PwC US Partners Ordered To Sever Brokerage Ties Following Internal Probe

Table of Contents

The Internal Probe: Unveiling the Issues

PwC's internal investigation, launched [insert timeframe if available], aimed to address serious concerns regarding potential conflicts of interest and breaches of internal policies among its US partners. While specific details remain confidential to protect ongoing investigations and the integrity of the process, the probe reportedly focused on potential violations related to [mention general areas of concern, e.g., personal trading activities, client relationship management, use of inside information]. The investigation’s scope included a review of [mention departments or practices affected, e.g., audit, consulting, tax].

- Specific examples of alleged misconduct: While specifics remain undisclosed, sources suggest the investigation examined instances of potential self-dealing and undisclosed financial interests that could create conflicts of interest with PwC's clients.

- Departments most affected: The probe reportedly involved partners across multiple service lines, including [mention affected departments if known, e.g., audit, tax, consulting].

- Individuals or groups implicated: The investigation involved a number of partners, though their identities haven't been publicly released to protect their privacy and the integrity of the investigation.

The Mandate: Severing Brokerage Relationships

Following the internal probe, PwC issued a firm mandate requiring all US partners to sever all brokerage relationships by [insert deadline if available]. This includes:

- Personal brokerage accounts: Partners are prohibited from holding brokerage accounts that could create potential conflicts of interest.

- Business dealings: Any business partnerships or financial dealings with brokerage firms are strictly forbidden.

- Referrals: Partners can no longer refer clients to specific brokerage firms.

The reasoning behind this drastic measure is multifaceted. PwC aims to:

-

Mitigate conflicts of interest: Severing brokerage ties minimizes the potential for partners to exploit their positions for personal financial gain.

-

Enhance regulatory compliance: The mandate demonstrates PwC's commitment to upholding the highest ethical standards and complying with regulatory requirements.

-

Protect PwC's reputation: This decisive action is intended to rebuild client trust and prevent further reputational damage.

-

Deadline for compliance: Partners were given a deadline of [insert deadline if available] to comply with the mandate.

-

Process for compliance: PwC provided detailed instructions and resources to guide partners through the process of severing their brokerage ties.

-

Consequences of non-compliance: Failure to comply could result in disciplinary action, up to and including termination.

Impact on PwC's Reputation and Client Trust

The PwC US partner brokerage tie severance order carries significant implications for the firm's reputation and client trust. This situation could lead to:

- Potential loss of clients: Clients may question PwC's ability to maintain objectivity and independence.

- Increased scrutiny from regulatory bodies: The SEC and other regulatory bodies are likely to intensify their oversight of PwC's operations.

- Impact on recruitment and retention of talent: Top talent may be hesitant to join or stay with a firm facing such reputational challenges.

Regulatory Implications and Future Actions

The PwC internal probe and subsequent actions will undoubtedly attract increased scrutiny from regulatory bodies, including the Securities and Exchange Commission (SEC) and other relevant authorities. This could result in:

- Further investigations: Regulatory bodies may launch their own investigations to determine the extent of any wrongdoing.

- Potential fines or penalties: PwC may face significant fines or penalties if regulatory violations are discovered.

To prevent similar incidents, PwC is likely to implement:

- Enhanced compliance programs: Strengthened internal controls and ethical guidelines will likely be implemented.

- Improved training and education: Partners will likely receive more robust training on conflict of interest avoidance and ethical conduct.

- Independent audits: Regular independent reviews of PwC's internal controls will provide additional assurance to stakeholders.

The PwC US Partner Brokerage Tie Severance: Implications and Next Steps

The PwC internal probe and the subsequent order to sever brokerage ties mark a critical moment for the firm. The mandate demonstrates a commitment to addressing potential conflicts of interest and enhancing regulatory compliance, but the long-term impact remains to be seen. The situation underscores the importance of robust internal controls, transparent ethical practices, and maintaining the highest levels of client trust within the financial services industry. Stay informed about further developments regarding the PwC US internal probe and its impact on partner brokerage ties by following reputable news sources and industry publications. We will continue to update this article as new information becomes available.

Featured Posts

-

2025 Nfl Season Chargers Justin Herbert To Play In Brazil

Apr 29, 2025

2025 Nfl Season Chargers Justin Herbert To Play In Brazil

Apr 29, 2025 -

The Role Of Misogyny In Protecting Women And Girls A Discussion With Mhairi Black

Apr 29, 2025

The Role Of Misogyny In Protecting Women And Girls A Discussion With Mhairi Black

Apr 29, 2025 -

Braintree And Witham Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Braintree And Witham Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

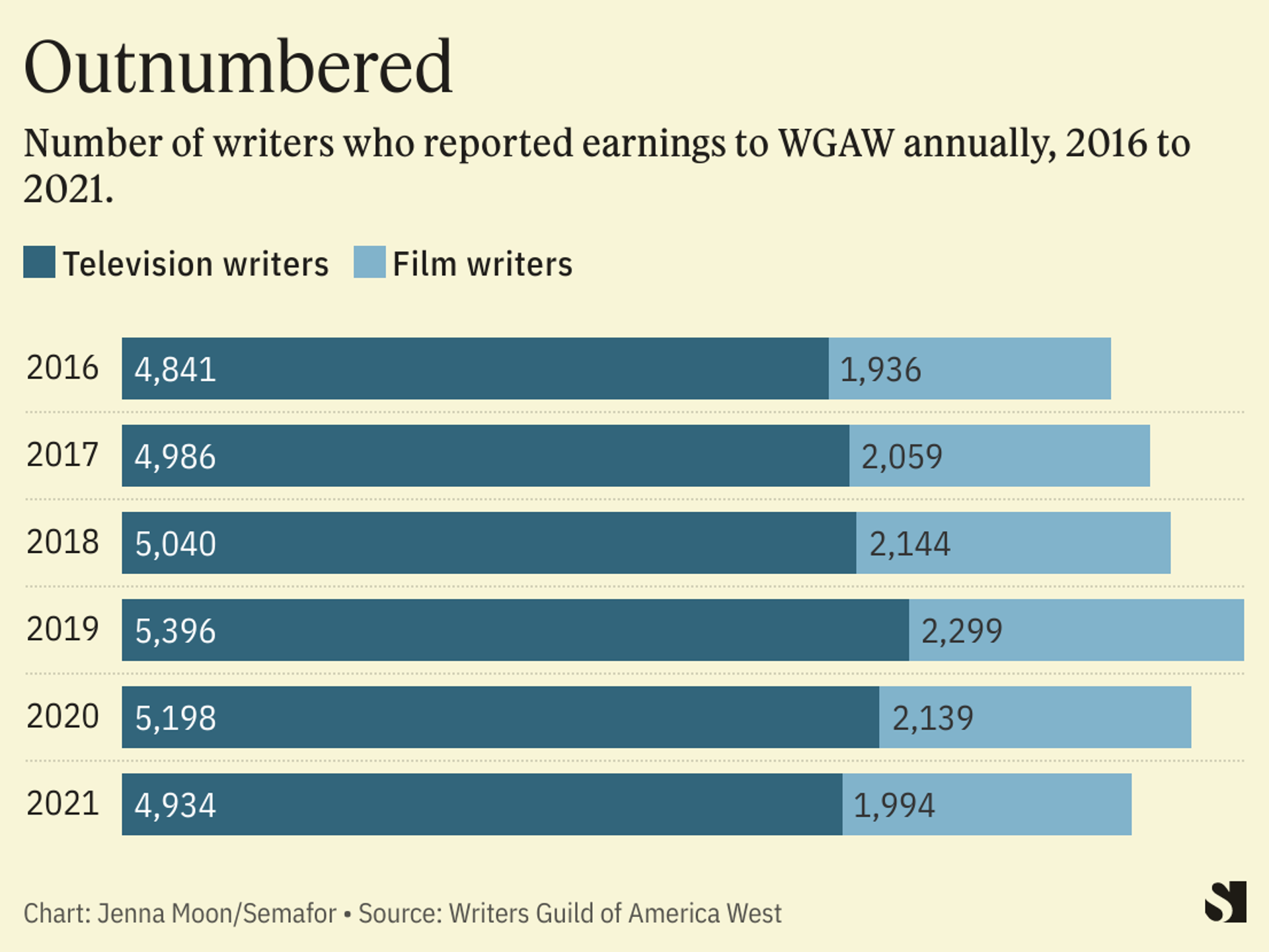

Double Trouble In Hollywood Writers And Actors Strike Causes Industry Wide Shutdown

Apr 29, 2025

Double Trouble In Hollywood Writers And Actors Strike Causes Industry Wide Shutdown

Apr 29, 2025 -

Milly Alcocks Supergirl Role Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

Apr 29, 2025

Milly Alcocks Supergirl Role Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

Apr 29, 2025