Protect Your Credit Score: Manage Your Student Loan Debt Effectively

Table of Contents

Understanding the Impact of Student Loans on Your Credit Score

Your student loans have a powerful influence on your creditworthiness. Understanding this impact is the first step towards protecting your credit score.

How Student Loan Payments Affect Your Credit Report

Timely student loan payments are a cornerstone of a healthy credit report. Consistent on-time payments demonstrate responsible financial behavior to lenders, positively impacting your credit score. Conversely, late or missed payments can severely damage your credit rating.

- Credit Scoring Models: Major credit scoring models like FICO and VantageScore incorporate your payment history, which includes your student loan payments, into their algorithms. A consistent record of on-time payments significantly boosts your scores.

- Credit Utilization Ratio: While not directly related to student loans themselves, maintaining a low credit utilization ratio (the percentage of available credit you're using) across all your credit accounts is also vital for a high credit score. High utilization can negatively impact your score, even if you're making all your student loan payments on time.

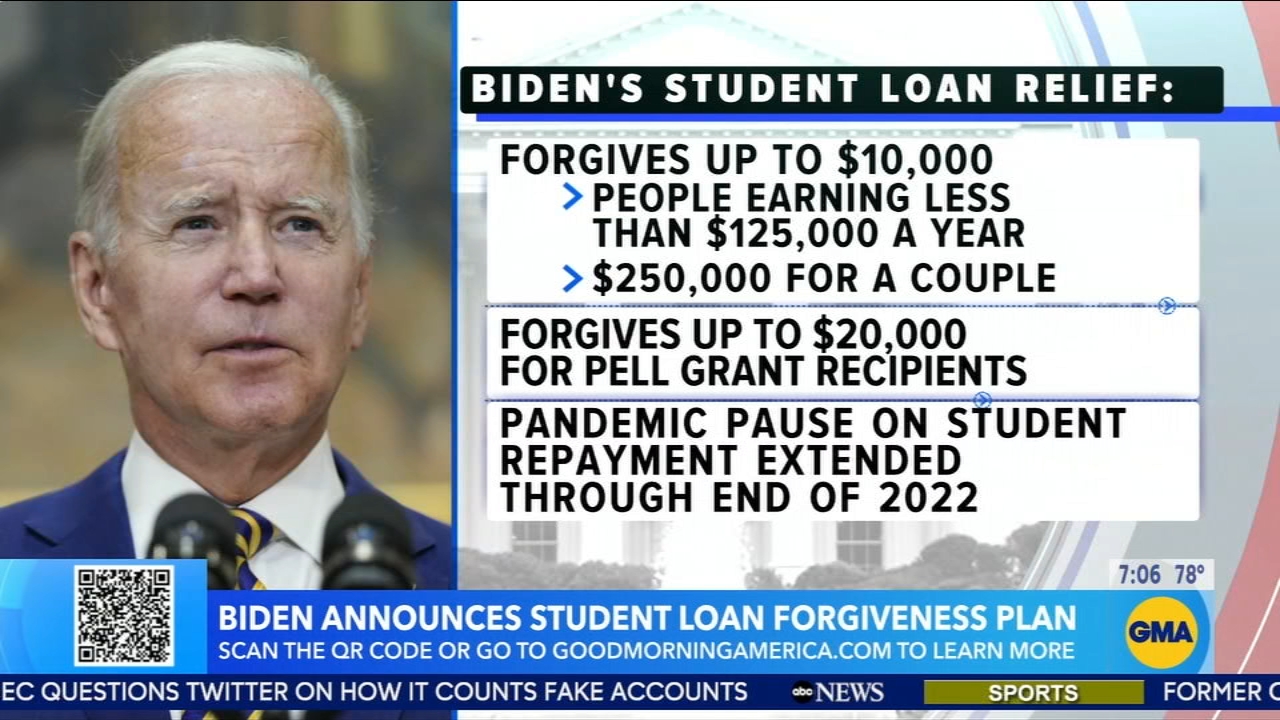

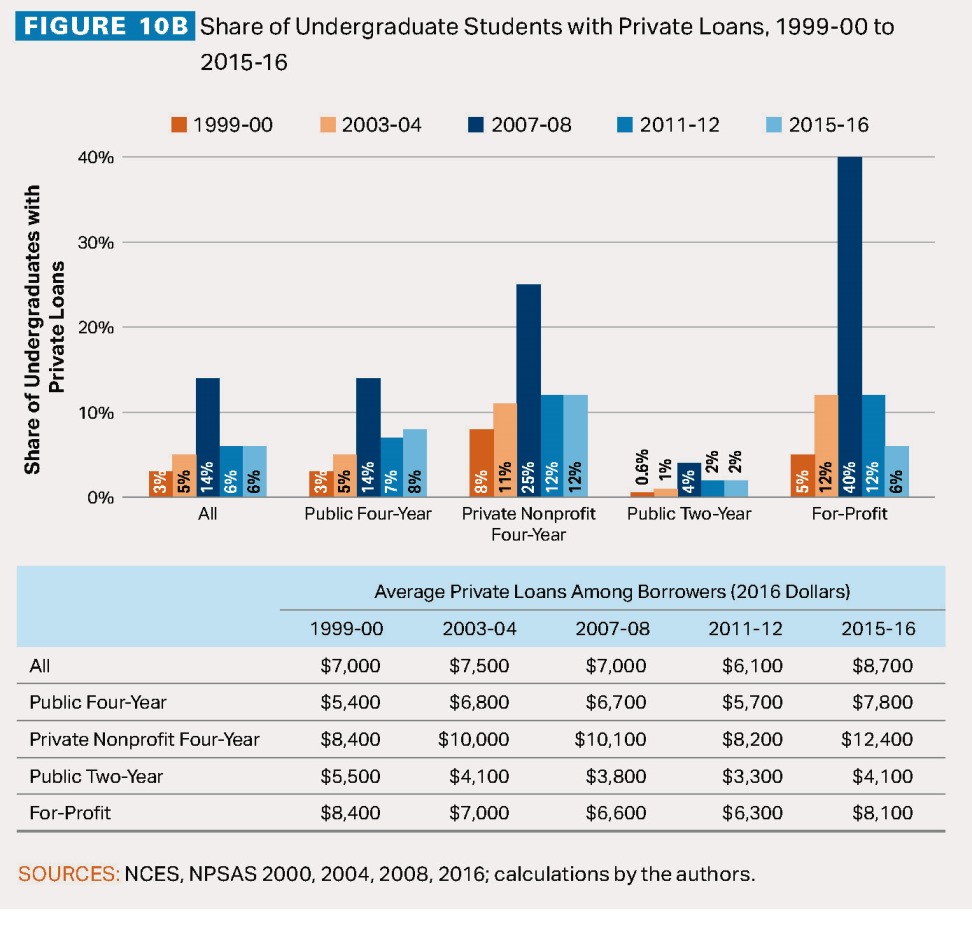

- Federal vs. Private Loans: Both federal and private student loans are reported to the credit bureaus. Missing payments on either type will negatively affect your credit score. However, defaulting on a federal loan can lead to additional serious consequences like wage garnishment.

The Effects of Defaulting on Student Loans

Defaulting on your student loans is a serious matter with devastating consequences. Default occurs when you fail to make payments for a certain period, often 270 days.

- Significant Credit Score Drop: Defaulting results in a substantial and long-lasting drop in your credit score, making it extremely difficult to obtain credit in the future (mortgages, car loans, credit cards).

- Wage Garnishment and Tax Refund Offset: The government can garnish your wages or seize your tax refund to recover the defaulted loan amount.

- Collection Agencies: Your debt will be referred to collection agencies, leading to further negative impacts on your credit and potential legal action.

To avoid default, explore options like forbearance, deferment, or income-driven repayment plans (discussed below).

Strategies for Effective Student Loan Management

Proactive management of your student loan debt is key to protecting your credit score and long-term financial health.

Creating a Realistic Budget and Repayment Plan

The foundation of effective student loan management is a well-structured budget that accommodates your monthly loan payments.

- Budgeting Tools and Apps: Utilize budgeting tools like Mint, YNAB (You Need A Budget), or Personal Capital to track your income and expenses, enabling you to allocate funds for your student loans.

- Budgeting Methods: Consider employing budgeting methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) or zero-based budgeting (allocating every dollar of your income).

- Repayment Plans: Federal student loans offer various repayment plans:

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase over 10 years.

- Extended Repayment: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR): Monthly payments are based on your income and family size. These plans often lead to loan forgiveness after 20-25 years. Choose the plan that best suits your financial situation.

Exploring Repayment Options and Consolidation

Refinancing and consolidation can streamline your payments and potentially lower your interest rate.

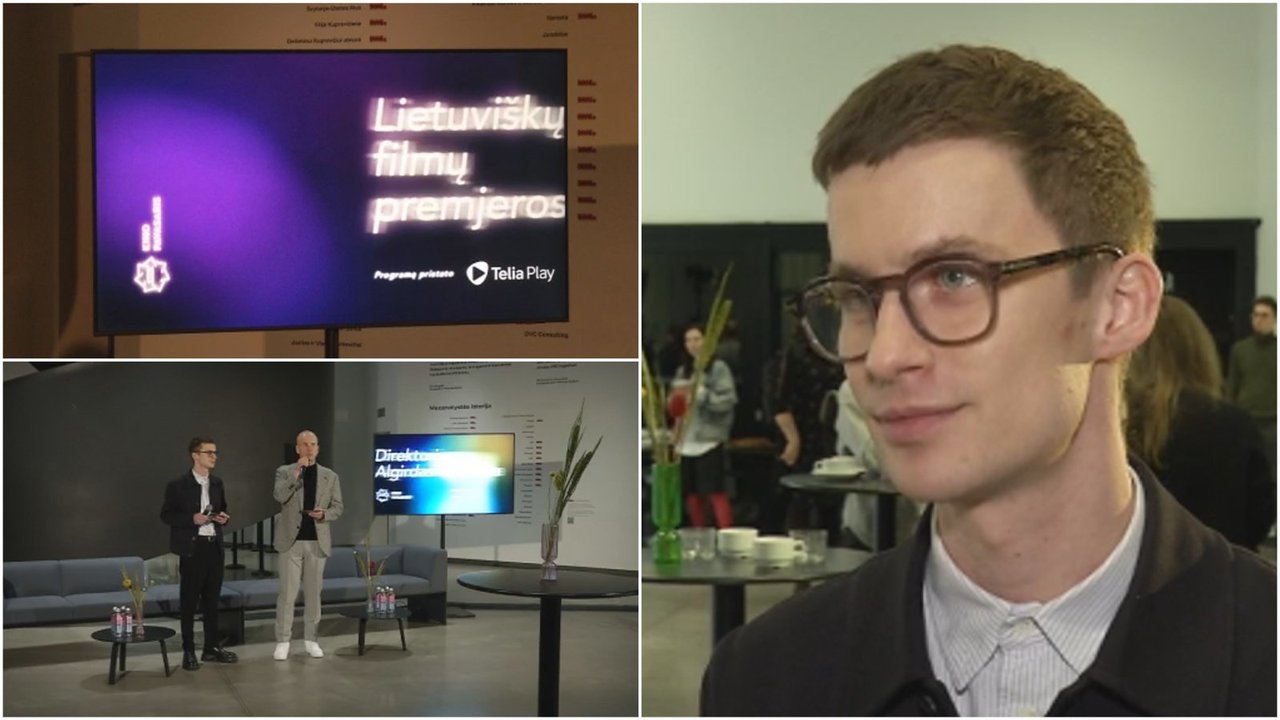

- Refinancing: Replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This is generally only beneficial if you qualify for a lower rate.

- Consolidation: Combining multiple student loans into a single loan, simplifying payments. This can be done through the federal government or a private lender.

- Potential Savings and Risks: While refinancing and consolidation can offer potential savings, carefully consider the terms and conditions, including fees and interest rates, before making a decision. Ensure you're not extending your repayment term excessively, which could lead to paying more interest in the long run.

Utilizing Resources and Seeking Professional Advice

Don't hesitate to seek help from qualified professionals or utilize available resources.

- Trusted Resources: The Federal Student Aid website (studentaid.gov) provides valuable information and tools for managing your student loans. Non-profit credit counseling agencies can offer guidance on repayment strategies and debt management.

- Financial Advisors and Credit Counselors: Consider consulting a financial advisor or credit counselor who can provide personalized advice and assistance in creating a comprehensive student loan repayment plan. They can help you navigate complex repayment options and avoid potential pitfalls.

Conclusion

Effectively managing your student loan debt is crucial for protecting your credit score and achieving long-term financial stability. By understanding the impact of student loans on your credit report, implementing a realistic budget and repayment plan, exploring refinancing and consolidation options, and seeking professional advice when needed, you can take control of your finances and build a strong financial future. Start protecting your credit score today by implementing these student loan management strategies. Don't let student loan debt damage your credit – take control of your finances now! Visit [link to relevant resource or contact form] for further assistance.

Featured Posts

-

Daugiau Nei 70 000 Ziurovu Kino Pavasario Filmu Reitingas

May 17, 2025

Daugiau Nei 70 000 Ziurovu Kino Pavasario Filmu Reitingas

May 17, 2025 -

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025 -

Play At The Best No Kyc Online Casinos In 2025 No Id Verification Required

May 17, 2025

Play At The Best No Kyc Online Casinos In 2025 No Id Verification Required

May 17, 2025 -

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025

Play At Mirax Casino Your Top Choice For Online Gambling In Ontario 2025

May 17, 2025 -

Justes Jocytes Karjeros Etapas Villeurbanne Oficiali Pabaiga

May 17, 2025

Justes Jocytes Karjeros Etapas Villeurbanne Oficiali Pabaiga

May 17, 2025