Recent Ethereum Price Action: Resilience And Breakout Potential

Table of Contents

Ethereum's Recent Price Performance

Analyzing the Dip and Recovery

Ethereum's price has experienced several dips in recent months, but these corrections have been relatively short-lived, often followed by swift recoveries. For example:

- June 2023: A significant dip saw ETH fall below the $1,600 mark, but it quickly rebounded above $1,800 within a week, demonstrating strong support at that level. This correlated with a general market correction affecting Bitcoin and other altcoins.

- July 2023: Another minor pullback occurred, testing the $1,700 support. This was quickly overcome, with ETH reclaiming the $1,800-$1,900 range. The percentage change during this period demonstrated a swift recovery from the dip.

These rapid recoveries suggest strong underlying demand for Ethereum, even amidst bearish market sentiment. Analyzing the candlestick patterns during these periods reveals buyers stepping in to support the price at crucial levels.

Key Technical Indicators

Several technical indicators point towards a potential bullish trend for Ethereum:

- Relative Strength Index (RSI): The RSI has been hovering above 50, indicating an upward momentum. Periods below 50 have been short and quickly overcome, suggesting buying pressure.

- Moving Averages (MA): The 50-day and 200-day moving averages are showing a bullish crossover, a classic technical signal potentially confirming an uptrend.

- Moving Average Convergence Divergence (MACD): The MACD histogram shows positive momentum, further supporting the possibility of continued price appreciation.

[Insert Chart showing RSI, MA, and MACD for ETH]

Factors Influencing Ethereum's Resilience

Growing DeFi Ecosystem

The decentralized finance (DeFi) ecosystem built on Ethereum continues to thrive, driving demand for ETH. This is evidenced by:

- Total Value Locked (TVL): The TVL in various DeFi protocols remains substantial, indicating continued user activity and locked capital within the Ethereum ecosystem. A high TVL suggests that the Ethereum blockchain is actively being used and is valuable to DeFi users.

- Key DeFi Protocols: Protocols like Aave, Uniswap, and Compound continue to grow, attracting significant user participation and driving transaction fees on the Ethereum network. These protocols represent substantial value and utility built on the Ethereum blockchain, contributing to increased demand for ETH.

Ethereum 2.0 Development and Upgrades

The ongoing development and upgrades to Ethereum 2.0 (now called Ethereum) are significantly enhancing the network's scalability and efficiency. This includes:

- Sharding: The implementation of sharding promises to significantly increase transaction throughput and reduce congestion.

- Staking: The staking mechanism incentivizes network security and participation, further strengthening the Ethereum ecosystem.

- Reduced Transaction Fees: The upgrades aim to lower gas fees, making Ethereum more accessible and user-friendly, thereby boosting adoption. These improvements contribute positively to the overall value proposition of ETH.

Institutional Adoption and Interest

Institutional investors are increasingly showing interest in Ethereum, further boosting its price:

- Grayscale Investments: Grayscale, a major digital asset investment firm, holds a substantial amount of ETH in its Grayscale Ethereum Trust.

- Other Institutional Holdings: Several other institutional investors and hedge funds have added ETH to their portfolios, signaling growing confidence in the asset.

- Regulatory Clarity (Potential): While still evolving, increasing regulatory clarity around cryptocurrencies could further encourage institutional participation and drive ETH price appreciation.

Breakout Potential and Future Price Predictions (Cautious)

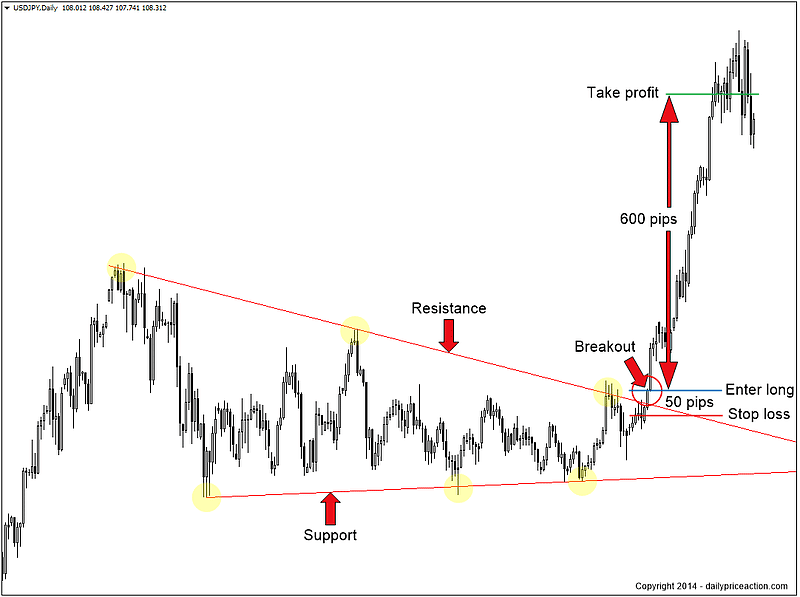

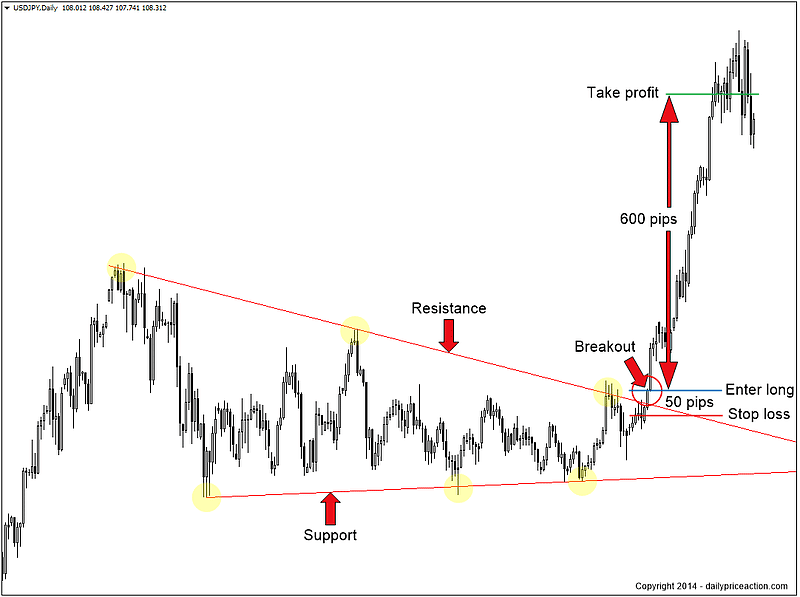

Technical Analysis of Potential Breakout Points

Technical analysis suggests potential resistance levels around $2,000 and $2,500. A decisive break above these levels could trigger a significant upward movement. However, it is important to consider that technical analysis is not foolproof.

- Support Levels: Support levels exist around $1,700 and $1,600. A fall below these levels could signal a short-term bearish trend, but the overall long-term picture appears to be influenced by other fundamental factors.

- Breakout Targets: Depending on the strength of the breakout, potential price targets could reach $3,000 or even higher, but this is highly speculative.

Market Sentiment and Speculation

Market sentiment toward Ethereum is currently positive, with many analysts and commentators expressing bullish predictions. However, it's crucial to remember that price predictions are inherently speculative.

- Social Media Sentiment: Social media sentiment and news headlines can significantly impact investor sentiment, which, in turn, influences the price.

- Analyst Predictions: While analyst forecasts can provide insights, they should be considered cautiously, as they are not guarantees of future performance.

Conclusion

Recent Ethereum price action demonstrates remarkable resilience, fueled by the continued growth of the DeFi ecosystem, progress in Ethereum 2.0 development, and growing institutional adoption. While price predictions are inherently speculative, technical analysis and fundamental factors suggest a potential for a significant price breakout. To stay updated on the Ethereum price and learn more about its potential, continue researching the project, monitor the Ethereum market, and stay informed about the latest developments. The exciting future of Ethereum and its price action warrants continued attention. Explore the Ethereum ecosystem and stay informed about upcoming upgrades and developments for a comprehensive understanding of this evolving cryptocurrency's potential.

Featured Posts

-

Rogues Cyclops Like Powers In New X Men Comics

May 08, 2025

Rogues Cyclops Like Powers In New X Men Comics

May 08, 2025 -

Bitcoin In Son Durumu Guencel Fiyat Ve Trendler

May 08, 2025

Bitcoin In Son Durumu Guencel Fiyat Ve Trendler

May 08, 2025 -

Yavin 4s Return A Star Wars Retrospective

May 08, 2025

Yavin 4s Return A Star Wars Retrospective

May 08, 2025 -

Is Jayson Tatum Out Tonight Latest Celtics Injury News Celtics Vs Nets

May 08, 2025

Is Jayson Tatum Out Tonight Latest Celtics Injury News Celtics Vs Nets

May 08, 2025 -

Sonys Ps 5 Pro A Comprehensive Look At The Announced Changes

May 08, 2025

Sonys Ps 5 Pro A Comprehensive Look At The Announced Changes

May 08, 2025