RBC Faces Headwinds: Lower Earnings And Rising Loan Concerns

Table of Contents

Declining Earnings at RBC: A Closer Look

RBC's recent financial reports reveal a concerning trend of declining earnings, a phenomenon impacting profitability and investor confidence. Several factors contribute to this challenging situation.

Impact of Rising Interest Rates

The aggressive interest rate hikes implemented by central banks globally, including the Bank of Canada, have significantly impacted RBC's profitability. These higher rates have resulted in:

- Decreased mortgage applications: Higher borrowing costs deter potential homebuyers, leading to a slowdown in mortgage origination, a key revenue stream for RBC.

- Lower net interest margin: While higher rates increase returns on some assets, the cost of funding also rises, potentially squeezing the net interest margin—the difference between interest earned and interest paid.

- Impact on investment banking divisions: Reduced investment activity and market volatility negatively impact RBC's investment banking operations, affecting fees and trading revenue.

Data from the Bank of Canada and RBC's quarterly reports show a clear correlation between rising interest rates and reduced profitability. For example, [cite specific data and source from a credible financial news outlet like the Financial Post or Bloomberg]. This trend underscores the sensitivity of RBC's business model to macroeconomic shifts.

Weakening Economic Outlook

A potentially slowing global and Canadian economy further exacerbates the challenges faced by RBC. This weakening outlook translates into:

- Increased loan defaults: Economic slowdown leads to job losses and reduced consumer spending, increasing the likelihood of borrowers defaulting on their loans.

- Potential for write-downs: RBC may need to write down the value of some assets on its balance sheet, further impacting profitability, if defaults become widespread.

- Decreased consumer spending impacting loan repayments: Reduced consumer confidence and discretionary spending lead to lower loan repayments, straining RBC's cash flow.

The possibility of a recession in Canada or globally poses a significant threat, potentially leading to a substantial increase in non-performing loans and further pressure on RBC's earnings. Analysts are closely monitoring economic indicators to assess the severity of the potential downturn and its impact on RBC's financial health.

Rising Loan Concerns and Credit Risk at RBC

Alongside declining earnings, RBC is facing growing concerns about rising loan concerns and credit risk. This section analyzes the key aspects of this challenge.

Increased Non-Performing Loans (NPLs)

A notable increase in non-performing loans (NPLs) poses a substantial threat to RBC's balance sheet. This rise is particularly evident in:

- Specific examples of sectors experiencing higher defaults: The real estate sector, particularly commercial real estate, is showing signs of stress, with higher-than-expected defaults. Similarly, some commercial lending portfolios are also experiencing increased delinquencies.

- Geographic concentration of risk: Certain geographic areas with overheated housing markets may exhibit a higher concentration of risky loans, amplifying the potential for losses.

RBC's risk management strategies, including stress testing and rigorous credit underwriting processes, will be crucial in mitigating these risks. However, the effectiveness of these strategies in a rapidly deteriorating economic climate remains to be seen.

Provisioning for Loan Losses

RBC's approach to loan loss provisioning will be critical in navigating the current economic uncertainty. Key questions include:

- Analysis of RBC's provisions compared to competitors: How does RBC's provisioning compare to that of its peers? Are they adequately prepared for a potential surge in defaults?

- Discussion of potential future provisioning needs: Will RBC need to significantly increase its loan loss provisions in the coming quarters to account for the increased risk?

Examining RBC's financial reports and investor statements ([link to relevant documents]) provides crucial insights into the bank's approach to loan loss provisioning and its preparedness for potential future losses.

Investor Sentiment and Market Reaction to RBC's Challenges

The combination of lower earnings and rising loan concerns has significantly impacted investor sentiment and market reaction.

Stock Price Performance

RBC's stock price has reflected the concerns surrounding its financial performance:

- Stock price trends: [Include a chart or graph showing RBC's stock price performance over a relevant period].

- Analyst ratings: Many analysts have downgraded their ratings on RBC stock, reflecting the increased uncertainty surrounding its outlook.

- Investor confidence levels: Investor confidence in RBC has waned, leading to reduced investment and potential capital flight.

These factors have collectively contributed to a decline in RBC's market capitalization and investor confidence.

Investor Response and Future Outlook

Investors are closely monitoring RBC's response to these challenges. Key questions include:

- Potential for dividend cuts: Will RBC maintain its dividend payout, or will it consider a cut to conserve capital?

- Impact on future investments: How will these challenges impact RBC's future investment plans and growth strategy?

- Strategic responses from RBC leadership: What strategic initiatives is RBC implementing to address these headwinds and restore investor confidence?

Statements from RBC leadership and analysis from financial experts ([include quotes from credible sources]) will shed light on the bank's future direction and its ability to navigate this challenging period.

Conclusion

In summary, RBC is facing significant headwinds, including declining earnings driven by rising interest rates and a weakening economic outlook, compounded by rising loan concerns and increased credit risk. The impact on investor sentiment is evident in the stock price performance and reduced investor confidence. These challenges underscore the vulnerability of the Canadian banking sector to macroeconomic fluctuations. The effectiveness of RBC's risk management strategies and its ability to adapt to this challenging environment will determine its future success.

Call to Action: Stay updated on the latest developments concerning RBC's financial performance and the potential long-term implications of these headwinds. For further insights, delve deeper into RBC's financial reports and follow reputable financial news sources for ongoing analysis. Consider subscribing to a financial newsletter like [mention a relevant newsletter] for comprehensive updates on the Canadian banking sector.

Featured Posts

-

Indian Wells Tennis Tsitsipas Wins Medvedev Advances To Next Round

May 31, 2025

Indian Wells Tennis Tsitsipas Wins Medvedev Advances To Next Round

May 31, 2025 -

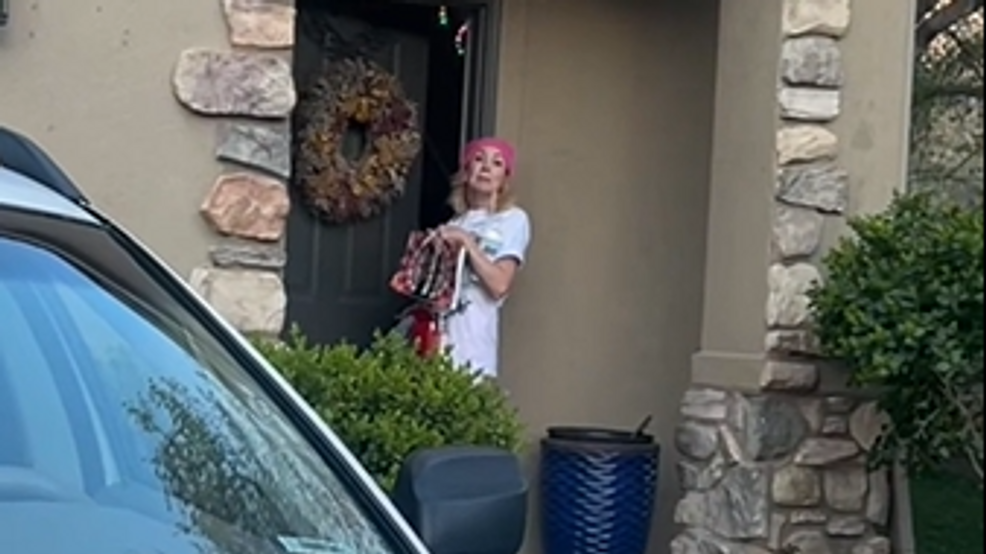

Beautician Escapes Prison For Repeated Racial Slurs And Property Damage

May 31, 2025

Beautician Escapes Prison For Repeated Racial Slurs And Property Damage

May 31, 2025 -

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025 -

Umzug Ins Gruene Deutsche Gemeinde Wirbt Mit Kostenlosen Wohnungen

May 31, 2025

Umzug Ins Gruene Deutsche Gemeinde Wirbt Mit Kostenlosen Wohnungen

May 31, 2025 -

Finding The Good Life Strategies For Happiness And Fulfillment

May 31, 2025

Finding The Good Life Strategies For Happiness And Fulfillment

May 31, 2025