Point72's Exit: Emerging Markets Fund Closure And Trader Departures

Table of Contents

The Closure of Point72's Emerging Markets Fund: A Detailed Analysis

The closure of Point72's emerging markets fund wasn't a sudden decision; it's the culmination of several factors impacting performance and strategic direction.

Financial Performance and Underperformance

Point72's emerging markets fund experienced consistent underperformance in recent years. While precise figures aren't publicly available due to the private nature of hedge fund operations, sources suggest:

- Return rates significantly lagged behind comparable benchmarks, including major emerging market indices.

- Several quarters showed substantial losses, eroding investor confidence and capital.

- The fund's specific investment strategies, potentially focusing on specific sectors or geographies within emerging markets, may have been disproportionately affected by macroeconomic headwinds and geopolitical instability. This included increased inflation in several target countries and currency fluctuations that negatively impacted returns.

Strategic Realignment and Resource Allocation

Point72's decision aligns with a broader strategic realignment. The firm might be prioritizing other investment areas deemed more promising, such as:

- Increased focus on technology and private equity investments.

- Expansion into alternative asset classes, such as real estate or infrastructure.

- A shift toward more established markets offering potentially higher, less volatile returns.

Point72 hasn't explicitly detailed its resource reallocation, but the closure strongly suggests a redirection of capital and expertise away from emerging markets. Any public statements regarding strategic goals have emphasized a focus on long-term value creation through diversified portfolios.

Impact on Investors and the Hedge Fund Landscape

The closure has significant implications for Point72's investors and the wider hedge fund landscape:

- Investors may experience losses and reduced returns on their investment in the fund. This could impact investor sentiment towards Point72 and other emerging market investments.

- Other hedge funds specializing in emerging markets might face increased scrutiny and pressure to demonstrate strong performance.

- The move might signal a broader trend of caution within the hedge fund community regarding emerging market investments, leading to reduced capital flows into these regions.

Key Trader Departures and Their Significance

The closure of Point72's emerging markets fund coincided with the departure of several experienced traders, further highlighting the strategic shift.

Identifying Key Departures

While Point72 hasn't publicly named all departing individuals, reports suggest significant losses within the emerging markets trading team. These included:

- Experienced portfolio managers with extensive expertise in specific emerging market regions.

- Analysts and traders responsible for crucial aspects of investment research and execution.

Reasons Behind Departures

Several factors may have contributed to these departures:

- Dissatisfaction with Point72's evolving strategic direction and reduced emphasis on emerging markets.

- Changes in compensation structures or lack of promotional opportunities.

- Attractive offers from competing firms with more robust emerging market strategies.

Implications for Future Strategies

The departures raise questions about Point72's future involvement in emerging markets:

- The firm might significantly reduce its presence in this sector, possibly liquidating remaining assets.

- Alternatively, Point72 may restructure its emerging markets team with a different investment focus.

- Any future involvement is likely to be significantly smaller and less impactful than previously.

Understanding the Implications of Point72's Emerging Markets Fund Closure

Point72's decision to close its emerging markets fund stems from a combination of underperformance, strategic realignment, and key personnel departures. The impact extends beyond Point72, influencing investor confidence in emerging markets and potentially shaping the strategies of other hedge funds. The significant trader departures further underscore the depth of this strategic shift. Understanding these developments is crucial for anyone interested in Point72's investment strategies, emerging market investment analysis, or the broader hedge fund landscape. To stay informed about developments in the hedge fund industry and Point72's future strategies, subscribe to our newsletter for the latest news and analysis on Point72's investment strategies and emerging market investment analysis.

Featured Posts

-

Colnago Y1 Rs A Look At Pogacars World Champion Bike At The Uae Tour

Apr 26, 2025

Colnago Y1 Rs A Look At Pogacars World Champion Bike At The Uae Tour

Apr 26, 2025 -

Ajax Stunned At Home Frankfurt Win First Leg

Apr 26, 2025

Ajax Stunned At Home Frankfurt Win First Leg

Apr 26, 2025 -

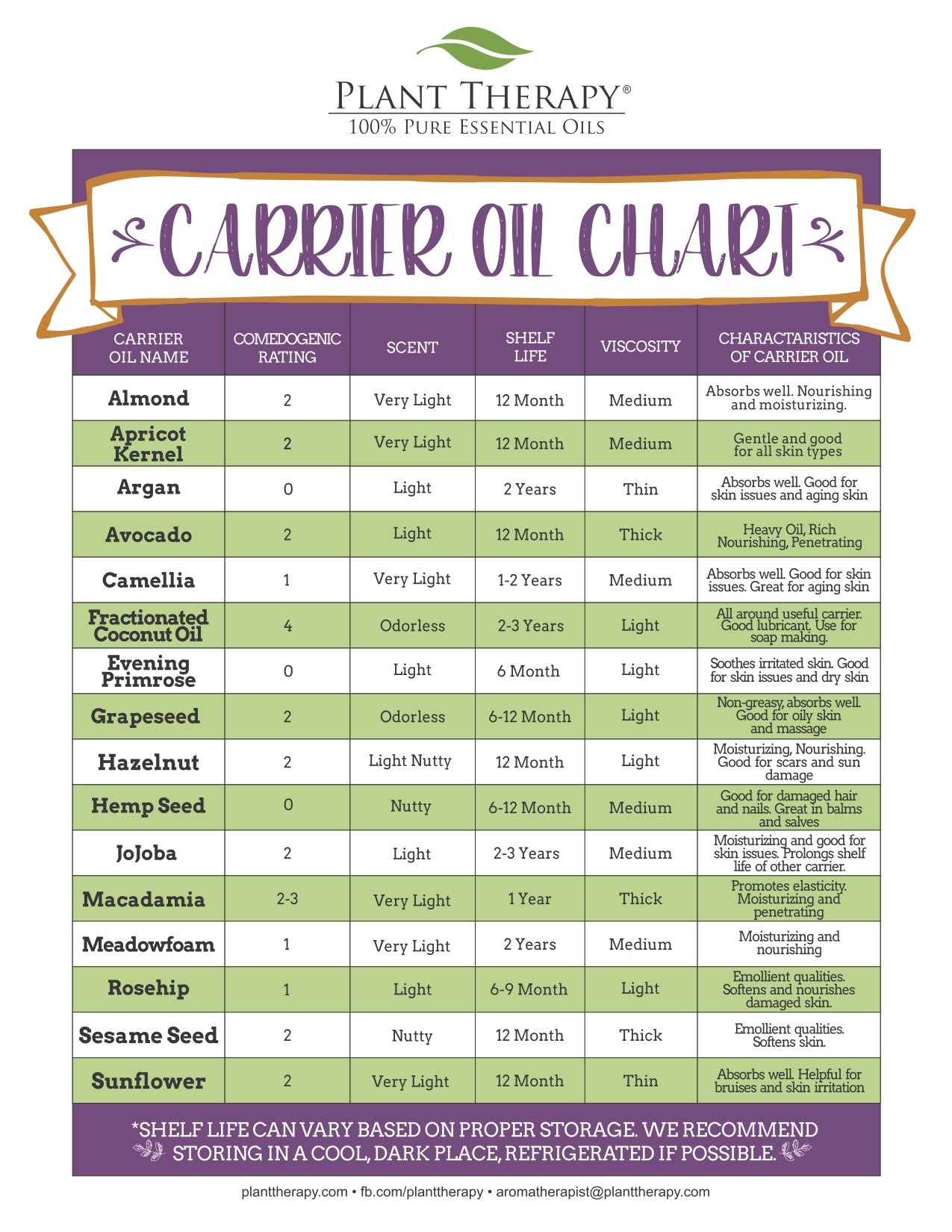

The Best Southern Olive Oils A Guide To Selection And Use

Apr 26, 2025

The Best Southern Olive Oils A Guide To Selection And Use

Apr 26, 2025 -

Republican Congressman Criticizes Gavin Newsoms Interview With Steve Bannon

Apr 26, 2025

Republican Congressman Criticizes Gavin Newsoms Interview With Steve Bannon

Apr 26, 2025 -

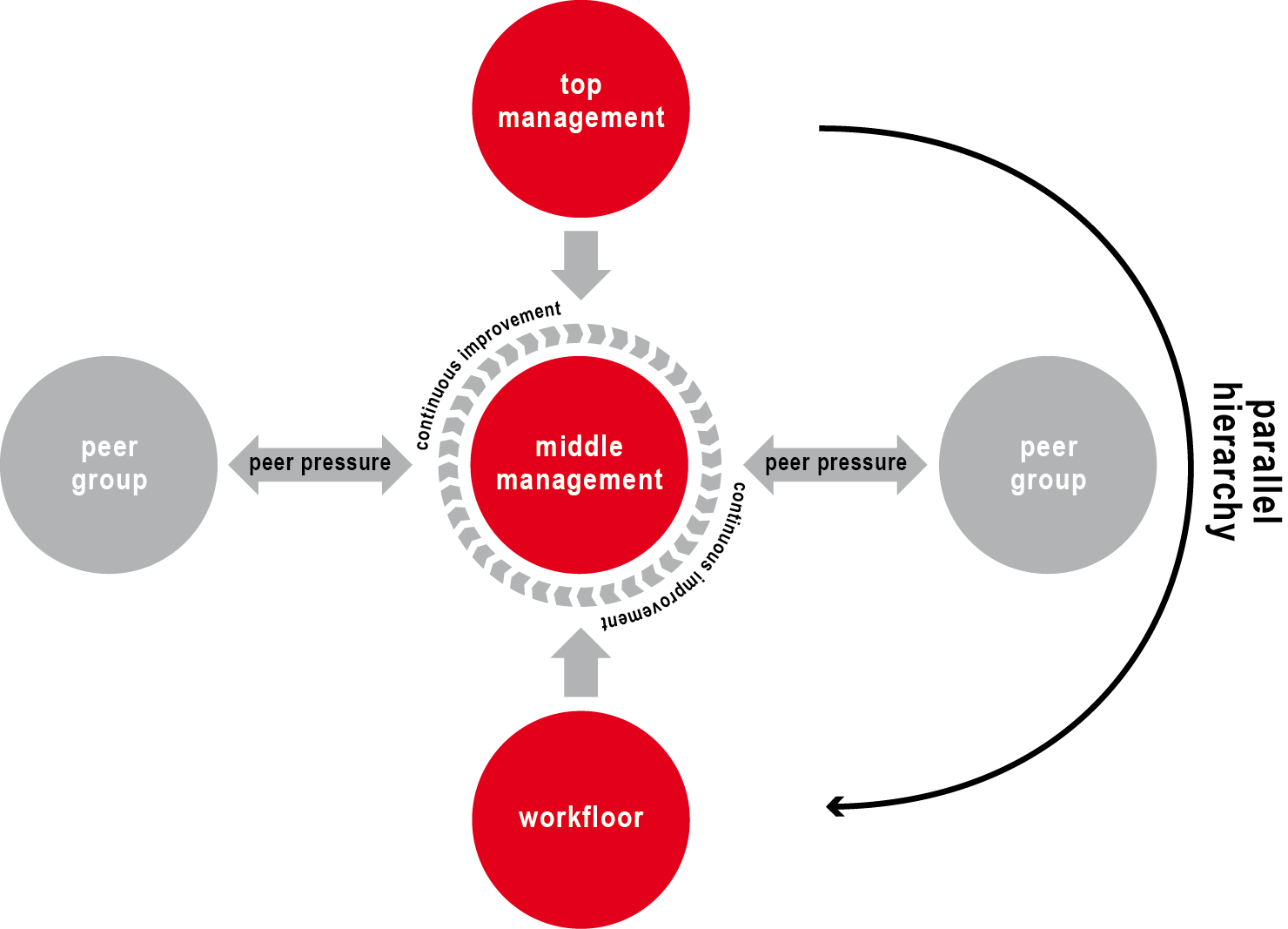

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Why Invest In Middle Management A Strategic Approach To Business Growth

Apr 26, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025