Reliance Earnings Surprise: Boost For India's Large-Cap Stocks?

Table of Contents

Analyzing the Reliance Earnings Surprise

Key Financial Highlights

Reliance Industries' latest quarterly results revealed a mixed bag, exceeding expectations in some areas while falling short in others. The Reliance Q[Quarter] earnings showcased robust growth in certain sectors, but challenges remain in others. Let's look at the specifics:

- Reliance Net Profit: [Insert precise figure and percentage change compared to the previous quarter and year]. This represents a [positive/negative] surprise compared to analyst predictions of [insert analyst prediction].

- Reliance Revenue: [Insert precise figure and percentage change]. Growth was primarily driven by [mention key drivers, e.g., strong performance in Jio and Retail segments].

- Reliance Jio Subscriber Growth: [Insert subscriber numbers and growth percentage]. This reflects Jio's continued dominance in the Indian telecom sector.

- Reliance Retail Segment Growth: [Insert revenue figures and growth percentage]. The retail segment continues its impressive expansion, fueled by [mention key factors contributing to growth].

- Debt Reduction: Reliance successfully reduced its debt by [insert figure and percentage], further strengthening its financial position.

Market Reaction to the Reliance Earnings Report

The market reacted swiftly to the Reliance earnings report. The Reliance stock price experienced [describe the immediate price movement – e.g., a sharp increase, a moderate rise, a dip followed by recovery]. Trading volume surged significantly, indicating heightened investor interest. Investor sentiment shifted towards [positive/cautious optimism/concern], reflecting the mixed nature of the results. Market capitalization witnessed a [quantifiable change – e.g., increase of X%]. This volatility underscores the significant influence Reliance holds within the Indian market.

Factors Contributing to the Surprise

Several factors contributed to the surprise elements within the Reliance earnings:

- Jio Platforms' continued growth: The success of Jio Platforms, fueled by its digital services and growing subscriber base, played a major role in boosting overall performance.

- Reliance Retail's expansion: Aggressive expansion and innovative strategies within the retail sector contributed significantly to revenue growth.

- Improved macroeconomic conditions in India: A recovering Indian economy provided a favorable environment for Reliance's businesses to thrive.

- Strategic investments and partnerships: Reliance's strategic investments and partnerships in emerging technologies further bolstered its performance and future outlook.

Impact on India's Large-Cap Stocks

Broader Market Sentiment

The Reliance earnings surprise significantly impacted broader investor confidence in the Indian stock market. The positive aspects of the report boosted overall market sentiment, potentially leading to increased investment in other large-cap companies. However, the mixed nature of the results tempered the enthusiasm. This event serves as a strong indicator of the interconnectedness within the Indian stock market; the performance of a giant like Reliance inevitably influences the perception of other large-cap players. The market outlook for the near future remains cautiously optimistic.

Sector-Specific Impacts

Reliance's performance has had ripple effects across various sectors:

- Telecom Sector: Jio's continued success has reinforced investor confidence in the Indian telecom sector, potentially attracting more investment.

- Retail Sector: Reliance Retail's growth underscores the potential for further expansion and investment in the Indian retail market.

- Energy Sector: [Discuss the impact on the energy sector based on Reliance's performance in this area].

Long-Term Implications

The long-term implications of this Reliance earnings surprise are multifaceted. While the results suggest positive momentum, several factors need consideration:

- Global economic uncertainty: Global economic headwinds could impact Reliance's future performance.

- Competition: Intense competition in various sectors could pose challenges.

- Regulatory changes: Changes in government regulations could influence the company's operations.

- Sustainable growth strategies: The company's ability to maintain sustainable growth strategies will be crucial for long-term success.

Conclusion

The Reliance earnings surprise presents a complex picture. While significant positive aspects, such as robust growth in Jio and Reliance Retail, boosted investor confidence and potentially signaled a positive trend for India's large-cap stocks, challenges remain. Analyzing Reliance earnings carefully reveals a mixed bag, affecting different sectors and long-term prospects differently. It's crucial for investors to stay informed and consider both the positive and negative aspects before making investment decisions. To make informed investment decisions, continue to analyze Reliance earnings, track Reliance stock performance, and carefully consider investing in India's large-cap stocks based on a thorough understanding of Reliance's impact on the market.

Featured Posts

-

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 29, 2025

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 29, 2025 -

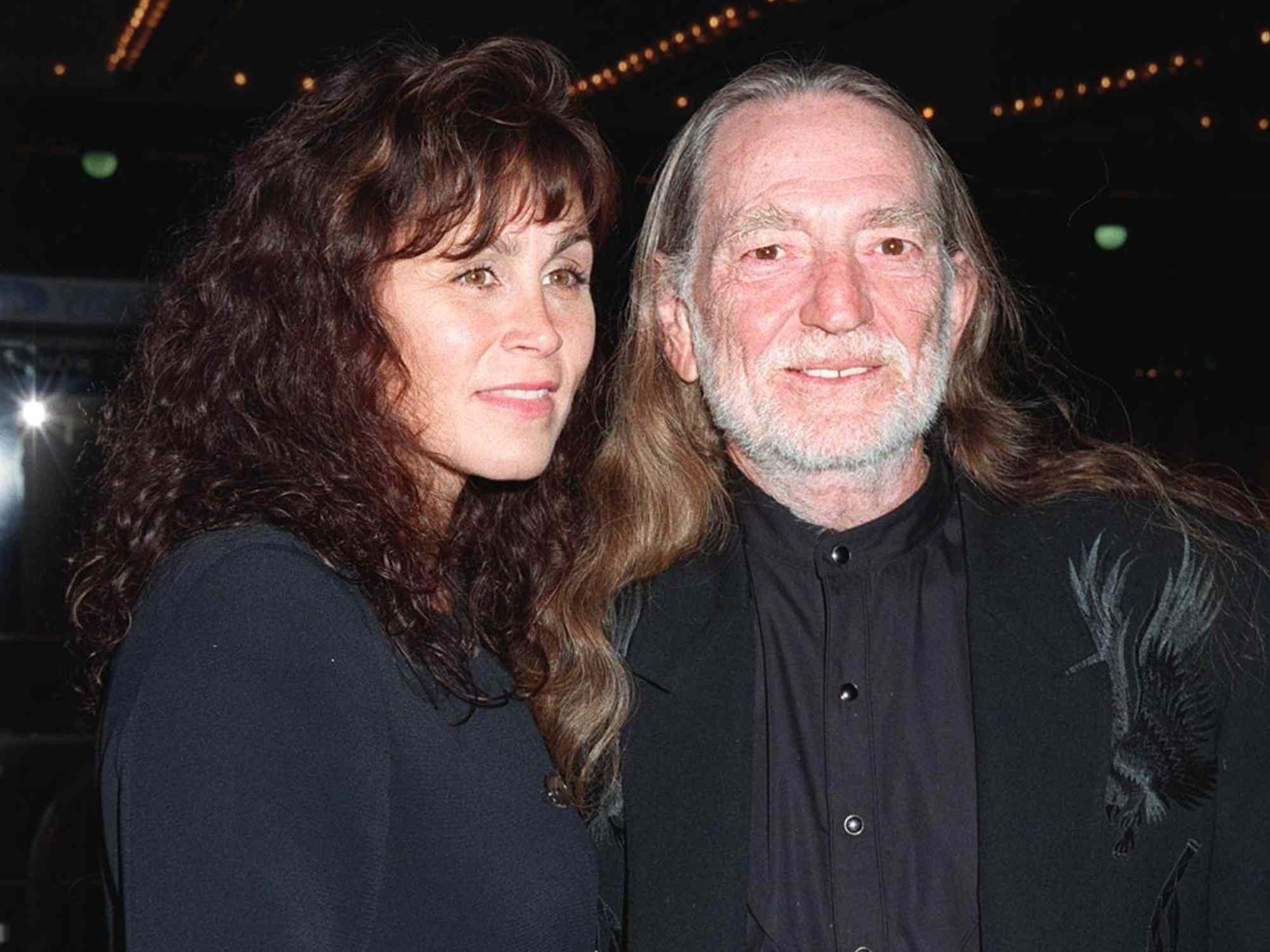

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025

Willie Nelsons Wife Responds To False Media Report

Apr 29, 2025 -

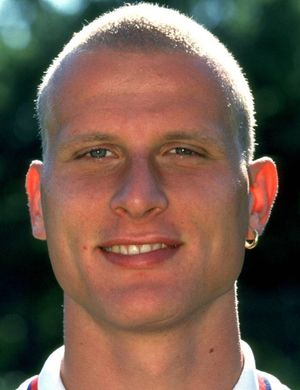

Carsten Jancker Der Neue Trainer Von Austria Klagenfurt

Apr 29, 2025

Carsten Jancker Der Neue Trainer Von Austria Klagenfurt

Apr 29, 2025 -

Why Older Viewers Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Entertainment

Apr 29, 2025 -

Snow Fox Closures And Delays Tuesday February 11

Apr 29, 2025

Snow Fox Closures And Delays Tuesday February 11

Apr 29, 2025