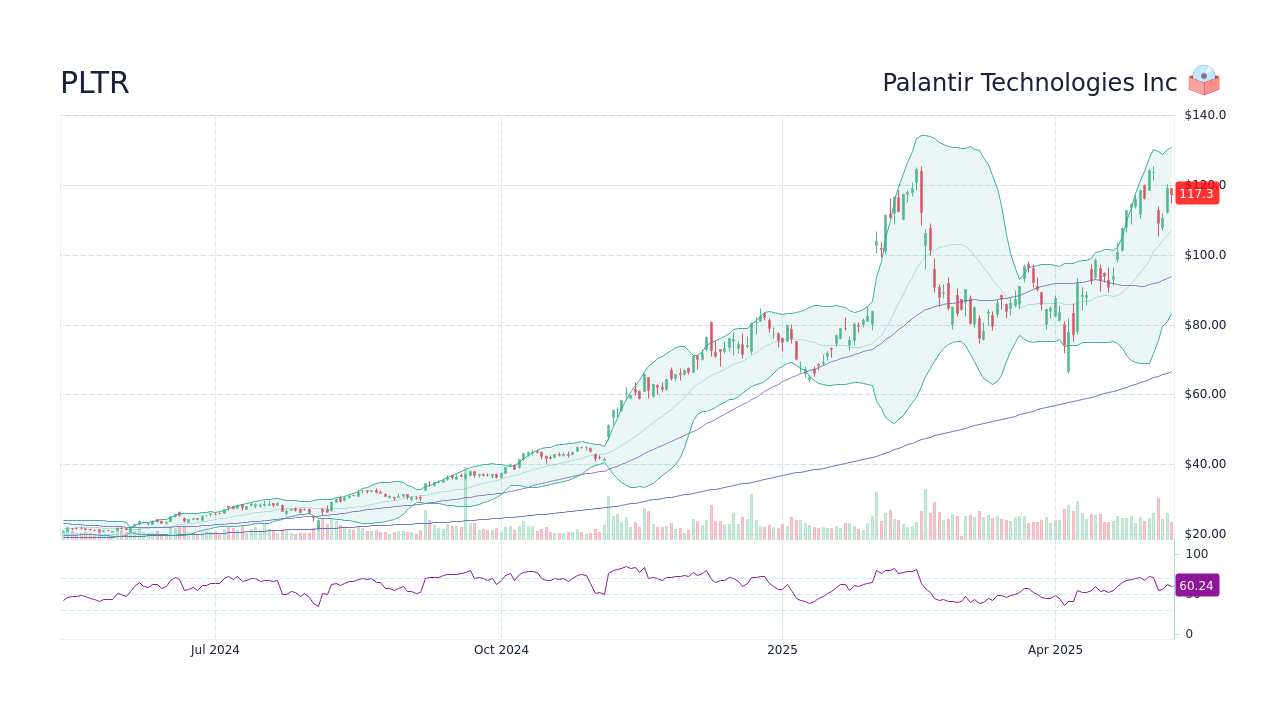

Palantir Stock Forecast Revised: A Deep Dive Into The Market Shift

Table of Contents

Analyzing Recent Palantir Performance and Key Financial Indicators

Analyzing Palantir's recent performance requires a close look at its key financial indicators. Understanding these metrics is crucial for any accurate PLTR stock prediction.

H3: Revenue Growth and Profitability

Palantir's revenue growth has been a point of focus for investors. While the company has shown significant growth in recent years, the rate of this growth, and its profitability, are subject to market fluctuations and require ongoing evaluation as part of any robust Palantir stock forecast.

- Q2 2024 Revenue: [Insert actual figures when available]. This represents a [percentage]% year-over-year increase/decrease.

- Operating Margin: [Insert actual figures when available]. This indicates [analysis of margin trend - improvement, stagnation, decline].

- Net Income: [Insert actual figures when available]. A key metric for assessing profitability and future Palantir stock prediction. This shows [analysis of net income trend].

H3: Government vs. Commercial Contracts

Palantir's revenue stream is split between government and commercial contracts. The balance between these two sectors significantly impacts its overall financial health and any long-term Palantir stock forecast.

- Government Contracts: [Percentage]% of Q2 2024 revenue. This sector offers stability but may be subject to budgetary constraints.

- Commercial Contracts: [Percentage]% of Q2 2024 revenue. This sector offers higher growth potential but also higher competition.

- Future Outlook: A shift towards a greater proportion of commercial contracts could signal higher future growth, but also increased risk, in the Palantir stock prediction.

H3: Key Partnerships and Strategic Initiatives

Strategic partnerships and internal initiatives are vital drivers influencing the Palantir stock forecast.

- Partnership with [Company Name]: This collaboration aims to [explain the partnership's impact on Palantir's offerings and market reach].

- Investment in [Technology/Initiative]: This demonstrates Palantir's commitment to [explain the strategic value of the investment to the future of the company].

- Future Partnerships: Potential partnerships with [mention potential partners and the potential positive impact on PLTR stock].

Factors Influencing the Revised Palantir Stock Forecast

Several external factors significantly influence the accuracy of any Palantir stock prediction.

H3: Macroeconomic Conditions

The broader economic climate directly impacts technology stocks, including Palantir.

- Inflation: High inflation can lead to reduced government and commercial spending, affecting Palantir's revenue growth.

- Interest Rate Hikes: Higher interest rates increase borrowing costs and can dampen investment in technology solutions.

- Economic Uncertainty: General economic instability can make investors hesitant, impacting the PLTR stock price.

H3: Geopolitical Events and Global Instability

Geopolitical events and global instability introduce uncertainty, which is a critical factor in a revised Palantir stock forecast.

- International Conflicts: These can impact government spending on defense and intelligence technologies, affecting Palantir's government contracts.

- Global Supply Chain Disruptions: These can lead to increased costs and delays in project delivery.

- Regulatory Changes: Changes in data privacy regulations can affect Palantir's operations in certain regions.

H3: Competition and Market Dynamics

The competitive landscape is another crucial element in any accurate Palantir stock prediction.

- Key Competitors: [List key competitors and briefly describe their strengths and weaknesses].

- Market Share: Palantir's market share in the [mention specific market segments] is [analyze market share trend].

- Competitive Advantages: Palantir's strengths lie in [mention its key competitive advantages such as its advanced data analytics capabilities, strong government relationships, etc.].

The Revised Palantir Stock Forecast and Potential Scenarios

Based on the analysis above, several scenarios are possible for Palantir's future stock performance.

H3: Bullish Case

A bullish Palantir stock prediction hinges on positive developments.

- Increased Government Contracts: Securing significant new government contracts could drive substantial revenue growth.

- Successful Expansion into New Markets: Penetration into new market sectors can unlock significant growth potential.

- Breakthroughs in AI and Data Analytics: Advances in AI and data analytics could enhance Palantir's offerings and increase demand.

H3: Bearish Case

A bearish Palantir stock prediction highlights potential risks.

- Increased Competition: Intensified competition could pressure margins and limit revenue growth.

- Slower-than-Expected Revenue Growth: Failure to meet revenue growth targets would negatively impact investor sentiment.

- Failure to Secure Major Contracts: Losing bids for significant contracts could stall growth and hurt the PLTR stock price.

H3: Neutral Case

A neutral Palantir stock prediction represents a more balanced outlook.

- Steady Growth: Maintaining consistent revenue growth and profitability.

- Maintaining Current Market Share: Successfully defending its existing market position against competitors.

- Effective Risk Management: Successfully navigating macroeconomic and geopolitical challenges.

Conclusion

This revised Palantir stock forecast highlights the complexity of predicting future performance. Several factors – from macroeconomic conditions and geopolitical events to competitive dynamics and Palantir's own strategic initiatives – all play a crucial role. Understanding these factors and considering both bullish and bearish scenarios is essential for any informed investment decision. The key takeaway is the need for ongoing monitoring of these factors to refine the Palantir stock prediction over time. Stay informed about the evolving Palantir stock forecast and make strategic investment decisions based on your own research. Remember that this analysis is not financial advice, and individual investment decisions should be based on thorough personal research and risk tolerance.

Featured Posts

-

Elizabeth Line Accessibility Addressing Wheelchair User Gaps

May 10, 2025

Elizabeth Line Accessibility Addressing Wheelchair User Gaps

May 10, 2025 -

Elizabeth Line Strike Dates And Affected Routes February And March

May 10, 2025

Elizabeth Line Strike Dates And Affected Routes February And March

May 10, 2025 -

Nhls Next Goal King 9 Players Who Could Surpass Ovechkin

May 10, 2025

Nhls Next Goal King 9 Players Who Could Surpass Ovechkin

May 10, 2025 -

0 1 Concarneau Cree La Surprise Face A Dijon En National 2

May 10, 2025

0 1 Concarneau Cree La Surprise Face A Dijon En National 2

May 10, 2025 -

Calls To Halt Farcical Misconduct Proceedings In Nottingham

May 10, 2025

Calls To Halt Farcical Misconduct Proceedings In Nottingham

May 10, 2025