Recession Worries? Why Stock Investors Aren't Concerned

Table of Contents

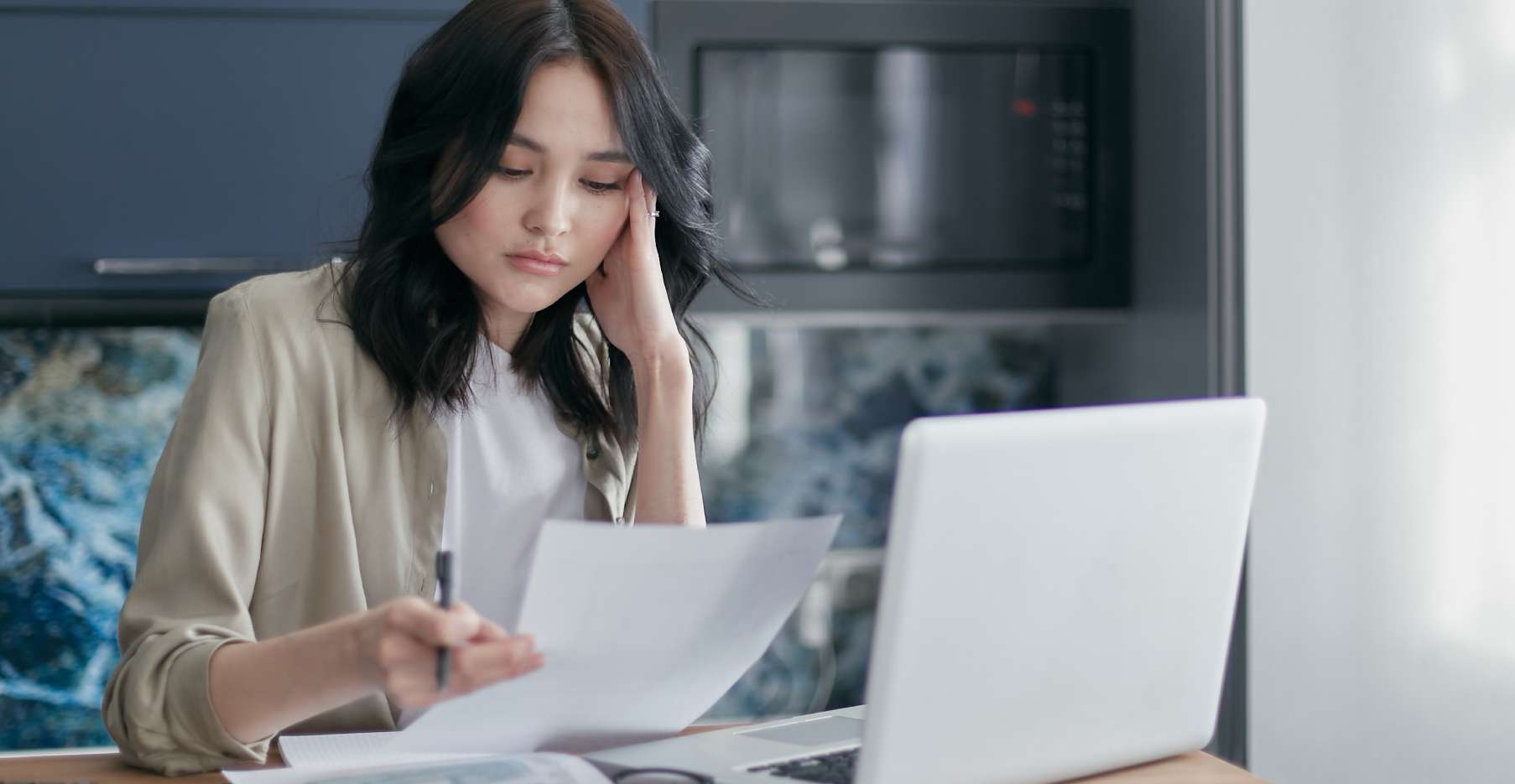

Strong Corporate Earnings Despite Economic Uncertainty

Despite widespread economic uncertainty and inflationary pressures, many companies are exceeding profit expectations. This robust performance is a significant factor in mitigating recession worries among investors.

Robust Profit Margins

Many sectors are demonstrating impressive profit margins, defying predictions of widespread economic downturn.

-

Technology: The tech sector, while experiencing a slowdown in certain areas, continues to show strong earnings in cloud computing, software as a service (SaaS), and artificial intelligence (AI). Companies are adapting to changing consumer behavior and focusing on efficiency.

-

Energy: The energy sector has benefited from increased demand and higher prices, leading to significant profit growth. This resilience has buffered the impact of other economic factors on the overall market.

-

Data points supporting strong earnings: Many publicly traded companies are reporting increased revenue, driven by strategic pricing adjustments and efficient cost-cutting measures. This demonstrates adaptability and a proactive approach to navigating economic headwinds.

Adaptability and Innovation

Companies are showcasing remarkable adaptability and innovation in response to the challenging economic environment.

- Successful navigation: Companies are successfully navigating challenges by streamlining operations, investing in automation, and exploring new market segments.

- Strategic pivots: Many businesses are undertaking strategic pivots, shifting their focus towards areas with higher growth potential. This proactive approach minimizes exposure to declining markets and maximizes profitability.

- Technological advancements: Investment in technology and automation is driving efficiency gains and cost reductions, further bolstering profitability. This highlights the importance of technological innovation as a key driver of resilience in uncertain times.

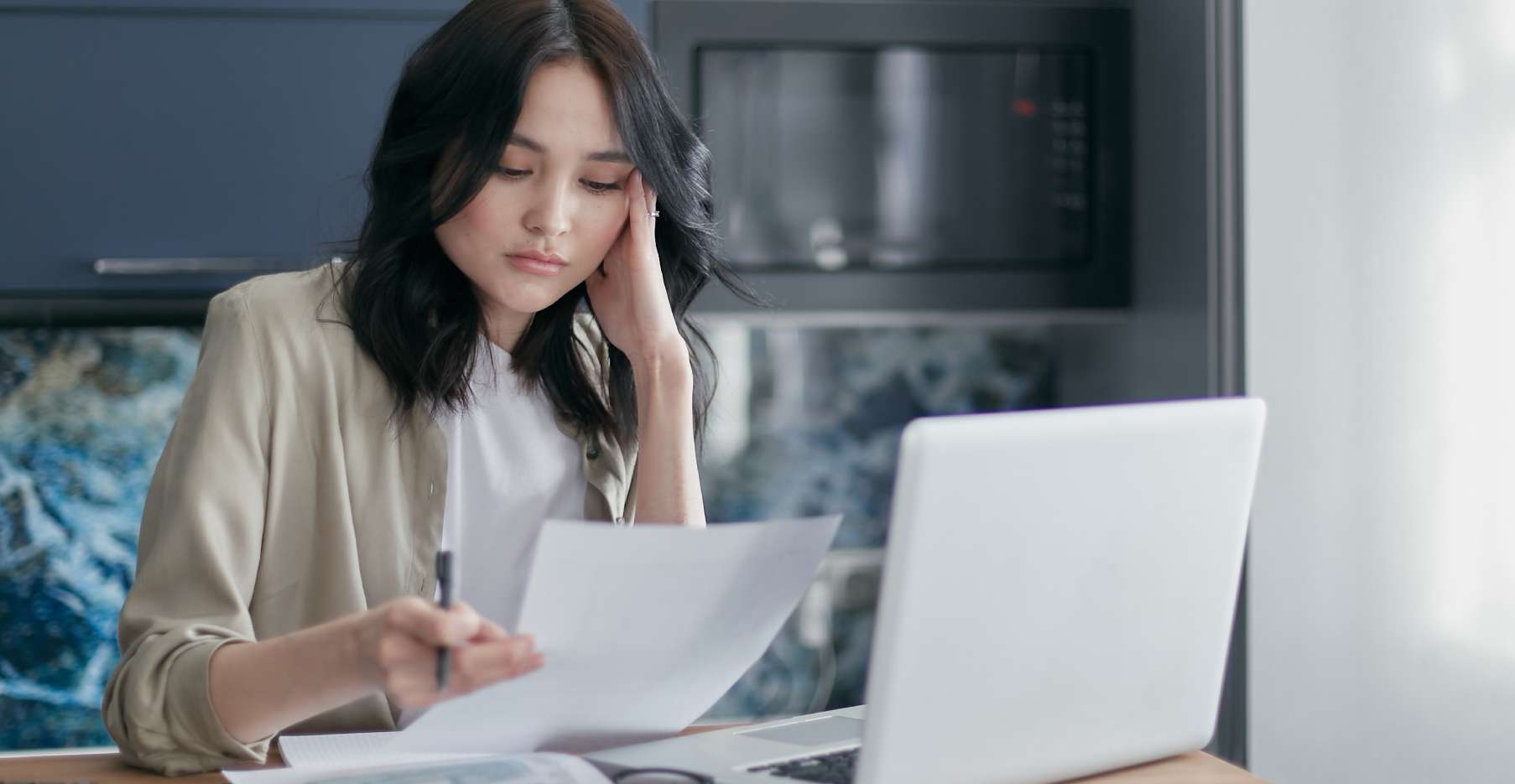

Historical Context: Recessions and Stock Market Performance

While recessions invariably cause short-term market volatility, historically, the stock market has demonstrated a remarkable ability to recover and resume its long-term growth trajectory. Understanding this historical context helps to alleviate some recession worries.

Market Volatility vs. Long-Term Growth

Examining past recessions reveals a pattern: while short-term dips are common, the market generally recovers and surpasses previous highs over the long term.

- Data illustrating historical performance: Analysis of historical market data clearly demonstrates that while recessions often lead to temporary setbacks, the long-term trend remains upward.

- Examples of past recessions: The dot-com bubble of 2000 and the 2008 financial crisis, while significant events, ultimately resulted in market recovery and subsequent growth. This historical context provides reassurance for long-term investors.

Buy-the-Dip Strategy

The concept of "buying the dip" – purchasing assets when prices are low – is a common strategy employed by experienced investors during economic downturns. This approach capitalizes on the eventual market rebound.

- Risk mitigation: While inherently risky, diversification across asset classes and a long-term investment horizon significantly mitigate the risk associated with this strategy.

- Long-term horizons: The importance of long-term investing cannot be overstated. Short-term market fluctuations should not overshadow the broader long-term growth potential of the market.

The Federal Reserve's Influence on Investor Sentiment

The Federal Reserve's actions play a crucial role in shaping investor sentiment and influencing market behavior. Its efforts to manage inflation and interest rates significantly impact recession worries.

Interest Rate Hikes and Their Impact

The Federal Reserve's interest rate hikes are aimed at curbing inflation, but they can also impact borrowing costs and investor confidence.

- Effect on borrowing costs: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth.

- Market reaction to rate increases: Historically, the market's reaction to interest rate increases has been mixed, with some periods of volatility followed by eventual stabilization.

The Fed's Guidance and Market Expectations

The Federal Reserve's communication and guidance profoundly influence market expectations and investor confidence.

- Interpretation of Fed statements: Analyzing recent Fed statements reveals a cautious but optimistic outlook, suggesting that while challenges remain, the central bank is actively working to manage the situation.

- Market expectations: Market participants are keenly focused on the Federal Reserve's future actions, anticipating further interest rate adjustments based on economic data and inflation trends.

Conclusion

Recession worries are understandable given the current economic climate. However, a closer examination reveals several factors mitigating these concerns. Strong corporate earnings, historical market resilience, and the Federal Reserve's active management of the economy all contribute to a more nuanced picture than headlines often suggest. Don't let recession worries paralyze you. Learn more about how to build a resilient investment portfolio and navigate market volatility. Contact us today to discuss your investment strategy and how to approach your financial goals effectively, even during times of uncertainty.

Featured Posts

-

Analyzing The Portrayal Of Women In Mindy Kalings Television Shows

May 06, 2025

Analyzing The Portrayal Of Women In Mindy Kalings Television Shows

May 06, 2025 -

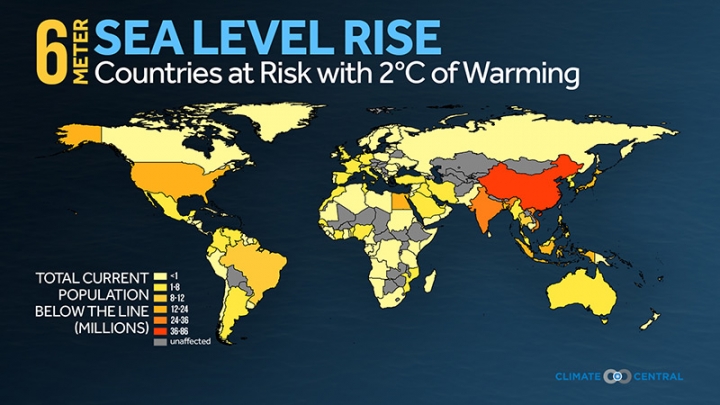

Venices Future The Feasibility Of Raising The City Above Rising Sea Levels

May 06, 2025

Venices Future The Feasibility Of Raising The City Above Rising Sea Levels

May 06, 2025 -

Knicks Vs Celtics 2025 Nba Playoffs Your Ultimate Viewing Guide

May 06, 2025

Knicks Vs Celtics 2025 Nba Playoffs Your Ultimate Viewing Guide

May 06, 2025 -

Miley Cyrus Dan Busana Sebuah Eksplorasi Gaya Yang Berkembang

May 06, 2025

Miley Cyrus Dan Busana Sebuah Eksplorasi Gaya Yang Berkembang

May 06, 2025 -

Vvs V Azerbaydzhani Prizupinennya Roboti Ofisu V Baku

May 06, 2025

Vvs V Azerbaydzhani Prizupinennya Roboti Ofisu V Baku

May 06, 2025