PBOC's Yuan Intervention Falls Short Of Expectations

Table of Contents

Insufficient Intervention Scale

The scale of the PBOC's intervention was arguably insufficient to counter the substantial downward pressure on the Yuan. While the exact figures remain undisclosed, market analysts suggest the intervention was significantly smaller than anticipated, leaving many questioning its effectiveness. This limited intervention raises questions about the PBOC's strategy and its willingness to expend significant foreign exchange reserves.

- Comparison to Previous Interventions: Compared to previous instances of PBOC intervention, this latest effort appeared less forceful and ultimately less impactful. Past interventions often involved larger sums and more aggressive actions to influence the Yuan's trajectory.

- Market Forces vs. PBOC Actions: The strength of market forces pushing the Yuan lower far outweighed the PBOC's actions. This indicates a deep-seated concern among investors and traders regarding the Chinese economy.

- Reasons for Limited Scale: The limited scale might be attributed to several factors, including concerns about depleting China's substantial but finite foreign exchange reserves. The PBOC may have been reluctant to commit excessive resources to a potentially losing battle against strong market headwinds.

Market Speculation and Sentiment

Negative market sentiment and rampant speculation played a significant role in undermining the effectiveness of the PBOC's Yuan intervention. Geopolitical tensions, coupled with anxieties surrounding China's economic growth, fueled a bearish outlook on the Yuan, prompting investors to sell.

- Impact of Negative News: Reports of slowing economic growth in China, escalating trade tensions with the West, and concerns about the real estate sector all contributed to the negative sentiment surrounding the Yuan.

- Global Economic Uncertainty: The current global economic uncertainty, marked by high inflation and interest rate hikes in major economies, further exacerbated investor anxieties, leading to capital flight and increased pressure on the Yuan.

- Role of Currency Traders: Currency traders, anticipating further downward pressure on the Yuan, likely exacerbated the selling pressure, making the PBOC's efforts even less effective.

Underlying Economic Factors

The PBOC's Yuan intervention struggles highlight deeper, underlying economic issues impacting the Yuan's value. These structural weaknesses make short-term interventions less effective.

- China's Economic Growth and the Yuan: The slowdown in China's economic growth, coupled with ongoing challenges in the property market and weakening export demand, directly impacts investor confidence in the Yuan.

- Impact of Trade Disputes: Lingering trade disputes and geopolitical uncertainties continue to weigh on the Yuan, as they create uncertainty for businesses operating in China and reduce investor confidence.

- Interest Rate Differentials: The difference in interest rates between China and other major economies also plays a crucial role. Lower interest rates in China compared to the US, for example, make the Yuan less attractive to foreign investors.

Implications for the Global Economy

The ineffectiveness of the PBOC's Yuan intervention carries significant implications for the global economy. A weaker Yuan can impact international trade, investment flows, and potentially even global financial stability.

- Impact on International Trade and Investment: A weaker Yuan can make Chinese exports more competitive, but it also raises concerns about potential currency wars and disruptions to global supply chains.

- Consequences for Global Financial Stability: The Yuan's decline could trigger further volatility in global currency markets and increase the risk of capital flight from emerging markets.

- Impact on Other Asian Currencies: The weakening Yuan could put downward pressure on other Asian currencies, creating ripple effects throughout the region.

Assessing the Future of PBOC's Yuan Intervention Strategies

The PBOC's recent Yuan intervention highlights the limitations of short-term interventions in the face of deep-seated economic challenges and strong market forces. The failure stemmed from insufficient scale, negative market sentiment, and underlying economic weaknesses. The PBOC may need to reassess its strategies, perhaps focusing on addressing structural economic problems rather than relying solely on interventions to manage the Yuan exchange rate. Future interventions may require a more comprehensive approach, incorporating measures to boost economic growth and investor confidence.

To stay informed about future developments regarding the PBOC's Yuan intervention, its impact on global markets, and the evolution of China's currency strategy, continue to monitor financial news and economic analysis. Understanding the fluctuations in the Yuan exchange rate and PBOC monetary policy is crucial for navigating the complexities of the global economy.

Featured Posts

-

1 0 Thriller Gurriels Pinch Hit Rbi Single Leads Padres To Victory Over Braves

May 15, 2025

1 0 Thriller Gurriels Pinch Hit Rbi Single Leads Padres To Victory Over Braves

May 15, 2025 -

The Sobering Truth Why Womens Alcohol Consumption Is On The Rise And What Doctors Are Doing About It

May 15, 2025

The Sobering Truth Why Womens Alcohol Consumption Is On The Rise And What Doctors Are Doing About It

May 15, 2025 -

Individual Taken Into Custody Gsw Campus Resumes Normal Operations

May 15, 2025

Individual Taken Into Custody Gsw Campus Resumes Normal Operations

May 15, 2025 -

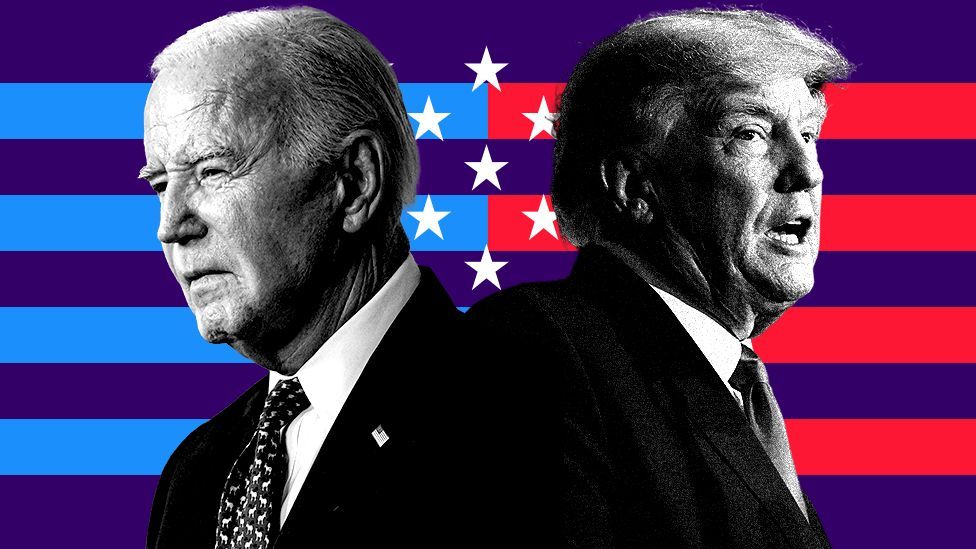

Bidens Response To Trumps Russia Ukraine Policies Vances Criticism

May 15, 2025

Bidens Response To Trumps Russia Ukraine Policies Vances Criticism

May 15, 2025 -

Warren Struggles To Defend Bidens Mental State

May 15, 2025

Warren Struggles To Defend Bidens Mental State

May 15, 2025