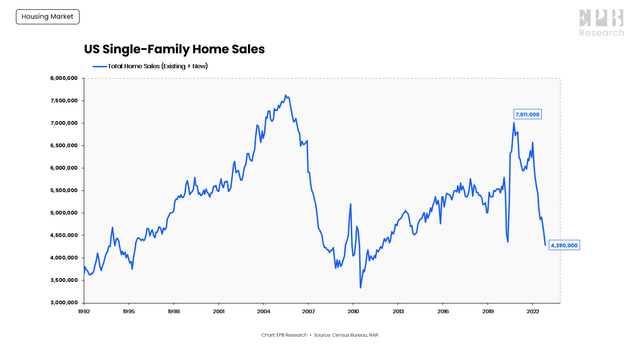

Plummeting Home Sales: The Reality Of The Current Housing Market Crisis

Table of Contents

The Impact of Rising Interest Rates on Home Sales

Mortgage Rate Increases and Affordability

Higher interest rates directly impact monthly mortgage payments, making homeownership less affordable for many potential buyers. Even a small percentage increase can significantly increase the monthly cost.

- Example 1: A $300,000 mortgage at a 3% interest rate results in a monthly payment of approximately $1,265. Increasing the rate to 6% increases the monthly payment to roughly $1,798 – a difference of over $500.

- Example 2: The impact is even more dramatic for larger loans. A $500,000 mortgage sees a much larger jump in monthly payments with a rise in interest rates.

- Impact on Loan Types: Fixed-rate mortgages offer predictable payments, but the initial cost is significantly impacted by interest rates. Adjustable-rate mortgages (ARMs) offer lower initial payments but expose borrowers to potentially higher payments in the future if rates rise.

- Impact on Income Brackets: Lower-income buyers are disproportionately affected by rising interest rates, as the increase in monthly payments represents a larger percentage of their income.

Reduced Buyer Purchasing Power

Increased mortgage payments directly reduce the amount buyers can afford to spend on a home, shrinking the pool of potential buyers. This reduced purchasing power leads to fewer offers and decreased competition for sellers.

- Purchasing Power Comparison: A buyer who could afford a $400,000 home a year ago with a lower interest rate might now only qualify for a $300,000 home due to higher interest rates.

- Data and Statistics: Data from national real estate organizations can illustrate the significant drop in affordability indices, showcasing the impact on the number of potential buyers. These statistics should be included to support claims made.

Inflation and its Effect on the Housing Market

Increased Construction Costs

Rising material and labor costs lead to higher home prices, further impacting affordability. This makes it more expensive for both builders and buyers.

- Rising Material Costs: Lumber prices, concrete costs, and steel prices have all fluctuated significantly, directly impacting construction expenses.

- Labor Shortages: A shortage of skilled labor in the construction industry increases labor costs and extends construction timelines, adding further expense.

Reduced Consumer Confidence

General inflation erodes consumer confidence, leading to decreased spending on big-ticket items like homes. This hesitancy is a major factor in the current downturn.

- Impact on Consumer Spending: Inflation reduces disposable income, making consumers more cautious with their spending, and less likely to make large purchases like buying a home.

- Buyer Hesitancy: Uncertainty about the future economic climate is fueling buyer hesitancy, leading to a decline in home sales. Economic indicators like the Consumer Price Index (CPI) and inflation rates can help illustrate this point.

Shifting Market Dynamics: From Seller's Market to Buyer's Market

Inventory Levels and Their Impact

Increased inventory of homes for sale is impacting the market, shifting the balance of power from sellers to buyers. The days of multiple offers and bidding wars are lessening in many areas.

- Inventory Comparison: Compare current inventory levels to those of the past few years, highlighting the significant increase in available properties.

- Implications for Negotiation: Buyers now have increased negotiation power, allowing them to secure better deals and potentially negotiate lower prices.

Price Adjustments and Negotiation

Sellers are adjusting prices to compete in the changed market. This means increased opportunities for buyers to negotiate favorable terms.

- Price Reductions: Examples of price reductions across various market segments can illustrate the competitive pressure sellers are facing.

- Buyer Negotiation Strategies: Highlight strategies buyers can use to negotiate lower prices, favorable closing costs, or other concessions.

Future Predictions and Outlook for the Housing Market

Potential Scenarios and Economic Factors

Analyzing potential future scenarios for the housing market requires examining several factors. The trajectory will depend heavily on interest rate changes and economic policy decisions.

- Interest Rate Changes: The Federal Reserve's actions regarding interest rates will significantly influence the housing market's future.

- Government Interventions: Government policies and interventions may affect affordability and demand.

- Economic Forecasts: Different economic forecasts predict varying outcomes, ranging from a continued slowdown to a potential recovery.

Advice for Buyers and Sellers

Navigating this period requires careful planning and strategy. Here's some advice for both buyers and sellers:

- Buyers: Research thoroughly, secure pre-approval, be patient, and be prepared to negotiate. Look for properties with price reductions or motivated sellers.

- Sellers: Price your property competitively, be realistic about expectations, and work with a skilled real estate agent to strategize your approach.

Conclusion

The plummeting home sales are a clear indication of a significant housing market crisis. Rising interest rates, inflation, and shifting market dynamics are creating unprecedented challenges for both buyers and sellers. Understanding these factors is crucial for navigating this complex landscape. Whether you're a buyer looking for opportunities or a seller strategizing your next move, staying informed about current real estate trends and seeking expert advice is paramount. Don't let the current downturn in plummeting home sales deter you—research the market thoroughly and make informed decisions to successfully navigate this challenging period in the housing market.

Featured Posts

-

Zverev Triumphs Munich Semifinals Await After Hard Fought Wins

May 31, 2025

Zverev Triumphs Munich Semifinals Await After Hard Fought Wins

May 31, 2025 -

Indian Wells Masters Alcaraz Nga Ngua O Ban Ket

May 31, 2025

Indian Wells Masters Alcaraz Nga Ngua O Ban Ket

May 31, 2025 -

Building The Good Life Strategies For Wellbeing And Success

May 31, 2025

Building The Good Life Strategies For Wellbeing And Success

May 31, 2025 -

Banksy Print Market 22 777 000 Generated In 12 Months

May 31, 2025

Banksy Print Market 22 777 000 Generated In 12 Months

May 31, 2025 -

Memahami Ekspresi Diri Miley Cyrus Melalui Pilihan Busananya

May 31, 2025

Memahami Ekspresi Diri Miley Cyrus Melalui Pilihan Busananya

May 31, 2025