Palantir Stock: Risks And Rewards

Table of Contents

The Allure of Palantir: Potential Rewards of Investment

Palantir's stock presents a compelling proposition, but understanding its potential benefits is crucial. Let's examine the key drivers of potential returns.

Dominance in Government Contracts

Palantir has established itself as a major player in government and defense contracting. These contracts often represent long-term, high-value agreements, translating into relatively stable revenue streams for the company. Successful partnerships with agencies like the CIA and various branches of the US military provide a foundation of consistent income. However, this reliance on government funding also presents a risk (discussed later). Future government spending on advanced data analytics and national security initiatives could significantly impact Palantir's growth trajectory.

- Stable revenue streams: Long-term contracts provide predictable income.

- High-value contracts: Individual contracts often represent substantial revenue.

- Government dependence (potential risk highlighted here): Over-reliance on government contracts can make the company vulnerable to shifts in government priorities.

Growth in the Commercial Sector

While government contracts form a significant portion of Palantir's revenue, its expansion into the commercial sector holds immense potential for accelerated growth. The company is increasingly targeting large enterprises across various industries, offering its data analytics platform to improve operational efficiency, enhance decision-making, and uncover valuable insights. This diversification reduces the risk associated with relying heavily on government contracts. Key partnerships and successful implementations in this sector showcase Palantir’s ability to compete with established players.

- Expanding customer base: Palantir is actively acquiring new clients in diverse industries.

- Diverse revenue streams: Reduced reliance on government contracts mitigates risk.

- Increased market penetration: Growing market share in the commercial sector signifies significant growth potential.

Technological Innovation and Future Potential

Palantir's continuous investment in research and development (R&D) positions it to remain at the forefront of the data analytics industry. Its ongoing advancements in artificial intelligence (AI), machine learning (ML), and other cutting-edge technologies promise to unlock new applications and market opportunities. New product launches and strategic partnerships further solidify its position as a leader in the field.

- Cutting-edge technology: Palantir consistently innovates to maintain its competitive edge.

- Future-proof solutions: Adaptability to evolving technological landscapes is crucial for long-term success.

- Potential for disruptive innovation: Palantir's technology has the potential to reshape industries and create new markets.

Navigating the Perils: Risks Associated with Palantir Stock

Despite the allure of potential rewards, investing in Palantir stock involves considerable risks. Understanding these risks is crucial for making informed decisions.

High Valuation and Volatility

Palantir's stock price often experiences significant fluctuations, reflecting the inherent volatility of the technology sector and the company’s high valuation. Investor sentiment and market trends heavily influence the stock price, leading to periods of both rapid growth and sharp declines. This high volatility makes it a risky investment for those with a low-risk tolerance.

- Price volatility: Significant price swings can lead to substantial gains or losses.

- High P/E ratio: The stock’s high price-to-earnings ratio indicates a premium valuation.

- Market sensitivity: External market factors can significantly impact the stock price.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud vying for market share. Palantir faces intense pressure to innovate and maintain its competitive advantages to avoid market share erosion. The company's ability to differentiate itself and offer unique value propositions will be key to its long-term success.

- Intense competition: Many established tech giants compete in the same market.

- Market share vulnerability: Competition can lead to a decline in market share and revenue.

- Need for continuous innovation: Staying ahead of the competition requires constant technological advancement.

Dependence on Government Contracts (Revisited)

As mentioned earlier, Palantir's reliance on government contracts represents a significant risk. Changes in government policy, budget cuts, or geopolitical instability can negatively impact revenue. The renewal of existing contracts and the securing of new ones are crucial for the company’s financial stability. Diversification into the commercial sector is essential to mitigate this risk.

- Contract renewals: The success of future contracts is crucial for maintaining revenue.

- Geopolitical uncertainty: International events can impact government spending and contract awards.

- Government budget fluctuations: Changes in government spending can significantly affect Palantir's revenue.

Making Informed Decisions about Palantir Stock

Investing in Palantir stock offers the potential for substantial returns, driven by its innovative technology, strong government presence, and growing commercial market penetration. However, it's crucial to acknowledge the significant risks involved, including high valuation, market volatility, and dependence on government contracts. Thorough due diligence, including careful analysis of financial reports and consideration of your personal risk tolerance, is paramount before making any investment decisions. Remember to consult with a qualified financial advisor before investing in Palantir stock or any other security. Learn more about Palantir's latest financial reports and consult with a financial advisor before investing in Palantir Stock.

Featured Posts

-

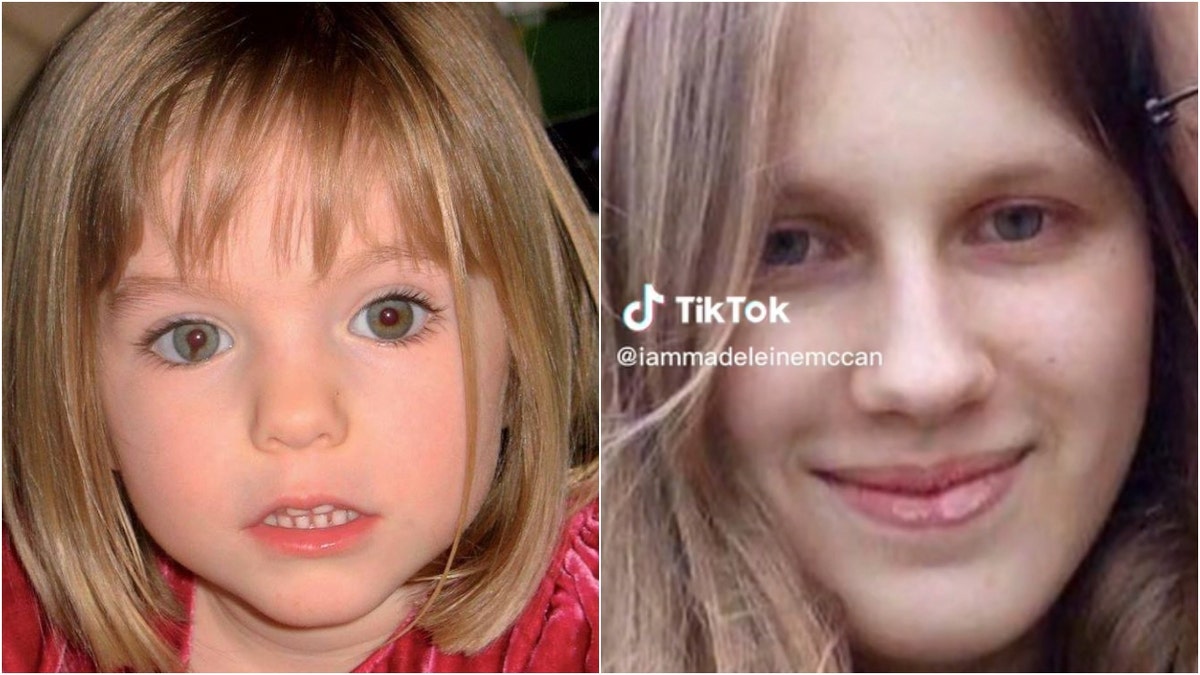

A 23 Year Old Claims To Be Madeleine Mc Cann Analysis Of New Dna Test Results

May 09, 2025

A 23 Year Old Claims To Be Madeleine Mc Cann Analysis Of New Dna Test Results

May 09, 2025 -

West Hams 25m Financial Problem Strategies For Resolution

May 09, 2025

West Hams 25m Financial Problem Strategies For Resolution

May 09, 2025 -

Edmonton Oilers Favored Betting Odds For Kings Series

May 09, 2025

Edmonton Oilers Favored Betting Odds For Kings Series

May 09, 2025 -

Mans 3 K Babysitting Bill Turns Into 3 6 K Daycare Nightmare

May 09, 2025

Mans 3 K Babysitting Bill Turns Into 3 6 K Daycare Nightmare

May 09, 2025 -

Demolition Of Historic Broad Street Diner To Make Way For New Hyatt Hotel

May 09, 2025

Demolition Of Historic Broad Street Diner To Make Way For New Hyatt Hotel

May 09, 2025