Record Ethereum Liquidations: A Sign Of Further Price Drops?

Table of Contents

H2: Understanding Ethereum Liquidations

H3: What are Liquidations?

In the world of cryptocurrency, liquidations occur when a trader's position is automatically closed by an exchange due to insufficient collateral to cover losses. This typically happens in leveraged trading, where traders borrow funds to amplify their potential profits (and losses). When the market moves against a leveraged position, and the loss exceeds the trader's margin (the collateral they put up), the exchange liquidates the position to recover its losses. This liquidation impacts not only the individual trader but also contributes to broader market volatility.

H3: Causes of Liquidations

Several factors can trigger Ethereum liquidations. These include:

- Leveraged trading and margin calls: High leverage magnifies both gains and losses, increasing the likelihood of liquidations during volatile market conditions. Margin calls demand additional collateral; failure to provide it results in liquidation.

- Sharp price drops exceeding stop-loss orders: Stop-loss orders are designed to limit losses, but rapid, unexpected price drops can trigger them before the trader can react, leading to liquidation.

- Unexpected market events (e.g., regulatory news): Significant news announcements, regulatory changes, or security breaches can cause sudden price swings and trigger mass liquidations.

- System-wide issues (e.g., network congestion): Technical issues on the Ethereum network can also lead to unexpected price fluctuations and increased liquidation events.

H3: Measuring Liquidation Volume

The volume of Ethereum liquidations is tracked by various cryptocurrency analytics platforms, providing valuable insights into market sentiment. Metrics like the total value liquidated (TVL) and the number of liquidated positions are closely monitored. Platforms like CoinGlass and Bybt provide real-time data on liquidations across various exchanges. The sheer volume of liquidations serves as a potential indicator of market stress and possible future price movements.

H2: Analyzing Recent Record Ethereum Liquidations

H3: Data and Statistics

Recent data from CoinGlass shows a significant spike in Ethereum liquidations, exceeding [Insert Specific Number and Date] [Insert Link to Source]. This represents [Percentage] increase compared to the previous [Time Period]. [Insert Chart or Graph if possible]. This surge indicates a heightened level of risk-taking in the market and a potential shift in investor sentiment.

H3: Correlation with Price Drops

Historically, periods of high Ethereum liquidations have often been followed by price corrections. While not a guaranteed indicator, it suggests a potential correlation. For example, [cite specific historical example with data]. This highlights the importance of examining liquidation data in context with other market factors.

H3: Other Contributing Factors

Beyond liquidations, several other factors contribute to Ethereum's price fluctuations:

- Macroeconomic conditions: Global economic uncertainty and inflation can impact investor risk appetite and affect cryptocurrency prices.

- Regulatory changes: Government regulations on cryptocurrencies can create volatility and uncertainty in the market.

- Overall market sentiment: General investor confidence and fear in the market significantly influence price movements.

H2: Predicting Future Ethereum Price Movement

H3: Challenges in Prediction

Predicting future cryptocurrency prices is notoriously difficult. The crypto market is highly volatile and influenced by a complex interplay of factors beyond liquidations alone. Attempting to predict price movements solely based on liquidations is risky and unreliable.

H3: Interpreting Liquidation Data

Liquidation data should be interpreted cautiously as just one piece of the puzzle. It's crucial to consider other market indicators, technical analysis, and fundamental analysis before making any investment decisions. Relying solely on liquidation data can lead to inaccurate predictions.

H3: Risk Management Strategies

In the current volatile market, effective risk management is paramount. Traders should:

- Diversify their portfolios across various assets to mitigate risk.

- Use stop-loss orders to limit potential losses.

- Avoid excessive leverage to prevent liquidation.

- Thoroughly research and understand the risks before investing in any cryptocurrency.

3. Conclusion

Record Ethereum liquidations are a noteworthy market event, indicating stress and potentially foreshadowing price corrections. However, they are not a sole predictor of future price movements. Understanding the causes and interpreting liquidation data in conjunction with other market indicators is crucial for informed decision-making. Relying on liquidations alone for price prediction is unreliable. Stay updated on the latest trends in Ethereum liquidations and continue to monitor the market for informed decision-making. Subscribe to our newsletter for more updates on record Ethereum liquidations and other crucial market insights.

Featured Posts

-

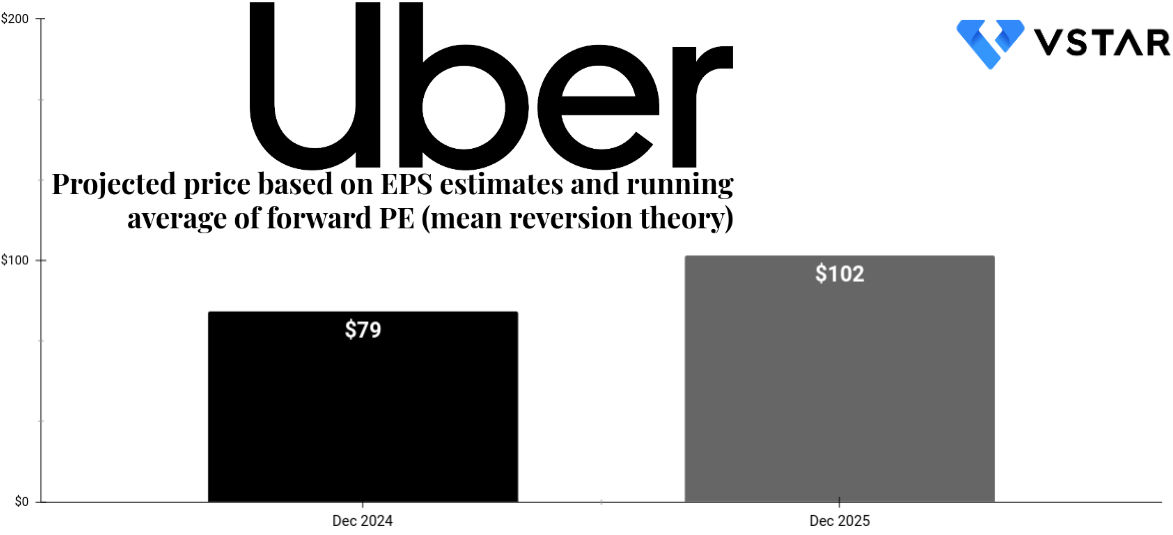

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025

Uber Stock Forecast Will Autonomous Vehicles Drive Growth

May 08, 2025 -

Kripto Piyasa Coekuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Piyasa Coekuesue Yatirimcilar Neden Satiyor

May 08, 2025 -

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025 -

355 000 To Lose Benefits Urgent Dwp 3 Month Warning

May 08, 2025

355 000 To Lose Benefits Urgent Dwp 3 Month Warning

May 08, 2025 -

Iznena Enje U Ligi Shampiona Seged Eliminishe Pariz

May 08, 2025

Iznena Enje U Ligi Shampiona Seged Eliminishe Pariz

May 08, 2025