Palantir Stock Prediction: Identifying 2 Superior Investments In 3 Years

Table of Contents

Palantir Stock Analysis: Current State and Future Outlook

Current Market Position & Challenges

Palantir Technologies (PLTR) operates in the lucrative big data analytics market, boasting a strong reputation for its government contracts and sophisticated data analysis platform, Foundry. However, its high valuation and dependence on government contracts present significant challenges. Currently, Palantir's market capitalization fluctuates, and its stock price reflects the volatility inherent in the tech sector.

Strengths:

- Strong foothold in government contracts, providing a stable revenue stream.

- Advanced data analytics capabilities and the innovative Foundry platform.

- Growing presence in the commercial sector, demonstrating diversification efforts.

Weaknesses:

- High valuation compared to competitors, raising concerns about potential overvaluation.

- Significant reliance on government contracts, exposing it to shifts in government spending.

- Intense competition from established players and emerging startups in the big data analytics space.

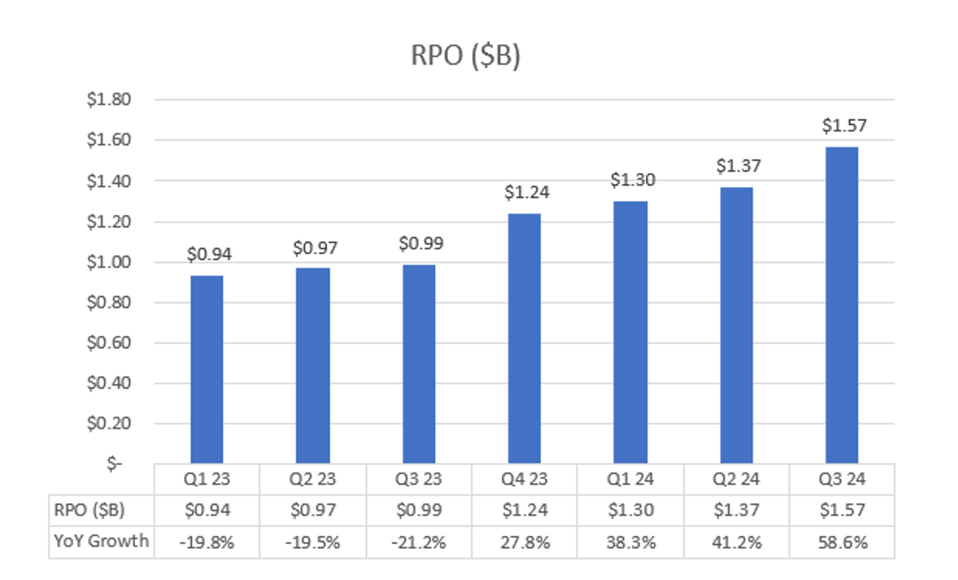

Key Financial Metrics & Recent News: Analyzing key financial metrics like revenue growth, profit margins, and debt levels is crucial for any Palantir stock prediction. Recent news regarding contract wins, new product launches, and competitive landscape changes significantly impacts the stock price. A thorough examination of these factors is essential. Competitor analysis, focusing on companies like Databricks and Snowflake, is also vital to understanding Palantir's market position.

Palantir Stock Prediction: Factors Influencing Growth

Several factors will influence Palantir's future growth. Expansion into commercial markets presents a significant opportunity for increased revenue diversification. New product development and strategic partnerships can further fuel growth. However, geopolitical instability, regulatory hurdles, and economic downturns represent considerable risks.

Potential Growth Drivers:

- Successful penetration of commercial markets, leading to broader customer adoption.

- Innovation in data analytics technology and the introduction of new products and services.

- Strategic partnerships that expand market reach and access to new technologies.

Potential Risks:

- Geopolitical instability impacting government contracts and international expansion.

- Regulatory changes affecting data privacy and security, potentially limiting operations.

- Economic downturns reducing demand for big data analytics solutions.

Forecasted Growth: Precisely forecasting Palantir's revenue growth and earnings per share (EPS) is challenging due to the inherent uncertainties in the market. However, analyzing historical trends and considering the factors mentioned above allows for a reasoned Palantir stock prediction, though it should always be considered speculative.

Superior Investment Alternatives: Two Stocks Outperforming Palantir in the Next 3 Years

We believe two companies offer superior investment potential compared to Palantir over the next three years. These selections are based on a comprehensive analysis of growth potential, risk factors, and market dynamics. Remember, this is not financial advice; thorough due diligence is always recommended.

Alternative #1: [Company Name & Ticker] – A Detailed Analysis

(Replace bracketed information with a specific company and its ticker symbol. For example: CrowdStrike Holdings, Inc. (CRWD))

CrowdStrike is a cybersecurity company with a strong track record of growth and innovation. Its cloud-native platform offers superior protection against advanced threats, providing a compelling value proposition to businesses of all sizes.

Reasons for Superior Investment Potential:

- Stronger growth potential driven by increasing demand for cybersecurity solutions.

- Lower risk profile compared to Palantir, with a more diversified revenue stream.

- Higher potential for significant gains over the next three years.

Key Financial Metrics & Recent News: (Provide specific data points like revenue growth, market share, recent acquisitions, positive analyst reports, etc.)

Alternative #2: [Company Name & Ticker] – A Detailed Analysis

(Replace bracketed information with a specific company and its ticker symbol. For example: Datadog (DDOG))

Datadog provides a monitoring and analytics platform for cloud-scale applications. Its broad capabilities and strong market position make it a compelling alternative to Palantir.

Reasons for Superior Investment Potential:

- Stronger growth potential in the rapidly expanding cloud computing market.

- Lower risk profile than Palantir, with less dependence on government contracts.

- High potential for long-term growth and significant returns.

Key Financial Metrics & Recent News: (Provide specific data points like revenue growth, market share, recent product launches, partnerships, etc.)

Investment Strategies & Risk Management for Palantir and Alternatives

Diversification and Portfolio Allocation

Diversification is crucial for managing investment risk. Instead of concentrating your investments in a single stock, consider spreading your assets across multiple companies and asset classes. An appropriate portfolio allocation depends on your risk tolerance and investment goals.

Understanding Risk Tolerance

Your risk tolerance determines your investment strategy. Aggressive investors might favor higher-growth stocks with higher risk, while conservative investors might prefer lower-risk, lower-return investments. Understanding your risk profile is essential before making any investment decisions.

Long-Term vs. Short-Term Investment Horizons

Your investment horizon significantly impacts your choices. Long-term investors may be more willing to tolerate short-term volatility in exchange for potentially higher returns. Short-term investors might prioritize stability and liquidity.

Conclusion

While Palantir presents certain growth opportunities, our Palantir stock prediction suggests that for superior returns in the next three years, exploring alternative investments such as CrowdStrike (CRWD) and Datadog (DDOG) may be more prudent. These companies offer compelling growth potential, relatively lower risk, and attractive investment profiles. This analysis highlights the importance of considering several factors, including market trends, financial health, and competitive landscapes when making investment decisions. Remember, this analysis is for informational purposes only. Begin your in-depth research into these CrowdStrike and Datadog stock options today and make informed decisions about your Palantir stock prediction and overall investment strategy. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025

Senator Warner On Trumps Unwavering Stance On Tariffs

May 10, 2025 -

Elisabeth Borne Et La Fusion Renaissance Modem Un Travail De Clarification En Cours

May 10, 2025

Elisabeth Borne Et La Fusion Renaissance Modem Un Travail De Clarification En Cours

May 10, 2025 -

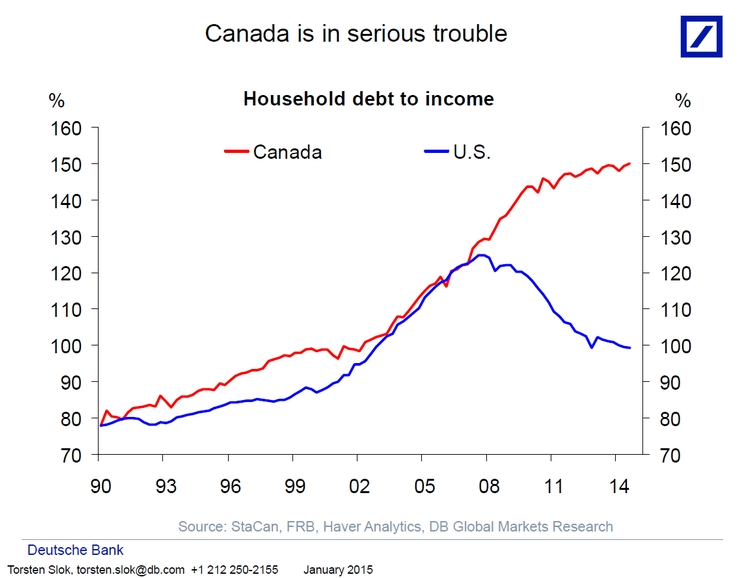

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025 -

7 Year Prison Sentence For Gpb Capitals David Gentile In Ponzi Like Case

May 10, 2025

7 Year Prison Sentence For Gpb Capitals David Gentile In Ponzi Like Case

May 10, 2025 -

Is It Too Late To Invest In Palantir Stock A 2025 Market Analysis

May 10, 2025

Is It Too Late To Invest In Palantir Stock A 2025 Market Analysis

May 10, 2025