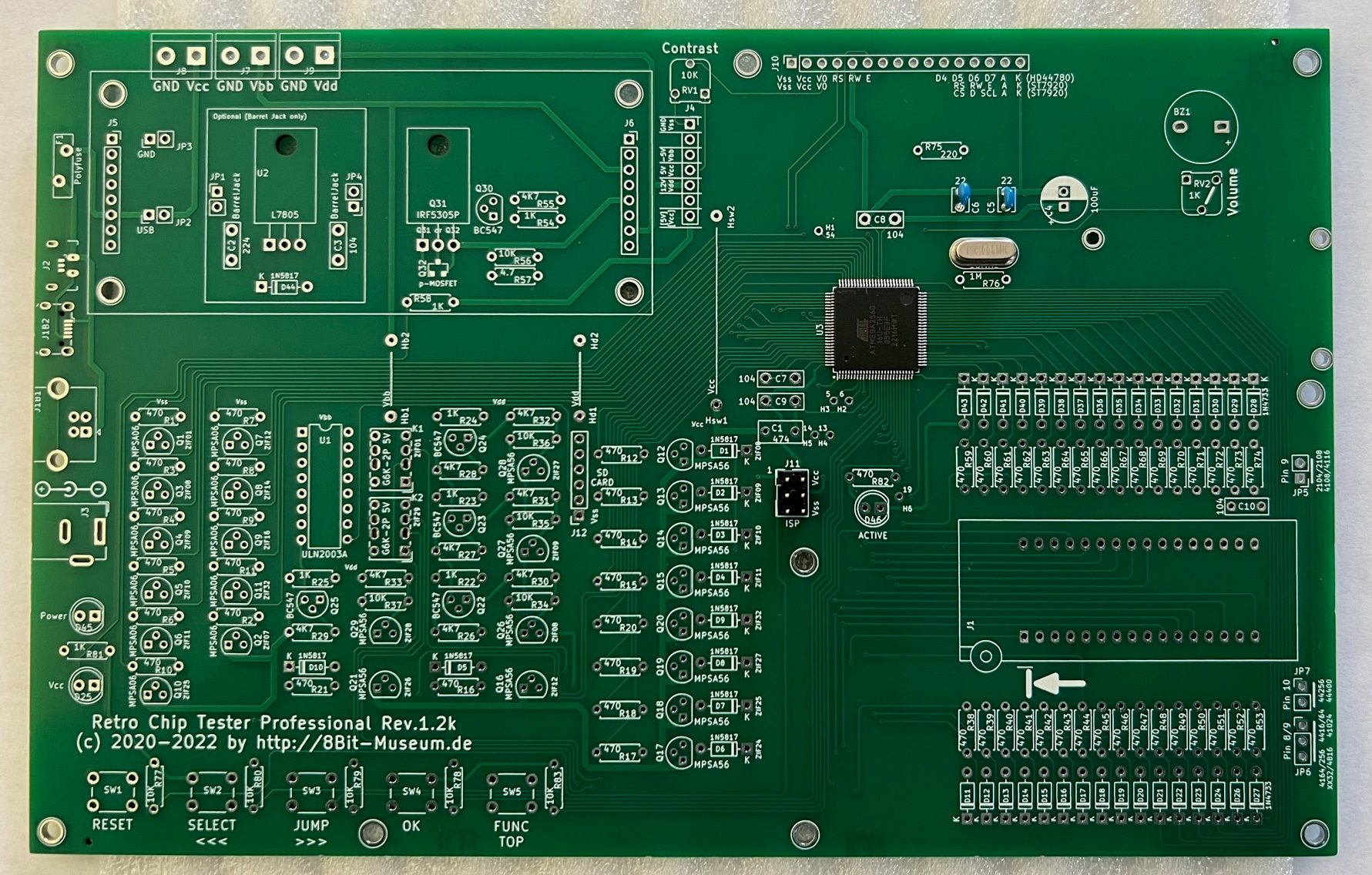

Potential Sale Of UTAC Chip Tester: A Chinese Buyout Firm's Decision

Table of Contents

The Strategic Importance of UTAC Chip Tester

UTAC Chip Tester's position in the semiconductor industry is pivotal, making this potential acquisition a high-stakes game.

Market Dominance and Technological Advancement

UTAC holds a substantial market share in high-end chip testing, possessing proprietary technology crucial for next-generation semiconductor production.

- UTAC's advanced testing capabilities are essential for verifying the functionality of cutting-edge chips used in 5G, AI, and high-performance computing applications. This makes them a critical player in the global technological race.

- Their technology represents a key competitive advantage, setting them apart from competitors. Losing access to this technology could significantly hinder the technological advancement of US and allied nations.

- The loss of this leading-edge technology to a foreign entity could severely impact US and allied technological leadership in the semiconductor sector, potentially hindering innovation and economic growth.

Financial Implications of the Acquisition

The buyout presents a lucrative financial opportunity for UTAC's shareholders, potentially exceeding initial valuation estimates.

- The offered price suggests a significant premium over UTAC's current market capitalization, providing strong motivation for the sale. This financial incentive is a powerful driving force in the deal.

- The substantial financial rewards could overshadow other concerns for some stakeholders, making the deal attractive despite potential risks.

- A thorough examination of the financing details and the potential debt incurred by the acquiring firm is crucial for a complete understanding of the deal's long-term implications.

Concerns Regarding Chinese Ownership of UTAC Chip Tester

The prospect of Chinese ownership of UTAC Chip Tester raises significant concerns regarding national security and geopolitical stability.

National Security Risks

The acquisition raises serious concerns about the potential transfer of sensitive technology to China, jeopardizing US national security and economic interests.

- Concerns exist about the possibility of intellectual property theft and technology espionage, potentially giving China an unfair advantage.

- The deal is likely to face intense government scrutiny and encounter significant regulatory hurdles before approval. The review process will be rigorous.

- The Committee on Foreign Investment in the United States (CFIUS) will play a crucial role in evaluating the deal's potential national security implications and determining its fate.

Geopolitical Implications

The deal could escalate existing geopolitical tensions between the US and China, significantly impacting trade relations and technological competition.

- This acquisition highlights the intensifying technological rivalry between the two global superpowers. The race for technological dominance is at the heart of this deal.

- The acquisition could provoke retaliatory measures from other countries, creating further instability in the global market.

- The deal could significantly impact future collaborations and partnerships within the semiconductor industry, potentially creating new alliances and rivalries.

Potential Outcomes and Future Scenarios

The future of UTAC Chip Tester hinges on the outcome of this acquisition, with several possible scenarios unfolding.

Deal Completion and its Ramifications

If the deal is completed, the integration of UTAC into the Chinese buyout firm's operations will have far-reaching consequences for the chip testing market.

- Potential price increases and disruptions in global supply chains are possible outcomes. Market stability could be affected.

- Increased competition from China in the semiconductor market is a highly probable consequence. This will have significant long-term effects.

- The acquisition could dramatically accelerate China's technological advancement in the semiconductor sector, altering the global balance of power.

Deal Rejection and Alternative Scenarios

If the deal is blocked by regulatory bodies or fails to materialize, UTAC may explore alternative strategies.

- UTAC's future direction would depend heavily on market conditions and technological advancements. Adaptability will be key.

- Alternative buyers might emerge, potentially leading to a different outcome. The deal's future is uncertain.

- A strategic partnership with a US-based company could become a viable alternative, securing domestic interests.

Conclusion

The potential sale of UTAC Chip Tester to a Chinese buyout firm marks a critical juncture for the global semiconductor industry, presenting both immense opportunities and considerable risks. The acquisition's impact on national security, technological leadership, and geopolitical stability demands thorough analysis and careful consideration. Regardless of whether the deal proceeds or is blocked, it underscores the intensifying competition and strategic importance of chip testing technology in the 21st century. Staying informed about developments surrounding the UTAC Chip Tester sale and similar Chinese buyout attempts is vital for understanding the evolving landscape of the semiconductor industry. Follow the story to stay updated on the future of UTAC Chip Tester and the implications of this significant acquisition.

Featured Posts

-

Steffy Blames Bill Calls Finn The Bold And The Beautiful April 9 Recap

Apr 24, 2025

Steffy Blames Bill Calls Finn The Bold And The Beautiful April 9 Recap

Apr 24, 2025 -

Office 365 Security Breach Millions Stolen Through Executive Account Hacks

Apr 24, 2025

Office 365 Security Breach Millions Stolen Through Executive Account Hacks

Apr 24, 2025 -

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield

Apr 24, 2025

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield

Apr 24, 2025 -

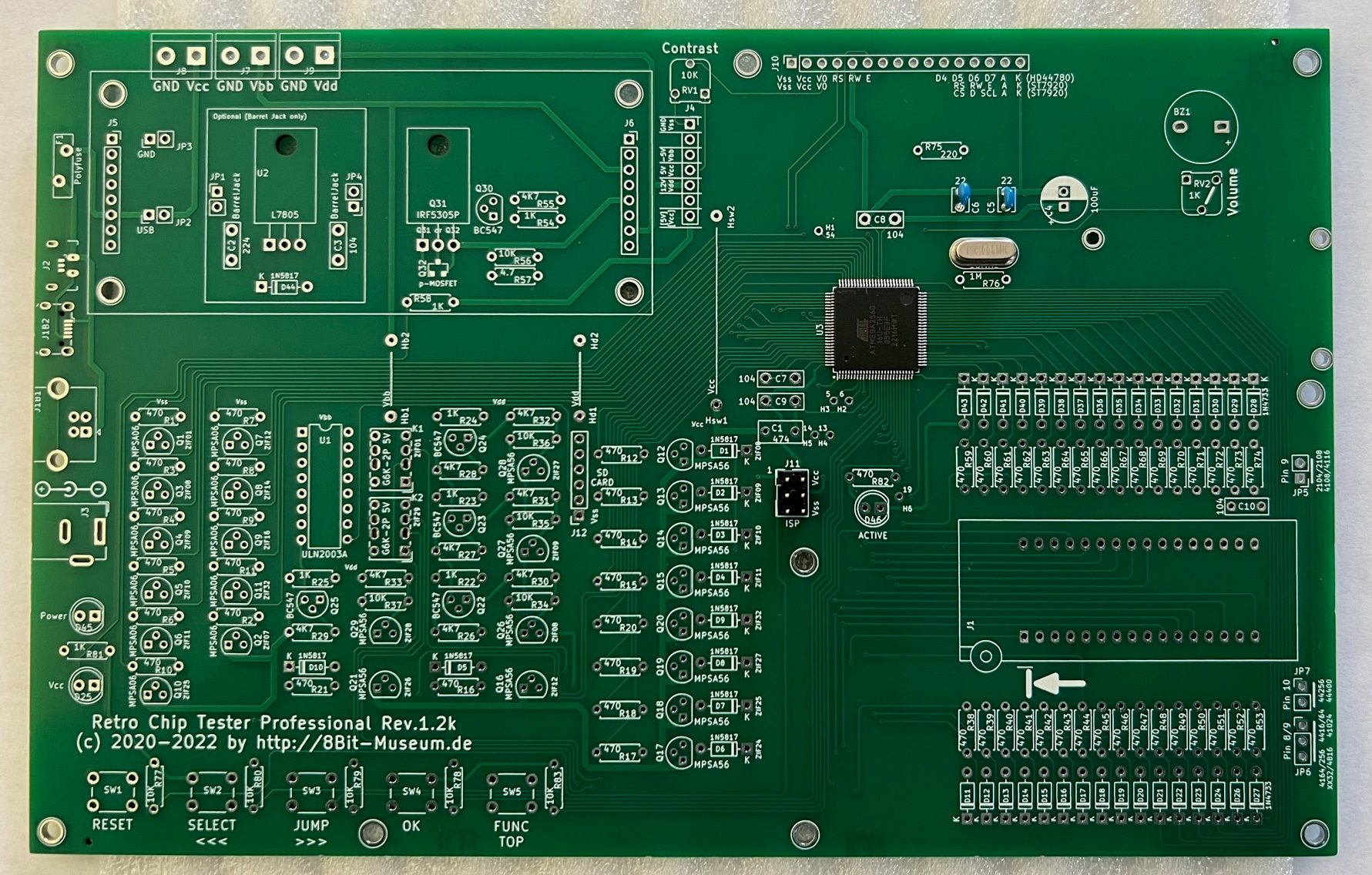

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Odrasla U Pravu Ljepoticu

Apr 24, 2025

Ella Travolta Kci Johna Travolte Odrasla U Pravu Ljepoticu

Apr 24, 2025

Latest Posts

-

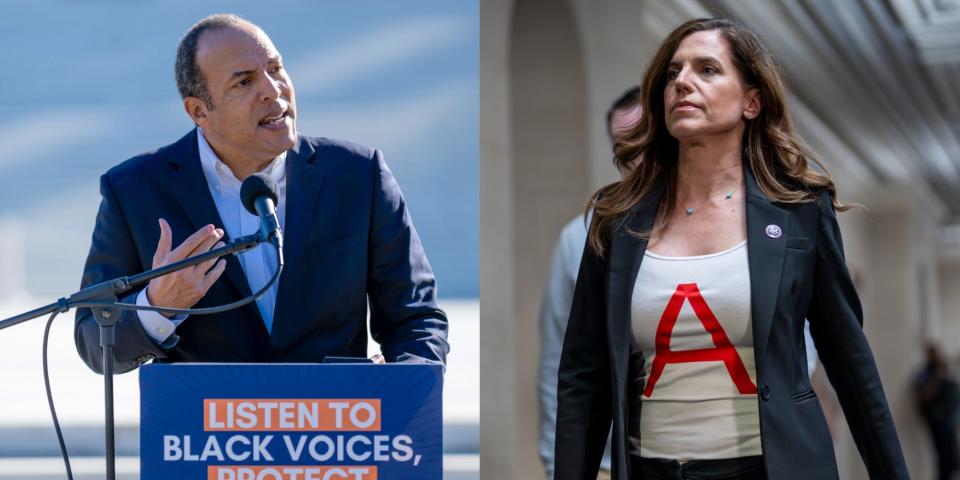

Stephen Kings Take Comparing Stranger Things To It

May 10, 2025

Stephen Kings Take Comparing Stranger Things To It

May 10, 2025 -

Top 5 Stephen King Books A Fans Essential Reading List

May 10, 2025

Top 5 Stephen King Books A Fans Essential Reading List

May 10, 2025 -

Stephen Kings Comments On Stranger Things And It A Comparison

May 10, 2025

Stephen Kings Comments On Stranger Things And It A Comparison

May 10, 2025 -

Stivn King Na Netflix Ochakvan Rimeyk

May 10, 2025

Stivn King Na Netflix Ochakvan Rimeyk

May 10, 2025 -

Stephen King 5 Books Every Fan Should Own

May 10, 2025

Stephen King 5 Books Every Fan Should Own

May 10, 2025