Potential Unicaja-Sabadell Merger: Investor Reactions And Implications

Table of Contents

Market Reactions to the Potential Unicaja-Sabadell Merger

Initial reactions to the Unicaja-Sabadell merger rumors have been mixed. Following news reports suggesting potential discussions, both Unicaja and Sabadell stock prices experienced significant volatility. Trading volumes surged, indicating heightened investor interest and uncertainty.

Analyst opinions are similarly divided. While some, like analysts at Bank of America Merrill Lynch, predict significant synergies and a positive impact on shareholder value, others at Morgan Stanley express concerns regarding potential integration challenges. The overall investor sentiment appears to lean towards cautious optimism, with many awaiting further clarity on the merger's terms and conditions.

- Stock price changes: Unicaja saw a [insert percentage]% increase, while Sabadell experienced a [insert percentage]% fluctuation following the initial reports.

- Trading volume spikes: Daily trading volumes for both banks increased by [insert percentage]%, reflecting increased investor interest and speculation.

- Key analyst ratings and target prices: Bank of America Merrill Lynch issued a "Buy" rating with a target price of [insert price], while Morgan Stanley maintained a "Hold" rating with a target price of [insert price].

- Investor commentary: [Insert quotes from relevant news articles or financial reports reflecting investor sentiment, if available].

Potential Synergies and Benefits of a Unicaja-Sabadell Merger

A successful Unicaja-Sabadell merger could unlock substantial synergies and benefits. Cost-cutting opportunities are plentiful, particularly through the consolidation of branch networks and the streamlining of IT infrastructure. This could lead to significant cost savings, potentially in the range of [insert estimated amount] euros annually.

Furthermore, the merger would significantly expand market share, creating lucrative cross-selling opportunities for both banks' existing customer bases. The combined entity would possess a broader geographic reach and a more diversified product portfolio, enhancing its competitive position within the Spanish banking landscape.

- Estimated cost savings: Analysts project annual cost savings of between €[lower estimate] million and €[higher estimate] million through operational efficiencies.

- Potential revenue increase: Increased market share and cross-selling could lead to a projected revenue increase of [insert percentage]% within [insert timeframe].

- Expansion into new market segments: The merger could facilitate expansion into previously underserved markets or niche segments.

- Strengthened competitive position: The combined entity would become a stronger competitor to larger Spanish banks, potentially improving its negotiating power and profitability.

Potential Challenges and Risks Associated with the Unicaja-Sabadell Merger

Despite the potential benefits, a Unicaja-Sabadell merger also presents significant challenges and risks. Integrating two distinct banking cultures could prove difficult and lead to integration setbacks. Significant regulatory hurdles and potential antitrust concerns cannot be overlooked; the approval process could be lengthy and uncertain.

Furthermore, job losses and branch closures are likely, leading to potential negative impacts on employee morale and customer service. Maintaining positive customer relationships during and after the integration process will be critical to preserving brand reputation.

- Integration timeline and potential setbacks: The integration process is projected to take [insert timeframe], with potential delays due to unforeseen complications.

- Regulatory approval process and potential delays: Obtaining regulatory approval could take several months or even years, depending on the scrutiny of the merger.

- Potential for employee layoffs: Cost-cutting measures may necessitate job cuts, potentially leading to social and political repercussions.

- Impact on customer relationships and brand reputation: Effective communication and service continuity will be key to mitigating any negative impact on customer loyalty.

Long-Term Implications for the Spanish Banking Sector

A successful Unicaja-Sabadell merger would significantly reshape the Spanish banking sector's competitive landscape. The combined entity would command a larger market share, potentially leading to increased competition or, depending on market response, a period of decreased competition followed by re-emergence of new contenders. This could impact interest rates and lending conditions for businesses and consumers.

Moreover, the merger could trigger a wave of further consolidation within the Spanish banking industry, as smaller banks seek to enhance their competitiveness and profitability in a rapidly changing market. The long-term effects on profitability and efficiency within the sector will depend heavily on the successful execution of the merger and the adaptability of other players.

- Changes in market share distribution: The merged entity would become a major player, altering the existing market share distribution among Spanish banks.

- Increased/Decreased competition: The short-term effect could be decreased competition, but the long-term outcome is uncertain and potentially dependent on other market reactions.

- Impact on interest rates and lending conditions: The merger could lead to changes in interest rates and lending conditions, impacting both borrowers and lenders.

- Potential for similar mergers: The success or failure of the Unicaja-Sabadell merger will set a precedent and influence future consolidation attempts in the Spanish banking sector.

Conclusion

The potential Unicaja-Sabadell merger presents both significant opportunities and considerable challenges. While potential synergies and cost savings are substantial, integration risks and regulatory hurdles need careful consideration. Investor reactions have been mixed, reflecting the uncertainty surrounding the deal's ultimate success. The long-term implications for the Spanish banking sector are far-reaching, potentially shaping the competitive landscape and driving further consolidation. Staying informed about the progress of this potential union is crucial for investors seeking to navigate the evolving landscape of the Spanish banking sector. Continue to monitor developments related to the Unicaja-Sabadell merger for further insights and updates.

Featured Posts

-

Drug Pricing Reform Republican Budget Bill Includes Middlemen Changes

May 13, 2025

Drug Pricing Reform Republican Budget Bill Includes Middlemen Changes

May 13, 2025 -

Chinas Byd Challenges Fords Decline The Future Of Electric Vehicles In Brazil

May 13, 2025

Chinas Byd Challenges Fords Decline The Future Of Electric Vehicles In Brazil

May 13, 2025 -

Doom The Dark Ages 17 Off Deal

May 13, 2025

Doom The Dark Ages 17 Off Deal

May 13, 2025 -

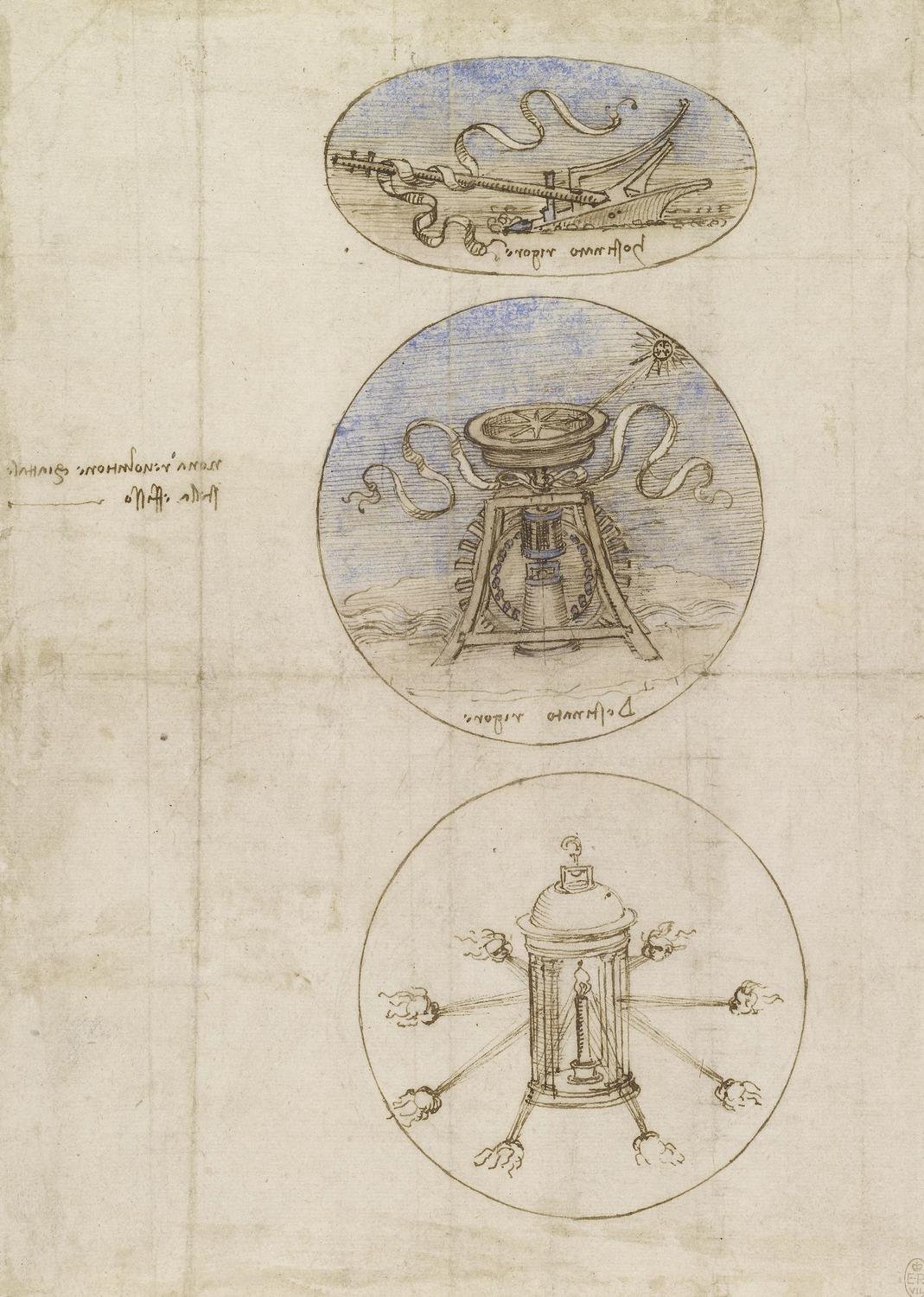

The Da Vinci Code And The History Of Religious Symbolism

May 13, 2025

The Da Vinci Code And The History Of Religious Symbolism

May 13, 2025 -

Olympus Has Fallen Examining The Films Impact And Legacy

May 13, 2025

Olympus Has Fallen Examining The Films Impact And Legacy

May 13, 2025