Predicting Future Stock Performance: Will These 2 Stocks Beat Palantir In 3 Years?

Table of Contents

Assessing Palantir's Current Market Position and Future Projections

Palantir's Strengths

Palantir boasts several competitive advantages that have fueled its growth. Its strong government contracts provide a stable revenue stream and significant brand recognition within the government and intelligence sectors. Furthermore, its proprietary technology, particularly its Gotham and Foundry platforms, offers sophisticated data analytics capabilities that are difficult for competitors to replicate. This creates high switching costs for clients, ensuring continued loyalty.

- Strong government contracts: A significant portion of Palantir's revenue comes from long-term contracts with government agencies.

- Leading data analytics platform: Gotham and Foundry provide unparalleled data integration and analysis capabilities.

- Expanding commercial sector: Palantir is actively pursuing growth in the commercial market, diversifying its revenue streams.

- High switching costs for clients: The complexity and integration of Palantir's platforms make switching to competitors difficult.

Supporting this positive outlook are various analyst predictions and financial reports indicating strong projected revenue and earnings growth for Palantir in the coming years. However, relying solely on these projections for stock prediction would be unwise.

Palantir's Weaknesses and Potential Risks

Despite its strengths, Palantir faces several challenges that could impact its future stock performance. The company's significant reliance on government contracts makes it vulnerable to changes in government spending or priorities. Furthermore, increasing competition from established tech giants like Microsoft and Google, who are investing heavily in data analytics, poses a considerable threat. Finally, Palantir's high stock valuation compared to its current earnings raises concerns about its sustainability.

- Competition from established tech firms: Major players are aggressively entering the data analytics market.

- Potential for contract losses: Government contracts are not always guaranteed and can be subject to competitive bidding.

- High stock valuation compared to earnings: This poses a risk if the company fails to meet growth expectations.

Economic downturns could also significantly impact Palantir's performance, particularly in the commercial sector. Therefore, any stock prediction must consider these inherent risks.

Candidate Stock #1: Snowflake - A Deep Dive

Company Overview and Competitive Advantages

Snowflake (SNOW) operates a cloud-based data warehousing platform, offering a scalable and cost-effective solution for businesses of all sizes. Its key competitive advantage lies in its ability to provide near real-time data analytics, catering to the growing need for agility and speed in data-driven decision-making. Snowflake's strong financial performance, consistently exceeding expectations, further strengthens its position.

- Strong market position in cloud data warehousing: Snowflake is a leader in this rapidly growing market segment.

- Innovative technology: Its unique architecture allows for exceptional scalability and performance.

- Expanding customer base: Snowflake continues to attract a diverse range of clients across various industries.

- Solid financial performance: Consistent revenue growth and expanding profitability indicate a strong financial outlook.

Potential to Outperform Palantir

Snowflake’s potential to outperform Palantir stems from several factors. Its faster growth rate, driven by the increasing adoption of cloud computing, positions it for significant market share expansion. Furthermore, its lower valuation relative to its growth prospects makes it a potentially more attractive investment. Snowflake's focus on a broader commercial market also offers greater diversification compared to Palantir's reliance on government contracts.

- Faster growth rate: Snowflake's revenue growth consistently outpaces Palantir's.

- Disruptive technology: Its cloud-based platform is more adaptable and scalable than traditional solutions.

- Lower valuation: Snowflake’s stock might be undervalued compared to its growth potential.

- Stronger market penetration: Snowflake has a wider and more diverse customer base.

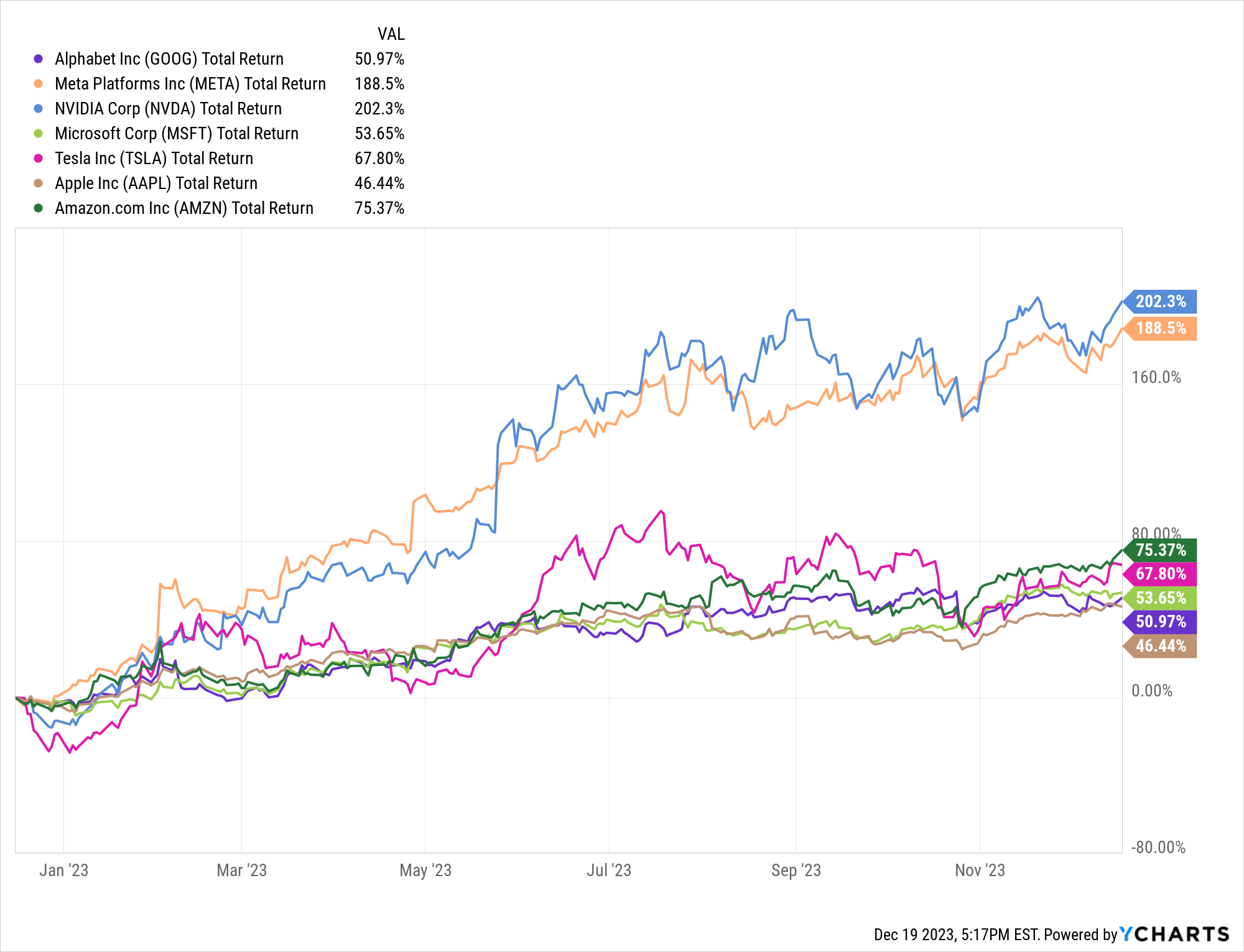

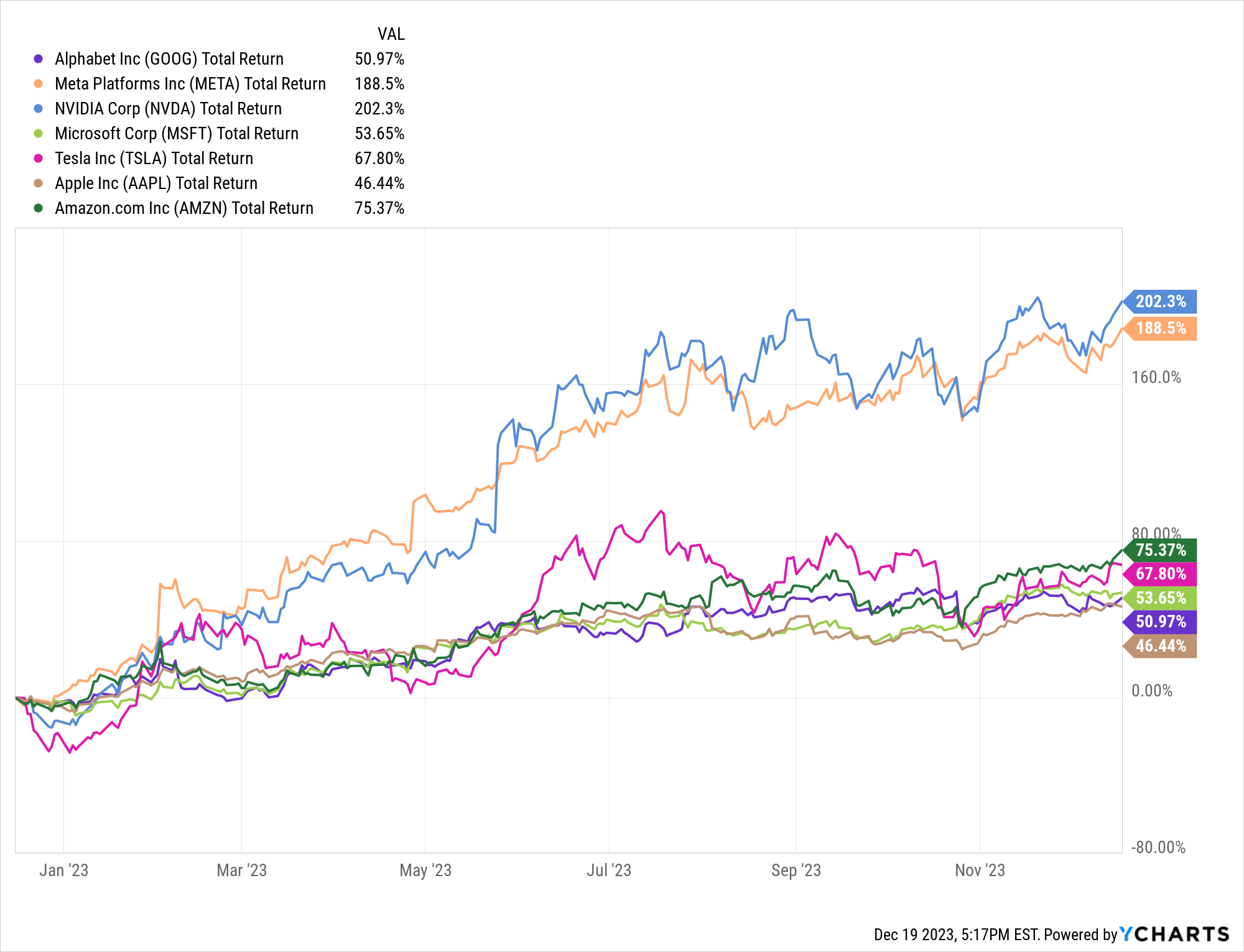

Comparative charts showing revenue growth, market capitalization, and profitability would provide a more visual and compelling argument.

Candidate Stock #2: Datadog - A Detailed Analysis

Company Overview and Competitive Advantages

Datadog (DDOG) provides a monitoring and analytics platform for cloud-scale applications. Its platform offers comprehensive visibility into the performance of applications, infrastructure, and logs, enabling businesses to proactively identify and address issues. Datadog's key competitive advantage lies in its unified platform, streamlining operations and simplifying complex monitoring tasks. Its strong partnerships and established brand reputation in the developer community also contributes to its success.

- Strong partnerships: Datadog collaborates with major cloud providers and technology companies.

- Access to key markets: Its platform is compatible with a wide range of technologies and cloud environments.

- Established brand reputation: Datadog enjoys high brand recognition among developers and IT professionals.

- Cost-effective operations: Its scalable platform allows for efficient resource utilization.

Potential to Outperform Palantir

Datadog’s potential to surpass Palantir rests on its high growth potential fueled by the ongoing digital transformation and increasing demand for cloud-based monitoring solutions. Its expansion into new markets and strategic acquisitions further enhance its growth trajectory. Furthermore, Datadog’s efficient management and strong financial performance provide a solid foundation for continued success.

- High growth potential: The demand for cloud monitoring solutions is constantly rising.

- Expanding into new markets: Datadog is continually broadening its product offerings and target markets.

- Strategic acquisitions: Acquisitions can help accelerate growth and enhance the platform's capabilities.

- Efficient management: Effective management practices contribute to strong financial performance.

Again, comparative charts and tables highlighting key metrics will visually underscore Datadog's potential against Palantir.

Conclusion

Predicting future stock performance requires careful consideration of numerous factors. This analysis has highlighted the strengths and weaknesses of Palantir, Snowflake, and Datadog, offering insights into their potential for future growth. While Snowflake and Datadog present compelling arguments for outperforming Palantir in the next three years due to faster growth rates, broader market reach, and potentially more attractive valuations, significant uncertainties and market risks always remain.

Conduct thorough due diligence before making any investment decisions. Analyzing stock performance and predicting future trends is complex, and this article should serve only as a starting point for your research. Remember to consult with a financial advisor before making any investment decisions related to Palantir, Snowflake, or Datadog, or any other stock market prediction. Remember that past performance is not indicative of future results.

Featured Posts

-

Analyzing Apples Position In The Ai Revolution

May 10, 2025

Analyzing Apples Position In The Ai Revolution

May 10, 2025 -

Should You Invest In Palantir Stock Before May 5 2024

May 10, 2025

Should You Invest In Palantir Stock Before May 5 2024

May 10, 2025 -

Wynne Evans On Potential Strictly Come Dancing Return A Clear Statement

May 10, 2025

Wynne Evans On Potential Strictly Come Dancing Return A Clear Statement

May 10, 2025 -

Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025

Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025 -

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025