Parents Less Worried About College Costs: Survey Shows Shift In Attitudes

Table of Contents

Increased Availability of Financial Aid and Scholarships

The rising accessibility of financial aid and scholarships plays a crucial role in easing parental concerns about college tuition. This increase stems from both government initiatives and the expanding efforts of the private sector.

Government Initiatives

Recent changes in government policies have significantly boosted the availability of federal student aid. This includes:

- Increased Pell Grant funding: The Pell Grant program has seen substantial increases in funding in recent years, making college more affordable for low-income students.

- Expansion of eligibility criteria: Changes in eligibility requirements have broadened access to Pell Grants and other federal grant programs, benefiting more students.

- Improved loan repayment programs: New and improved income-driven repayment plans make repaying student loans more manageable after graduation. These programs aim to reduce the financial burden on borrowers.

- Streamlined financial aid application: The FAFSA (Free Application for Federal Student Aid) application process has become simpler, leading to higher application rates and greater access to aid.

These initiatives have significantly improved the landscape of federal student aid, granting and scholarship opportunities, making college more financially accessible for many families.

Private Sector Initiatives

The private sector also contributes significantly to making college more affordable. Many private organizations and foundations offer a wide array of scholarships and grants based on merit, need, or specific criteria:

- Merit-based scholarships: These awards recognize academic achievement, extracurricular activities, and other talents.

- Need-based scholarships: These scholarships are specifically designed to assist students from low-income families and ensure that financial constraints do not hinder their college aspirations.

- Corporate scholarships: Many large corporations partner with universities and organizations to offer scholarships to students pursuing specific fields of study.

- Targeted scholarships: Numerous scholarships cater to students from underrepresented groups or those pursuing specific majors (e.g., STEM fields).

Accessing these private scholarships requires diligent research and careful application, utilizing resources like scholarship search engines and college websites.

Shifting Perceptions of the Value of a College Degree

The value proposition of a college education is undergoing a reevaluation. Parents are increasingly focusing on the return on investment (ROI) of a college degree and exploring alternative educational pathways.

Return on Investment (ROI)

The traditional view of a college degree as a guaranteed path to high earnings is evolving. Parents and students are more carefully considering:

- Job market demand: The focus is shifting towards programs and degrees that align with high-demand job sectors, ensuring a strong return on investment.

- Starting salaries: Information on starting salaries for graduates in various fields is readily available, aiding informed decision-making.

- Career services: Colleges that provide robust career services and job placement assistance are becoming more attractive.

A well-planned college education now takes into account the earning potential and job prospects related to the chosen major.

Alternative Educational Pathways

Vocational training, apprenticeships, and online learning are gaining wider acceptance as viable alternatives to traditional four-year college degrees. This offers flexibility and potential for quicker entry into the workforce:

- Vocational training programs: These programs provide specialized skills for specific trades and industries, often leading to well-paying jobs.

- Apprenticeships: Apprenticeships combine on-the-job training with classroom instruction, offering practical experience and earning potential simultaneously.

- Online learning platforms: Online courses and degree programs provide flexible learning options, accommodating different learning styles and schedules.

These alternative pathways offer valid career opportunities and often lead to faster completion times and lower overall costs.

Improved Financial Planning and Savings Strategies

Proactive financial planning and the increased use of college savings strategies contribute to the reduced anxiety surrounding college expenses.

Early College Savings

Parents are increasingly utilizing college savings plans like 529 plans to build a financial foundation for their children's higher education:

- 529 plan usage: The popularity of 529 plans, which offer tax advantages for college savings, continues to rise.

- Early saving benefits: Starting to save early, even with small amounts, can significantly reduce the burden of college costs later on.

- Financial planning resources: Numerous resources are available to help parents create effective college savings plans.

These strategies help alleviate the financial strain associated with higher education costs.

Parental Financial Literacy

Greater access to financial literacy resources and improved understanding of financial planning have empowered parents:

- Financial literacy programs: Many organizations offer financial literacy workshops and educational materials specifically designed to help parents plan for college.

- Online resources: Numerous websites and online tools provide valuable information and calculators for college cost estimation and savings planning.

- Financial advisors specializing in college planning: Working with a financial advisor can provide personalized guidance and strategies for college funding.

These improvements in financial literacy and access to resources have empowered parents to make more informed decisions regarding their children’s college funding.

Conclusion

The survey results clearly indicate a lessening of parental worry about college costs, driven by a combination of increased financial aid, a more nuanced perspective on the value of higher education, and improved financial planning. Increased availability of federal student aid, private scholarships, and the growing acceptance of alternative educational pathways all contribute to this positive shift. Parents are actively engaging in early college savings through 529 plans and other methods, and improved access to financial literacy resources equips them to navigate the complexities of college funding more effectively.

Don't let college costs keep you up at night; explore the resources available to ease your worries about college expenses and plan for a brighter future. Visit websites like [link to federal student aid website], [link to scholarship search engine], and [link to financial planning resource] to start your journey toward a financially secure higher education for your child. Remember, careful planning and utilizing available resources can significantly alleviate the financial burden associated with college costs.

Featured Posts

-

Sbry Abwshealt Tkrym Jzayry Yubrz Mwhbt Fnyt Astthnayyt

May 17, 2025

Sbry Abwshealt Tkrym Jzayry Yubrz Mwhbt Fnyt Astthnayyt

May 17, 2025 -

Leading Australian Crypto Casino Sites In 2025

May 17, 2025

Leading Australian Crypto Casino Sites In 2025

May 17, 2025 -

Conservative Outcry Leads To Comey Removing Instagram Post

May 17, 2025

Conservative Outcry Leads To Comey Removing Instagram Post

May 17, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 17, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025

Latest Posts

-

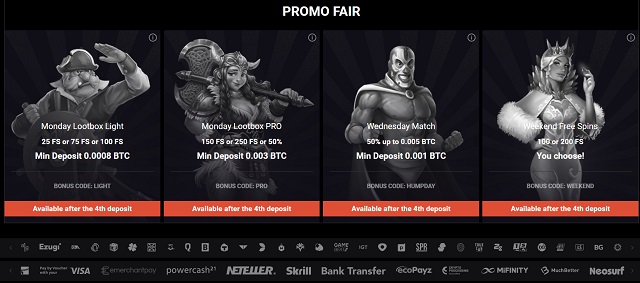

Best No Verification Casinos 2025 Experience Speedy Payouts At 7 Bit

May 17, 2025

Best No Verification Casinos 2025 Experience Speedy Payouts At 7 Bit

May 17, 2025 -

7 Bit Casino Vs The Best Canadian Online Casinos In 2025

May 17, 2025

7 Bit Casino Vs The Best Canadian Online Casinos In 2025

May 17, 2025 -

Choosing The Best Online Casino In Ontario The Mirax Casino Advantage

May 17, 2025

Choosing The Best Online Casino In Ontario The Mirax Casino Advantage

May 17, 2025 -

Best Australian Crypto Casinos Online 2025 Edition

May 17, 2025

Best Australian Crypto Casinos Online 2025 Edition

May 17, 2025 -

High Rtp Online Casinos In Ontario Mirax Casino Leads The Pack

May 17, 2025

High Rtp Online Casinos In Ontario Mirax Casino Leads The Pack

May 17, 2025