Putin's War Economy: A Retooled Russia

Table of Contents

Sanctions and Their Impact on the Russian Economy

The West's response to the Ukraine invasion involved a multifaceted assault on the Russian economy, aiming to cripple its ability to fund the war effort. These sanctions, unprecedented in scale and scope, have profoundly impacted various sectors.

Energy Sector Realignment

Prior to the sanctions, Russia's economy was heavily reliant on energy exports, particularly oil and gas, to the European Union. Sanctions drastically altered this landscape. The EU, a primary buyer of Russian energy, implemented restrictions, forcing Russia to seek alternative markets.

-

Shift to Asia: Russia has aggressively pursued new markets in Asia, particularly China and India, to compensate for reduced European demand. This diversification, while successful to some extent, comes with its own challenges, including longer transportation routes and potentially lower prices.

-

Impact of Price Caps: The imposition of price caps on Russian oil and gas has further reduced revenue, although Russia has managed to circumvent some of these measures.

-

Infrastructure Development: Russia is investing in new pipeline infrastructure and expanding its existing network to facilitate energy exports to Asia, showcasing a long-term strategy for energy security independent of Western markets.

-

Bullet points:

- Reduced export volume to Europe.

- Increased reliance on Asian markets (China, India).

- Development of new pipeline infrastructure to bypass Europe.

- Negotiation of long-term energy contracts with Asian partners.

Technological Isolation and Import Substitution

The sanctions targeted Russia's technology sector, restricting access to vital components and software. This technological isolation forced Russia to accelerate its efforts towards import substitution and self-sufficiency.

-

Import Substitution Challenges: While Russia has made some progress in increasing domestic production of certain goods, significant challenges remain. The country still lacks the technological capabilities to produce many high-tech goods independently.

-

Parallel Imports: Russia has resorted to parallel imports – importing goods indirectly through third countries – to circumvent sanctions and obtain necessary components.

-

Technological Backwardness: The long-term impact of this technological isolation could significantly hinder Russia’s economic growth and development.

-

Bullet points:

- Increased domestic production of some goods (e.g., automobiles, electronics).

- Reliance on parallel imports to acquire essential technologies.

- Growing technological gap with advanced economies.

- Difficulties in attracting foreign investment in technology sectors.

Financial Sector Resilience (or Lack Thereof)

The sanctions severely impacted the Russian financial sector. While the ruble initially experienced a sharp decline, it later stabilized due to government intervention.

-

Ruble Stabilization: The Central Bank of Russia implemented stringent capital controls and increased interest rates to support the ruble. This measure, while successful in short term stabilization, comes at the cost of limiting economic activity.

-

Banking Sector Impact: Russian banks face significant challenges, including limited access to international financial markets and SWIFT (Society for Worldwide Interbank Financial Telecommunication).

-

Capital Flight: Significant capital flight occurred following the imposition of sanctions, further weakening the economy and limiting investment opportunities.

-

Bullet points:

- Ruble stabilization through capital controls and interest rate hikes.

- Limited access to international financial markets.

- Significant capital flight from Russia.

- Reduced foreign investment.

Adaptation and Resilience Strategies

Despite the significant challenges, Russia has employed various strategies to adapt and mitigate the impact of sanctions.

Strengthening Ties with Non-Western Countries

Russia is actively strengthening its economic ties with non-Western countries, particularly China.

-

China's Role: China has emerged as a crucial economic partner, providing crucial support in areas like energy and technology.

-

BRICS Cooperation: Russia is also deepening its cooperation with other BRICS nations (Brazil, Russia, India, China, South Africa), seeking to establish alternative economic and political alliances.

-

Eurasian Economic Union: The Eurasian Economic Union (EAEU) provides a platform for closer economic integration with neighboring countries, creating a more self-sufficient economic bloc.

-

Bullet points:

- Increased trade volume with China.

- Investment from BRICS nations in Russian infrastructure projects.

- Development of trade routes and agreements within the EAEU.

Military-Industrial Complex Expansion

A significant portion of Russia’s resources is being channeled into the military-industrial complex.

-

Increased Defense Spending: Defense spending has increased significantly, diverting resources from other sectors of the economy.

-

Resource Mobilization: The government is mobilizing resources, including human capital, for military production.

-

Implications for Domestic Economy: This prioritization of military production comes at the expense of investment in civilian industries and social programs.

-

Bullet points:

- Increased production of weapons and military equipment.

- Diverting resources from civilian sectors.

- Potential for long-term economic stagnation.

Internal Economic Reforms and Austerity Measures

The Russian government has implemented various austerity measures to address the economic crisis.

-

Fiscal Consolidation: The government is aiming to reduce the budget deficit through tax increases and spending cuts.

-

Social Consequences: These austerity measures are likely to have significant social and political consequences, potentially leading to social unrest.

-

Economic Reform: While some reforms are being implemented, the pace and scope are limited by the prevailing geopolitical and economic climate.

-

Bullet points:

- Increased taxes.

- Reduced social spending.

- Potential for social and political instability.

Conclusion

Putin's war economy is a dynamic and evolving system. The sanctions imposed following the invasion of Ukraine have undeniably reshaped Russia's economic landscape, forcing a significant restructuring of its priorities and relationships. While Russia has shown resilience in some areas, leveraging its energy resources and forging new partnerships, substantial challenges remain. The long-term sustainability of this model is questionable given the technological challenges, the high cost of sustaining the military-industrial complex, and the potential for social unrest. Further analysis of Putin's war economy is essential for comprehending the shifting global geopolitical landscape and its future implications. Understanding the complexities of Putin's war economy and its adaptations is vital for navigating the evolving global economic environment.

Featured Posts

-

Live Nation Appoints Richard Grenell To Board Amidst Doj Investigation

May 29, 2025

Live Nation Appoints Richard Grenell To Board Amidst Doj Investigation

May 29, 2025 -

Kondisi Cuaca Jawa Tengah 23 April Waspada Hujan Dan Angin Kencang

May 29, 2025

Kondisi Cuaca Jawa Tengah 23 April Waspada Hujan Dan Angin Kencang

May 29, 2025 -

Stranger Things Season 5 Everything We Know So Far

May 29, 2025

Stranger Things Season 5 Everything We Know So Far

May 29, 2025 -

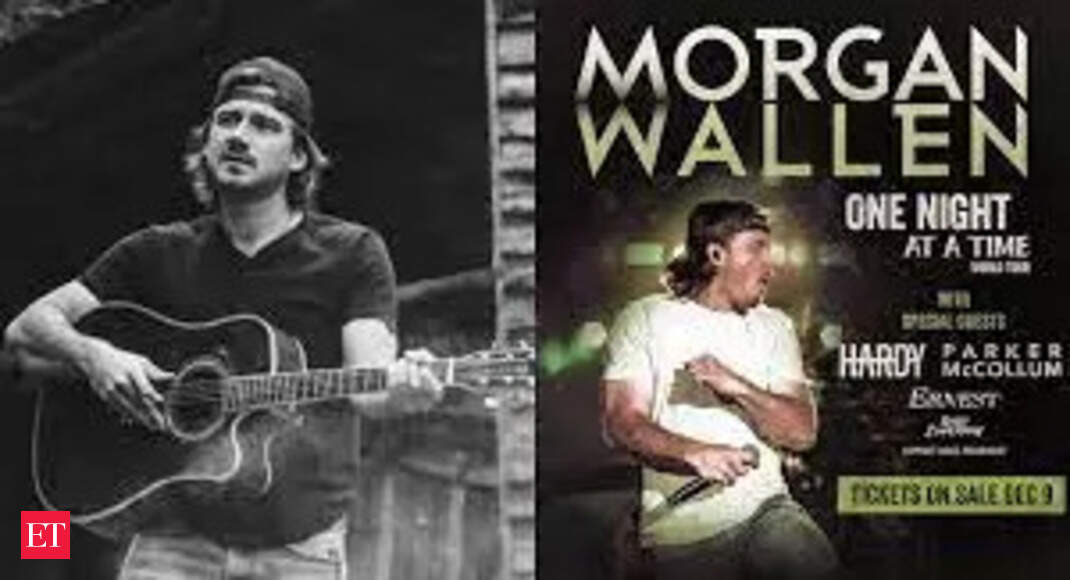

Analyzing The Success Of Morgan Wallens One Thing At A Time Album

May 29, 2025

Analyzing The Success Of Morgan Wallens One Thing At A Time Album

May 29, 2025 -

Fan Outrage Tate Mc Raes Potential Republican Leanings After Wallen Collab

May 29, 2025

Fan Outrage Tate Mc Raes Potential Republican Leanings After Wallen Collab

May 29, 2025