Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Factors Affecting Personal Loan Interest Rates Today

Several key factors influence personal loan interest rates today. Understanding these factors is crucial for securing a favorable rate.

-

Credit Score Impact: Your credit score is the most significant factor determining your personal loan interest rate. Lenders use your credit score (like your FICO score) and credit rating to assess your creditworthiness. A higher credit score generally translates to a lower interest rate.

- Excellent Credit (750+): Expect the most competitive personal loan interest rates.

- Good Credit (700-749): You'll likely receive favorable rates, though not as low as those with excellent credit.

- Fair Credit (650-699): You might qualify for a loan, but expect higher interest rates.

- Poor Credit (Below 650): Securing a loan will be more challenging, and interest rates will be significantly higher. Consider working on improving your credit score before applying.

-

Debt-to-Income Ratio (DTI): Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. A lower DTI indicates better financial responsibility and increases your chances of loan approval with a lower interest rate. Lenders carefully assess your DTI to ensure you can comfortably manage your debt obligations.

-

Loan Amount and Term: The amount you borrow and the repayment period (loan term) both affect your interest rate. Larger loan amounts and longer loan terms typically result in higher interest rates due to increased risk for the lender. Carefully consider your repayment schedule and choose a loan term that fits your budget.

-

Loan Type: Personal loans are categorized as secured or unsecured. Secured loans require collateral (e.g., a car or savings account), reducing lender risk and potentially leading to lower interest rates. Unsecured loans don't require collateral, but carry higher interest rates to compensate for the increased risk.

-

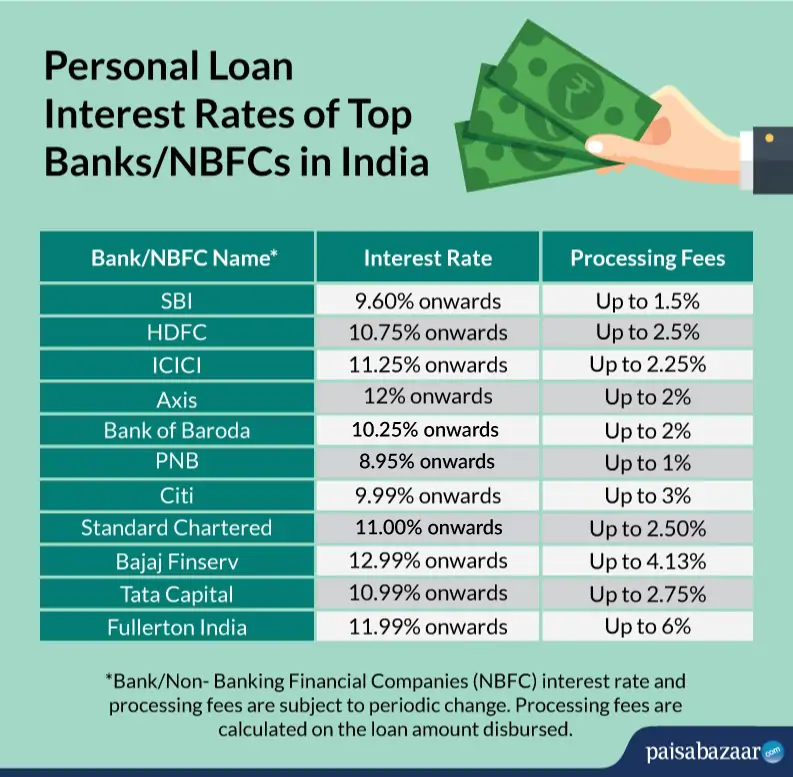

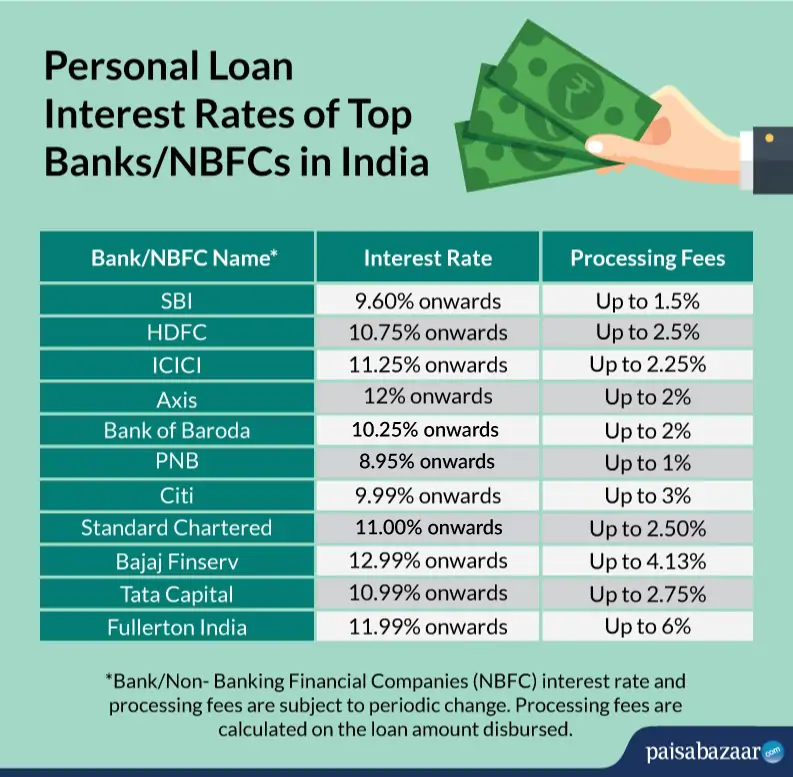

Lender Type: Different lenders offer varying interest rates. Banks, credit unions, and online lenders each have their own lending criteria and rate structures. Comparing offers from multiple lenders is crucial to finding the best personal loan interest rates today.

How to Find the Lowest Personal Loan Interest Rates Today

Finding the lowest personal loan interest rates requires a proactive approach:

-

Check Your Credit Report: Before applying for a loan, check your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for accuracy. Identify and dispute any errors that could be negatively impacting your credit score. Regular credit monitoring can help identify potential issues early.

-

Compare Interest Rates from Multiple Lenders: Don't settle for the first offer you receive. Compare interest rates, fees, and loan terms from several banks, credit unions, and online lenders. Use online loan comparison tools to streamline this process. Remember to look beyond just the interest rate; consider the overall cost of the loan.

-

Negotiate with Lenders: Once you've identified a few lenders offering competitive rates, don't hesitate to negotiate. Highlight your strong financial profile and explore the possibility of a lower interest rate.

-

Consider Pre-Qualification: Many lenders offer pre-qualification options that allow you to check your eligibility for a loan without affecting your credit score. This is a valuable tool for exploring potential loan options and comparing rates.

-

Read the Fine Print: Carefully review the loan agreement before signing. Pay close attention to APR (Annual Percentage Rate), origination fees, late payment penalties, and prepayment penalties. Hidden charges can significantly increase the overall cost of your loan.

Understanding APR and Other Loan Costs

The Annual Percentage Rate (APR) represents the total cost of your loan, including interest and fees. It's a crucial factor in comparing loan offers. A lower APR indicates a lower overall cost.

Other potential loan costs include:

- Origination Fees: A one-time fee charged by the lender for processing your loan application.

- Late Payment Penalties: Fees incurred for missed or late payments.

- Prepayment Penalties: Fees charged if you repay your loan early. These are less common with personal loans.

Tips for Improving Your Chances of Getting a Lower Personal Loan Interest Rate

Improving your financial health can significantly improve your chances of securing a lower personal loan interest rate:

-

Pay Down Existing Debt: Reducing your existing debt improves your debt-to-income ratio and credit utilization, making you a less risky borrower.

-

Improve Your Credit Score: Focus on responsible credit management – pay bills on time, keep credit utilization low (ideally below 30%), and avoid opening too many new accounts in a short period.

-

Shop Around for the Best Rates: Reiterating the importance of comparing multiple lenders to secure the best loan rates cannot be overstated.

Conclusion: Securing the Best Personal Loan Interest Rates Today

Finding the best personal loan interest rates today involves understanding the key factors influencing rates, actively comparing offers from various lenders, and improving your personal financial health. By following the strategies outlined above, you can significantly improve your chances of securing a loan with the lowest possible interest rate and the best terms to suit your needs. Don't wait! Start comparing personal loan interest rates today and find the lowest rate to fit your financial needs. Remember to carefully consider all loan costs, including APR and any associated fees, before making a decision. Secure the best personal loan rates for your financial future!

Featured Posts

-

Guaranteed Approval Tribal Loans Best Options For Bad Credit

May 28, 2025

Guaranteed Approval Tribal Loans Best Options For Bad Credit

May 28, 2025 -

Bali Belly Prevention And Treatment A Travelers Guide

May 28, 2025

Bali Belly Prevention And Treatment A Travelers Guide

May 28, 2025 -

The Ryan Reynolds Justin Baldoni Feud A Legal Battle Unfolds

May 28, 2025

The Ryan Reynolds Justin Baldoni Feud A Legal Battle Unfolds

May 28, 2025 -

Ajaxs Title Dream Shattered The Story Of Nine Crucial Points

May 28, 2025

Ajaxs Title Dream Shattered The Story Of Nine Crucial Points

May 28, 2025 -

Diamondbacks Vs Dodgers Prediction Can La Regain Its Form

May 28, 2025

Diamondbacks Vs Dodgers Prediction Can La Regain Its Form

May 28, 2025