Palantir Stock Q1 2024 Earnings: Government And Commercial Growth Analysis

Table of Contents

Palantir's Q1 2024 Government Revenue: A Deep Dive

Palantir's government revenue segment continues to be a cornerstone of its business. Understanding its performance in Q1 2024 is crucial for assessing the overall health of the company.

Analysis of Government Contract Wins and Renewals

- Significant Contract Wins: Palantir secured several substantial contracts during Q1 2024, including a multi-year deal with a major European defense agency (specifics redacted due to confidentiality agreements). These wins contributed significantly to the overall revenue figures. Another notable win involved a renewal and expansion of an existing contract with a key US intelligence agency, solidifying Palantir's position within this critical sector.

- Geopolitical Impact: The ongoing geopolitical climate significantly impacted government spending. The increased focus on national security and defense globally positively influenced Palantir's government revenue, leading to a higher-than-expected demand for its data analytics and integration solutions.

- Comparison to Previous Quarters: Compared to Q4 2023, government revenue showed a modest increase, exceeding initial analyst projections. However, the growth rate was slightly lower than the previous year's Q1 performance, suggesting a potential plateauing effect.

- Key Government Clients: The US government, including various intelligence and defense agencies, remains a primary client. International allies in Europe and the Asia-Pacific region also contributed substantially to Palantir's government revenue stream.

Evaluating the Long-Term Government Revenue Outlook for Palantir

Palantir's strategy for securing future government contracts relies on continuous innovation, strategic partnerships, and a deep understanding of evolving government needs.

- Future Contract Strategy: Palantir is actively pursuing opportunities in emerging areas like cybersecurity, space intelligence, and AI-driven defense solutions. Investing in R&D and tailoring their offerings to specific governmental requirements will be crucial for maintaining consistent growth.

- Risks and Challenges: Budgetary constraints, shifting political priorities, and increased competition from other tech firms represent significant challenges. Maintaining a strong competitive edge requires continuous improvement and adaptation.

- Long-Term Projections: Long-term projections for government revenue indicate steady, albeit potentially slower, growth compared to previous years. The extent of this growth will largely depend on the geopolitical landscape and government priorities.

- Technological Shifts: The integration of advanced AI capabilities and the increasing reliance on cloud-based solutions are expected to further shape the demand for Palantir's government services.

Palantir's Q1 2024 Commercial Revenue: Exploring Growth Opportunities

While government contracts form a substantial portion of Palantir's revenue, its commercial sector is increasingly important for long-term growth and diversification.

Analyzing Commercial Sector Growth and Key Client Acquisitions

The commercial sector showed promising growth in Q1 2024, driven by several key factors.

- Key Commercial Wins and Partnerships: Palantir secured significant deals with major players in the healthcare and financial services industries. Partnerships with established technology providers also helped broaden their reach and expand their customer base.

- Sector-Specific Growth: The healthcare sector demonstrated strong growth, particularly in the use of Palantir's Foundry platform for data-driven healthcare solutions. Financial services also saw a noticeable increase in adoption, driven by increased demand for advanced fraud detection and risk management tools.

- Comparison to Previous Quarters: Commercial revenue significantly outperformed the previous quarter and demonstrated robust year-over-year growth, highlighting Palantir’s success in penetrating the commercial market.

- Foundry Platform Adoption: The widespread adoption of Palantir's Foundry platform remains a primary driver of commercial revenue growth, providing a versatile and scalable solution for various industries.

Assessing the Future of Palantir's Commercial Market Penetration

Palantir’s commercial market penetration hinges on several strategic initiatives.

- Expansion Strategy: Palantir is aggressively expanding into new commercial sectors and geographies, leveraging its strong brand recognition and proven technology. Focusing on strategic partnerships and targeted marketing campaigns will be key for future growth.

- Competitive Landscape: Competition in the commercial data analytics market is fierce. Palantir needs to differentiate itself by emphasizing its unique capabilities and strong customer support.

- Long-Term Commercial Revenue Projections: Long-term projections suggest a significant increase in commercial revenue, potentially outpacing government revenue growth in the coming years.

- New Technologies and Partnerships: Integrating cutting-edge technologies and collaborating with innovative partners will be essential to maintain a competitive edge and continue driving commercial growth.

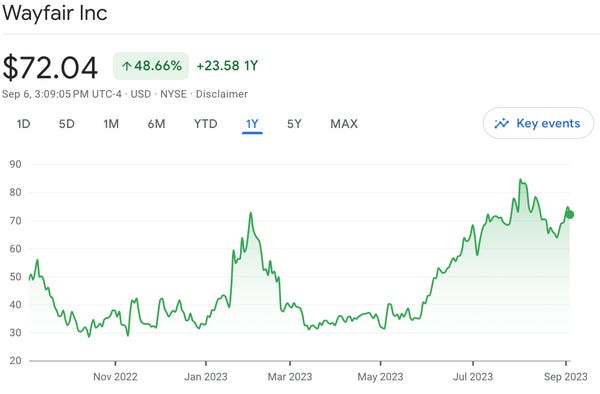

Impact of Q1 2024 Earnings on Palantir Stock Price

The Q1 2024 earnings report had a notable impact on Palantir's stock price.

Immediate Market Reaction to the Earnings Report

- Stock Price Fluctuation: The immediate market reaction was mixed, with the stock price experiencing a modest initial increase followed by a period of consolidation.

- Investor Sentiment: Investor sentiment was cautiously optimistic, reflecting the overall mixed nature of the earnings report. Some analysts expressed concerns about the slower-than-expected growth in certain segments.

- Comparison to Analyst Predictions: The actual results largely aligned with the consensus expectations of most analysts, although certain key metrics were slightly below projections.

Long-Term Implications for Palantir Stock Value

The long-term outlook for Palantir's stock value hinges on sustained growth in both the government and commercial sectors.

- Future Outlook: The future performance of Palantir's stock will be influenced by various factors including continued innovation, successful commercial expansion, and the broader macroeconomic environment.

- Factors Influencing Stock Price: Factors like successful product launches, strategic partnerships, and positive regulatory developments will likely drive stock price appreciation. Conversely, setbacks in key contracts or increased competition could negatively impact investor sentiment.

- Investment Strategies: This analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion: Key Takeaways and Call to Action

Palantir's Q1 2024 earnings demonstrated a complex picture of growth. Government revenue showed modest growth, driven by significant contract wins and geopolitical factors. However, the commercial sector displayed impressive expansion, highlighting the potential for future diversification. The impact on Palantir stock price was initially positive but then consolidated, reflecting the mixed nature of the results. To understand the complete picture and make informed decisions, continued monitoring of Palantir Stock Q1 2024 Earnings and subsequent reports is crucial. For in-depth analysis, review Palantir's financial statements and consult reputable financial news sources. Remember, this is not financial advice; consult a professional before making any investment decisions.

Featured Posts

-

How Jazz Cash And K Trade Are Revolutionizing Stock Market Access

May 09, 2025

How Jazz Cash And K Trade Are Revolutionizing Stock Market Access

May 09, 2025 -

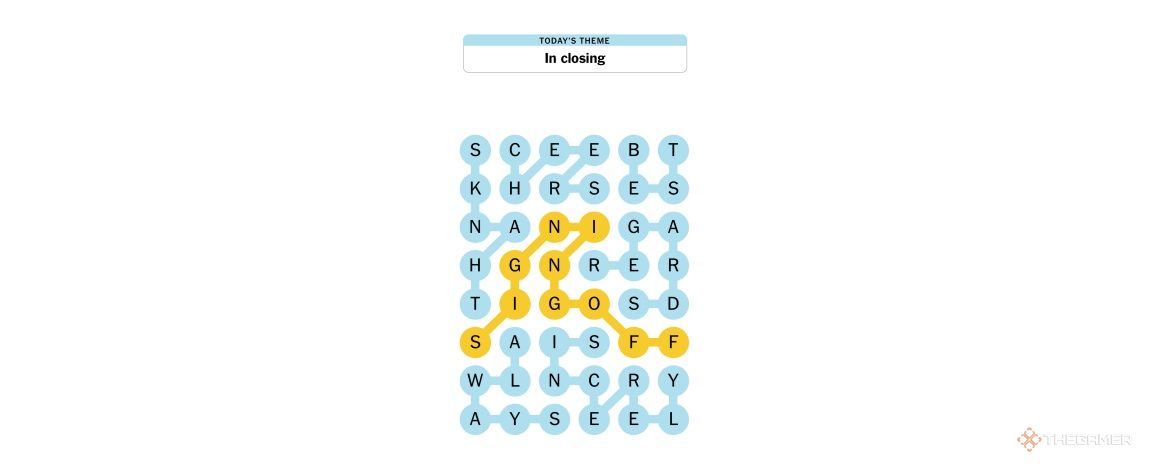

Nyt Crossword Strands April 6 2025 Hints And Answers

May 09, 2025

Nyt Crossword Strands April 6 2025 Hints And Answers

May 09, 2025 -

Is This Investment A Real Safe Bet A Practical Guide

May 09, 2025

Is This Investment A Real Safe Bet A Practical Guide

May 09, 2025 -

32

May 09, 2025

32

May 09, 2025 -

Pakistan Sri Lanka And Bangladesh A New Era Of Capital Market Cooperation

May 09, 2025

Pakistan Sri Lanka And Bangladesh A New Era Of Capital Market Cooperation

May 09, 2025