Quantum Computing Stocks To Watch In 2025: Rigetti And IonQ

Table of Contents

Rigetti Computing: A Deep Dive into its Potential

Rigetti's Technology and Market Position

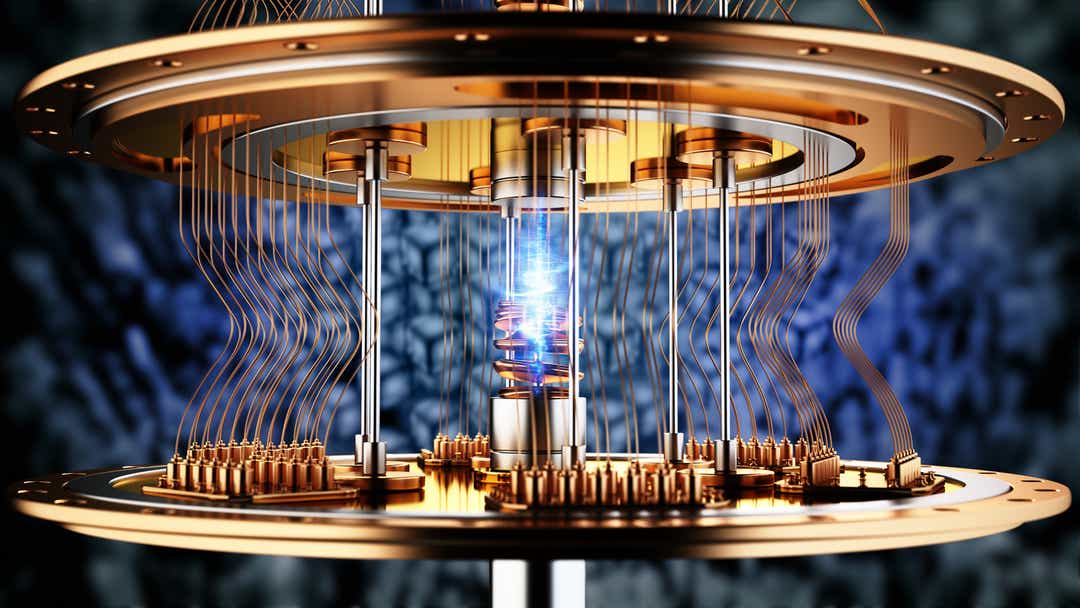

Rigetti Computing is a prominent player in the quantum computing space, distinguished by its unique approach to building quantum computers.

- Superconducting Qubits: Rigetti utilizes superconducting qubits, a leading technology in the field, known for its potential for scalability and high qubit counts.

- Hybrid Quantum Computing: They are developing hybrid quantum computing systems that combine classical and quantum processing, aiming to offer practical solutions for near-term applications.

- Quantum Annealing Capabilities: While focusing on gate-based quantum computing, Rigetti also explores quantum annealing techniques to address specific optimization problems.

- Target Markets: Rigetti targets various sectors, including pharmaceutical research, financial modeling, and materials discovery, leveraging their quantum computing power for complex simulations and optimizations.

- Partnerships and Breakthroughs: Rigetti has secured collaborations with significant players in the industry, further solidifying their position and driving technological advancements. Recent breakthroughs in qubit coherence times and control demonstrate their commitment to innovation.

Rigetti's potential for future growth hinges on its ability to scale its qubit count and maintain its technological edge within the fiercely competitive quantum computing landscape. Successful execution of its roadmap could lead to significant market share capture.

Investment Considerations for Rigetti Stock

Investing in Rigetti stock presents both significant opportunities and substantial risks.

- Stock Valuation: Evaluating Rigetti's current stock valuation requires careful analysis of its financial performance, future growth projections, and the overall risk profile of the quantum computing sector.

- Risk Assessment: Investing in any early-stage technology company involves considerable risk. Rigetti's success depends on overcoming significant technological hurdles and securing sufficient funding to reach commercial viability.

- Financial Stability and Funding: Assessing Rigetti's financial health, including its cash reserves, revenue streams, and funding rounds, is crucial for any potential investor. Analyzing its financial projections alongside industry analyst reports offers a more comprehensive picture. [Insert citation to relevant financial analysis here].

- Analyst Predictions: While forecasts vary, many analysts anticipate significant growth in the quantum computing market, potentially leading to substantial returns for early investors in companies like Rigetti. However, these predictions should be viewed with caution, considering the inherent uncertainties associated with this emerging technology. [Insert citation to analyst predictions here].

A well-defined investment strategy, including risk tolerance assessment and diversification, is crucial when considering Rigetti as part of your portfolio.

IonQ: A Leading Player in the Quantum Computing Race

IonQ's Technological Advantages and Market Strategy

IonQ stands out in the quantum computing arena through its utilization of trapped-ion technology.

- Trapped-Ion Technology: IonQ's trapped-ion qubits boast high fidelity and long coherence times, offering potential advantages in terms of accuracy and stability compared to other qubit technologies.

- Quantum Cloud Computing: IonQ emphasizes cloud-based access to its quantum computers, allowing broader access and fostering collaboration within the quantum computing community.

- Quantum Algorithm Development: IonQ is actively involved in developing and optimizing quantum algorithms tailored for its trapped-ion systems.

- Notable Collaborations: IonQ has forged partnerships with leading research institutions and companies, demonstrating its commitment to advancing quantum computing research and applications.

- Competitive Landscape: While facing competition from other players in the field, IonQ's unique approach to quantum computing positions it favorably within the evolving market landscape.

IonQ's ability to maintain its technological leadership and expand its cloud-based platform will significantly impact its market share and future growth prospects.

Evaluating IonQ as a Quantum Computing Stock

Assessing IonQ's potential as a quantum computing stock requires a comprehensive evaluation of its financial health and growth potential.

- Market Capitalization: IonQ's market capitalization and stock performance provide insights into investor sentiment and market valuation. [Insert citation to market data here].

- Financial Health: Analyzing IonQ's financial statements, including its revenue, profitability, and debt levels, is essential for understanding its long-term sustainability.

- Return on Investment (ROI): Predicting the return on investment for IonQ stock is challenging, but understanding the potential applications and market size of quantum computing offers a framework for projecting potential growth.

- Long-Term Growth Potential: The long-term growth potential of IonQ hinges on its ability to consistently innovate and develop practical applications of its technology. Market analysts offer a range of projections, reflecting the inherent uncertainties in this emerging sector. [Insert citation to analyst predictions here].

- Risk Assessment: Investing in IonQ, like any other quantum computing stock, involves risk. Technological challenges, competition, and the overall maturity of the market must be carefully considered.

Careful risk management and diversification are crucial strategies for investors considering IonQ.

Comparing Rigetti and IonQ: Which Quantum Computing Stock is Right for You?

Both Rigetti and IonQ represent compelling investment opportunities in the quantum computing sector, each with distinct strengths and weaknesses.

| Feature | Rigetti | IonQ |

|---|---|---|

| Qubit Technology | Superconducting Qubits | Trapped Ions |

| Market Strategy | Hybrid approach, diverse applications | Cloud-based access, algorithm development |

| Market Cap | [Insert Data] | [Insert Data] |

| Revenue | [Insert Data] | [Insert Data] |

Choosing between Rigetti and IonQ depends largely on your individual investment strategy and risk tolerance. Investors with a higher risk tolerance and a long-term outlook might favor either company, depending on their preference for specific technologies and market strategies. A more conservative approach might suggest diversification across both companies or a broader portfolio of quantum computing stocks.

Conclusion: Making Informed Decisions on Quantum Computing Stocks

Investing in quantum computing stocks like Rigetti and IonQ presents a significant opportunity for long-term growth, but it's crucial to remember that it also involves considerable risk. Both companies are leaders in their respective technological approaches, offering potentially disruptive technologies with broad applications. However, the industry is still in its early stages, and considerable technological and market challenges remain.

Key takeaways include the distinct technological approaches of Rigetti and IonQ (superconducting qubits vs. trapped ions), their different market strategies, and the need for thorough due diligence before making any investment decisions. Thoroughly research top quantum computing stocks like Rigetti and IonQ, carefully assess your risk tolerance, and consider diversifying your portfolio to mitigate potential losses. Remember, informed investment decisions are crucial for maximizing potential returns in the exciting but volatile world of quantum computing stocks.

Featured Posts

-

Solo Travel For Beginners Everything You Need To Know

May 20, 2025

Solo Travel For Beginners Everything You Need To Know

May 20, 2025 -

Exploring The World Of Agatha Christies Poirot

May 20, 2025

Exploring The World Of Agatha Christies Poirot

May 20, 2025 -

Us China Relations The Impact Of The New Missile System

May 20, 2025

Us China Relations The Impact Of The New Missile System

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop Monday Reasons And Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop Monday Reasons And Analysis

May 20, 2025 -

The Genius Of Agatha Christies Poirot Detective Fiction At Its Finest

May 20, 2025

The Genius Of Agatha Christies Poirot Detective Fiction At Its Finest

May 20, 2025