Pound Strengthens: Traders Reduce BOE Interest Rate Cut Wagers Following Inflation Report

Table of Contents

Inflation Report's Impact on Pound Sterling

The latest inflation report delivered a surprise, showing lower-than-anticipated inflation figures, significantly influencing market reaction and the Pound Strengthens as a result. This unexpected data led to a reassessment of the BOE's likely future actions concerning interest rates. Key findings that shaped market sentiment included:

- CPI Figures: The Consumer Price Index (CPI) showed a lower-than-expected increase in inflation, suggesting that inflationary pressures might be easing more quickly than previously forecast.

- Core Inflation Data: Excluding volatile items like food and energy, core inflation also demonstrated a smaller rise than anticipated. This suggests underlying inflationary pressures are less intense than feared.

- Producer Price Index (PPI) Changes: A moderation in producer price inflation signaled a potential easing of cost pressures further down the supply chain, contributing to the overall downward revision of inflation expectations.

This unexpectedly positive inflation data contrasted sharply with analysts' predictions, leading to a significant shift in market expectations regarding the BOE's next move. The market had previously priced in a higher probability of further interest rate cuts to combat inflation. The report effectively countered this assumption, leading to the Pound Strengthens.

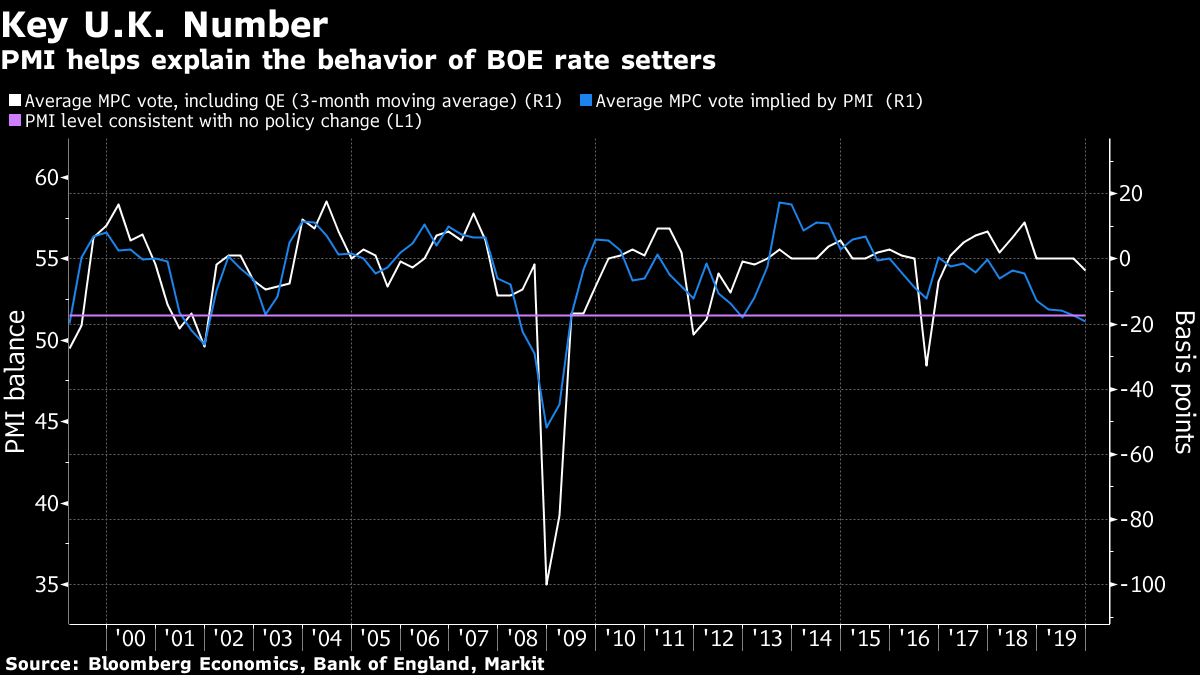

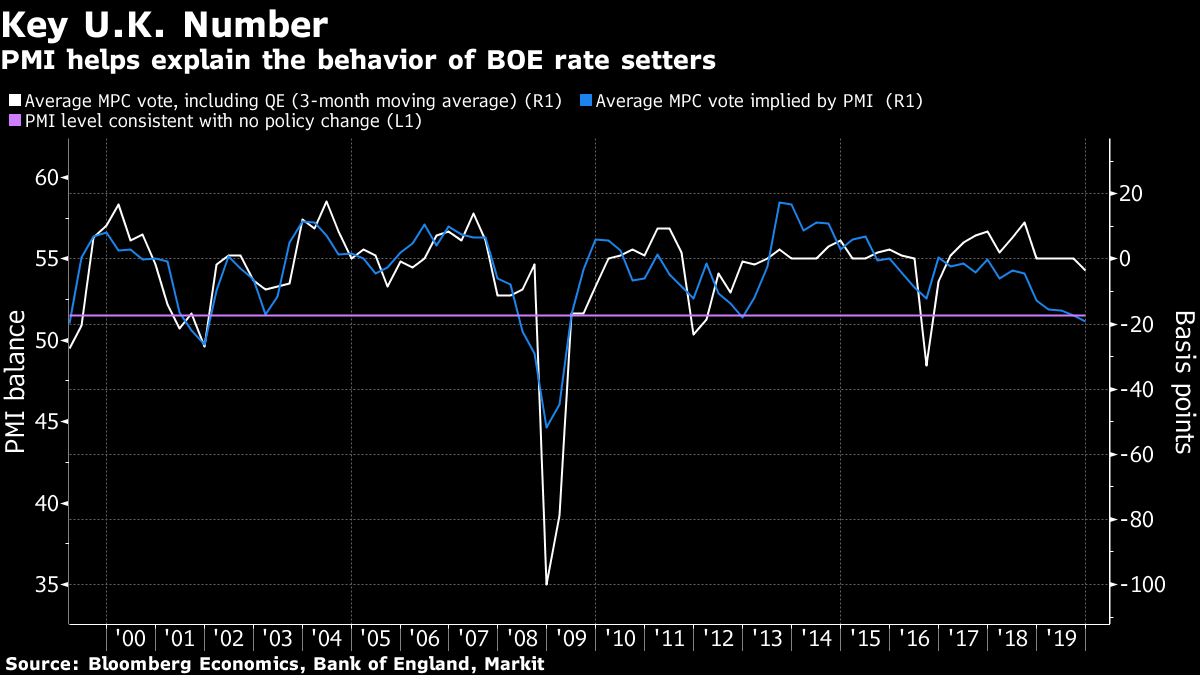

Reduced BOE Interest Rate Cut Wagers

Interest rate wagers, or bets on future interest rate movements by the BOE, are commonly used by traders to speculate on the central bank's monetary policy decisions. Following the release of the inflation report, there was a noticeable decrease in these wagers predicting a BOE interest rate cut. Estimates suggest a reduction of approximately X% (replace X with a realistic percentage decrease based on current market data) in the number of bets anticipating a rate cut.

Several factors contributed to this reduction in wagers:

- Lower-than-expected inflation: The lower-than-anticipated inflation figures reduced the perceived urgency for the BOE to implement further rate cuts.

- Shifting market sentiment: Market sentiment shifted towards a more hawkish stance, reflecting a growing belief that the BOE might hold off on further cuts or even consider future rate hikes if inflation remains stubbornly high.

- Potential for future rate hikes: Some analysts now believe that if inflation fails to fall as predicted, the BOE might even need to consider raising interest rates to control price increases. This possibility also contributed to the reduced wagers on further cuts.

Pound Sterling's Strength and Market Volatility

The Pound Strengthens significantly against major currencies following the release of the inflation report. For instance, the GBP/USD exchange rate saw an increase of approximately Y% (replace Y with a realistic percentage increase), while the GBP/EUR exchange rate appreciated by Z% (replace Z with a realistic percentage increase). This appreciation reflects the market’s positive reaction to the better-than-expected inflation data.

The foreign exchange market experienced increased volatility immediately following the report's release, as traders adjusted their positions in response to the new information. This volatility underscores the sensitivity of currency markets to unexpected economic data.

The pound's strengthening has potential implications for the UK economy:

- Impact on consumer spending: A stronger pound can reduce the cost of imported goods, potentially easing inflationary pressures and boosting consumer purchasing power.

- Effect on businesses with foreign currency exposure: Businesses with significant foreign currency earnings or liabilities will experience altered profit margins due to currency fluctuations. Those exporting from the UK might see reduced competitiveness due to the stronger Pound.

- Overall effect on the UK economy: The net effect on the UK economy will depend on the interplay of these various factors and the overall duration of the Pound's strength.

Expert Opinions and Market Analysis

“[Insert quote from a financial analyst regarding the pound’s strengthening and the BOE’s future policy decisions].” – [Source: Analyst's Name/Organization]

“[Insert quote from a second financial analyst offering a contrasting or supporting view].” – [Source: Analyst's Name/Organization]

Conclusion

The unexpectedly positive inflation report significantly impacted market expectations, leading to a reduction in BOE interest rate cut wagers and a subsequent strengthening of the pound. The Pound Strengthens due to this positive economic indicator, presenting a shift in the market's perception of the UK's economic outlook. This highlights the considerable influence of inflation data on monetary policy decisions and currency movements. The BOE's response to future economic data will remain crucial in shaping the pound's trajectory and the overall health of the UK economy.

Stay tuned for further updates on how the pound strengthens in response to future economic data and BOE announcements. Keep an eye on our site for more analysis of the BOE interest rate cut probabilities and the impact on the Pound Sterling, as well as the continued analysis of inflation’s effect on the pound and the broader UK economy.

Featured Posts

-

Dem Qmrt Lsnaet Alaflam Alqtryt

May 23, 2025

Dem Qmrt Lsnaet Alaflam Alqtryt

May 23, 2025 -

Eric Andre Regrets Turning Down A Real Pain Role

May 23, 2025

Eric Andre Regrets Turning Down A Real Pain Role

May 23, 2025 -

Analyzing The Fighting Styles In The Karate Kid Part Ii

May 23, 2025

Analyzing The Fighting Styles In The Karate Kid Part Ii

May 23, 2025 -

Today Shows Dylan Dreyer Faces Difficult Situation

May 23, 2025

Today Shows Dylan Dreyer Faces Difficult Situation

May 23, 2025 -

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025

Latest Posts

-

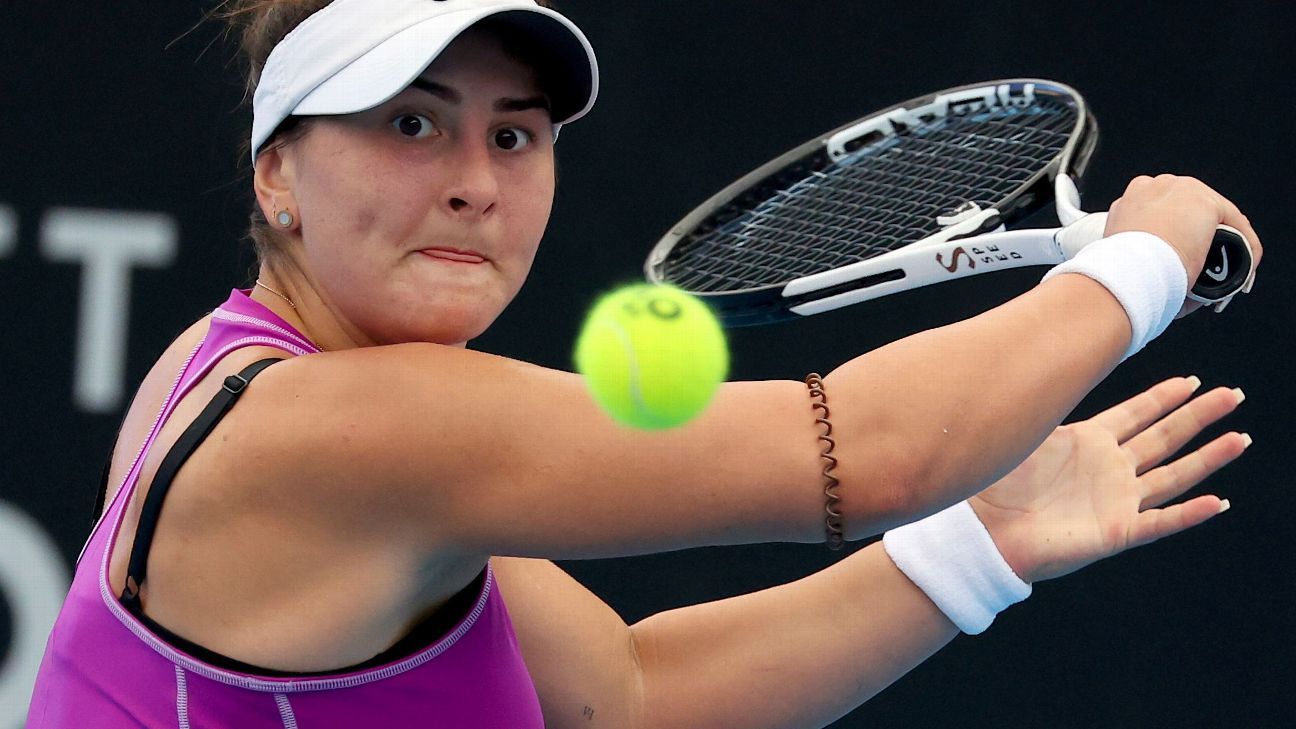

Andreescu Advances To Madrid Open Second Round

May 23, 2025

Andreescu Advances To Madrid Open Second Round

May 23, 2025 -

Perviy Krug Turnira V Shtutgarte Aleksandrova Protiv Samsonovoy

May 23, 2025

Perviy Krug Turnira V Shtutgarte Aleksandrova Protiv Samsonovoy

May 23, 2025 -

Shtutgart Aleksandrova Obygryvaet Samsonovu V Startovom Matche

May 23, 2025

Shtutgart Aleksandrova Obygryvaet Samsonovu V Startovom Matche

May 23, 2025 -

Elena Rybakina Tretiy Krug Turnira V Rime

May 23, 2025

Elena Rybakina Tretiy Krug Turnira V Rime

May 23, 2025 -

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 23, 2025

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 23, 2025