Powell Warns: Tariffs Could Jeopardize Fed's Economic Objectives

Table of Contents

The Fed's Economic Objectives and Current Challenges

The Federal Reserve operates under a dual mandate: maintaining price stability and achieving maximum employment. These seemingly simple goals become incredibly complex in the face of current economic headwinds. High inflation, fueled by factors like supply chain disruptions and robust consumer demand, is a primary concern. Simultaneously, while the labor market has shown signs of recovery, wage pressures and potential inflationary spirals remain a threat.

- High inflation rates: The current inflation rate significantly impacts consumer spending, eroding purchasing power and potentially leading to a slowdown in economic growth. The higher the inflation, the more challenging it becomes for the Fed to manage the economy without triggering a recession.

- Supply chain bottlenecks: Disruptions in global supply chains, exacerbated by geopolitical events and the lingering effects of the pandemic, continue to constrain production and contribute to elevated prices. This is a significant challenge in achieving both price stability and maximum employment.

- Labor market dynamics: While unemployment is low, rapid wage growth, especially in certain sectors, could fuel further inflationary pressures, creating a difficult balancing act for the Fed.

How Tariffs Exacerbate Economic Challenges

Tariffs, while intended to protect domestic industries, often have unintended and negative consequences for the overall economy. Their impact on inflation is direct and significant: increased import costs translate into higher prices for consumers and businesses. This inflationary pressure directly counters the Fed's goal of price stability.

Furthermore, tariffs can create ripple effects throughout the economy. They disrupt supply chains, leading to shortages and further price increases. The uncertainty created by trade disputes also discourages business investment, hindering economic growth and employment.

- Increased consumer prices: Tariffs directly increase the cost of imported goods, forcing businesses to pass these increased costs onto consumers, resulting in higher prices across various sectors.

- Retaliatory tariffs: When one country imposes tariffs, other countries often retaliate, leading to a tit-for-tat trade war that harms all involved, disrupting global trade flows.

- Reduced business investment: The uncertainty associated with fluctuating tariffs discourages businesses from investing in expansion or new projects, hindering long-term economic growth.

Powell's Statements and Warnings

Chairman Powell has repeatedly expressed his concern about the inflationary pressures caused by tariffs. In several public statements and press conferences, he has highlighted the detrimental effect of protectionist trade policies on the Fed's ability to achieve its economic objectives.

- Inflationary concerns: Powell has specifically cited tariffs as a contributing factor to the elevated inflation rates, emphasizing the direct link between trade policies and consumer prices.

- Policy recommendations: While the Fed primarily utilizes monetary policy tools like interest rate adjustments, Powell has indirectly advocated for policies that promote free and fair trade to alleviate inflationary pressures.

- Potential consequences: Powell's statements imply that if tariffs are not addressed, the Fed’s ability to manage inflation effectively will continue to be hampered, potentially leading to more aggressive interest rate hikes and a higher risk of recession.

Alternative Economic Policies and Their Impact

Addressing inflation requires a multifaceted approach. While tariffs worsen the situation, other economic policy tools can be employed to combat inflation.

- Monetary policy adjustments: The Fed can raise interest rates to cool down the economy and curb inflation. However, this measure carries the risk of slowing economic growth and potentially triggering a recession.

- Fiscal policy measures: Government spending and taxation policies can play a role. For instance, targeted tax cuts could stimulate consumer spending, but this needs careful management to avoid exacerbating inflation.

- Supply-side solutions: Addressing supply chain bottlenecks through infrastructure investments and regulatory reforms can help alleviate shortages and ease inflationary pressures without relying on protectionist measures like tariffs.

Conclusion: The Peril of Tariffs on Economic Stability

Powell's warnings about tariffs jeopardizing the Fed's economic objectives are serious. The evidence clearly shows that tariffs contribute to inflation, disrupt supply chains, and create uncertainty that hinders economic growth. While the Fed can utilize monetary policy tools, a more holistic approach is needed. This includes addressing supply-side issues and avoiding trade policies that exacerbate inflationary pressures. Understanding Powell's concerns about tariffs and their impact on the US economy is crucial. Stay informed about economic developments and advocate for policies that promote sustainable growth and price stability. Ignoring the warning signs could have severe consequences for the American economy.

Featured Posts

-

Entreprise Charentaise A Saint Brieuc Un Heritage Preserve

May 25, 2025

Entreprise Charentaise A Saint Brieuc Un Heritage Preserve

May 25, 2025 -

Jensons Fw 22 Extended A Style Analysis

May 25, 2025

Jensons Fw 22 Extended A Style Analysis

May 25, 2025 -

Sse Announces 3 Billion Reduction In Spending Plan Due To Slowing Growth

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Plan Due To Slowing Growth

May 25, 2025 -

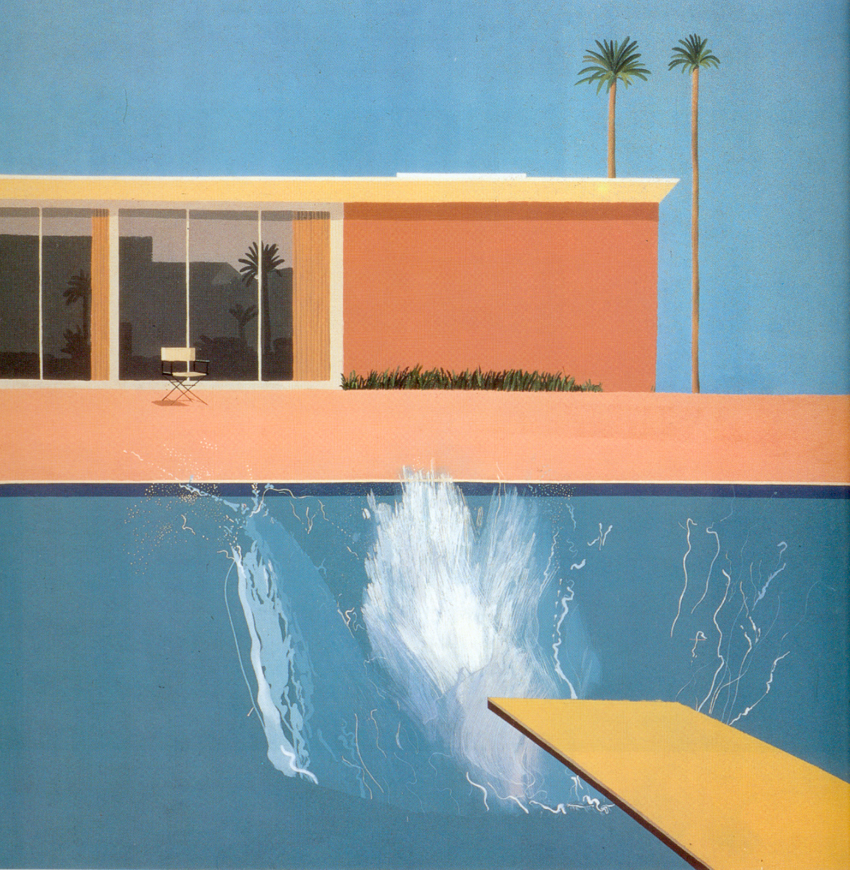

David Hockney A Bigger Picture Analyzing The Artists Techniques And Themes

May 25, 2025

David Hockney A Bigger Picture Analyzing The Artists Techniques And Themes

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 25, 2025