Recent Tesla Stock Drop: How It Affected The Price Of Dogecoin And Elon Musk's Influence

Table of Contents

The Tesla Stock Plunge: A Detailed Look

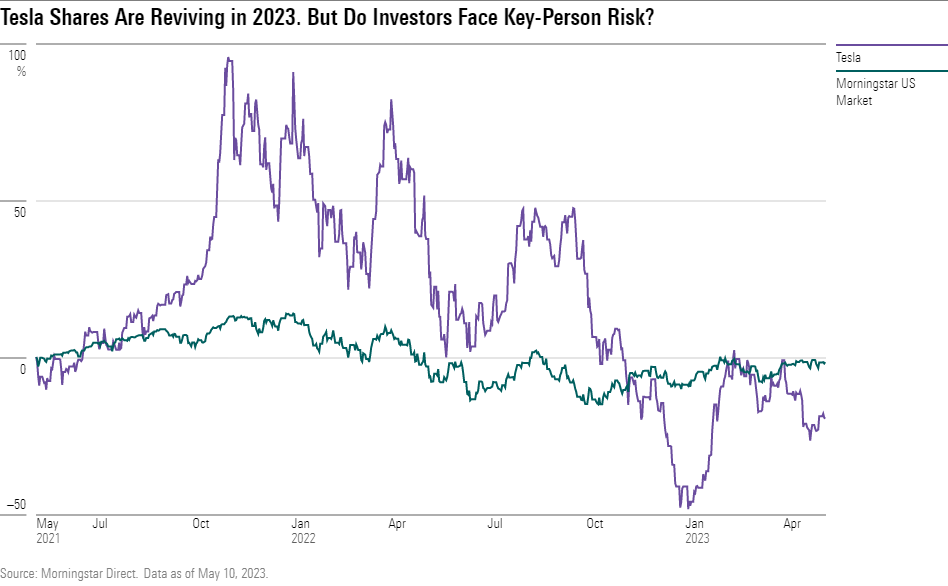

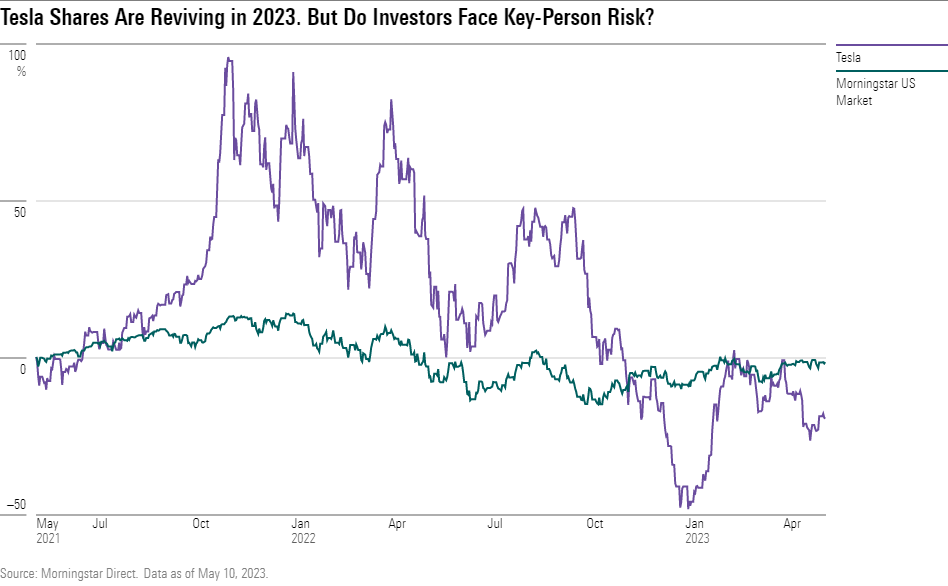

The recent decline in Tesla's stock price was a multifaceted event stemming from a confluence of factors. Investor concerns, broader market trends, and, significantly, Elon Musk's actions all played a role in this dramatic downturn.

-

Impact of Elon Musk's Twitter activity on Tesla stock: Musk's frequent and often controversial tweets have repeatedly influenced Tesla's stock price. His recent activities on Twitter, including his involvement in other ventures and his outspoken opinions, have contributed to investor uncertainty and fueled market volatility. This volatility directly impacts the confidence of shareholders, leading to sell-offs.

-

Analysis of key financial indicators contributing to the drop: Several key financial indicators, including Tesla's Q4 earnings report, production challenges, and increased competition in the electric vehicle market, also contributed to the decline. These factors, combined with broader macroeconomic concerns, created a perfect storm for negative investor sentiment.

-

Comparison to previous Tesla stock fluctuations: While Tesla's stock is known for its volatility, the recent drop was notably significant, exceeding many previous fluctuations. This underscores the amplified impact of the combined factors mentioned above.

-

Expert opinions and market analysis regarding the future of Tesla stock: Financial analysts offer varying opinions on the future trajectory of Tesla's stock. Some remain bullish, citing Tesla's long-term growth potential and innovative technology. Others express caution, highlighting the risks associated with market volatility and the company's dependence on Elon Musk's leadership.

Dogecoin's Correlation with Tesla and Elon Musk

The relationship between Dogecoin, Tesla, and Elon Musk is well-documented. Dogecoin, initially a meme-based cryptocurrency, has experienced dramatic price swings directly correlated with Musk's pronouncements and actions.

-

Instances where Musk's tweets directly impacted Dogecoin's price: Numerous instances exist where Musk's tweets mentioning Dogecoin have resulted in significant price spikes or drops. This highlights the speculative nature of the cryptocurrency and its susceptibility to social media influence.

-

Analysis of the correlation between Tesla stock price and Dogecoin price movements: While not perfectly correlated, a noticeable connection exists between Tesla's stock performance and Dogecoin's price. Negative news about Tesla often translates to a negative impact on Dogecoin, highlighting the interconnectedness of these seemingly disparate assets.

-

Discussion on the speculative nature of Dogecoin and its volatility: Dogecoin's volatility is significantly higher than that of most established cryptocurrencies or stocks. This is largely due to its meme-based origins and dependence on social media hype and sentiment, making it a highly risky investment.

-

Mention of other cryptocurrencies and their reactions to the Tesla news: The Tesla stock drop had a limited effect on other major cryptocurrencies like Bitcoin and Ethereum, suggesting that the correlation was primarily specific to Dogecoin due to Musk's association.

The Mechanism of Influence: How Musk's Actions Affect Both

Elon Musk's influence on both Tesla's stock and Dogecoin stems from his significant social media presence and his perceived ability to single-handedly impact these markets.

-

The power of social media and celebrity endorsements in the stock and crypto markets: Musk’s massive Twitter following grants him immense power to sway public opinion and investor sentiment. His endorsements, whether direct or implied, can significantly affect the price of assets he mentions.

-

Discussion on the ethical implications of Musk's influence: The ethical implications of Musk's influence are a subject of ongoing debate. Critics argue that his actions manipulate markets and disadvantage less informed investors. The lack of clear regulatory frameworks for social media-driven market movements adds to the complexity of this issue.

-

Analysis of regulatory responses and potential future implications: Regulatory bodies are increasingly scrutinizing the impact of social media on financial markets. Future regulations might aim to curb the influence of high-profile individuals on asset prices, potentially impacting Musk's future actions and their market consequences.

Analyzing the Impact on Investors

The Tesla stock drop and its subsequent effect on Dogecoin resulted in significant consequences for investors in both markets.

-

Financial losses experienced by investors in both Tesla and Dogecoin: Many investors suffered substantial financial losses due to the significant price drops. Dogecoin investors, in particular, experienced high volatility and substantial losses.

-

The psychological impact of such volatility on investor confidence: The sharp price swings created uncertainty and eroded investor confidence, impacting both long-term and short-term investment strategies.

-

Strategies for mitigating risk in volatile markets: Investors need to develop strategies to manage risk in volatile markets, including diversification, careful due diligence, and a long-term investment horizon.

-

Long-term implications for both Tesla and Dogecoin investors: The long-term implications remain uncertain, highlighting the need for continued monitoring of market trends and news related to Tesla and Dogecoin.

Conclusion

The recent Tesla stock drop significantly impacted Dogecoin's price, highlighting the considerable influence of Elon Musk on both markets. His actions demonstrate the power of social media and celebrity endorsements in shaping investor sentiment and market volatility. Understanding the interconnectedness of these markets and the potential impact of major players like Elon Musk is crucial for informed investment decisions. Stay informed about the interconnectedness of these markets and the impact of major players like Elon Musk. Continue following news and analysis related to the recent Tesla stock drop, Dogecoin, and Elon Musk's influence to make informed investment decisions. Understanding the dynamics of the recent Tesla stock drop and its effect on Dogecoin is crucial for navigating future market fluctuations.

Featured Posts

-

Metas Whats App Spyware Liability Assessing The 168 Million Judgment

May 10, 2025

Metas Whats App Spyware Liability Assessing The 168 Million Judgment

May 10, 2025 -

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025 -

Investigation Into Nottingham Attacks Leads To Officer Misconduct Meeting

May 10, 2025

Investigation Into Nottingham Attacks Leads To Officer Misconduct Meeting

May 10, 2025 -

Los Angeles Wildfires The Ethics Of Betting On Disaster

May 10, 2025

Los Angeles Wildfires The Ethics Of Betting On Disaster

May 10, 2025 -

Incident A La Mediatheque Champollion De Dijon Un Incendie Signale

May 10, 2025

Incident A La Mediatheque Champollion De Dijon Un Incendie Signale

May 10, 2025