Powell Warns: Tariffs Could Jeopardize Federal Reserve Objectives

Table of Contents

Inflationary Pressures from Tariffs

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods for consumers. This upward pressure on prices is a significant concern for the Federal Reserve, whose mandate includes maintaining price stability. When tariffs are imposed, businesses often pass these increased costs onto consumers, leading to higher prices across the board.

- Increased import costs passed onto consumers: The simplest mechanism is a direct pass-through of the tariff to the consumer. For example, a tariff on imported steel increases the cost of steel products, impacting everything from automobiles to construction materials.

- Reduced purchasing power: Higher prices for essential goods reduce consumers' purchasing power, potentially slowing down consumer spending and economic growth.

- Potential for wage-price spiral: Increased prices can lead to demands for higher wages, further fueling inflation and creating a challenging feedback loop.

- Impact on the Consumer Price Index (CPI): The CPI, a key measure of inflation, directly reflects the impact of tariff-driven price increases on the cost of living.

The Federal Reserve aims to keep inflation at a healthy, predictable level. Tariffs, by artificially inflating prices, undermine this crucial objective and complicate the Fed's ability to maintain price stability.

Impact on Economic Growth and Investment

The uncertainty generated by tariffs and trade wars significantly impacts business investment and economic growth. Businesses hesitate to invest in expansion or new projects when faced with unpredictable trade policies and fluctuating import costs. This uncertainty creates a chilling effect on economic activity.

- Uncertainty deterring business investment: Businesses avoid committing to long-term projects when future costs and market conditions are unclear due to unpredictable tariff policies.

- Reduced consumer spending due to higher prices: As mentioned earlier, higher prices resulting from tariffs reduce consumer purchasing power, leading to decreased consumer spending.

- Negative impact on GDP growth: Reduced investment and consumer spending directly translate to slower GDP growth, impacting the overall health of the economy.

- Potential job losses in affected sectors: Industries heavily reliant on imported goods or exports may experience job losses due to reduced competitiveness and decreased demand.

The Federal Reserve strives for sustainable economic growth. Tariffs, by creating uncertainty and dampening investment, directly contradict this goal, potentially leading to slower growth and even recession.

Challenges to Monetary Policy Effectiveness

Tariffs make it significantly more difficult for the Federal Reserve to manage monetary policy effectively. The unpredictable nature of trade wars and the resulting economic shocks complicate the Fed's ability to forecast inflation and economic growth accurately.

- Difficulty in forecasting inflation: The unpredictable nature of tariff-induced price changes makes it challenging for the Fed to accurately predict future inflation rates.

- Reduced effectiveness of interest rate adjustments: Traditional monetary policy tools, such as interest rate adjustments, may be less effective in mitigating the economic consequences of trade wars.

- Increased complexity in setting monetary policy targets: The added uncertainty necessitates more complex models and a more cautious approach to setting monetary policy targets.

- Potential for conflicting policy goals: The Fed may face conflicting policy goals—addressing inflation caused by tariffs while simultaneously trying to stimulate economic growth hampered by the same tariffs.

Predictable economic conditions are crucial for effective monetary policy. Tariffs introduce significant unpredictability, undermining the Fed's ability to achieve its objectives.

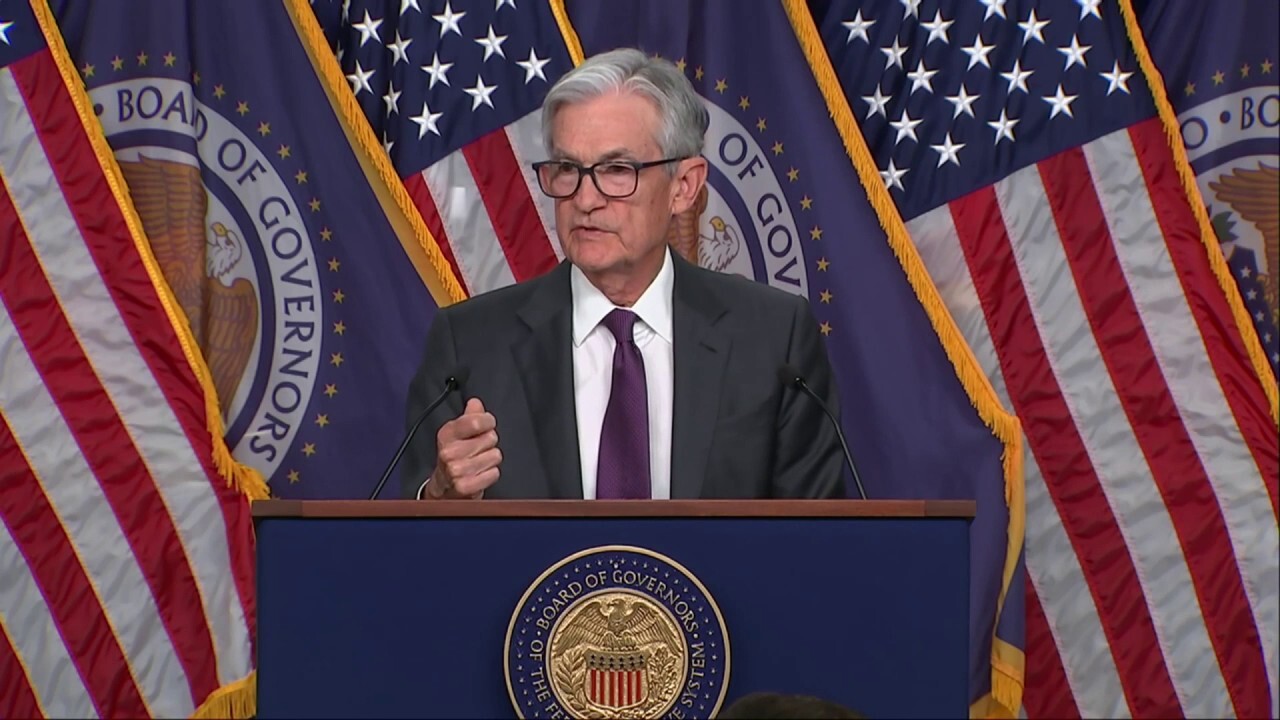

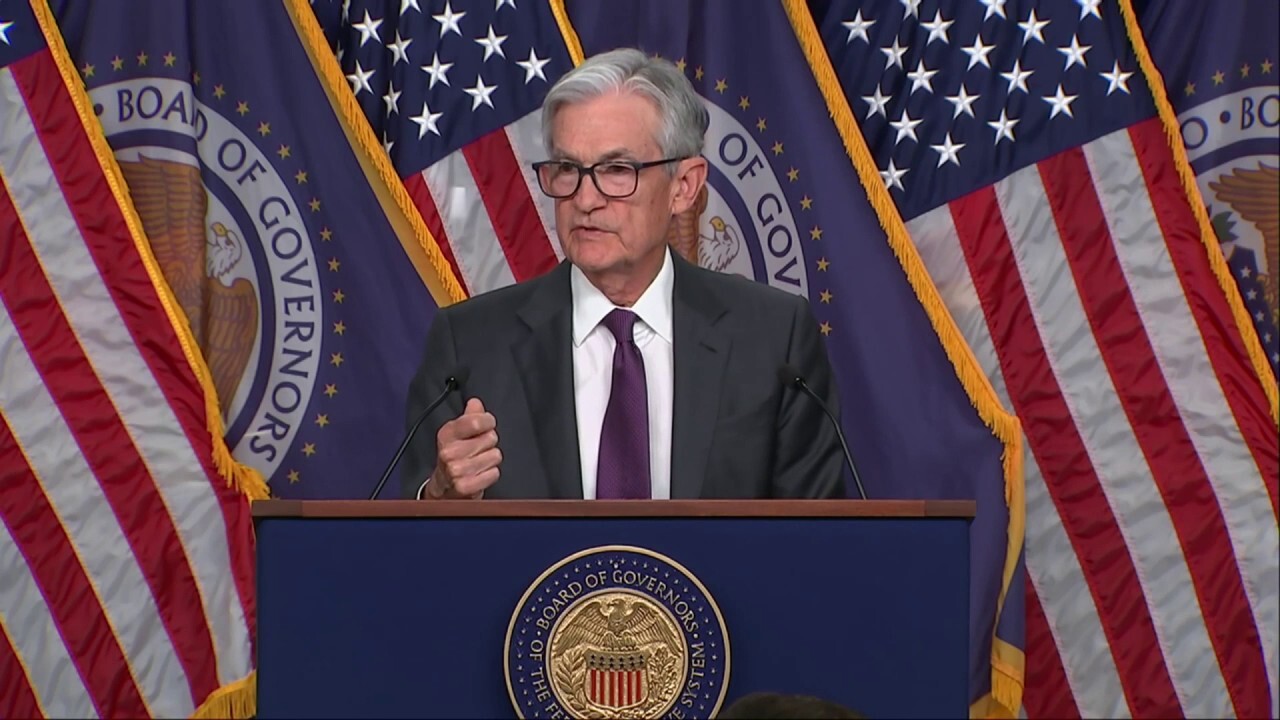

Powell's Statements and Federal Reserve Actions

Jerome Powell has repeatedly expressed his concerns about the negative economic consequences of tariffs. He has highlighted the inflationary pressures and the threat to economic growth posed by these trade policies. While the Federal Reserve hasn't directly controlled tariffs, their actions reflect a cautious approach to monetary policy in light of the increased uncertainty.

- Direct quotes from Powell's speeches or statements: Numerous public statements from Powell emphasize the risks associated with tariffs and their impact on the Fed's ability to maintain price stability and promote sustainable economic growth.

- Summary of Federal Reserve policy decisions related to tariffs: The Fed's actions, such as interest rate adjustments, have reflected a cautious approach, aiming to balance the risks of inflation and recession in a complex economic environment.

- Analysis of the Fed's response to the trade situation: The Fed's response demonstrates the challenges posed by tariffs to traditional monetary policy strategies.

Conclusion: Tariffs and the Future of the Federal Reserve's Objectives

In conclusion, Jerome Powell's warnings about the detrimental effects of tariffs on the Federal Reserve's objectives are well-founded. Tariffs create inflationary pressures, hinder economic growth, and significantly complicate the effective management of monetary policy. The uncertainty generated by trade wars makes it harder for the Fed to accurately predict economic trends and implement appropriate policies. If the tariff situation isn't addressed effectively, the consequences for the US economy could be severe. Understanding Powell's concerns about tariffs and their impact on Federal Reserve objectives is crucial. Stay informed on how tariffs threaten the Federal Reserve's objectives to protect your financial future.

Featured Posts

-

Myrtle Beach Challenges Ranking As Second Most Unsafe Us Beach

May 26, 2025

Myrtle Beach Challenges Ranking As Second Most Unsafe Us Beach

May 26, 2025 -

Bundesliga Jubel Beim Hsv Aufstieg Perfekt

May 26, 2025

Bundesliga Jubel Beim Hsv Aufstieg Perfekt

May 26, 2025 -

Armando Iannucci Has His Satirical Edge Dulled

May 26, 2025

Armando Iannucci Has His Satirical Edge Dulled

May 26, 2025 -

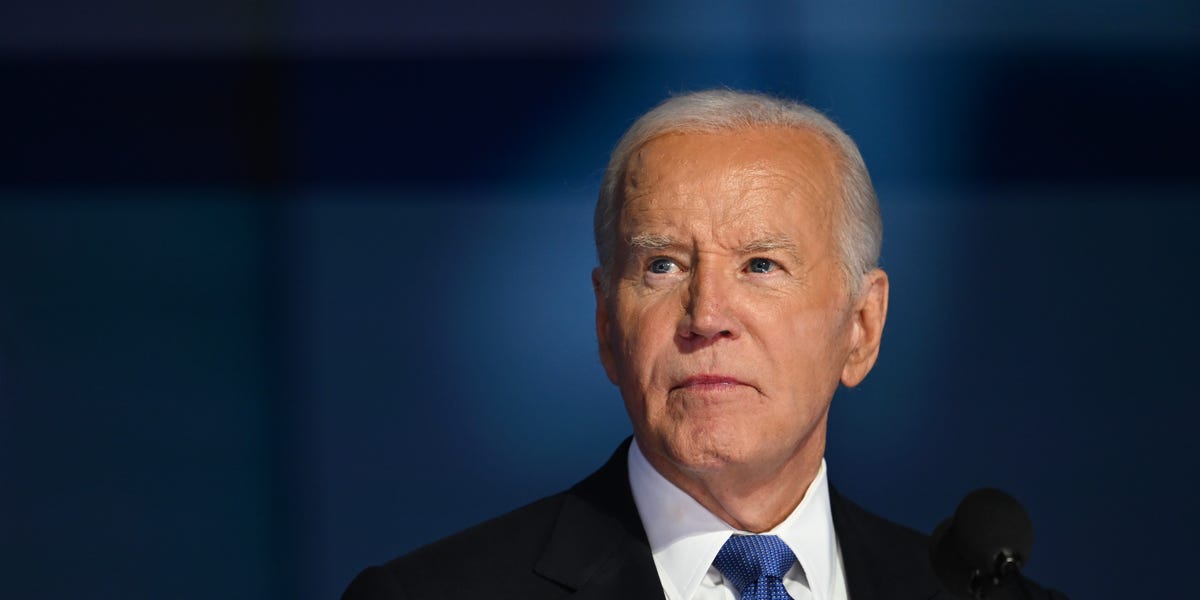

The Week That Derailed Joe Bidens Post Presidency A Comprehensive Look

May 26, 2025

The Week That Derailed Joe Bidens Post Presidency A Comprehensive Look

May 26, 2025 -

Understanding The F1 Drivers Press Conference A Comprehensive Overview

May 26, 2025

Understanding The F1 Drivers Press Conference A Comprehensive Overview

May 26, 2025