QBTS Stock: Predicting The Earnings Report Reaction

Table of Contents

Analyzing QBTS's Recent Performance and Trends

Analyzing QBTS's recent performance is critical to predicting the market's reaction to the upcoming earnings report. This involves examining several key areas:

Revenue Growth and Projections

QBTS's revenue growth trajectory is a primary indicator of its financial health. Comparing actual revenue against projected revenue reveals whether the company has met or exceeded expectations. A consistent track record of exceeding projections signals strong growth potential and usually translates into positive market sentiment. Conversely, consistently missing projections can lead to negative investor reactions.

- Analyze YoY revenue growth: Examine the year-over-year (YoY) growth rate to identify trends and assess the company's ability to consistently increase its revenue.

- Look at major contracts secured: Significant contracts secured by QBTS indicate strong market demand for its quantum computing solutions and suggest positive future revenue streams.

- Discuss the impact of R&D spending on future revenue streams: While research and development (R&D) expenditure can initially reduce short-term profits, it's crucial for long-term growth in the innovative quantum computing sector. High R&D spending might indicate a commitment to future innovation, potentially justifying a higher QBTS stock valuation.

Key Performance Indicators (KPIs)

Beyond revenue, several other KPIs offer valuable insights into QBTS's performance and potential. Analyzing these metrics provides a more comprehensive understanding of the company's operational efficiency and market position.

- Customer Acquisition Cost (CAC): A low CAC suggests efficient marketing and sales strategies, while a high CAC might indicate challenges in acquiring new customers.

- Average Revenue Per User (ARPU): ARPU reflects the revenue generated per customer, indicating the value each customer brings to the company. A rising ARPU is generally positive.

- Churn Rate: The churn rate, representing the percentage of customers who cancel their subscriptions or services, is a crucial indicator of customer satisfaction and retention. A low churn rate is usually favorable.

Analyzing how these KPIs have performed in previous quarters and how they correlate with stock price movements can reveal valuable patterns.

Competitive Landscape

QBTS operates within a dynamic and competitive quantum computing market. Understanding its position relative to its competitors is essential.

- List major competitors: Identify key players in the quantum computing industry competing directly with QBTS. This could include established tech giants as well as emerging startups.

- Compare their market capitalization and revenue: Assessing the relative market size and financial performance of competitors helps understand QBTS’s competitive standing.

- Discuss QBTS's competitive advantages: Identify what differentiates QBTS from its competitors. This could be technological superiority, superior market positioning, strong intellectual property, or a more efficient business model. This is crucial for assessing future growth prospects.

Factors Influencing Market Reaction to the Earnings Report

The market's reaction to QBTS's earnings report won't solely depend on the numbers themselves. Several factors influence investor sentiment and subsequent stock price movements.

Beat or Miss Expectations

Market sentiment leading up to the earnings report is crucial. Analyst expectations and previous performance heavily influence what constitutes a "beat" or "miss." Exceeding expectations usually results in a positive stock price reaction, while falling short tends to have the opposite effect.

- Summarize analyst ratings and price targets for QBTS stock: Consolidating information from multiple analysts provides a balanced perspective on the anticipated earnings.

- Discuss potential scenarios (beat, meet, miss expectations) and their probable market reactions: Prepare for various outcomes, acknowledging the potential for both positive and negative market responses.

Guidance for Future Quarters

The company's guidance for future quarters is as important as the current earnings report. Optimistic guidance often boosts investor confidence, leading to higher stock prices. Conversely, cautious or negative guidance can dampen investor enthusiasm.

- Explain how positive or negative guidance impacts stock price: A clear understanding of the relationship between guidance and stock price movements is vital.

- Discuss the importance of considering the overall economic climate and industry trends in evaluating guidance: It’s essential to consider the broader context when interpreting the company's guidance.

Market Sentiment and External Factors

Broader market conditions, economic indicators, and global events significantly influence investor sentiment.

- Discuss the impact of macroeconomic factors (interest rates, inflation): Rising interest rates or high inflation can negatively impact investor appetite for riskier assets like QBTS stock.

- Consider the effect of geopolitical events on the tech sector: Geopolitical instability can negatively impact investor confidence in the tech sector in general.

Strategies for Navigating the Post-Earnings Report Volatility

The period following the earnings report can be volatile. Having a clear strategy can help mitigate risk.

Risk Management

Managing risk is paramount when investing in stocks. Employing strategies can minimize potential losses.

- Explain various risk management techniques relevant to QBTS stock: This could include setting stop-loss orders, diversifying your portfolio, or using options strategies.

- Emphasize the importance of having a well-defined investment strategy: A thorough investment plan, factoring in your risk tolerance and financial goals, is crucial for navigating market fluctuations.

Long-Term vs. Short-Term Perspective

Your investment timeline should influence your approach.

- Outline the benefits and risks of short-term trading versus long-term investing in QBTS stock: Short-term trading carries higher risk but also higher potential returns, while long-term investing minimizes risk through time diversification.

Additional Research

Never rely solely on a single source of information.

- Suggest further resources for investors to research QBTS: This includes reviewing SEC filings, following financial news and analyst reports, and staying updated on industry developments.

Conclusion

Predicting the market's exact reaction to the QBTS earnings report is impossible. However, by carefully analyzing the company’s performance, understanding market sentiment, and considering external factors, investors can improve their chances of making informed decisions regarding their QBTS stock holdings. Remember to conduct your own thorough research and develop a robust risk management strategy. Stay informed about the QBTS stock and its performance post-earnings report. Understanding the nuances surrounding QBTS stock and the quantum computing industry will aid in developing a comprehensive investment strategy. Don't hesitate to further your research into QBTS stock and its future potential.

Featured Posts

-

Visita Familiar Michael Schumacher Viaja A Suiza Desde Mallorca En Helicoptero

May 20, 2025

Visita Familiar Michael Schumacher Viaja A Suiza Desde Mallorca En Helicoptero

May 20, 2025 -

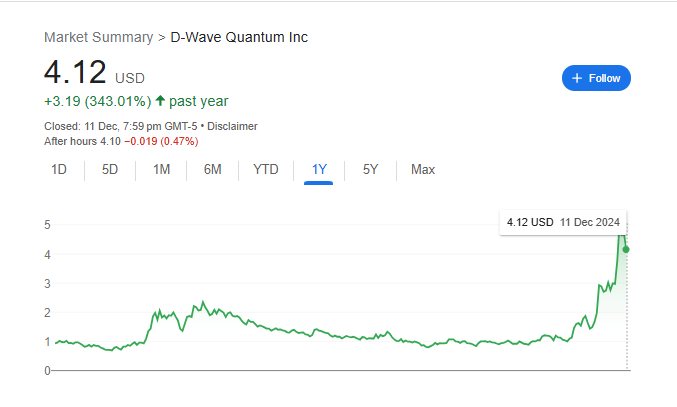

D Wave Quantum Qbts Understanding The 2025 Stock Decline

May 20, 2025

D Wave Quantum Qbts Understanding The 2025 Stock Decline

May 20, 2025 -

Challenges To Clean Energys Expansion A Growing Threat

May 20, 2025

Challenges To Clean Energys Expansion A Growing Threat

May 20, 2025 -

School Delays Due To Winter Weather Advisory

May 20, 2025

School Delays Due To Winter Weather Advisory

May 20, 2025 -

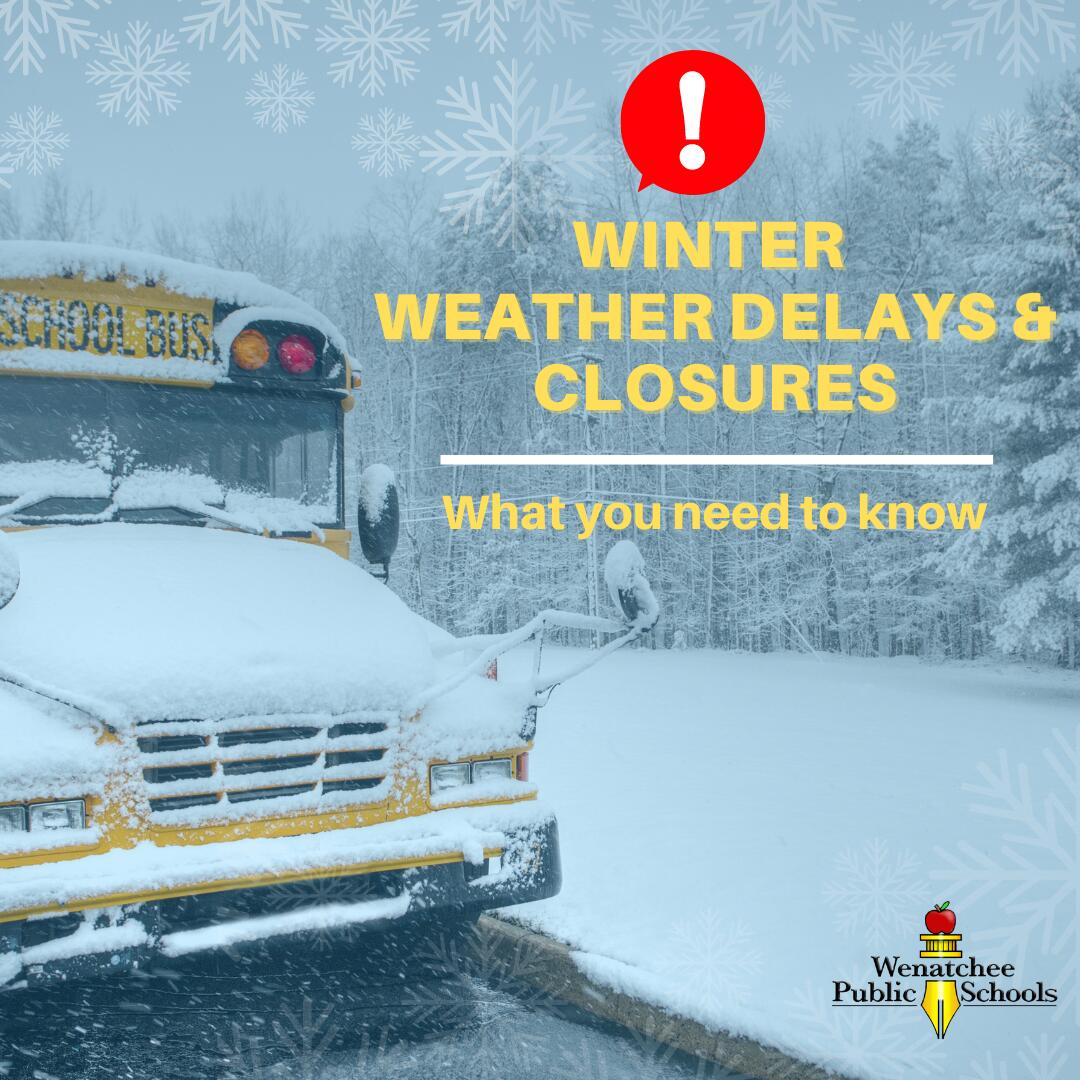

Chinas Concerns Examining The Us Typhon Missile System In The Philippines

May 20, 2025

Chinas Concerns Examining The Us Typhon Missile System In The Philippines

May 20, 2025