PwC's Withdrawal From Nine Sub-Saharan African Countries: Reasons And Implications

Table of Contents

Financial Viability and Profitability Challenges in Sub-Saharan Africa

Operating in Sub-Saharan Africa presents unique challenges for multinational corporations. The economic realities often include significant hurdles that impact profitability. PwC's decision to withdraw is, in part, a response to these persistent financial difficulties. The region's infrastructure limitations, coupled with political instability and fluctuating currencies, create a volatile and unpredictable business environment. These factors contribute to higher operational costs and decreased profitability compared to more stable and developed markets.

- High operational costs: Infrastructure deficits lead to increased transportation, communication, and logistical expenses. Power outages and unreliable internet connectivity also contribute significantly to operational inefficiencies.

- Limited client base in certain sectors: The availability of clients needing advanced professional services might be limited in some sectors, hindering revenue generation.

- Difficulty in recruiting and retaining skilled professionals: Competition for top talent is fierce, with many skilled professionals seeking opportunities in more developed economies, leading to higher recruitment and retention costs for firms like PwC.

- Regulatory complexities and compliance challenges: Navigating the diverse regulatory landscapes and compliance requirements across multiple countries adds complexity and cost to operations.

These financial pressures likely played a significant role in PwC's strategic reassessment of its African operations, prompting the decision to prioritize markets offering greater returns.

Strategic Re-evaluation and Global Restructuring

PwC's withdrawal is also indicative of a broader global restructuring strategy. The firm, like many multinational professional services organizations, is constantly reevaluating its market presence to optimize resource allocation and maximize profitability. This involves focusing resources on high-growth and high-profitability markets that align with its long-term strategic goals.

- Focus on core markets and service offerings: By withdrawing from less profitable regions, PwC can concentrate its efforts and investments on core markets where it can achieve higher returns.

- Investment in technology and digital transformation: The firm's global strategy likely prioritizes investments in technology and digital transformation, areas that may require significant resources and are better suited for deployment in markets with established infrastructure.

- Optimization of global operations and resource allocation: The withdrawal allows PwC to streamline its global operations and redistribute resources more effectively, maximizing efficiency and profitability.

This strategic re-evaluation underscores the increasingly competitive nature of the global professional services market and the need for firms to adapt to changing economic landscapes.

Implications for Businesses in Affected Countries

The withdrawal of PwC from nine Sub-Saharan African countries has significant ramifications for local businesses. The loss of access to PwC's auditing, tax, and consulting services will likely create several challenges. Businesses may struggle to find suitable alternative service providers, especially those with comparable expertise and global reach.

- Increased costs for obtaining auditing and consulting services: Finding alternative providers might lead to higher costs, especially given the limited pool of available firms with similar capabilities.

- Difficulty in attracting foreign investment: The absence of a major player like PwC could negatively impact investor confidence, making it harder for businesses to secure foreign direct investment.

- Potential impact on corporate governance and transparency: The loss of PwC's auditing expertise could potentially affect the quality of corporate governance and transparency within affected businesses.

Implications for the Overall Sub-Saharan African Economy

PwC's withdrawal has broader consequences for the Sub-Saharan African economy. The loss of a significant player in the professional services sector could hinder economic growth and development.

- Loss of expertise and skills in professional services: The departure of PwC reduces the availability of highly skilled professionals in auditing, tax, and consulting, potentially impacting the quality of services available to businesses.

- Potential negative impact on investor confidence: This decision might negatively impact investor confidence, leading to a decrease in foreign direct investment, a critical driver of economic growth in the region.

- Reduced capacity for economic development and growth: The reduced capacity in professional services might impede the region's ability to attract investment, foster innovation, and achieve sustainable economic development.

Conclusion: Analyzing the Long-Term Effects of PwC's Withdrawal from Sub-Saharan Africa

PwC's withdrawal from nine Sub-Saharan African countries is a complex issue driven by a combination of financial challenges, strategic considerations, and the evolving global landscape of professional services. The implications are far-reaching, affecting not only individual businesses but also the overall economic outlook of the affected countries. The long-term effects remain to be seen, but the potential negative consequences on investment, economic growth, and the availability of crucial professional services are significant. Further research into the specific impacts on individual countries and industries is crucial. To better understand the ramifications of PwC's withdrawal from nine Sub-Saharan African countries and its ripple effects on regional economies and individual businesses, explore related case studies from organizations like the World Bank or contact relevant professional accounting bodies for further analysis.

Featured Posts

-

Snow Fox Service Disruptions On February 11th

Apr 29, 2025

Snow Fox Service Disruptions On February 11th

Apr 29, 2025 -

Cardinal Maintains Entitlement To Vote In Next Papal Conclave Despite Conviction

Apr 29, 2025

Cardinal Maintains Entitlement To Vote In Next Papal Conclave Despite Conviction

Apr 29, 2025 -

Dysprosium The Rare Earth Element Disrupting The Ev Industry

Apr 29, 2025

Dysprosium The Rare Earth Element Disrupting The Ev Industry

Apr 29, 2025 -

President Trumps Potential Pardon Of Pete Rose Legal And Political Ramifications

Apr 29, 2025

President Trumps Potential Pardon Of Pete Rose Legal And Political Ramifications

Apr 29, 2025 -

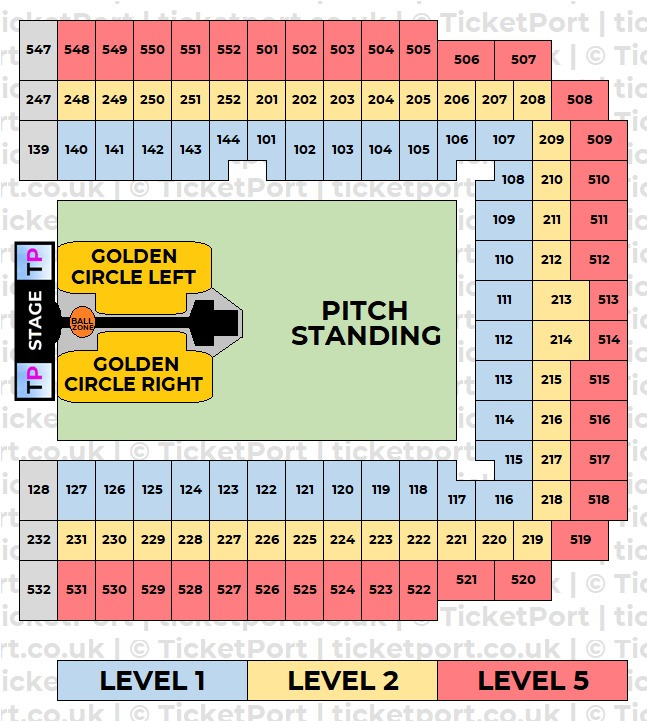

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025