Public Sector Pensions: A Costly Gamble For Taxpayers

Table of Contents

The Growing Burden of Public Sector Pension Liabilities

The long-term financial health of many countries is threatened by the mounting weight of public sector pension liabilities. Understanding the concept of unfunded liabilities is key to grasping the enormity of this challenge. Unfunded liabilities represent the difference between the present value of future pension obligations and the assets currently available to meet those obligations. This shortfall creates a significant fiscal risk, potentially leading to increased taxes, reduced public services, or even sovereign debt crises.

-

Unfunded Liabilities and Their Implications: These represent a ticking time bomb. As populations age and life expectancy increases, the number of retirees receiving pensions grows, while the number of working-age taxpayers contributing to the system often remains stagnant or shrinks. This imbalance creates a widening gap between obligations and available funds.

-

Statistics on Growing Public Sector Pension Debt: Data from numerous countries show a dramatic increase in unfunded pension liabilities over the past decades. For instance, [Insert statistic and source – e.g., a specific country's projected pension deficit over the next 20 years]. These figures highlight the urgency of addressing the issue.

-

Impact of Demographic Shifts: Longer lifespans and an aging population are key drivers of escalating pension costs. Retirees are living longer, requiring pension payments for a greater number of years, thus increasing the overall financial burden on the system.

-

Examples of Countries Facing Pension Challenges: Many developed nations, including [Insert examples of countries with significant pension challenges and brief descriptions of their situations], are grappling with the unsustainable growth of their public sector pension obligations. These examples underscore the global nature of this problem.

Actuarial valuations play a crucial role in estimating future pension obligations. These valuations, conducted by qualified actuaries, take into account factors such as life expectancy, salary growth, and investment returns. By accurately projecting future liabilities, governments can better understand the potential fiscal impact and take proactive steps to mitigate risks. The failure to address unfunded liabilities can lead to significant financial instability, potentially requiring drastic measures like substantial tax increases or deep cuts to essential public services.

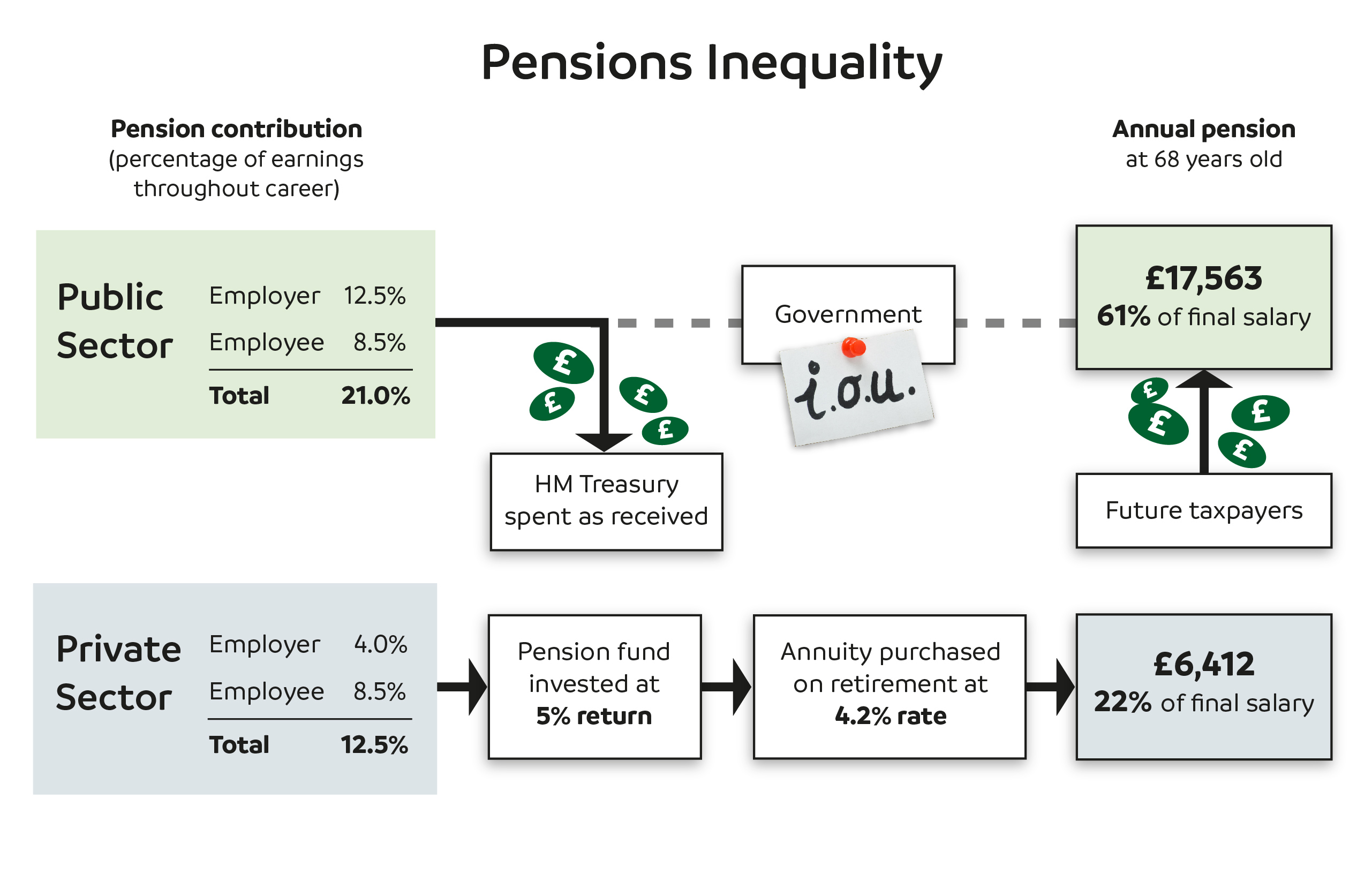

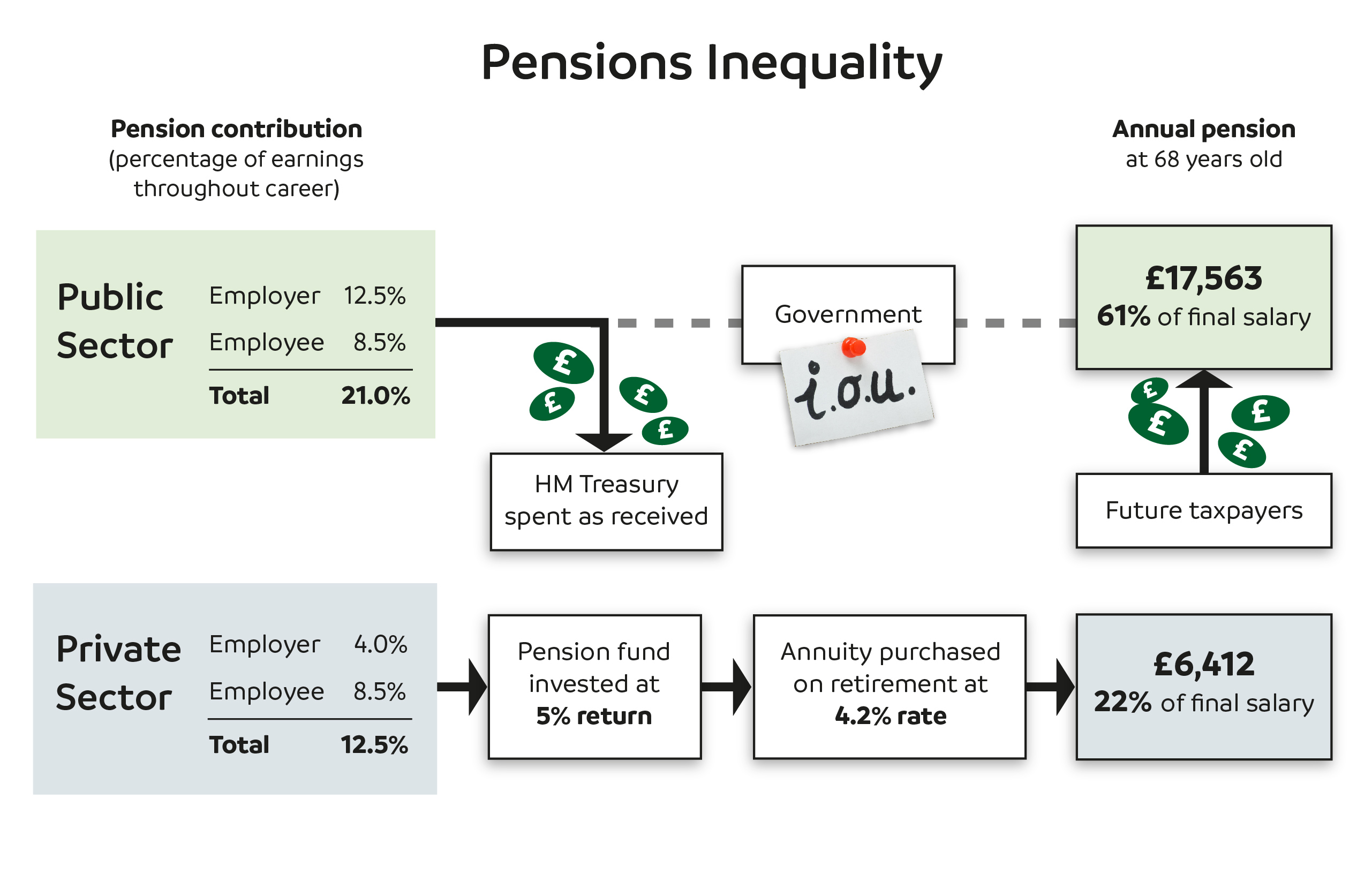

Generous Benefits Compared to the Private Sector

A key element fueling the cost of public sector pensions is the often generous benefit packages offered to employees. These benefits frequently exceed those offered in the private sector, leading to considerable financial strain on public finances.

-

Comparing Public and Private Sector Pension Benefits: Public sector employees often enjoy more favorable retirement benefits, such as:

- Early Retirement Options: The ability to retire earlier than in the private sector, increasing the duration of pension payments.

- Final Salary Schemes: Pensions calculated based on the final salary earned, potentially leading to significantly higher payments compared to defined contribution plans common in the private sector.

- Indexation of Benefits: Automatic adjustments to pension payments to keep pace with inflation, ensuring a stable level of income for retirees.

-

Contribution Rate Differences: Contribution rates for public sector employees are sometimes lower than those in the private sector, further exacerbating the financial burden on taxpayers.

-

Impact on Fairness and Public Perception: The disparity between public and private sector pensions can lead to perceptions of unfairness and inequality, sparking public debate and discontent.

The differences are stark. For example, [Insert a specific example showing the difference in benefits, e.g., average pension amount for a public sector worker vs. a private sector worker with similar career length and salary]. These discrepancies contribute significantly to the overall financial pressure on government budgets. Visualizing this disparity through charts and graphs provides a clear picture of the substantial variations in pension benefits.

The Impact on Public Spending and Fiscal Sustainability

The ever-increasing cost of public sector pensions significantly impacts government budgets and overall fiscal sustainability. The funds allocated to pensions could be used to finance other vital public services.

-

Limited Resources for Essential Services: Rising pension costs restrict government spending on healthcare, education, infrastructure, and other essential public services, potentially hindering economic growth and societal well-being.

-

Impact on Fiscal Deficits and National Debt: The strain on government budgets can lead to increased fiscal deficits and a rise in national debt, posing risks to long-term economic stability.

-

Austerity Measures and Pension Costs: Unsustainable pension systems often necessitate austerity measures, leading to cuts in public services and social programs.

-

Long-Term Economic Consequences: High pension costs can stifle economic growth by diverting resources from productive investments and increasing the overall tax burden on businesses and individuals.

Data illustrating the percentage of government expenditure allocated to pensions paints a concerning picture. [Insert data showing the percentage of government spending dedicated to pensions, ideally comparing it to spending on other sectors]. The consequences of inaction include potential credit rating downgrades, increased borrowing costs, and reduced investor confidence.

Potential Solutions for Pension Reform

Addressing the unsustainable trajectory of public sector pensions requires comprehensive reforms. Several strategies can be explored to improve the long-term viability of these systems.

-

Increasing Contribution Rates: Raising contribution rates for both employees and employers could help reduce the unfunded liability gap.

-

Raising the Retirement Age: Gradually increasing the retirement age aligns pension payments with the increasing life expectancy and reduces the overall burden on the system.

-

Introducing Defined Contribution Schemes: Shifting towards defined contribution schemes, where contributions are invested and the final payout depends on investment performance, can transfer some risk from the government to the individual.

-

Benefit Reform: Re-evaluating and adjusting pension benefit levels to reflect affordability and ensuring a fairer system may be necessary.

-

Privatization: In some cases, the privatization of parts of the pension system could introduce more efficient management and investment strategies.

Each of these approaches carries both advantages and disadvantages that need to be carefully considered in the context of the specific country's circumstances and social context. The political and social challenges involved in implementing pension reforms are significant, requiring careful communication and stakeholder engagement. Successful examples of pension reform from other countries can offer valuable lessons and insights. For example, [Insert an example of a country that successfully reformed its pension system, briefly describing the reforms implemented].

Conclusion

Public sector pensions represent a significant and growing financial burden for taxpayers. The generous benefits offered, coupled with demographic shifts and unfunded liabilities, pose a serious threat to fiscal sustainability. Addressing this issue requires comprehensive pension reform that balances the needs of current and future retirees with the financial constraints faced by governments. A multifaceted approach that incorporates various reform strategies is crucial.

Call to Action: Understanding the true cost of public sector pensions is vital for informed public discourse and effective policymaking. Demand transparency and engage in discussions about sustainable solutions for public sector pensions—your future depends on it. Let's work together to secure a financially sound future by advocating for responsible and sustainable public sector pension systems.

Featured Posts

-

Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Concern Grows For Missing British Paralympian Last Contact Over A Week Ago

Apr 29, 2025

Concern Grows For Missing British Paralympian Last Contact Over A Week Ago

Apr 29, 2025 -

You Tube A New Home For Favorite Shows Among Older Demographics

Apr 29, 2025

You Tube A New Home For Favorite Shows Among Older Demographics

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025 -

Vehicle Safety And Adhd Practical Tips And Research Findings

Apr 29, 2025

Vehicle Safety And Adhd Practical Tips And Research Findings

Apr 29, 2025