President Trump's Criticism Of Jerome Powell And The Federal Reserve

Table of Contents

The Nature of Trump's Criticism

President Trump's criticisms of Jerome Powell and the Federal Reserve were frequent and often scathing, focusing primarily on two key areas: the perceived slowing of economic growth and allegations of political motivation.

Accusations of Slowing Economic Growth

Trump repeatedly asserted that Powell's interest rate hikes were unnecessarily hindering economic expansion, directly contradicting the Fed's mandate of price stability and maximum employment.

- Specific Examples: Trump frequently used Twitter to express his displeasure, often calling for interest rate cuts. For instance, in July 2018, amidst rising interest rates, he tweeted his disapproval, stating that the Fed was "going loco." Similar criticisms continued throughout his presidency.

- Economic Context: The US economy was experiencing robust growth in 2017 and early 2018, but inflation was also starting to rise, prompting the Fed to tighten monetary policy. Trump, however, prioritized continued rapid growth, often ignoring potential inflationary pressures.

- Data Cited (or not cited): Trump rarely cited specific economic data to support his claims. His assertions often focused on anecdotal evidence and his own perception of economic conditions, rather than relying on rigorous economic analysis provided by the Federal Reserve.

Claims of Political Motivation

Trump frequently implied, and sometimes explicitly stated, that Powell's actions were politically motivated, designed to undermine his administration's economic policies.

- Evidence (or lack thereof): There's little concrete evidence to support these claims. The Federal Reserve's independence is constitutionally enshrined, and its decisions are guided by economic data and analysis, not political considerations. However, Trump's accusations fueled speculation and eroded public trust in the institution's neutrality.

- Independence of the Federal Reserve: The Fed's independence is paramount to its effectiveness. Political interference can lead to short-sighted monetary policy decisions, potentially causing instability and jeopardizing long-term economic health.

Impact on Market Volatility

Trump's public criticisms of Powell and the Federal Reserve inevitably led to increased market volatility.

- Market Reactions: The stock market often reacted negatively to Trump's statements, reflecting investor uncertainty and concern about the potential for political interference in monetary policy. Sharp fluctuations were observed on days following particularly critical pronouncements from the President.

- Analysis of Stock Market Indices: Studies have shown a correlation between Trump's public criticism of the Fed and negative short-term movements in key stock market indices, like the Dow Jones Industrial Average and the S&P 500.

- Commentary from Financial Experts: Many financial analysts warned that Trump's actions were undermining confidence in the stability of US economic policy and increasing market uncertainty.

Powell's Response and the Federal Reserve's Mandate

Jerome Powell faced the unprecedented challenge of navigating President Trump's consistent criticism while upholding the Federal Reserve's mandate.

Maintaining the Fed's Independence

Powell consistently defended the Fed's independence, emphasizing that its decisions were based solely on economic data and its commitment to price stability and maximum employment, not political considerations.

- Powell's Public Statements: In numerous press conferences and public appearances, Powell reiterated the Fed's commitment to its mandate and its independence from political pressure. He emphasized the importance of making decisions based on economic fundamentals rather than reacting to short-term political pressures.

- Importance of Central Bank Independence: An independent central bank is crucial for long-term economic stability. Political interference can lead to inflationary pressures, inconsistent policy decisions, and a loss of market confidence.

Justification for Monetary Policy Decisions

The Federal Reserve's monetary policy decisions during this period were justified by prevailing economic indicators.

- Economic Indicators: The Fed's decisions to raise interest rates were based on concerns about rising inflation and the need to prevent overheating of the economy. Data on inflation, unemployment, and GDP growth guided these policy choices.

- Counterarguments to Trump's Criticisms: The Fed provided detailed economic analysis to support its decisions, often countering Trump's criticisms by highlighting the long-term risks of ignoring inflationary pressures.

Long-Term Implications and Lessons Learned

The Trump-Powell conflict has significant long-term implications, highlighting the vital role of an independent central bank and the dangers of politicizing monetary policy.

The Importance of Central Bank Independence

Maintaining central bank independence is paramount for a healthy economy. Political interference undermines the credibility and effectiveness of monetary policy.

- Historical Examples: Numerous historical examples demonstrate the negative consequences of politicizing central banks, including periods of high inflation and economic instability. The experience of many countries around the world underscores the need for insulation from political whims.

Impact on Public Trust in Institutions

The highly publicized disagreement eroded public trust in both the presidency and the Federal Reserve.

- Polling Data and Media Coverage: Polling data reflected decreased public confidence in both institutions following the frequent clashes. Media coverage amplified the conflict, contributing to public confusion and skepticism.

- Expert Analysis: Experts warned that this public spectacle could diminish trust in the credibility of both branches of government and negatively impact the economy's long-term health.

Future Considerations for Presidents and the Fed

Improved communication and clearer protocols are needed to prevent similar conflicts in the future.

- Recommendations: Greater transparency in both the executive branch's and the Federal Reserve's communication strategies could help to avoid misunderstandings and ensure the public has access to accurate information. Establishing clearer protocols for communication between these two powerful entities could enhance the understanding and lessen the chance of conflict.

Conclusion

President Trump's criticism of Jerome Powell and the Federal Reserve had profound implications for the US economy and the public's perception of key institutions. This analysis demonstrates the critical importance of maintaining central bank independence and the potential risks associated with politicizing monetary policy. Understanding the complexities of President Trump's criticism of Jerome Powell and the Federal Reserve is crucial for informed participation in economic debates. Continue your research to deepen your understanding of this critical relationship and the ongoing importance of an independent central bank.

Featured Posts

-

Why Pope Francis Ring Will Be Destroyed After His Death The Papal Signets Fate

Apr 23, 2025

Why Pope Francis Ring Will Be Destroyed After His Death The Papal Signets Fate

Apr 23, 2025 -

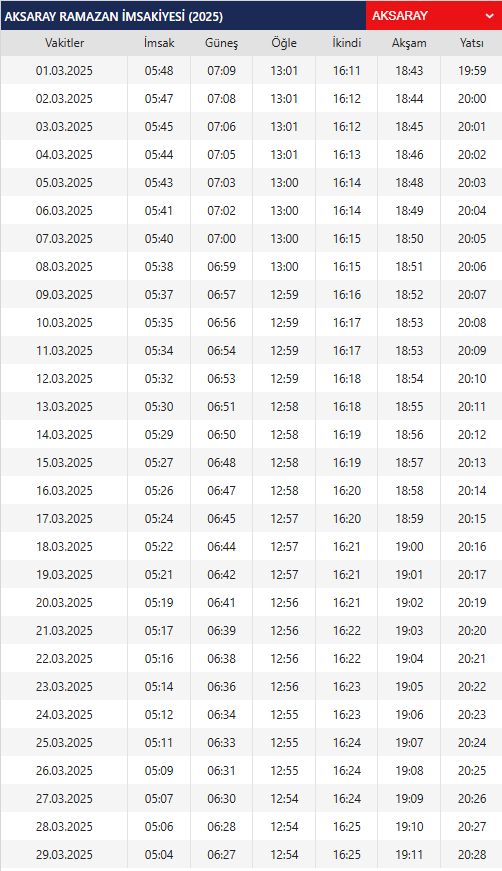

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025 -

Meta Vs Ftc A Deep Dive Into The Instagram And Whats App Antitrust Case

Apr 23, 2025

Meta Vs Ftc A Deep Dive Into The Instagram And Whats App Antitrust Case

Apr 23, 2025 -

The Science Behind Shota Imanagas Unhittable Splitter

Apr 23, 2025

The Science Behind Shota Imanagas Unhittable Splitter

Apr 23, 2025 -

Planirajte Svoju Uskrsnju Kupnju Radno Vrijeme Trgovina

Apr 23, 2025

Planirajte Svoju Uskrsnju Kupnju Radno Vrijeme Trgovina

Apr 23, 2025