PwC Exits Nine African Nations: Reasons And Future Implications

Table of Contents

Reasons Behind PwC's Withdrawal from Nine African Nations

PwC's decision to exit nine African nations is a complex issue with several contributing factors. These factors can be broadly categorized into profitability concerns, regulatory challenges, and strategic restructuring initiatives.

Profitability and Market Challenges

Operating in certain African markets presents unique profitability challenges. These include intense competition from other Big Four accounting firms (Deloitte, Ernst & Young, KPMG) and a growing number of well-established local players. Market saturation in some areas, coupled with limited growth opportunities, further exacerbates the situation. High operating costs, particularly in regions with limited infrastructure, also impact profitability.

- Decreased demand: Fluctuating economic conditions in some regions led to reduced demand for PwC's services.

- Price wars: Intense competition resulted in price wars, squeezing profit margins.

- High operating costs: Infrastructure limitations and logistical challenges contributed to higher operational expenses.

Regulatory and Compliance Issues

Navigating the diverse and often complex regulatory environments across nine different African nations presents significant challenges. Varying accounting standards, stringent anti-corruption laws, and difficulties in tax compliance add layers of complexity and risk. Changes in local regulations might have further influenced PwC's decision.

- Varying accounting standards: Inconsistencies in accounting standards across different countries increased compliance costs.

- Stringent anti-corruption laws: The need for robust compliance measures to meet increasingly stringent anti-corruption regulations added to operational burden.

- Tax compliance difficulties: Complex tax systems and frequent regulatory changes posed considerable challenges.

Strategic Restructuring and Global Focus

PwC's decision is also part of a broader global restructuring strategy. The firm is likely realigning its resources to focus on high-growth markets and areas offering greater returns on investment. This may involve divesting from markets perceived as less strategic, leading to the withdrawal from these nine African nations. This could also be linked to a broader shift towards investments in technology and innovation.

- Focus on key strategic markets: PwC is prioritizing investment in regions with higher growth potential and strategic importance.

- Resource optimization: The withdrawal reflects a strategic decision to optimize resource allocation across its global operations.

- Investment in technology and innovation: PwC might be prioritizing investment in technology and digital transformation initiatives, potentially shifting resources away from some less technologically advanced markets.

Implications for African Economies and Businesses

PwC's withdrawal has significant implications for African economies and businesses, affecting auditing, consulting, and creating opportunities for local firms.

Impact on Auditing and Financial Reporting

The departure of PwC diminishes auditing expertise, potentially affecting financial transparency and investor confidence. Local firms will need to step up to fill the void, potentially facing challenges in capacity and expertise. Increased audit fees could also result.

- Reduced auditing capacity: The immediate consequence is a reduction in the availability of experienced auditors.

- Potential for increased audit fees: The reduced supply of auditing services might lead to higher fees for businesses.

- Risk to financial reporting quality: A potential impact is a decline in the quality of financial reporting due to reduced auditing expertise.

Effect on Business Consulting and Advisory Services

PwC's exit also impacts access to consulting expertise in areas like tax, strategy, and operations. Businesses that relied on PwC for strategic guidance will need to find alternative providers, potentially facing increased costs. Other consulting firms are likely to see increased market share.

- Loss of specialized expertise: Businesses lose access to PwC’s specialized expertise in various consulting areas.

- Increased reliance on local consultants: Businesses will increasingly depend on local consulting firms.

- Potential for higher consulting costs: The demand for consulting services might lead to an increase in fees.

Opportunities for Local Firms

PwC's withdrawal creates significant opportunities for local accounting and consulting firms. They can expand their market share, potentially attracting foreign investment and partnerships with international firms. However, local firms need to enhance their capabilities and expertise to successfully fill this gap.

- Increased market share: Local firms have the chance to gain significant market share in the vacated space.

- Potential for partnerships with international firms: Local firms could establish partnerships with international organizations.

- Need for capacity building: Significant investment in capacity building and upskilling will be needed to meet the increased demand.

Conclusion: Analyzing the Long-Term Effects of PwC Exits Nine African Nations

PwC's withdrawal from nine African nations is driven by a combination of profitability challenges, regulatory complexities, and strategic restructuring. This decision has significant implications for African economies and businesses, affecting auditing, consulting services, and opening doors for local firms. The long-term consequences will depend on how effectively local firms adapt, and the extent to which regulatory environments are improved to foster a more conducive business climate. Further research into the specific impacts on different sectors and countries is crucial. To understand the multifaceted implications of PwC exits nine African nations, further exploration of African economic development and the global accounting landscape is recommended.

Featured Posts

-

Will Trump Pardon Pete Rose Examining The Baseball Betting Controversy

Apr 29, 2025

Will Trump Pardon Pete Rose Examining The Baseball Betting Controversy

Apr 29, 2025 -

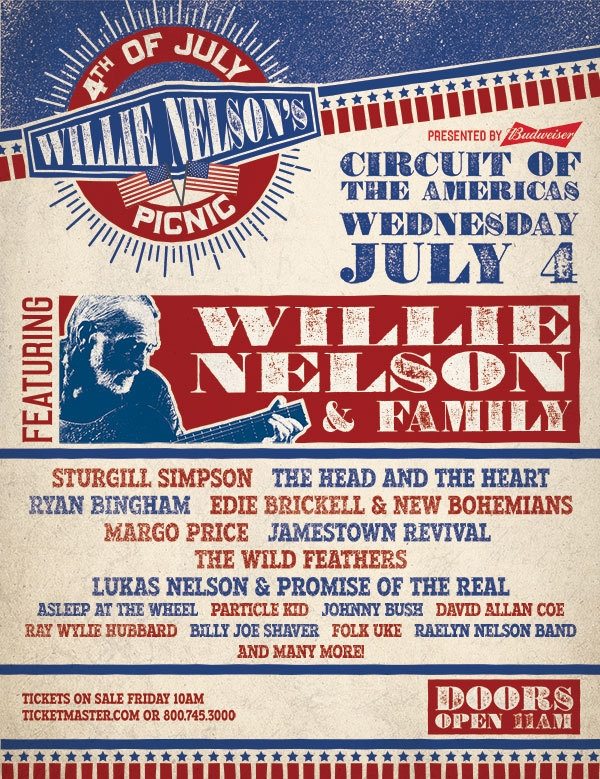

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025

Uk Courts Definition Of Woman Impact On Sex Based Rights And Transgender Issues

Apr 29, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025 -

Growth In Grief Fort Belvoirs Vigil For Fallen Soldiers

Apr 29, 2025

Growth In Grief Fort Belvoirs Vigil For Fallen Soldiers

Apr 29, 2025