Quebec's Lion Electric: New Takeover Bid From Investor Consortium

Table of Contents

Details of the New Takeover Bid

The Investor Consortium

The takeover bid for Lion Electric originates from a newly formed investor consortium, tentatively named "EV Growth Partners," although the final name may differ. The consortium comprises several key players: a prominent Canadian pension fund, known for its significant investments in sustainable infrastructure projects; a US-based private equity firm specializing in clean energy technologies; and a group of individual high-net-worth investors with extensive experience in the automotive industry.

- Investment History: The pension fund boasts a substantial portfolio of renewable energy and infrastructure assets, demonstrating a commitment to long-term, sustainable investments. The private equity firm has a proven track record of successfully investing in and scaling clean technology companies, including several successful EV-related ventures.

- Expertise: The consortium brings a wealth of expertise in finance, operations management, and the electric vehicle market. Their combined knowledge and resources are poised to significantly contribute to Lion Electric's growth and development.

- Proposed Valuation: The consortium has reportedly offered a premium of approximately 25% over Lion Electric's current market capitalization, valuing the company at an estimated CAD $X billion (replace X with the actual or estimated value). This reflects the investor consortium's confidence in Lion Electric's potential and the growth of the EV market.

Key Terms of the Bid

The proposed takeover bid is structured as a cash offer, providing Lion Electric shareholders with a clear and immediate return on their investment.

- Offer Price: The offer price per share is currently set at CAD $Y (replace Y with the actual or estimated value), representing a substantial premium over the recent trading price.

- Timeline: The consortium has proposed a timeline of approximately [number] months to complete the acquisition, subject to regulatory approvals and other customary closing conditions.

- Regulatory Hurdles: The successful completion of the bid is contingent upon receiving necessary approvals from relevant regulatory bodies in Canada and potentially other jurisdictions where Lion Electric operates. Antitrust reviews and assessments of foreign investment will be key considerations.

Lion Electric's Response to the Takeover Bid

Management's Statement

Lion Electric's management has issued a formal statement acknowledging the receipt of the takeover bid. While they haven't yet publicly accepted or rejected the offer, their statement indicates a willingness to engage in discussions with the investor consortium to thoroughly evaluate the proposal.

- Official Response: "The Board of Directors of Lion Electric is carefully reviewing the proposal received from EV Growth Partners. We are committed to acting in the best interests of our shareholders and will provide a further update in due course." - [Name and Title of Spokesperson]

- Analysis: This measured response suggests that Lion Electric's management is taking a cautious but receptive approach to the bid. They are likely assessing the long-term implications of the acquisition for the company’s strategic direction and its employees.

Potential Impact on Lion Electric's Operations

The takeover bid's acceptance could have a profound impact on Lion Electric's operations.

- Positive Impacts: Increased access to capital for expansion; enhanced technological capabilities and expertise; broader market reach and distribution networks.

- Negative Impacts: Potential job losses due to restructuring; potential changes to product lines or strategic priorities; cultural clashes within the organization.

- Strategic Direction: The investor consortium's focus on sustainable technologies suggests a potential shift towards increased production of electric buses and trucks, potentially accelerating Lion Electric's growth in this vital market segment.

Market Reaction and Analyst Opinions

Stock Price Fluctuations

The announcement of the Lion Electric takeover bid has caused significant volatility in the company's stock price.

- Price Movements: Following the announcement, Lion Electric's stock price initially surged by approximately [percentage] before settling slightly lower. [Insert graph/chart illustrating stock price movements here].

- Analyst Opinions: Financial analysts have expressed mixed views on the bid, with some praising the potential for increased investment and growth, while others express concerns about the potential impact on Lion Electric's independence and long-term strategy.

Industry Implications

This takeover attempt could reshape the Canadian and global EV landscape.

- Competition: The acquisition could lead to increased competition in the electric bus and truck manufacturing segment, potentially accelerating innovation and driving down prices for consumers.

- Consolidation: The bid underscores the ongoing trend of consolidation in the EV manufacturing sector, suggesting a move towards larger, more established players dominating the market.

Conclusion

The Lion Electric takeover bid represents a significant development for the company and the broader EV industry. The investor consortium's substantial offer, Lion Electric's measured response, and the market's enthusiastic (though cautious) reaction highlight the strategic importance of this Quebec-based electric vehicle manufacturer. Understanding the details of this Lion Electric takeover bid, including the consortium's identity, the terms of the offer, and the potential impact on operations, is critical for anyone following the evolving electric vehicle market.

Call to Action: Stay informed about the unfolding situation with Lion Electric and the implications of this takeover bid for the electric vehicle industry. Follow our website for updates on the Lion Electric takeover bid and other significant developments in the EV sector. We will keep you up-to-date on any significant changes to this developing story as the situation progresses. Keep an eye out for further analysis on the potential future of Lion Electric and its place in the growing electric vehicle market.

Featured Posts

-

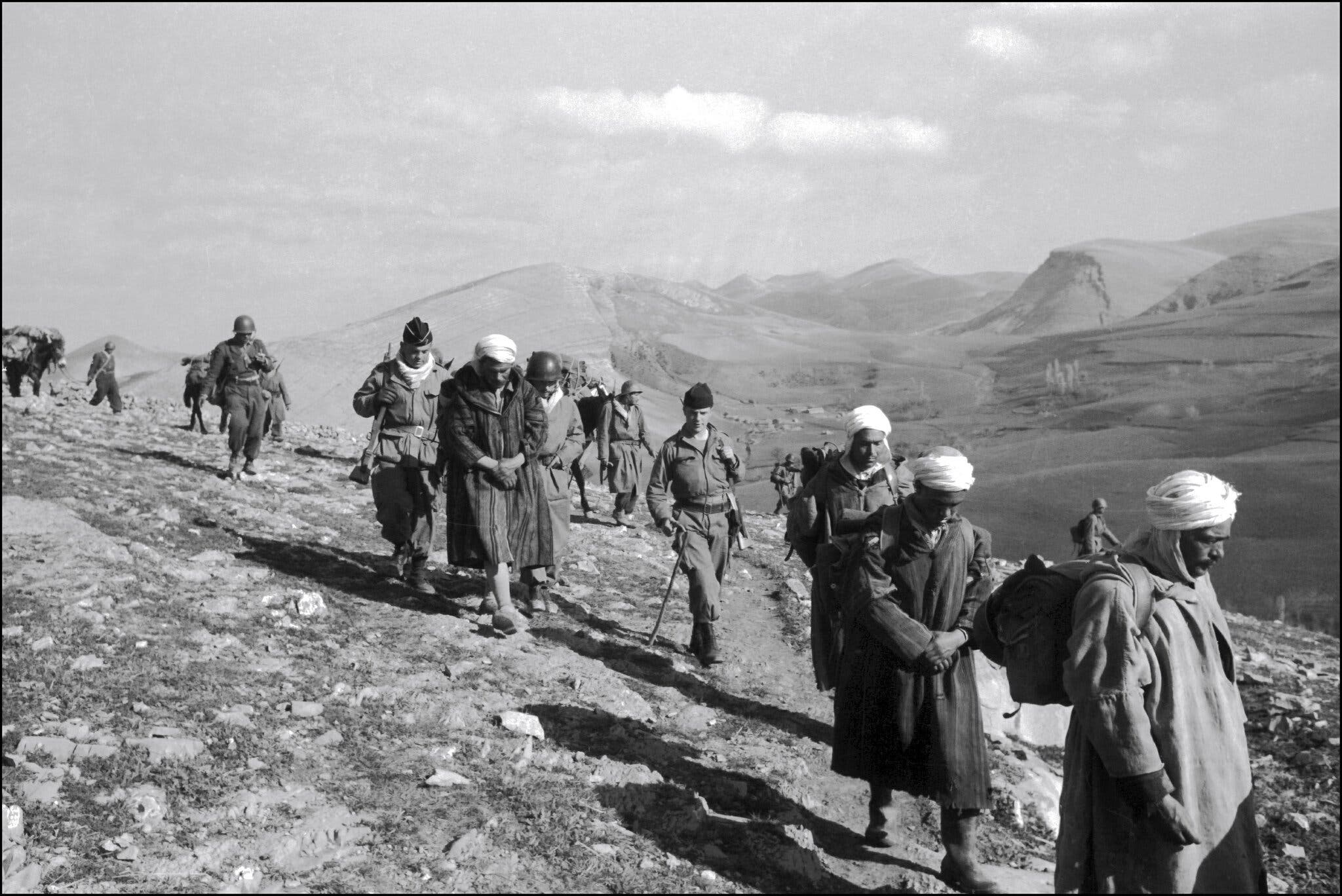

Les Tensions France Algerie Et Leurs Repercussions En Cote D Or

May 14, 2025

Les Tensions France Algerie Et Leurs Repercussions En Cote D Or

May 14, 2025 -

Awoniyi Out Forest Strikers Injury Confirmed After Surgery

May 14, 2025

Awoniyi Out Forest Strikers Injury Confirmed After Surgery

May 14, 2025 -

Ro Er Federer Se Vra A Puni Stadioni I Strasni Navi Achi Cheka U

May 14, 2025

Ro Er Federer Se Vra A Puni Stadioni I Strasni Navi Achi Cheka U

May 14, 2025 -

Newcastle Misses Out On Top Premier League Defender Target

May 14, 2025

Newcastle Misses Out On Top Premier League Defender Target

May 14, 2025 -

Maya Jama And Ruben Dias Romance Confirmed

May 14, 2025

Maya Jama And Ruben Dias Romance Confirmed

May 14, 2025