Private Credit Investment Opportunity: Invesco And Barings Partnership

Table of Contents

Understanding the Invesco and Barings Private Credit Strategy

Invesco and Barings, renowned for their expertise in alternative investments and private debt, have joined forces to offer a sophisticated private credit strategy. This partnership leverages the combined strengths and extensive experience of both firms, resulting in a robust and diversified approach to private credit. Their strategy focuses on a select group of sectors deemed to offer attractive risk-adjusted returns.

The investment approach is characterized by rigorous due diligence and proactive risk management. Before committing capital, the team conducts thorough assessments of each potential investment, evaluating not only the financial health of the borrower but also the underlying business model and market conditions. Their risk mitigation strategies involve diversifying across various sectors and borrower types, closely monitoring portfolio performance, and actively managing credit risk.

- Target Sectors: Healthcare, technology, renewable energy, and infrastructure are among the sectors prioritized for their resilient fundamentals and growth potential.

- Types of Private Credit Investments: The strategy encompasses a range of private credit instruments, including direct lending, mezzanine debt, and unitranche loans, allowing for flexibility and strategic portfolio construction.

- Investment Size and Ticket Size: While specific details may vary depending on the opportunity, the partnership targets investments with a range of sizes, catering to various deal structures.

- Geographical Focus: While the focus may be primarily on North America, the partnership may pursue opportunities internationally, depending on the specific circumstances and risk profile.

Benefits of Investing in the Invesco and Barings Partnership

Investing in the Invesco and Barings private credit partnership offers numerous compelling advantages. The combined expertise and long track record of both firms are significant differentiators. Invesco’s global reach and asset management prowess complement Barings’ deep experience in private debt and credit analysis, forming a powerful synergy.

- Diversification Benefits: Private credit often exhibits low correlation with traditional asset classes like equities and bonds, offering valuable diversification benefits for a well-rounded investment portfolio.

- Potential for Higher Returns: Private credit investments can potentially generate higher returns than comparable public market investments, thanks to their higher risk-adjusted yield.

- Access to Exclusive Deals: The partnership’s strong network and reputation provide access to exclusive investment opportunities unavailable to individual investors.

- Professional Management: The experienced investment teams at Invesco and Barings provide professional management and oversight, actively monitoring investments and mitigating risks.

Assessing the Risks Associated with Private Credit Investments

While the potential rewards of private credit are significant, it's crucial to acknowledge the inherent risks. Transparency is key, and understanding these risks is essential for informed decision-making.

- Illiquidity Risk: Private credit investments are typically less liquid than publicly traded securities, meaning selling them quickly can be challenging.

- Credit Risk: There's a risk of borrower default, which could lead to partial or total loss of investment capital. This is mitigated by the rigorous due diligence process employed by Invesco and Barings.

- Interest Rate Risk: Changes in interest rates can affect the value of private credit investments.

- Market Risk: Broader economic downturns can negatively impact the performance of private credit investments. However, the strategic focus on resilient sectors aims to lessen this impact.

The Invesco and Barings partnership actively mitigates these risks through its comprehensive due diligence, diversified portfolio approach, and ongoing risk monitoring.

Accessing the Invesco and Barings Private Credit Investment Opportunity

Accessing this compelling private credit investment opportunity typically involves specific requirements. While details regarding minimum investments and fee structures should be obtained directly from Invesco and Barings, it's important to note that this is generally an investment suitable for accredited or institutional investors rather than individual retail investors.

- Investment Minimums: Minimum investment amounts are usually substantial, reflecting the nature of private credit investments and the due diligence required.

- Fee Structure: Fees will include management fees and potentially performance-based fees, all of which should be clearly detailed in the offering documents.

- Expected Return Ranges: While specific return projections are not guaranteed and depend on market conditions, Invesco and Barings will provide prospective investors with potential return ranges based on historical performance and current market forecasts.

- Investment Timeline: There may be lock-up periods, meaning investors cannot readily sell their investments for a specific duration.

- Contact Information: Prospective investors should contact Invesco and Barings directly through their respective investor relations departments to obtain detailed information and explore the opportunity further.

Conclusion: Capitalize on the Invesco and Barings Private Credit Investment Opportunity

The Invesco and Barings partnership presents a compelling private credit investment opportunity for sophisticated investors seeking attractive risk-adjusted returns and portfolio diversification. While inherent risks exist within the private credit market, the partnership's rigorous approach to due diligence, risk management, and its deep industry expertise significantly mitigates these challenges. The potential for superior returns, combined with the diversification benefits offered by this alternative investment strategy, makes this a worthy consideration. To learn more about this high-yield investment in private debt and explore the specific requirements and details, contact Invesco and Barings directly. Don’t miss the chance to capitalize on this exciting Invesco Barings private credit investment opportunity.

Featured Posts

-

Analisis Perjodohan Weton Jumat Wage Dan Senin Legi Dalam Primbon Jawa

Apr 23, 2025

Analisis Perjodohan Weton Jumat Wage Dan Senin Legi Dalam Primbon Jawa

Apr 23, 2025 -

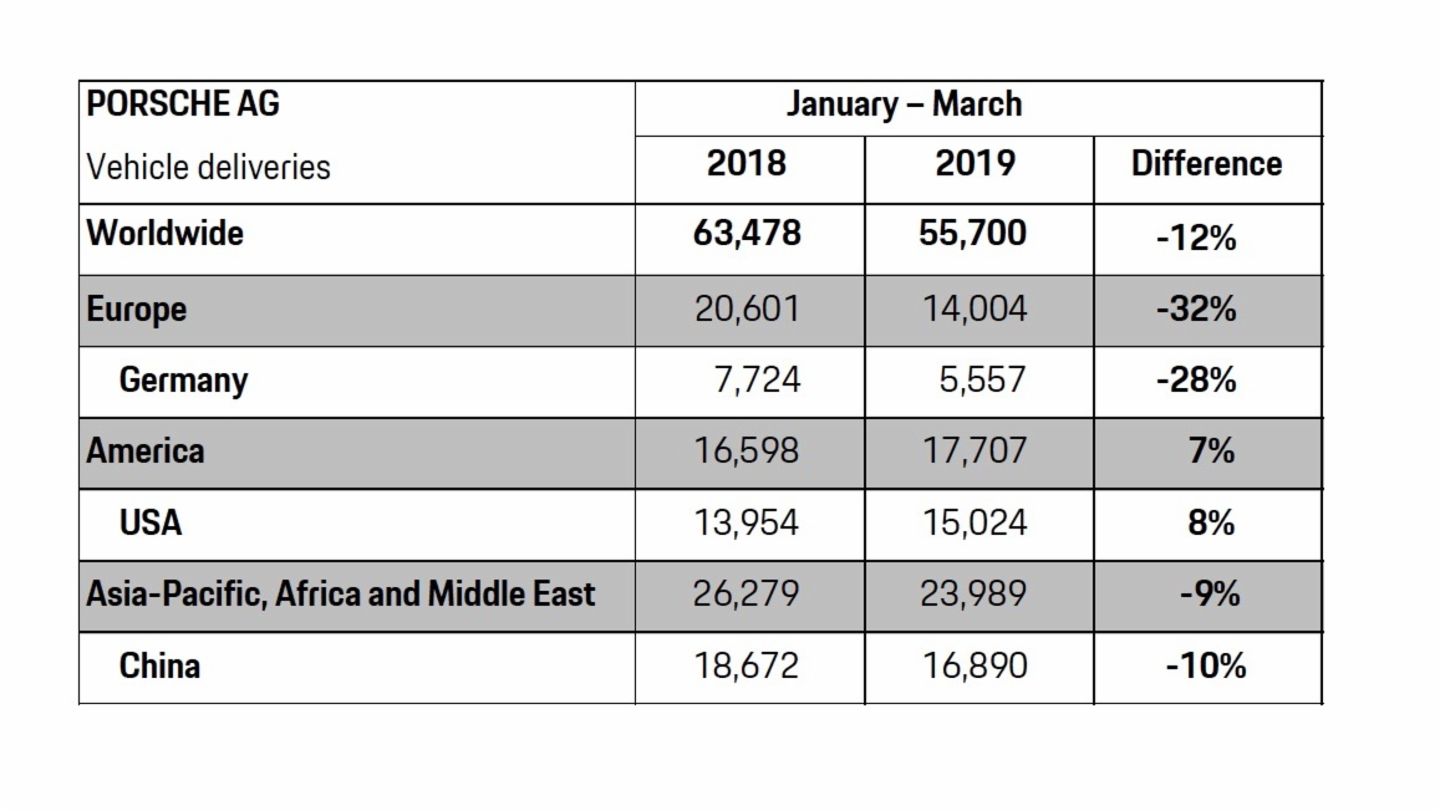

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 23, 2025

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 23, 2025 -

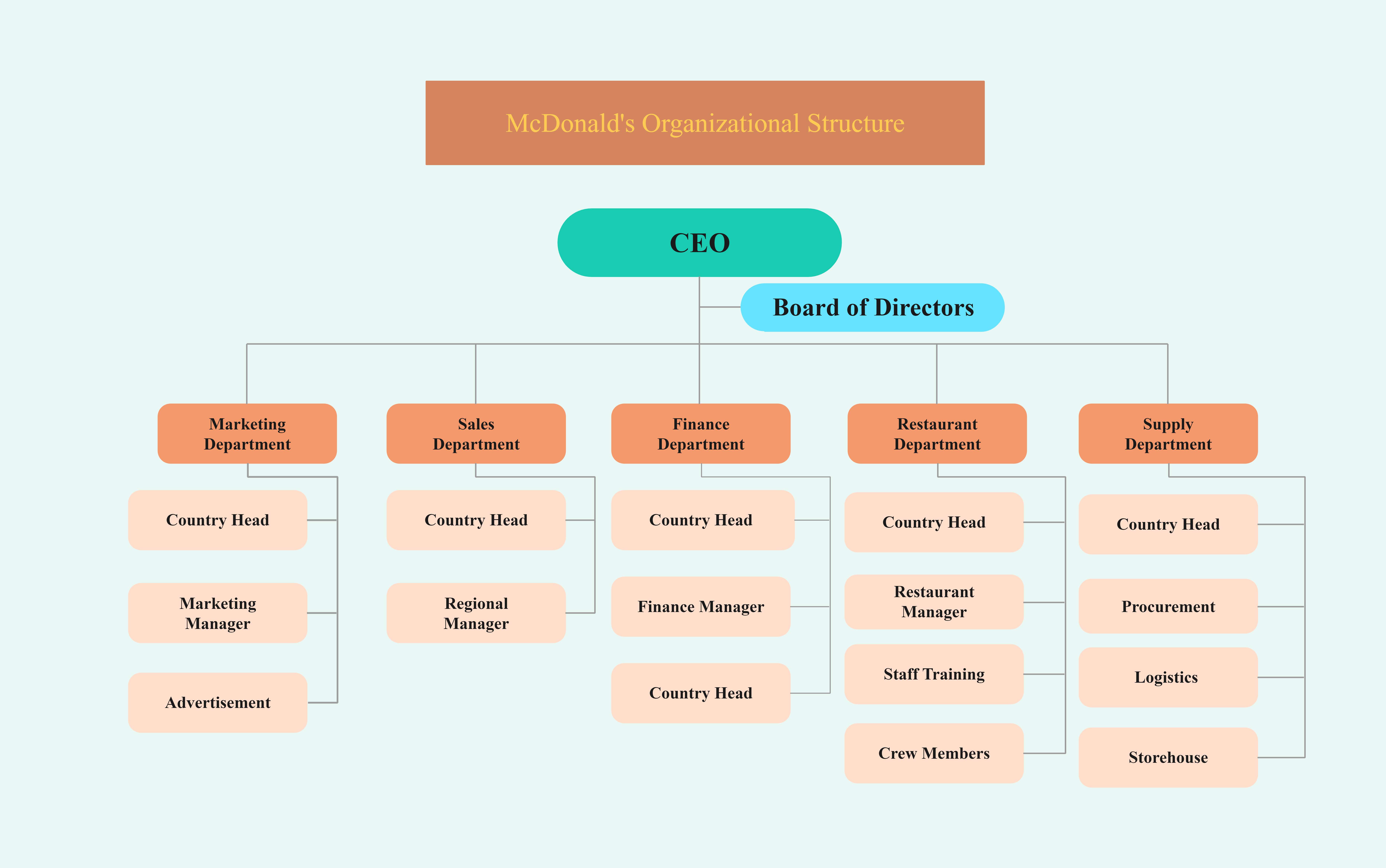

Middle Management A Key Component Of Effective Organizational Structure And Employee Development

Apr 23, 2025

Middle Management A Key Component Of Effective Organizational Structure And Employee Development

Apr 23, 2025 -

P E I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025

P E I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025 -

Nine Run Lead Strikeout Power Cy Young Winners April Performance

Apr 23, 2025

Nine Run Lead Strikeout Power Cy Young Winners April Performance

Apr 23, 2025