Palantir Stock (PLTR) Before May 5th: Investment Risks And Rewards

Table of Contents

Understanding Palantir's Business Model and Recent Performance

Palantir's success hinges on two primary revenue streams: government contracts and commercial sector partnerships. A thorough understanding of both is crucial for a comprehensive PLTR stock analysis.

Government Contracts: The Backbone of Palantir's Revenue

Government contracts have historically formed the backbone of Palantir's revenue stream. However, reliance on this sector presents inherent risks:

- Dependence on Defense Spending: Fluctuations in government defense spending directly impact PLTR's revenue. Budget cuts or shifts in geopolitical priorities could negatively affect contract renewals and future opportunities. Keywords: government contracts, defense spending, PLTR revenue stream.

- Contract Renewals: Securing contract renewals is crucial for maintaining consistent revenue. Failure to do so could lead to significant revenue shortfalls. Keywords: contract renewals, PLTR revenue stability.

- Geopolitical Factors: International relations and political instability in regions where Palantir operates can impact contract awards and project timelines. Keywords: geopolitical risk, international relations, PLTR contracts.

Despite these risks, Palantir has demonstrated some mitigation strategies:

- Geographical Diversification: Palantir works with government agencies across various countries, reducing reliance on any single nation's budget. Keywords: geographical diversification, client diversification, risk mitigation.

- Diverse Client Portfolio: The company serves various government departments, lessening the impact of any single contract loss. Keywords: government clients, client portfolio diversification, revenue stability.

Commercial Sector Growth: A Key Driver of Future Performance?

Palantir's expansion into the commercial sector is vital for long-term growth and reducing reliance on government contracts. This involves offering its advanced data analytics platform as a Software as a Service (SaaS) solution. Keywords: commercial clients, software as a service (SaaS), PLTR growth.

However, this expansion presents its challenges:

- Intense Market Competition: Palantir faces competition from established players in the big data analytics market, such as Microsoft, AWS, and Google. Keywords: market competition, market share, PLTR commercial growth.

- Customer Acquisition Costs: Attracting and retaining commercial clients can be expensive, potentially impacting profitability in the short term. Keywords: customer acquisition cost, profitability, PLTR commercial strategy.

Despite these obstacles, Palantir's proprietary technology and its focus on highly secure data solutions offer a potential competitive advantage in securing large enterprise clients.

Assessing the Risks Associated with Investing in PLTR Stock

Investing in PLTR stock involves substantial risk, demanding careful consideration.

Valuation Concerns and Stock Volatility

Valuing Palantir presents challenges due to its unique business model, high growth aspirations, and relatively young age as a publicly traded company. Keywords: PLTR valuation, stock price volatility, high-growth stock. The stock price can be highly volatile, influenced by factors like earnings reports, news about contract wins or losses, and overall market sentiment. Keywords: stock price fluctuations, risk tolerance, investment strategy. Investors need a high risk tolerance and a long-term investment horizon to potentially weather the volatility.

Dependence on a Few Key Clients

Palantir's revenue is still concentrated among a relatively small number of significant clients. This "client concentration" represents a considerable financial risk. Keywords: client concentration, revenue concentration, financial risk.

However, Palantir is actively working on mitigating this risk through:

- Diversification Efforts: The company is actively pursuing a broader range of clients across both the government and commercial sectors. Keywords: client diversification, risk management, growth strategy.

- Strategic Partnerships: Collaborations with other technology companies can expand Palantir's reach and reduce reliance on individual clients. Keywords: strategic alliances, collaboration, growth acceleration.

Exploring the Potential Rewards of Investing in PLTR

Despite the risks, several factors suggest potential rewards for investing in Palantir.

Growth Opportunities in Big Data Analytics

The global demand for advanced data analytics solutions is rapidly expanding, driven by the increasing volume of data generated across industries. Palantir is well-positioned to benefit from this growth. Keywords: big data analytics, artificial intelligence (AI), machine learning. Its unique technology offers capabilities not readily available from competitors, potentially enabling significant market share gains. Keywords: competitive advantage, market leadership, PLTR technology.

Long-Term Growth Potential and Strategic Partnerships

Palantir's long-term growth projections are ambitious, but their realization depends on several factors. Keywords: long-term growth, financial projections, future outlook. The company's strategic partnerships can accelerate its expansion into new markets and enhance its technological capabilities. Keywords: strategic alliances, collaboration, growth acceleration.

Conclusion

Investing in Palantir stock (PLTR) before May 5th, or any time, presents a complex equation of risks and rewards. The company's reliance on government contracts, coupled with the volatility of its stock price and client concentration, represents significant downside risk. However, the potential for growth in the big data analytics market and Palantir's innovative technology offer considerable upside potential. Before making any investment decisions regarding Palantir stock (PLTR), it’s crucial to carefully assess your personal risk tolerance and investment goals. Conduct thorough due diligence, analyze financial reports, and consider seeking professional financial advice before investing in Palantir Technologies (PLTR) or similar high-growth stocks. A comprehensive Palantir investment strategy requires understanding both the potential rewards and the inherent risks involved in this volatile but potentially high-reward market.

Featured Posts

-

West Ham Face 25m Funding Shortfall Potential Solutions Explored

May 09, 2025

West Ham Face 25m Funding Shortfall Potential Solutions Explored

May 09, 2025 -

Trumps Billionaire Buddies And The Economic Fallout Of Tariffs

May 09, 2025

Trumps Billionaire Buddies And The Economic Fallout Of Tariffs

May 09, 2025 -

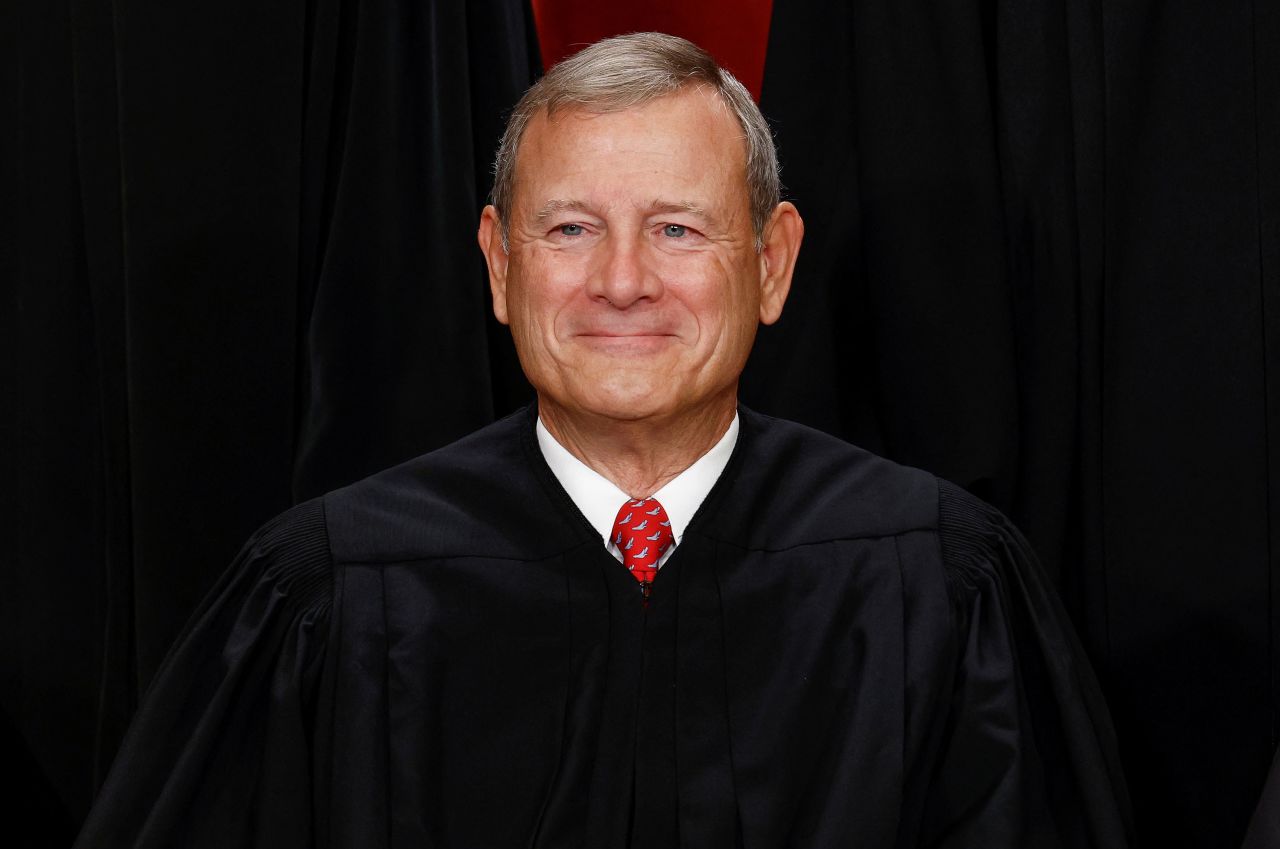

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025

Chief Justice Roberts Mistaken For Gop Leader His Response Revealed

May 09, 2025 -

Parad Pobedy Bez Gostey Zelenskiy V Odinochestve

May 09, 2025

Parad Pobedy Bez Gostey Zelenskiy V Odinochestve

May 09, 2025 -

U S Federal Reserve Decision Interest Rates Unchanged Due To Economic Uncertainty

May 09, 2025

U S Federal Reserve Decision Interest Rates Unchanged Due To Economic Uncertainty

May 09, 2025