Reduce Your Student Loan Burden: Advice From A Financial Planner

Table of Contents

Understanding Your Student Loans

Before you can effectively tackle your student loan debt, you need a clear understanding of what you're dealing with. This includes knowing the types of loans you have, their terms, and your overall financial situation.

Types of Student Loans

Student loans fall into two main categories: federal and private. Understanding the differences is crucial for developing a repayment strategy.

- Federal Student Loans: These loans are offered by the U.S. government and often come with more borrower protections and repayment options. They are further divided into subsidized and unsubsidized loans. Subsidized loans don't accrue interest while you're in school, while unsubsidized loans do.

- Private Student Loans: These loans are offered by banks and credit unions. They typically have higher interest rates and fewer repayment options than federal loans. They may also require a co-signer.

Interest rates, repayment terms, and potential benefits vary significantly between loan types. For example, federal loans often offer income-driven repayment plans, which are not typically available for private loans. The implications for long-term repayment strategies are significant – higher interest rates can dramatically increase your total repayment cost.

Consolidating Your Loans

Consolidating your student loans means combining multiple loans into a single loan. This can simplify your payments by reducing the number of monthly bills. However, it’s essential to weigh the pros and cons carefully.

- Potential Benefits: Simplified payment process, potentially lower monthly payments (though not necessarily lower overall cost).

- Potential Drawbacks: May extend the repayment period, potentially leading to higher overall interest paid; loss of certain benefits associated with specific loan types (e.g., income-driven repayment plans).

Income-driven repayment plans (IDRs), discussed in more detail below, can sometimes be a more beneficial alternative to consolidation, especially for those struggling with high monthly payments.

Assessing Your Current Financial Situation

Before implementing any student loan repayment strategy, it's crucial to assess your current financial situation. This involves understanding your income, expenses, and debt-to-income ratio.

- Create a Budget: Track your income and expenses meticulously to identify areas where you can cut back and allocate more funds towards your student loans.

- Calculate Your Debt-to-Income Ratio: This ratio indicates your ability to manage your debt. A higher ratio suggests greater financial strain.

- Understand Your Net Worth: Knowing your assets and liabilities allows you to create a holistic financial picture and strategize accordingly.

A realistic budget is the cornerstone of effective student loan repayment.

Strategies to Reduce Your Student Loan Burden

Several strategies can significantly help you reduce your student loan burden.

Income-Driven Repayment Plans (IDRs)

IDRs, such as IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn), base your monthly payments on your income and family size.

- Lower Monthly Payments: IDRs can dramatically lower your monthly payments, making them more manageable.

- Eligibility Requirements: Eligibility varies depending on the plan and your loan type.

- Potential Forgiveness: Some IDR plans offer loan forgiveness after a set number of years, particularly for those working in public service (Public Service Loan Forgiveness – PSLF).

While IDRs offer lower monthly payments, remember that they typically extend the repayment period, leading to higher total interest paid over the life of the loan. However, the immediate relief can be crucial for many borrowers.

Refinancing Your Student Loans

Refinancing involves replacing your existing student loans with a new loan, often at a lower interest rate. This can save you money on interest over time.

- Lower Interest Rates: A lower interest rate can significantly reduce your total repayment cost.

- Credit Score Importance: A good credit score is crucial for securing a favorable refinance rate.

- Careful Consideration: Do not refinance federal loans unless absolutely necessary, as you may lose valuable benefits like IDR plans.

Compare interest rates from multiple lenders before making a decision.

Making Extra Payments

Even small extra payments on your principal loan balance can make a significant difference over time.

- Accelerated Repayment: Extra payments shorten your repayment timeline and reduce the total interest paid.

- Strategic Payment Timing: Utilize bonuses, tax refunds, or unexpected income to make larger payments.

Use an online student loan calculator to see the impact of extra payments on your total repayment cost. The difference can be substantial.

Seeking Professional Help

Navigating student loan debt can be challenging. Seeking professional guidance can prove invaluable.

Financial Counseling

A certified financial planner or credit counselor can provide personalized advice tailored to your specific financial situation.

- Personalized Repayment Strategies: A financial planner can help you create a comprehensive strategy.

- Resource Identification: They can help you find and utilize available resources and programs.

Find a reputable financial advisor through organizations like the National Association of Personal Financial Advisors (NAPFA) or the Financial Planning Association (FPA).

Debt Management Programs

Debt management programs (DMPs) can help consolidate and manage your debt, but they are not always the most effective solution for student loans.

- Potential Benefits: Simplified payment process, potential for lower interest rates (negotiated with creditors).

- Potential Drawbacks: May negatively impact your credit score, fees may apply.

Explore all options carefully before enrolling in a DMP. Often, strategies mentioned above, like IDRs and refinancing, prove more effective for student loan debt.

Conclusion

Successfully reducing your student loan burden requires a strategic approach. By understanding your loan types, exploring repayment options like income-driven plans and refinancing, and actively making extra payments, you can significantly shorten your repayment timeline and save money on interest. Don't hesitate to seek professional help from a financial planner to create a personalized plan that works for your unique circumstances. Taking control of your student loan debt is a crucial step towards achieving long-term financial well-being. Start taking action today to reduce your student loan burden and build a brighter financial future. Remember to explore options like student loan forgiveness programs where applicable.

Featured Posts

-

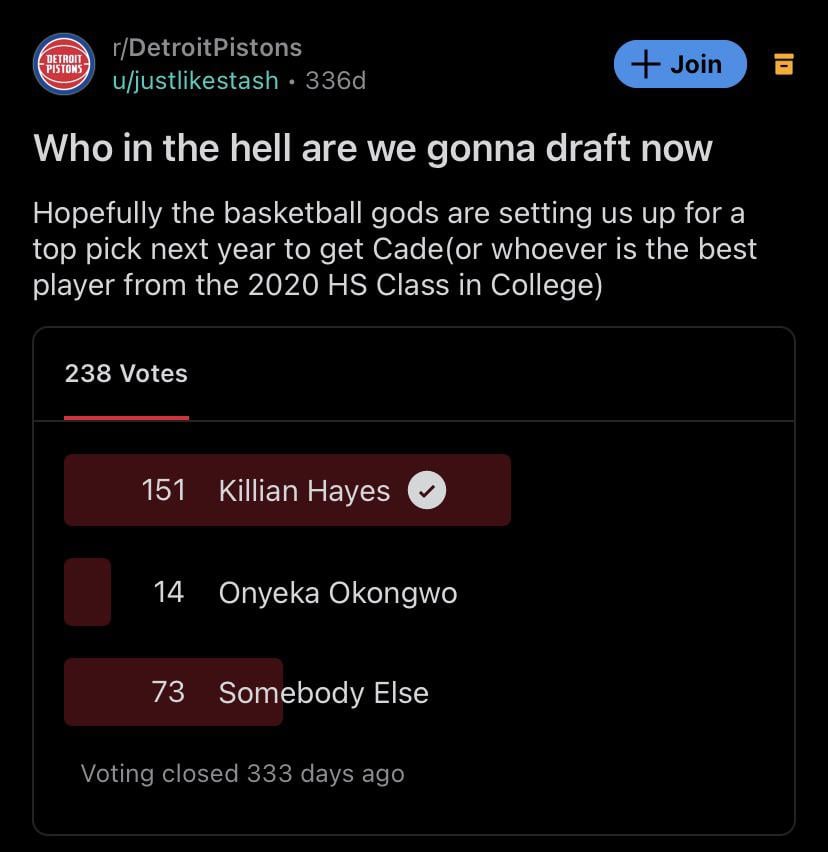

Crew Chief Admits Wrong Call Cost Detroit Pistons Game

May 17, 2025

Crew Chief Admits Wrong Call Cost Detroit Pistons Game

May 17, 2025 -

Resultado Talleres 2 0 Alianza Lima Analisis Del Partido

May 17, 2025

Resultado Talleres 2 0 Alianza Lima Analisis Del Partido

May 17, 2025 -

Cfare U Diskutua Ne Biseden Telefonike Ndermjet Putin Dhe Presidentit Te Emirateve Te Bashkuara Arabe

May 17, 2025

Cfare U Diskutua Ne Biseden Telefonike Ndermjet Putin Dhe Presidentit Te Emirateve Te Bashkuara Arabe

May 17, 2025 -

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025 -

16 Dominant Black Women In Wnba History

May 17, 2025

16 Dominant Black Women In Wnba History

May 17, 2025