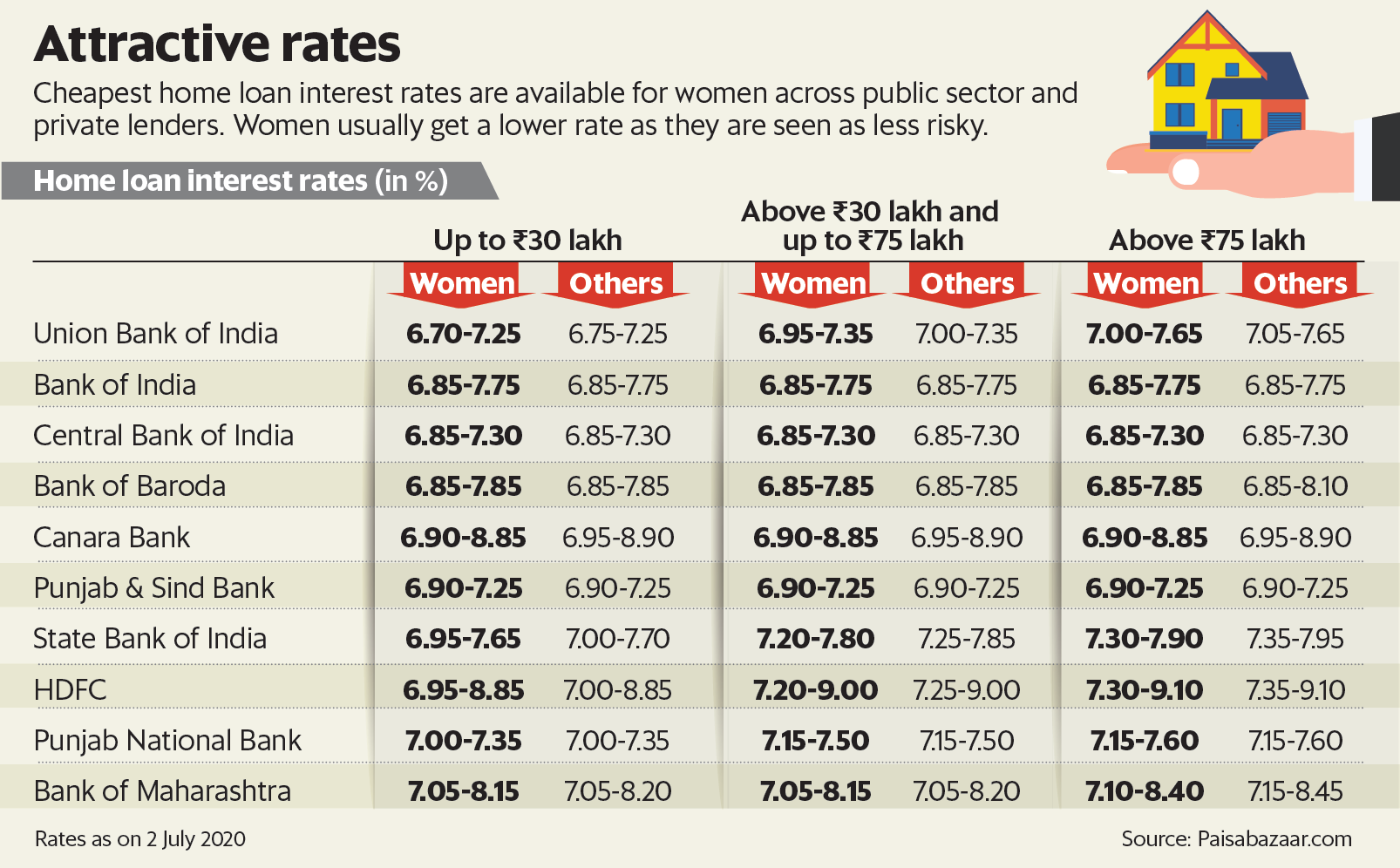

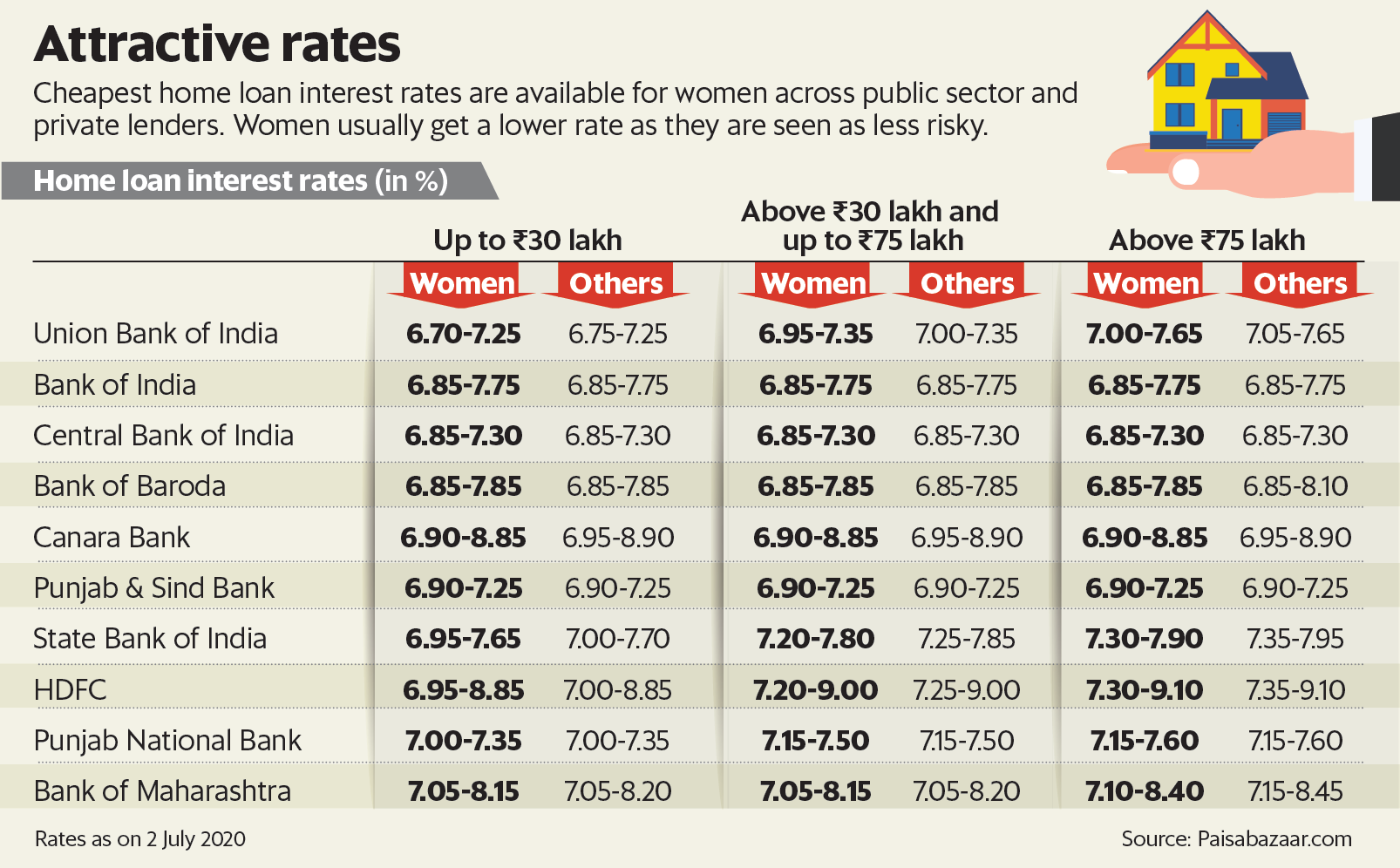

Personal Loan Interest Rates Today: A Comprehensive Overview

Table of Contents

Factors Affecting Personal Loan Interest Rates Today

Several factors significantly influence the interest rate you'll receive on a personal loan. Let's explore the key players.

Credit Score

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score – often a FICO score – to assess your creditworthiness and risk. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate.

- Excellent Credit (750+): Expect the lowest interest rates.

- Good Credit (700-749): You'll likely receive favorable rates.

- Fair Credit (650-699): Rates will be higher, and loan approval might be more challenging.

- Poor Credit (Below 650): Securing a loan will be difficult, with significantly higher interest rates or potential rejection.

Improving your credit score involves:

- Paying bills on time consistently.

- Keeping your credit utilization low (avoid maxing out your credit cards).

- Monitoring your credit report for errors and disputing them if necessary.

- Maintaining a healthy mix of credit accounts.

Loan Amount and Term

The amount you borrow and the length of your loan term also affect your interest rate.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates because they represent a greater risk to the lender.

- Loan Term: A longer loan term (loan tenure) means lower monthly payments, but you'll pay significantly more in total interest over the life of the loan. Shorter terms mean higher monthly payments but less interest paid overall. Understanding your loan repayment schedule and using an amortization schedule calculator can help you make the best decision.

Lender Type

Different lenders offer varying personal loan interest rates.

- Banks: Typically offer competitive rates, particularly for borrowers with excellent credit, but may have stricter lending criteria.

- Credit Unions: Often provide more favorable rates and terms to their members, but membership requirements may apply.

- Online Lenders: Can offer convenience and sometimes competitive rates, but it's crucial to thoroughly research their reputation and fees before applying. Peer-to-peer lending platforms also exist, offering another option.

Current Economic Conditions

Macroeconomic factors heavily influence personal loan interest rates.

- Prime Rate and Federal Funds Rate: Changes in these benchmark interest rates set by central banks directly impact borrowing costs.

- Inflation Rate: High inflation usually leads to higher interest rates as lenders adjust for the decreased purchasing power of money.

- Economic Outlook: A strong economy may result in lower rates, while an uncertain economic outlook might lead to higher rates to compensate for increased risk.

How to Find the Best Personal Loan Interest Rates

Securing the most favorable interest rate requires diligent research and comparison.

Shop Around and Compare

Never settle for the first offer. Use personal loan comparison websites and tools to see rates from multiple lenders. Utilize a loan calculator to estimate your monthly payments and total interest paid under different scenarios. Comparing interest rate comparison results is key.

Check for Fees and Charges

Beyond the stated interest rate, be aware of additional fees:

- Origination Fees: A one-time fee charged by the lender for processing your loan application.

- Prepayment Penalties: Fees charged if you pay off your loan early.

- Other potential fees should also be checked carefully.

Negotiate with Lenders

With a strong credit score and a well-reasoned argument, you might be able to negotiate a lower interest rate.

Understanding APR (Annual Percentage Rate)

The annual percentage rate (APR) represents the total cost of borrowing, including the interest rate and all other fees. It's a crucial metric for comparing loan offers accurately. Understanding APR calculation and the effective interest rate will help you make the best decision.

Conclusion: Making Informed Decisions on Personal Loan Interest Rates

Securing a personal loan requires careful consideration of your credit score, loan amount, loan term, lender type, and the current economic environment. Shopping around and comparing offers from multiple lenders, while fully understanding the APR and all associated fees, is essential for obtaining the best possible personal loan interest rates. Start comparing personal loan interest rates today to find the best deal for your financial needs. Don't delay – secure the lowest personal loan interest rates possible!

Featured Posts

-

E5 000 To E255 000 Irish Euro Millions Players Unexpected Lottery Windfall

May 28, 2025

E5 000 To E255 000 Irish Euro Millions Players Unexpected Lottery Windfall

May 28, 2025 -

Arsenal Transfer News Striker Wants Gunners Tottenham Prepare 58m Offer

May 28, 2025

Arsenal Transfer News Striker Wants Gunners Tottenham Prepare 58m Offer

May 28, 2025 -

Kim Kardashian Celebrates Psalm Wests 6th Birthday

May 28, 2025

Kim Kardashian Celebrates Psalm Wests 6th Birthday

May 28, 2025 -

Garnacho Transfer Update Chelsea In Talks United Considering Offer

May 28, 2025

Garnacho Transfer Update Chelsea In Talks United Considering Offer

May 28, 2025 -

Blake Lively Justin Baldoni Legal Battle Unexpected A List Development

May 28, 2025

Blake Lively Justin Baldoni Legal Battle Unexpected A List Development

May 28, 2025