Recent Canadian Trade Data: Deficit Narrows To $506 Million

Table of Contents

H2: Exports and Imports: A Detailed Breakdown

Analyzing the specific figures reveals a complex picture of Canadian exports and imports. The narrowing of the deficit is a result of both increased exports and decreased imports, although the precise contributions vary across sectors. Key data points offer a more nuanced understanding of this trend.

- Canadian Exports: While precise percentage changes require referencing the specific source data for the period in question (e.g., Statistics Canada), generally, key export sectors contributed to the positive shift. Strong performance in energy exports, fueled by global demand and higher commodity prices, played a significant role. Automotive exports also likely contributed positively, although the extent of this contribution would need further specification based on the specific data release.

- Canadian Imports: A decline in imports across several sectors also contributed to the narrower deficit. This could be attributed to various factors, including decreased domestic demand, supply chain adjustments, or strategic inventory management by businesses. Further analysis would be needed to identify the specific sectors where import decreases were most significant. This could include a closer look at manufacturing inputs, consumer goods, and capital equipment.

- Impact of Global Commodity Prices: Fluctuations in global commodity prices, especially energy prices, significantly influence Canadian export earnings. Periods of high commodity prices generally boost exports, contributing positively to the trade balance. This dynamic highlights the significant role of global economic conditions in shaping Canadian trade data.

H2: Impact on the Canadian Economy

The narrowing of the Canadian trade deficit has several implications for the broader Canadian economy:

- Canadian GDP Growth: A smaller trade deficit generally contributes positively to GDP growth. When exports exceed imports, it signifies increased net demand for Canadian-produced goods and services, thus boosting economic activity. However, the magnitude of this impact on GDP growth depends on other factors affecting the economy.

- Employment: The impact on employment varies across sectors. While increased exports may lead to job creation in export-oriented industries (e.g., energy, manufacturing), decreased imports might negatively impact sectors relying on imported inputs. The net effect on employment requires a detailed sector-specific analysis.

- Inflation: The influence on inflation is complex. Lower import costs can ease inflationary pressures, while increased export demand could potentially lead to higher prices for certain goods. The net effect on inflation is difficult to ascertain without considering other inflationary factors.

- Bank of Canada's Monetary Policy: The narrowing trade deficit, alongside other economic indicators (e.g., inflation, unemployment), will likely influence the Bank of Canada's decisions regarding interest rates. A positive trend in the trade balance could provide some flexibility in monetary policy decisions.

H2: Comparison to Previous Periods

Analyzing the current trade deficit in the context of historical data is crucial. By comparing the $506 million deficit to figures from previous months and years, we can identify trends and significant changes.

- Year-over-Year Comparison: Comparing the current deficit to the same period last year would reveal the direction of change. A smaller deficit compared to the previous year would reflect improvement in the trade balance.

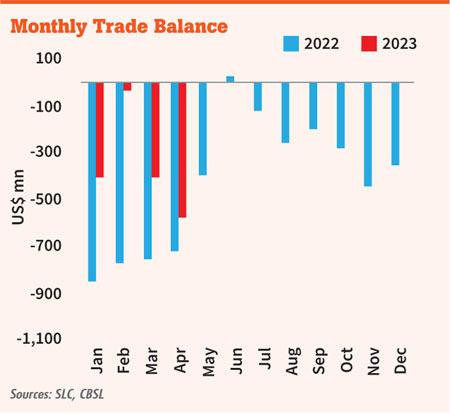

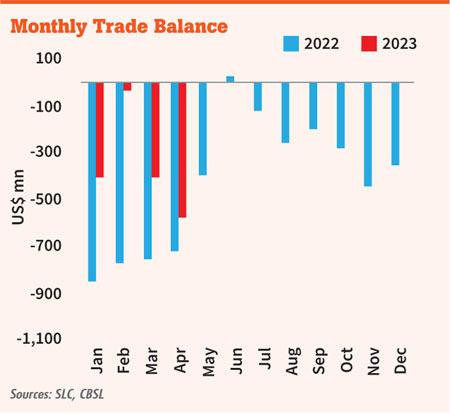

- Graphical Representation: A line graph or bar chart visually presenting the trade deficit over time would highlight trends and fluctuations. This visual representation makes identifying patterns easier and more accessible to a wider audience.

- Analysis of Contributing Factors: Analyzing the trade balance data in conjunction with economic data on key industries and global events allows for better explanations of the observed changes.

- International Comparison: Comparing Canada's trade balance with those of other major economies provides context. This comparison can reveal whether the narrowing deficit is a unique Canadian phenomenon or a broader global trend.

H3: Underlying Factors Contributing to the Narrowing Deficit

Several factors likely contributed to the narrowing of the Canadian trade deficit:

- Global Demand: Increased global demand for Canadian goods and services, particularly in energy and other commodity sectors, boosted exports.

- Exchange Rates: Fluctuations in exchange rates can affect the price competitiveness of Canadian exports and imports. A weaker Canadian dollar, for example, would make Canadian exports more attractive to foreign buyers.

- Supply Chain Disruptions: While supply chain disruptions have eased in some areas, the ongoing impact on imports could contribute to the narrowing of the deficit, particularly if domestic production or alternative sourcing steps in.

3. Conclusion

The recent narrowing of the Canadian trade deficit to $506 million is a positive economic sign. This improvement reflects a combination of increased exports, particularly in sectors like energy, and decreased imports. The impact on the Canadian economy includes potential positive effects on GDP growth and the Bank of Canada's monetary policy decisions, although the overall effect will also depend on other economic factors. However, it's crucial to monitor future Canadian trade data releases to assess whether this is a sustainable trend or a temporary fluctuation. Stay informed about future updates on Canadian trade data and economic indicators by subscribing to our newsletter and regularly checking our website for further Canadian trade data analysis. Monitoring the Canadian trade deficit is vital for understanding the overall health of the Canadian economy.

Featured Posts

-

Pakistan Super League 10 Tickets Sale Opens

May 08, 2025

Pakistan Super League 10 Tickets Sale Opens

May 08, 2025 -

Inters Yann Sommer Out With Thumb Injury Impact On Upcoming Games

May 08, 2025

Inters Yann Sommer Out With Thumb Injury Impact On Upcoming Games

May 08, 2025 -

Recent Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025

Recent Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025 -

Uber Driver Subscription Plans Details And Impact On Commission

May 08, 2025

Uber Driver Subscription Plans Details And Impact On Commission

May 08, 2025 -

Zbulimet E Agjentit Si U Realizua Transferimi I Neymar Per 222 Milione Euro

May 08, 2025

Zbulimet E Agjentit Si U Realizua Transferimi I Neymar Per 222 Milione Euro

May 08, 2025