Point72's Emerging Markets Investment Strategy Shift: Implications Of Fund Closure

Table of Contents

Analysis of Point72's Emerging Markets Fund Closure

The closure of Point72's emerging markets fund raises important questions about the firm's strategic direction and the overall attractiveness of emerging market investments. Several factors likely contributed to this decision. While Point72 has not publicly disclosed specific reasons, several possibilities exist.

-

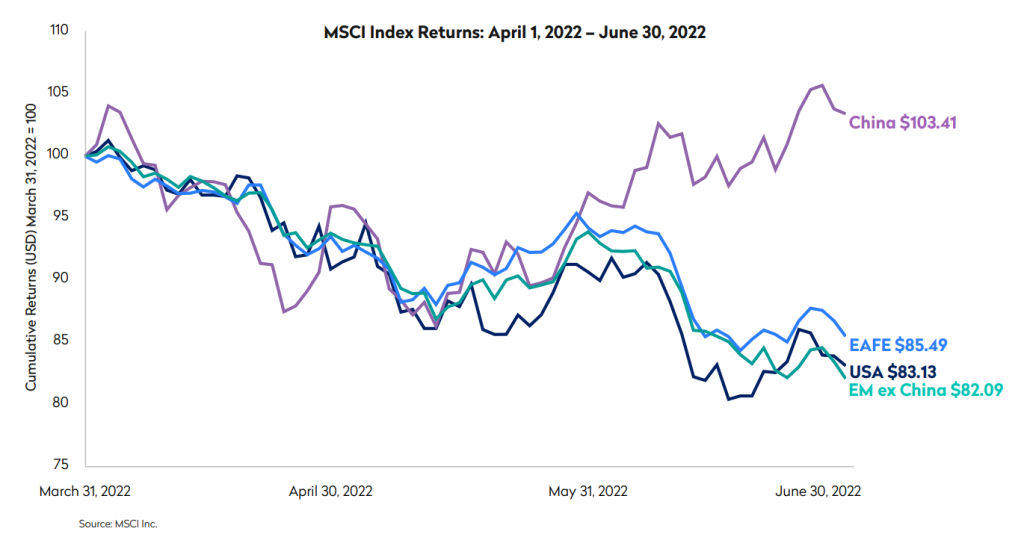

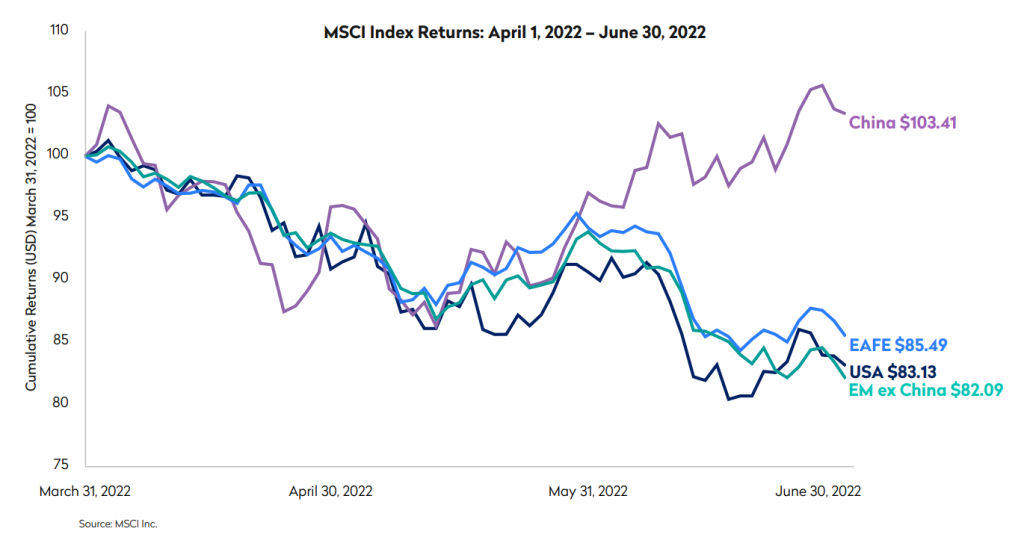

Underperformance: The fund may have underperformed benchmarks over a sustained period. While precise performance data remains undisclosed, persistent underperformance against comparable funds could have triggered the closure. Speculation suggests that challenges in specific emerging markets, coupled with broader macroeconomic headwinds, contributed to disappointing returns.

-

Shifting Market Sentiment: The global economic climate has presented significant challenges for emerging markets. Increased volatility, rising interest rates in developed economies, and geopolitical instability have dampened investor enthusiasm. This negative market sentiment could have influenced Point72's decision to exit.

-

Internal Restructuring: Point72 may be undertaking a broader internal restructuring, reallocating resources towards areas deemed more promising or aligning its investment strategy with evolving market opportunities. This strategic realignment could have led to the fund's closure.

-

Official Statements: Any official communication released by Point72 regarding the closure should be carefully examined for further insights. Such statements often offer crucial context and clarify the firm's rationale.

The timing of the closure is also significant, occurring amidst a period of heightened uncertainty in global markets. This suggests a proactive response to evolving market dynamics rather than a purely reactive measure. The impact on investors in the fund will depend on the terms of its closure and the methods employed for the liquidation of assets.

Shifting Investment Landscape for Emerging Markets

The overall attractiveness of emerging markets is currently a subject of intense debate among investors. While emerging markets historically offered high growth potential, several factors are currently creating headwinds.

-

Geopolitical Risks: Geopolitical instability, including regional conflicts and trade tensions, poses a significant threat to emerging market economies. Uncertainty in the global political landscape impacts investor confidence and makes long-term investments less attractive.

-

Currency Fluctuations: Significant currency fluctuations in many emerging markets introduce additional risk and complexity for investors. Unpredictable currency movements can severely impact returns and erode investor confidence.

-

Regulatory Changes: Regulatory changes within specific emerging markets can dramatically impact investment opportunities. Changes in tax laws, trade policies, or capital controls can render previously attractive investment less appealing.

Compared to previous periods of high growth, emerging markets are currently facing a challenging environment. Competing investment strategies, focusing on developed markets or specific sectors, are increasingly attracting capital. These factors have contributed to a less favorable investment climate. Point72's decision might reflect a broader reassessment of risk versus reward in the emerging markets sector.

Point72's Future Investment Strategy in Emerging Markets

Point72's future approach to emerging markets remains uncertain. Several scenarios are plausible:

-

Complete Withdrawal: Point72 may choose to completely withdraw from emerging market investments, focusing its resources on other sectors or geographies perceived as less risky and more profitable.

-

Regional/Sectoral Focus: Alternatively, Point72 might shift its focus towards specific emerging markets or sectors deemed less volatile and presenting more attractive opportunities. This approach would involve a more targeted and risk-managed strategy.

-

Alternative Investment Vehicles: Point72 could continue to invest in emerging markets but through different vehicles such as private equity or venture capital, offering greater control and potentially mitigating some risks associated with direct market exposure.

Despite the closure, Point72 retains substantial expertise and resources in emerging market analysis. Its future strategy will likely involve a careful recalibration of risk tolerance and investment horizons. A reallocation of assets towards other investment areas is a strong possibility.

Implications for Other Investors in Emerging Markets

Point72's decision carries significant implications for the broader investment community. It could be interpreted as a sign of decreasing confidence in emerging markets, potentially influencing other investors.

-

Investor Confidence: The closure may shake investor confidence, particularly among those with a similar investment approach. This could lead to capital flight from emerging markets.

-

Market Volatility: The announcement might trigger increased market volatility as investors reassess their positions and adjust their portfolios. Short-term price swings are likely in response to this strategic shift.

-

Investment Opportunities: Conversely, the decision could create opportunities for other investors willing to take on higher risk in search of potentially undervalued assets. This presents a chance for shrewd investors to acquire assets at discounted prices.

The ripple effect of Point72's decision could impact other hedge funds and institutional investors, prompting them to review their own emerging market strategies and potentially leading to further adjustments in portfolio allocations.

Conclusion

Point72's closure of its emerging markets fund represents a significant development, reflecting a complex interplay of underperformance, shifting market sentiment, and internal strategic reassessments. This Point72's Emerging Markets Investment Strategy Shift highlights the challenges facing investors in emerging markets and underscores the need for a carefully calibrated approach. The implications for the wider investment community are significant, potentially impacting investor confidence, market volatility, and creating opportunities for nimble investors. To stay informed, continued monitoring of Point72's investment strategies and broader trends within emerging markets is essential. Further research into the evolving landscape of emerging market investments and the strategies employed by major players like Point72 is highly recommended.

Featured Posts

-

Investigation Reveals Potential Fraud At Hungarys Central Bank Index

Apr 26, 2025

Investigation Reveals Potential Fraud At Hungarys Central Bank Index

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Gambling

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Gambling

Apr 26, 2025 -

Sustaining The Flow How European Shipyards Support Russias Arctic Gas Exports

Apr 26, 2025

Sustaining The Flow How European Shipyards Support Russias Arctic Gas Exports

Apr 26, 2025 -

Federal Agencys Survey On Jewish Affiliation At Columbia And Barnard Details And Reactions

Apr 26, 2025

Federal Agencys Survey On Jewish Affiliation At Columbia And Barnard Details And Reactions

Apr 26, 2025 -

Are Empty Shelves Inevitable Anna Wongs Perspective

Apr 26, 2025

Are Empty Shelves Inevitable Anna Wongs Perspective

Apr 26, 2025

Latest Posts

-

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 10, 2025 -

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025 -

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025

Fox News And The Us Attorney General Unpacking The Daily Dialogue

May 10, 2025 -

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025

James Comers Epstein Files Tirade Pam Bondis Response

May 10, 2025 -

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025

Pam Bondi Laughs Reaction To James Comers Epstein Files Accusations

May 10, 2025