Podcast: Riding The Wave Of Low Inflation

Table of Contents

Understanding Low Inflation and its Causes

Defining Low Inflation:

What constitutes "low inflation"? Low inflation generally refers to a sustained period where the inflation rate remains below the central bank's target rate, typically around 2%. It differs significantly from deflation (a sustained decrease in the general price level) and high inflation (a rapid increase in prices, often exceeding 10%). Key terms to understand include the Consumer Price Index (CPI), which measures changes in the price of a basket of consumer goods and services, and the inflation rate, which represents the percentage change in the CPI over time.

- Examples of low inflation scenarios: Periods of low inflation can be characterized by stable prices for many goods and services, with only gradual increases over time. For instance, a consistent annual inflation rate of 1-1.5% would be considered low inflation.

- Historical context: Historical data reveals that periods of low inflation have occurred throughout economic history, often following periods of economic recession or significant policy changes.

- Impact of global events: Global events, like pandemics or geopolitical instability, can significantly influence inflation rates, sometimes pushing them into low inflation territory.

Identifying the Root Causes:

Several factors contribute to periods of low inflation:

- Technological advancements: Increased automation and technological progress often lead to lower production costs, resulting in lower prices for consumers.

- Globalization: Increased global competition can suppress prices as businesses strive for market share.

- Changing consumer behavior: Shifts in consumer preferences, such as increased demand for cheaper goods or services, can exert downward pressure on prices.

- Monetary policy impact (interest rates): Central banks use monetary policy tools, primarily interest rates, to influence inflation. Low interest rates can stimulate borrowing and spending, potentially leading to moderate inflation or preventing deflation, but if too low can also lead to low inflation or even deflation.

- Supply chain dynamics: Efficient supply chains and increased global production capacity can contribute to lower prices.

The Impact of Low Inflation on Consumers

Spending and Saving Habits:

Low inflation influences consumer spending and saving decisions in several ways:

- Reduced urgency to buy now: With prices remaining relatively stable, consumers may be less inclined to rush purchases, delaying major purchases until a more opportune time.

- Potential for increased savings: Low inflation allows consumers to maintain their purchasing power over time, facilitating greater savings.

- Impact on debt management: Low inflation can make it easier to manage debt, as the real value of debt decreases over time.

Investment Strategies in a Low Inflation Environment:

Navigating investments during low inflation requires a strategic approach:

- Focus on asset classes that perform well during low inflation: Real estate and equities often perform well during low inflation as their value tends to rise over time, hedging against the erosion of purchasing power.

- Diversification strategies: Diversifying investments across various asset classes is crucial to mitigate risk and optimize returns.

- Risk management: While low inflation can provide a stable economic climate, investors still need to manage their risk profile accordingly.

Low Inflation's Effects on Businesses

Pricing Strategies and Profit Margins:

Low inflation presents challenges for businesses:

- Challenges of maintaining profit margins: Businesses may struggle to maintain profit margins if they can't raise prices to keep pace with rising costs.

- Competitive pressures: Intense competition forces businesses to keep prices low, further squeezing profit margins.

- Importance of cost efficiency: Businesses must focus on increasing efficiency and reducing operational costs to maintain profitability.

Investment and Expansion Decisions:

Low inflation influences business investment and expansion plans:

- Impact on borrowing costs: Low interest rates can reduce borrowing costs, making investment more attractive.

- Increased uncertainty: Low inflation can create uncertainty about future demand and economic growth, making businesses more cautious about expansion.

- Long-term planning considerations: Businesses need to develop long-term strategies to navigate the challenges and opportunities presented by low inflation.

Conclusion

Low inflation, while seemingly benign, has a profound and multifaceted impact on both consumers and businesses. Understanding its causes, effects, and potential implications is crucial for making informed financial decisions. This includes adapting spending habits, optimizing investment strategies, and adjusting business pricing and expansion plans. Successfully navigating a low-inflation environment demands vigilance and adaptability.

Call to Action: Learn more about navigating the challenges and opportunities presented by low inflation. Subscribe to our podcast (link here if applicable) for further insights and strategies for riding the wave of low inflation and securing your financial future. Stay informed about the latest economic trends and make sound financial decisions during periods of low inflation. Don't let low inflation catch you off guard; proactively manage your financial well-being.

Featured Posts

-

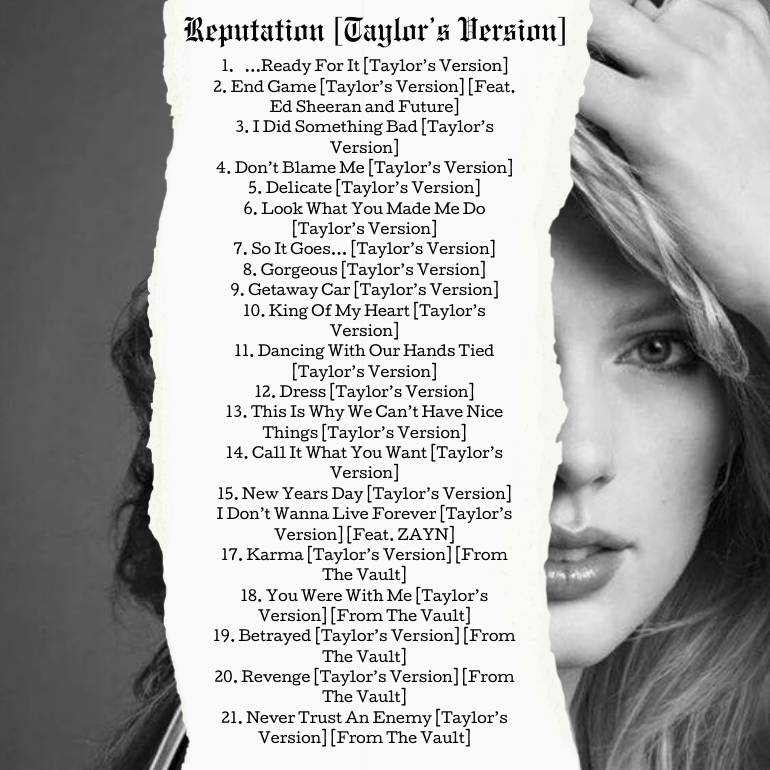

Everything We Know About Taylor Swifts Reputation Taylors Version Based On The Teaser

May 27, 2025

Everything We Know About Taylor Swifts Reputation Taylors Version Based On The Teaser

May 27, 2025 -

Aulnay Sous Bois Le Maire Demande La Non Verbalisation Des Commercants Le 1er Mai

May 27, 2025

Aulnay Sous Bois Le Maire Demande La Non Verbalisation Des Commercants Le 1er Mai

May 27, 2025 -

Is Gwen Stefani Expecting Another Child With Blake Shelton

May 27, 2025

Is Gwen Stefani Expecting Another Child With Blake Shelton

May 27, 2025 -

90s Rock Star Speaks Out About Ex Wifes Transformation Into Maga Pop Diva

May 27, 2025

90s Rock Star Speaks Out About Ex Wifes Transformation Into Maga Pop Diva

May 27, 2025 -

Is Yellowstones Taylor Sheridan Planning An Early Retirement

May 27, 2025

Is Yellowstones Taylor Sheridan Planning An Early Retirement

May 27, 2025