Reciprocal Tariffs: Assessing Second-Order Risks To Key Indian Sectors

Table of Contents

Impact on Indian Exports

Reciprocal tariffs imposed by other countries create a significant headwind for Indian exports. The imposition of tariffs by trading partners leads to a competitive disadvantage for Indian businesses, hindering market access and potentially triggering a slowdown in export growth. Sectors like textiles, pharmaceuticals, and even IT services, which rely heavily on global markets, are particularly vulnerable.

- Loss of market share: Higher prices due to tariffs make Indian goods less competitive, leading to a loss of market share to competitors in countries not subject to the same tariffs.

- Increased production costs: Tariffs increase the cost of production, impacting price competitiveness and potentially reducing profit margins.

- Retaliatory tariffs: The imposition of tariffs can trigger retaliatory measures from other countries, further exacerbating the negative impact on Indian exports.

- Reduced foreign investment: Uncertainty caused by trade wars and reciprocal tariffs can deter foreign investment in export-oriented Indian industries. This limits growth potential and innovation.

Supply Chain Disruptions

The ripple effects of reciprocal tariffs extend far beyond export markets. They significantly disrupt global supply chains, impacting the availability and cost of imported raw materials and intermediate goods crucial for various Indian manufacturing sectors. This affects production efficiency and competitiveness across the board.

- Increased costs for raw materials and components: Tariffs directly increase the cost of imported inputs, squeezing profit margins and potentially leading to price increases for consumers.

- Delays in production schedules: Import restrictions and longer lead times for raw materials can cause significant delays in production, disrupting delivery schedules and potentially leading to lost sales.

- Shifting of supply chains: Businesses might relocate their sourcing or manufacturing to avoid tariffs, leading to a potential shift of supply chains away from India and towards other countries.

- Increased reliance on less reliable suppliers: The search for alternative suppliers in response to disrupted supply chains might force companies to rely on less reliable sources, impacting product quality and consistency.

Inflationary Pressures

Reciprocal tariffs contribute significantly to inflationary pressures within the Indian economy. The increased cost of imported goods, directly impacted by tariffs, translates into higher consumer prices. This can trigger a cost-push inflation scenario, potentially leading to a wage-price spiral.

- Increased import prices leading to higher consumer prices: Tariffs directly increase the prices of imported goods, which are often essential inputs for various industries or consumer products.

- Reduced purchasing power for consumers: Higher prices reduce the purchasing power of consumers, potentially dampening overall economic activity.

- Potential for wage increases to offset rising prices: Workers may demand higher wages to compensate for increased living costs, further fueling the inflationary spiral.

- Impact on the Reserve Bank of India's monetary policy: The RBI may be forced to implement tighter monetary policies to combat inflation, potentially impacting economic growth.

Impact on Specific Indian Sectors

The second-order risks associated with reciprocal tariffs vary significantly across different Indian sectors. Let's consider a few key examples:

- Agriculture: Increased prices for imported fertilizers and pesticides could reduce farmers' profitability. Similarly, tariffs on agricultural exports could severely impact market access and farm incomes.

- Automobiles: The automobile industry relies heavily on imported components. Tariffs on these components would directly impact production costs and vehicle prices, potentially reducing consumer demand.

- Pharmaceuticals: The pharmaceutical sector relies on imported active pharmaceutical ingredients (APIs). Tariffs on these APIs would increase the cost of manufacturing medicines, impacting affordability and access to essential drugs.

Conclusion

The potential second-order risks of reciprocal tariffs on the Indian economy are significant and far-reaching. Understanding these indirect consequences is crucial for mitigating potential economic damage. The impact on Indian exports, supply chain resilience, inflation, and specific sectors necessitates a proactive and strategic policy response. This includes diversifying trade partners, strengthening domestic industries, and investing in supply chain resilience. Further research into the specific sector impacts and the exploration of robust policy responses to mitigate the risks of reciprocal tariffs are crucial for building a more resilient Indian economy. Delve deeper into the topic by researching specific sector impacts or exploring potential policy responses to mitigate the risks of reciprocal tariffs and strengthen India's trade policy in the face of global trade wars.

Featured Posts

-

Injury Update Celtics Holiday Out Tatum And Brown Suit Up For Game 3

May 15, 2025

Injury Update Celtics Holiday Out Tatum And Brown Suit Up For Game 3

May 15, 2025 -

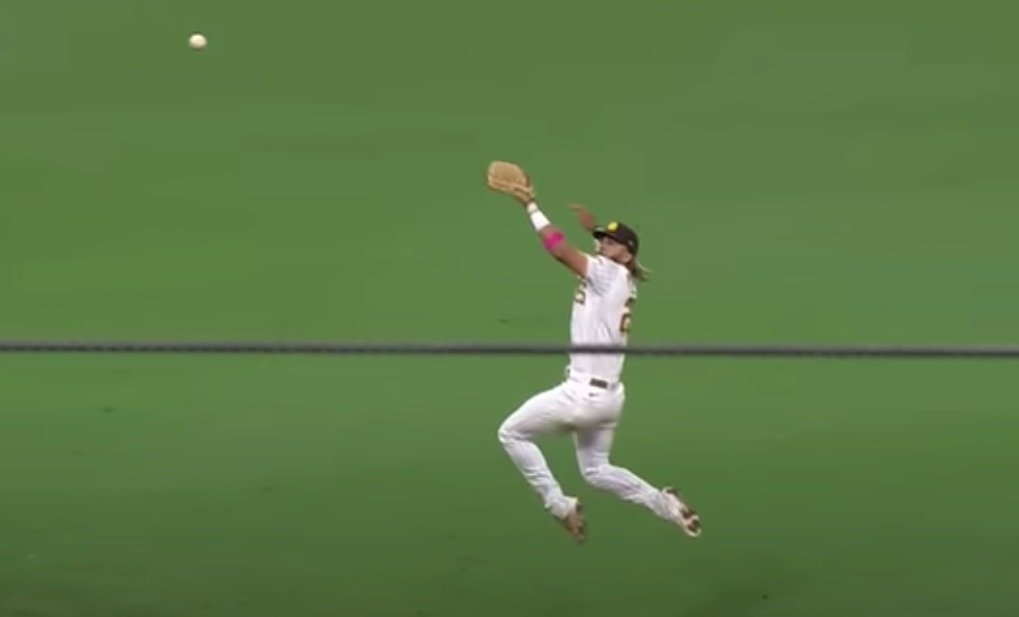

Nfl Stars Casual Fly Ball Grab In Japanese Baseball Game

May 15, 2025

Nfl Stars Casual Fly Ball Grab In Japanese Baseball Game

May 15, 2025 -

Pembangunan Giant Sea Wall Peran Swasta Dan Pemerintah

May 15, 2025

Pembangunan Giant Sea Wall Peran Swasta Dan Pemerintah

May 15, 2025 -

Absurdistisch Jiskefet 20 Jaar Later Ere Zilveren Nipkowschijf

May 15, 2025

Absurdistisch Jiskefet 20 Jaar Later Ere Zilveren Nipkowschijf

May 15, 2025 -

Ere Zilveren Nipkowschijf Voor Jiskefet Een Retrospectief Op 20 Jaar Absurdisme

May 15, 2025

Ere Zilveren Nipkowschijf Voor Jiskefet Een Retrospectief Op 20 Jaar Absurdisme

May 15, 2025