Private Credit Jobs: 5 Do's And Don'ts For Success

Table of Contents

5 Do's for Landing Your Dream Private Credit Job

Securing a private credit job requires a multifaceted approach. Here are five key actions that will dramatically improve your prospects:

Do 1: Master Financial Modeling and Analysis

Proficiency in financial modeling is paramount in private credit. You'll be constantly evaluating potential investments, analyzing financial statements, and building complex models to predict future performance.

- Proficiency in Excel/Financial modeling software: Mastering Excel is a non-negotiable, but going beyond the basics is crucial. Learn advanced functions, shortcuts, and data manipulation techniques. Consider specialized software like Argus or Bloomberg Terminal for enhanced capabilities.

- Understanding of discounted cash flow (DCF) analysis: This is the cornerstone of valuation in private credit. You need to be comfortable building, interpreting, and challenging DCF models.

- LBO modeling: Leverage Buyout (LBO) modeling is vital for understanding the intricacies of private equity transactions, which often involve significant private debt financing.

- Credit metrics: A deep understanding of key credit metrics (e.g., leverage ratios, interest coverage ratios, debt-to-equity ratios) is essential for assessing risk and evaluating potential investments.

- Sensitivity analysis: The ability to conduct sensitivity analysis is crucial for understanding the impact of various assumptions on the projected financial performance of an investment.

Do 2: Develop Expertise in Credit Analysis and Underwriting

Credit analysis forms the backbone of private credit investing. Your ability to assess risk, evaluate collateral, and understand the nuances of credit agreements will be rigorously tested.

- Understanding credit ratings: Familiarize yourself with credit rating agencies and their methodologies. Understand the implications of different credit ratings on investment decisions.

- Covenants: Deeply understand the various covenants (restrictive clauses) in loan agreements and their impact on borrowers and lenders.

- Collateral: Be able to assess the value and liquidity of different types of collateral, from real estate to inventory.

- Cash flow analysis: You need to be an expert in analyzing cash flows to determine a borrower's ability to service its debt.

- Debt structuring: Understand the different types of debt instruments (e.g., senior secured loans, subordinated debt, mezzanine financing) and their relative risk-return profiles. This includes understanding the various types of credit analysis such as qualitative and quantitative analysis.

Do 3: Network Strategically Within the Private Credit Industry

Networking is vital in this niche field. Building relationships opens doors to unadvertised positions and invaluable mentorship opportunities.

- Attend industry conferences: These events are prime networking grounds, allowing you to meet professionals and learn about the latest trends.

- Join relevant professional organizations: Associations like the American Investment Council (AIC) or industry-specific groups can provide excellent networking opportunities.

- Leverage LinkedIn: Optimize your LinkedIn profile, connect with professionals in the field, and actively engage in industry discussions.

- Informational interviews: Reach out to professionals in private credit for informational interviews to gain insights and build relationships.

Do 4: Tailor Your Resume and Cover Letter to Each Application

Generic applications won't cut it. Each application should highlight the specific skills and experience relevant to the target role and company.

- Highlight achievements: Don't just list your responsibilities; quantify your accomplishments and demonstrate their impact.

- Use keywords from the job description: Incorporate relevant keywords to help your resume get past applicant tracking systems (ATS).

- Customize your resume for each application: Tailor your resume to emphasize the skills and experience most relevant to each specific job description.

- Demonstrate a clear understanding of the role and company: Research the company thoroughly and demonstrate your understanding of their investment strategy and target market.

Do 5: Prepare for Behavioral and Technical Interview Questions

Private credit interviews are rigorous. Be prepared for both technical and behavioral questions.

- Case studies: Practice case studies involving financial modeling, credit analysis, and investment decisions.

- Technical questions on financial modeling and credit analysis: Be prepared to explain your approach to valuation, credit risk assessment, and deal structuring.

- Behavioral interview questions: Prepare for questions that assess your soft skills, such as teamwork, problem-solving, and communication. STAR method (Situation, Task, Action, Result) is highly recommended.

5 Don'ts That Can Hurt Your Private Credit Job Prospects

Avoiding these pitfalls can significantly improve your chances of success.

Don't 1: Neglect Networking Opportunities

Failing to network limits your visibility and access to hidden job opportunities.

- Missing out on hidden job opportunities: Many private credit jobs are filled through networking, not public job postings.

- Failing to build relationships within the industry: Strong relationships are essential for long-term success in the private credit industry.

- Limiting exposure to potential mentors: Mentors can provide invaluable guidance and support throughout your career.

Don't 2: Submit Generic Resumes and Cover Letters

Generic applications demonstrate a lack of effort and genuine interest.

- Failing to demonstrate a genuine interest in the specific role and company: A tailored application shows that you've taken the time to research the company and understand the role.

- Appearing unprofessional: Submitting a generic application suggests a lack of attention to detail and professionalism.

- Reducing chances of getting an interview: A generic application is unlikely to stand out from the competition.

Don't 3: Underestimate the Importance of Soft Skills

Technical skills are crucial, but soft skills are equally important.

- Poor communication skills: Effective communication is essential for collaboration and building relationships.

- Inability to work collaboratively: Private credit involves teamwork, requiring effective collaboration with colleagues and clients.

- Lack of initiative: Proactive individuals who demonstrate initiative are highly valued in this fast-paced industry.

- Poor time management: Efficient time management is crucial for handling multiple projects and meeting deadlines.

Don't 4: Lack Enthusiasm and Passion for Private Credit

Genuine passion is essential for thriving in this demanding field.

- Showing lack of interest during interviews: A lack of enthusiasm can quickly disqualify a candidate.

- Not demonstrating a deep understanding of the market: Showcasing knowledge about current market trends and investment strategies is crucial.

- Failing to express genuine passion for the industry: Passion for the industry is contagious and highly valued by employers.

Don't 5: Ignore Continuous Learning and Professional Development

The private credit industry is constantly evolving. Staying current is essential for long-term success.

- Failing to update your skills: Continuously learning and updating your skills is essential for staying competitive.

- Neglecting industry news and trends: Stay informed about the latest developments in the private credit market.

- Not pursuing further education or professional certifications: Consider pursuing relevant certifications or advanced degrees to enhance your expertise.

Conclusion

Securing a rewarding career in private credit jobs requires a combination of technical expertise, strategic networking, and unwavering dedication. By following these "Do's" and avoiding the "Don'ts," you'll significantly increase your chances of landing your dream role in this dynamic and lucrative field. Are you ready to launch your successful career in private credit jobs? Follow these guidelines, and start building your path to a rewarding career in the dynamic world of private debt and alternative lending. Remember to leverage your skills and network strategically to land your dream role in private credit.

Featured Posts

-

Russias Disinformation Campaign False Greenland News And The Denmark Us Rift

Apr 26, 2025

Russias Disinformation Campaign False Greenland News And The Denmark Us Rift

Apr 26, 2025 -

Indonesias Rice Diplomacy Exploring Export Opportunities For Unique Varieties

Apr 26, 2025

Indonesias Rice Diplomacy Exploring Export Opportunities For Unique Varieties

Apr 26, 2025 -

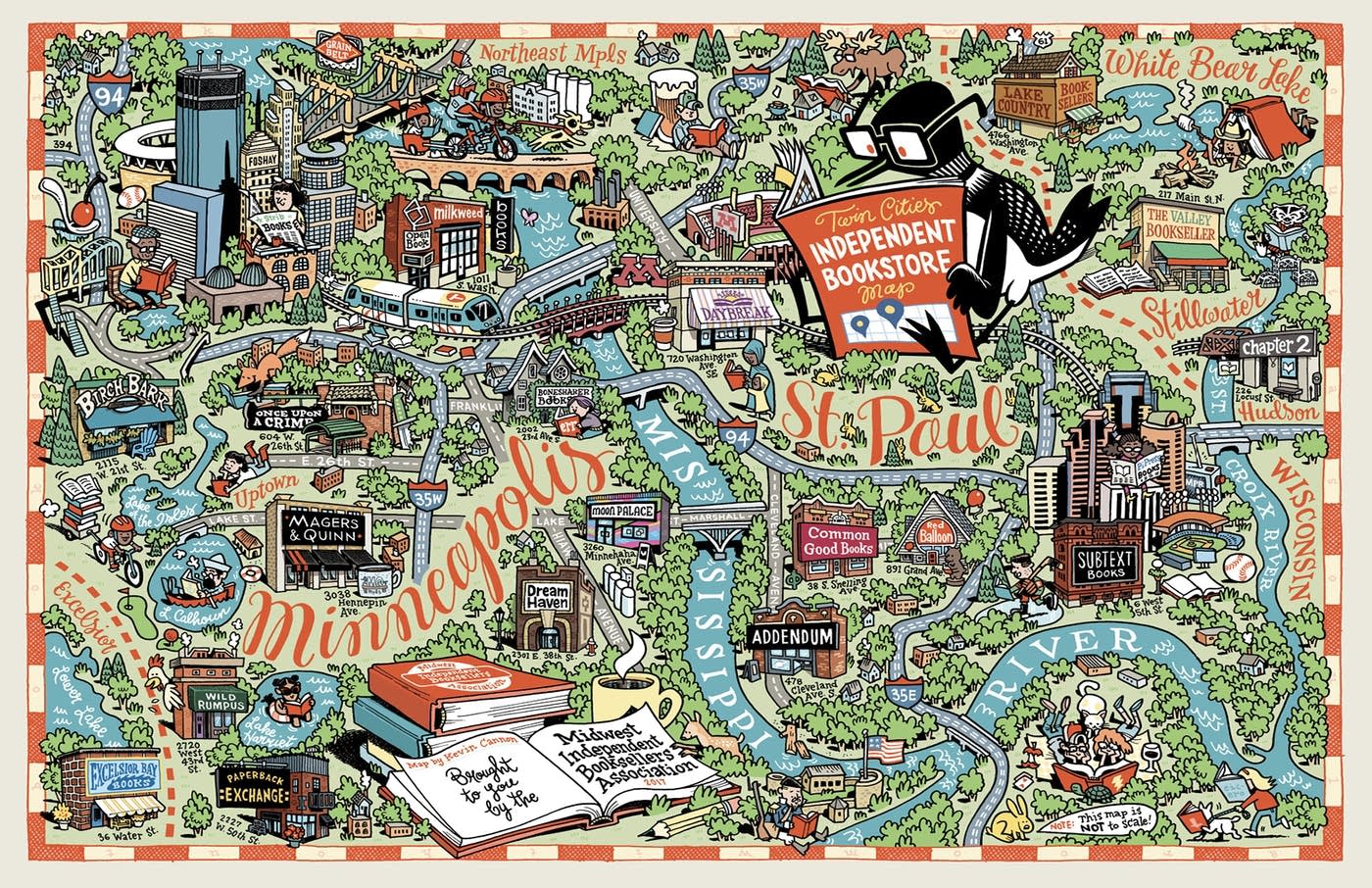

April Events Calendar Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025

April Events Calendar Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025 -

Damen And Icdas Partner To Construct Tugboat In Turkey

Apr 26, 2025

Damen And Icdas Partner To Construct Tugboat In Turkey

Apr 26, 2025 -

Holden And Daly Daughters Survival Challenge A New Tv Show

Apr 26, 2025

Holden And Daly Daughters Survival Challenge A New Tv Show

Apr 26, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025