PwC's Strategic Retreat: Impact Of Withdrawal From Nine Sub-Saharan African Markets

Table of Contents

The Affected Markets and PwC's Rationale

PwC's strategic retreat involves its withdrawal from nine Sub-Saharan African countries. While the exact list of countries may vary depending on the source and official statements, the affected nations share certain characteristics that contributed to the decision. PwC has cited a reassessment of market conditions and profitability concerns as the primary drivers behind this move. [Insert link to official PwC statement, if available]. However, underlying factors not explicitly mentioned by PwC likely played a significant role. These could include political instability in certain regions, fluctuating economic climates, and evolving regulatory landscapes.

- Specific Challenges: Each affected country presents unique challenges. For example, some might grapple with high inflation, others with political uncertainty impacting business continuity, and still others with stringent regulatory environments that increase operational costs.

- Economic Climate Comparison: A comparative analysis of the economic climates in these nine countries before the withdrawal reveals varying degrees of vulnerability. Some might have experienced sustained economic growth before the withdrawal, while others might have been dealing with economic downturns.

- PwC's Market Share: PwC held varying market shares across these nations. A detailed analysis of their prior market dominance in each affected country would further elucidate the extent of the impact of their withdrawal. Understanding their previous market share will clarify the scale of the resulting vacuum in the market.

Impact on Clients and Businesses

The immediate consequence of PwC's withdrawal is the disruption faced by its existing clients in the affected regions. Ongoing audits, consulting projects, and other crucial services are now abruptly suspended, forcing businesses to scramble for alternative providers. Finding suitable replacements will be challenging, particularly in regions with limited availability of similar professional services firms. The transition will inevitably lead to:

- Increased Costs: Businesses will likely face increased costs in securing new service providers, especially if the transition necessitates higher fees or necessitates engaging multiple firms to cover the wide range of services previously offered by PwC.

- Project Delays: The transition period itself will inevitably lead to delays in ongoing projects, potentially impacting timelines and business objectives.

- Loss of Expertise: The departure of PwC also means the loss of accumulated expertise and institutional knowledge that the firm had cultivated over years of working within these markets. This loss of institutional memory will create challenges for businesses transitioning to other service providers.

Implications for the Sub-Saharan African Economy

PwC's strategic retreat has broader economic implications for Sub-Saharan Africa. The withdrawal could impact foreign direct investment, business confidence, and employment levels. The resulting uncertainty might deter potential investors and hamper economic growth in the affected regions. This is especially critical given PwC's significant role in attracting foreign investment into various sectors.

- Job Losses: The immediate impact is the loss of skilled jobs within PwC's offices in these nine countries.

- Ripple Effects: The effect extends beyond direct employment. Related businesses and sectors that relied on PwC's services—such as legal firms, financial institutions, and technology companies—are likely to experience indirect negative impacts.

- Investor Confidence: A decrease in investor confidence is a potential long-term consequence. The withdrawal might signal to some investors a heightened level of risk in the region, potentially leading to reduced investment in these specific markets.

The Future of PwC's African Operations

Despite the strategic retreat from these nine markets, PwC maintains a presence in other Sub-Saharan African countries. The company's decision to withdraw from some markets suggests a reassessment of its overall African strategy. This necessitates a closer look at PwC's future plans for the continent.

- Future Investments: PwC will likely recalibrate its future investments in Africa, focusing its resources on markets deemed more stable and profitable.

- Risk Management: The retreat suggests a shift in PwC's approach to risk management in African markets, potentially leading to more stringent criteria for selecting and investing in specific markets.

- Potential for Further Withdrawals: The possibility of future withdrawals from other African markets cannot be entirely dismissed, making continuous monitoring of their strategy essential.

Conclusion: Understanding the Long-Term Effects of PwC's Strategic Retreat

PwC's withdrawal from nine Sub-Saharan African markets marks a significant event with far-reaching consequences for businesses, economies, and the region's overall investment climate. The impact extends beyond immediate job losses and client disruption; it touches on broader issues of investor confidence and economic stability. The long-term effects of this strategic shift remain to be seen, but it underscores the complex challenges faced by multinational companies operating in Sub-Saharan Africa.

What are your thoughts on PwC's strategic shift? Let's continue the discussion about the implications of PwC's strategic retreat in Sub-Saharan Africa. Share your insights on the future of accounting and consulting services in the affected markets following PwC's decision. The implications of this decision for PwC Sub-Saharan Africa, the PwC withdrawal impact, and the Sub-Saharan Africa business environment warrant further research and debate.

Featured Posts

-

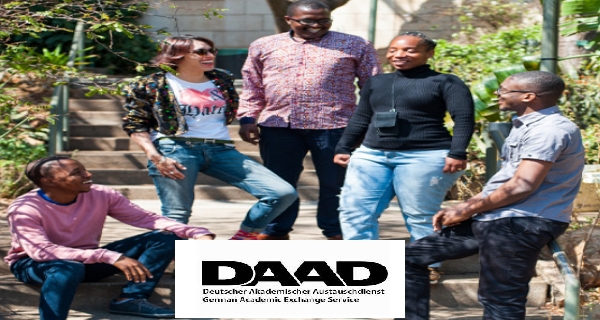

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025 -

You Tubes Growing Senior Audience Strategies And Demographics

Apr 29, 2025

You Tubes Growing Senior Audience Strategies And Demographics

Apr 29, 2025 -

Celebrating Culture The Annual Canoe Awakening Event

Apr 29, 2025

Celebrating Culture The Annual Canoe Awakening Event

Apr 29, 2025 -

Put A Finger Down Has Tik Tok Misdiagnosed My Adhd

Apr 29, 2025

Put A Finger Down Has Tik Tok Misdiagnosed My Adhd

Apr 29, 2025 -

Understanding Russias Military Strategy And Europes Response

Apr 29, 2025

Understanding Russias Military Strategy And Europes Response

Apr 29, 2025