Private Equity Acquires Boston Celtics For $6.1 Billion: Fan Concerns And Analysis

Table of Contents

Financial Implications of the Private Equity Boston Celtics Acquisition

The $6.1 billion price tag immediately brings financial implications to the forefront. Private equity firms are known for their focus on maximizing returns, and this naturally leads to concerns about how this will affect the Celtics and their fans.

Increased Ticket Prices and Merchandise Costs

Will the pursuit of maximizing shareholder returns lead to inflated prices for fans? This is a major concern. Private equity's profit motives often translate into strategies to increase revenue streams. This could manifest in:

- Significant Ticket Price Increases: Season ticket holders, already a significant revenue source, could see substantial increases, potentially pricing out loyal fans.

- Higher Merchandise Costs: Increased prices on jerseys, hats, and other team merchandise are another potential avenue for profit maximization.

- Reduced Discounts and Promotions: The frequency and value of discounts and promotions offered to fans might decrease to boost overall profitability.

A comparison to other teams under similar ownership models reveals a concerning trend. Many teams acquired by private equity firms have experienced upward pressure on ticket and merchandise costs. The impact on the average fan's ability to attend games and support the team must be carefully considered.

Impact on Player Salaries and Team Building

The financial focus could significantly influence player recruitment and retention strategies. While increased revenue could lead to higher player salaries, there's also the potential for:

- Budget Constraints: Despite increased revenue, private equity might prioritize immediate returns over long-term investments in player development.

- Short-Term Focus: The pressure to win quickly and generate immediate financial returns could lead to risky trades and roster changes that prioritize short-term wins over sustainable success.

- Impact on Team Culture: The emphasis on financial performance might negatively impact the team's culture and camaraderie, potentially hindering player morale and performance. The team's long-term competitive success might suffer if player development and cohesion are compromised.

Fan Concerns and the Future of the Boston Celtics Brand

Beyond the financial aspects, the acquisition raises crucial questions about the future of the Celtics brand and its relationship with its loyal fanbase.

Maintaining the Celtics' Legacy and Culture

Preserving the team's rich history and connection with its fan base is paramount. The new ownership must understand the significance of the Celtics' legacy:

- Protecting Team Traditions: Maintaining established traditions, rituals, and community engagement initiatives is essential for preserving the team’s identity.

- Fan Engagement: Effective communication with fans, actively addressing concerns, and incorporating fan feedback are crucial to maintaining a positive relationship.

- Community Outreach: Continuing and expanding community outreach programs demonstrates the team's commitment to Boston and strengthens its connection with fans.

Looking at past examples, some sports franchises have successfully navigated ownership transitions, while others have suffered a decline in fan engagement. The Boston Celtics' case will be a crucial test of how to balance financial goals with fan loyalty.

Accessibility and Fan Experience

The acquisition could impact the accessibility and overall experience for Celtics fans, potentially leading to:

- Changes in Game-Day Atmosphere: Changes to the game-day experience, potentially affecting concessions, seating arrangements, and overall atmosphere, could alienate some fans.

- Reduced Accessibility: Increased ticket prices and changes in seating arrangements might reduce accessibility for lower-income fans and families.

- Stadium Upgrades (or Lack Thereof): While there's potential for stadium upgrades and improved amenities, the priority might shift towards maximizing returns rather than enhancing the fan experience.

The Role of Private Equity in Professional Sports

The increasing trend of private equity investment in professional sports franchises necessitates a broader analysis.

- Advantages: Private equity can bring significant capital for stadium renovations, player acquisitions, and franchise growth.

- Disadvantages: The primary focus on financial returns could lead to decisions that prioritize short-term gains over long-term team success and fan loyalty.

Looking at other leagues, we can see examples of both successful and unsuccessful private equity investments. The long-term implications of private equity's growing influence on professional sports warrant careful monitoring and discussion.

Conclusion

The $6.1 billion Private Equity Boston Celtics Acquisition marks a significant turning point for the franchise. While it presents opportunities for financial growth and improved infrastructure, it also raises valid concerns regarding ticket prices, player recruitment strategies, and the preservation of the team's unique cultural identity. Fans need to actively engage with the new ownership to ensure the continued success and accessibility of their beloved team. Staying informed about the evolving situation and voicing concerns are crucial for safeguarding the future of the Boston Celtics under this new ownership model. Following the developments of this Private Equity Boston Celtics Acquisition will be critical for understanding the evolving landscape of professional sports. Continue to monitor news and analysis to stay updated on this monumental shift for the Boston Celtics.

Featured Posts

-

Post Presidency Life Joe And Jill Bidens First Significant Public Engagement

May 15, 2025

Post Presidency Life Joe And Jill Bidens First Significant Public Engagement

May 15, 2025 -

Ali Marks Everything You Need To Know About Jalen Brunsons Spouse

May 15, 2025

Ali Marks Everything You Need To Know About Jalen Brunsons Spouse

May 15, 2025 -

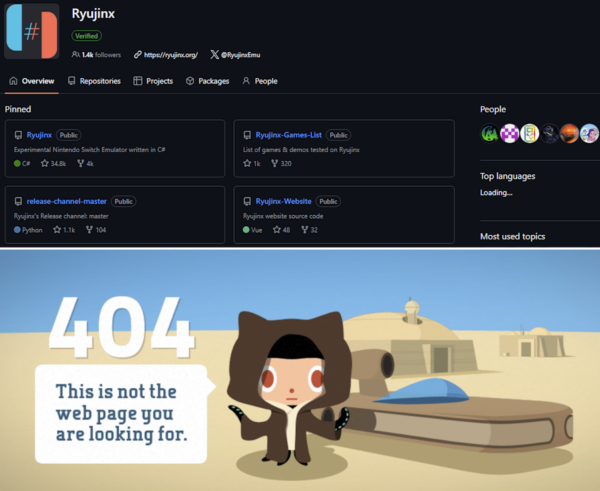

Ryujinx Emulator Shuts Down Nintendos Involvement Confirmed

May 15, 2025

Ryujinx Emulator Shuts Down Nintendos Involvement Confirmed

May 15, 2025 -

Witness Testimony Cassie Ventura Recounts Experiences With Sean Combs

May 15, 2025

Witness Testimony Cassie Ventura Recounts Experiences With Sean Combs

May 15, 2025 -

2 4 Mayis 2025 Tarim Kredi Koop Ciftci Marketlerinde Bueyuek Indirim Kampanyasi

May 15, 2025

2 4 Mayis 2025 Tarim Kredi Koop Ciftci Marketlerinde Bueyuek Indirim Kampanyasi

May 15, 2025