Record April Customs Duties: U.S. Collects $16.3 Billion

Table of Contents

Factors Driving the Surge in April Customs Duties

Several interconnected factors contributed to the record-high April customs duties. Let's examine the key drivers:

Increased Import Volumes

The most significant factor driving the surge in customs duties is the substantial increase in import volumes. Strong consumer spending fueled a significant rise in imported goods across various sectors. This import growth reflects a robust U.S. economy and increased demand for goods not readily available domestically.

- Electronics: Import growth in electronics, particularly smartphones and consumer electronics, saw a marked increase.

- Automotive Parts: The automotive industry experienced a surge in imported parts, reflecting increased vehicle production and demand.

- Apparel and Footwear: Imports in the apparel and footwear sectors also contributed significantly to the overall increase in import volume.

These increases align with positive economic indicators such as rising consumer confidence and strong retail sales figures during the period. The growth in trade volume directly translates to higher customs duties collected by U.S. Customs and Border Protection.

Impact of Tariffs and Trade Policies

Existing tariffs and recent adjustments to trade policies also played a role in boosting customs revenue. While some trade negotiations aim to lower tariffs, others maintain or even increase them on specific goods. This complex interplay significantly impacts the overall tariff revenue generated.

- Section 301 Tariffs: The ongoing Section 301 tariffs imposed on certain goods from specific countries continued to contribute to increased import duties.

- Changes to Harmonized Tariff System (HTS): Minor adjustments within the HTS could influence the classification of imported goods, potentially affecting the applicable tariff rates and subsequently impacting customs duty collection.

- Anti-dumping and countervailing duties: The imposition of anti-dumping and countervailing duties on unfairly traded goods added to the overall tariff revenue.

Strengthening U.S. Dollar

The relative strength of the U.S. dollar against other major currencies during April also influenced the value of collected customs duties. A stronger dollar means that imported goods are effectively cheaper in dollar terms, leading to increased import volumes. However, this also means that the dollar value of the duties collected on these goods is higher.

- Exchange Rate Fluctuations: The U.S. dollar's strength against the Euro and the Chinese Yuan, for example, amplified the value of import duties collected.

- Impact on Import Prices: A stronger dollar lowers the price of imported goods in dollar terms, making them more attractive to consumers and businesses. While this seemingly reduces tariff revenue per unit, the overall increase in import volume offsets this effect.

Implications of the Record Customs Duty Revenue

The record-breaking customs duty revenue has significant implications across various sectors of the U.S. economy.

Government Spending and Budget

The influx of $16.3 billion in customs duties provides the U.S. government with substantial additional revenue. This could lead to a larger budget surplus, influencing fiscal policy decisions.

- Infrastructure Investment: A portion of this revenue could be allocated towards funding critical infrastructure projects.

- Debt Reduction: Some of the surplus may be used to reduce the national debt.

- Social Programs: The increased revenue might also be directed towards expanding or improving social programs.

Impact on Businesses and Consumers

The increased customs duties have a direct impact on businesses and consumers.

- Increased Import Costs: Businesses that rely on imported goods will experience higher import costs, which could lead to increased prices for consumers.

- Consumer Prices: Higher import costs could translate to higher prices for consumers, potentially contributing to inflationary pressures.

- Competitive Landscape: Businesses may face challenges in maintaining competitiveness if they heavily rely on imported goods subject to higher tariffs.

International Trade Relations

The record customs duty revenue also has implications for U.S. trade relations with other countries.

- Trade Negotiations: The revenue might influence the U.S.'s negotiating position in future trade agreements.

- Bilateral Trade Agreements: It could impact discussions and agreements regarding tariffs and trade barriers with other nations.

- Global Trade Dynamics: The increase in customs revenue reflects the complex global trade dynamics and the U.S.'s position within them.

Analyzing the Record April Customs Duties: A Look Ahead

The record $16.3 billion in April customs duties resulted from a confluence of factors: increased import volumes, existing and adjusted tariff policies, and a stronger U.S. dollar. This surge in revenue has profound implications for the U.S. government's budget, businesses, consumers, and international trade relations. Understanding these complex interactions is crucial for navigating the evolving global economic landscape. Stay informed on future updates regarding U.S. customs duties and their impact on the economy by subscribing to our newsletter or following us on social media for the latest trade news and economic analysis. Learn more about U.S. import regulations and their effects on customs duties.

Featured Posts

-

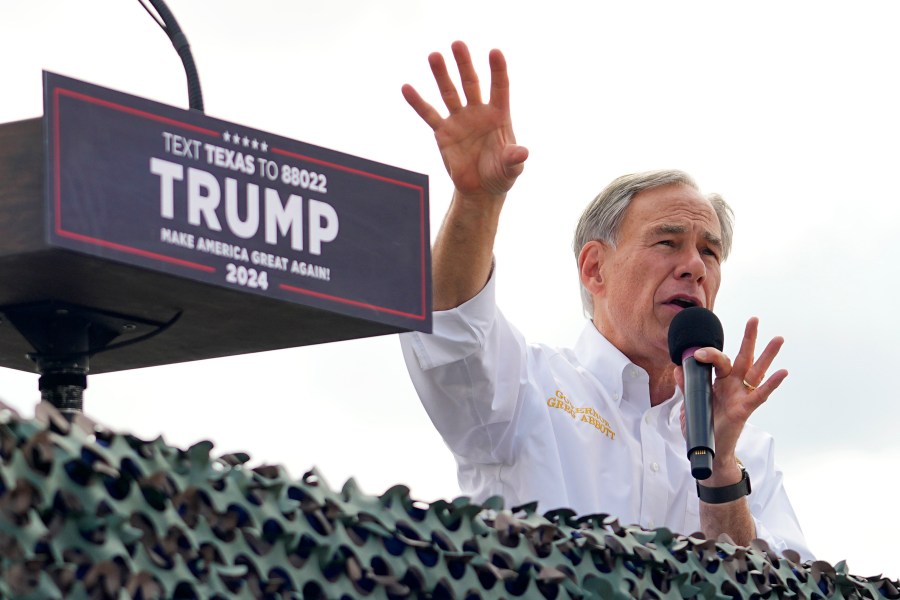

Outcry From North Texas Faith Leaders Over Abbotts Epic City Investigations

May 13, 2025

Outcry From North Texas Faith Leaders Over Abbotts Epic City Investigations

May 13, 2025 -

Met Gala 2024 Leonardo Di Caprio Makes A Statement With Vittoria Ceretti

May 13, 2025

Met Gala 2024 Leonardo Di Caprio Makes A Statement With Vittoria Ceretti

May 13, 2025 -

Eva Longoria 50 Evesen Is Toekeletes Alak

May 13, 2025

Eva Longoria 50 Evesen Is Toekeletes Alak

May 13, 2025 -

Ac Milan Vs Atalanta Cuando Y Donde Ver A Gimenez En La Serie A

May 13, 2025

Ac Milan Vs Atalanta Cuando Y Donde Ver A Gimenez En La Serie A

May 13, 2025 -

Sabalenka Claims Madrid Open Title After Victory Over Gauff

May 13, 2025

Sabalenka Claims Madrid Open Title After Victory Over Gauff

May 13, 2025