Reliance Stock Market Performance: Significant Gain Driven By Earnings

Table of Contents

Strong Q2 Earnings Fuel Reliance Stock Performance

Exceeding Analyst Expectations

Reliance Industries' Q2 2024 earnings demonstrated exceptional strength, significantly surpassing analyst forecasts. The company reported a net profit of ₹X billion (replace X with actual figure), representing a Y% increase compared to Q1 2024 (replace Y with actual percentage). This is notably higher than the anticipated Z% increase predicted by analysts (replace Z with actual percentage). This positive surprise underscores the company's robust financial health and operational efficiency.

- Net profit: ₹X billion (replace X with actual figure) - a Y% increase (replace Y with actual percentage) compared to Q1 2024.

- Revenue: ₹A billion (replace A with actual figure) - a B% increase (replace B with actual percentage) year-on-year.

- Earnings per share (EPS): ₹C (replace C with actual figure) - exceeding analyst estimates by D% (replace D with actual percentage).

Growth Across Key Business Segments

The stellar Q2 performance wasn't confined to a single sector; rather, it reflects broad-based growth across Reliance's key business segments. This diversified strength contributes significantly to the improved Reliance stock performance.

- Jio Platforms: Continued subscriber growth and increased average revenue per user (ARPU) fueled strong performance in this segment. The expansion into new digital services further boosted revenue.

- Reliance Retail: Impressive expansion into new markets and a strong online presence contributed to substantial revenue growth. The retail segment's performance highlights Reliance's ability to adapt to evolving consumer preferences.

- Reliance Petrochemicals: Despite global market fluctuations, this segment demonstrated resilience, driven by efficient operations and strategic partnerships.

Investor Sentiment and Market Confidence Boosting Reliance Stock

Positive Investor Outlook

The recent surge in Reliance stock performance is closely linked to a significant shift in investor sentiment. Positive news releases, including announcements about new projects and strategic partnerships, have further strengthened investor confidence.

- Several rating agencies upgraded Reliance's outlook, citing strong fundamentals and significant future growth potential.

- Positive analyst recommendations have encouraged increased investment, contributing to the upward trend.

- The successful execution of key strategic initiatives has further solidified investor trust in Reliance's management team.

Increased Foreign Institutional Investor (FII) Interest

A considerable influx of investments from Foreign Institutional Investors (FIIs) has played a vital role in driving up the Reliance stock price. This influx reflects the growing global recognition of Reliance's growth potential and its strong financial position.

- FII investments in Reliance have increased by X% (replace X with actual percentage) in the last quarter, significantly higher than the average for other companies in the same sector.

- This increased buying pressure has directly contributed to the upward momentum observed in the Reliance stock performance.

Future Outlook and Predictions for Reliance Stock Performance

Sustained Growth Potential

Several factors suggest that Reliance Industries is poised for sustained growth, which will likely further enhance its stock performance.

- The ongoing expansion of Reliance's renewable energy portfolio represents a significant long-term growth driver.

- Continued investments in technology and digital infrastructure are expected to yield significant returns.

- Expansion into new markets and diversification of the business portfolio mitigate potential risks and ensure sustained growth.

Potential Risks and Challenges

While the outlook for Reliance is largely positive, it's essential to acknowledge potential risks that could impact future Reliance stock performance.

- Fluctuations in global crude oil prices can affect the profitability of the petrochemicals segment.

- Changes in government regulations could impact various business segments.

- Increased competition in the telecom and retail sectors requires ongoing adaptation and innovation.

Conclusion

The recent remarkable surge in Reliance stock performance is a direct outcome of strong earnings, which have exceeded expectations and solidified investor confidence. The robust performance across diverse business segments, coupled with a positive investor outlook and increased FII interest, paints a picture of sustained growth for the company. Although potential risks exist, the overall outlook for Reliance stock remains optimistic. Understanding the factors driving Reliance stock performance is crucial for investors looking to capitalize on this blue-chip stock's potential. To stay abreast of the latest developments in Reliance stock performance, continue to check back for our regular market analysis and insights. Learn more about investing in Reliance stock today!

Featured Posts

-

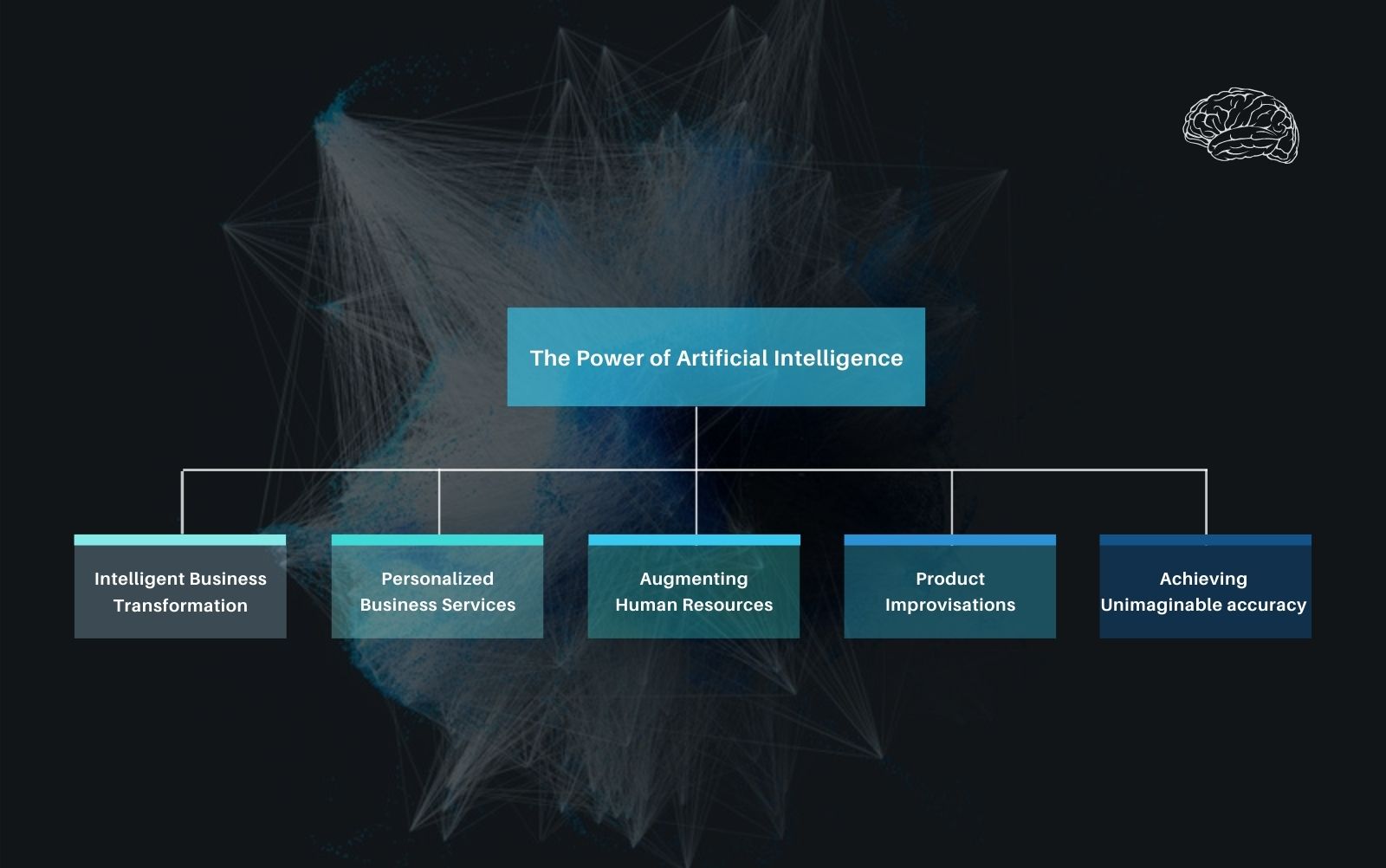

Is Ai Truly Thinking A Critical Analysis Of Artificial Intelligence

Apr 29, 2025

Is Ai Truly Thinking A Critical Analysis Of Artificial Intelligence

Apr 29, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

Apr 29, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

Apr 29, 2025 -

The Link Between Brain Iron Adhd And Cognitive Decline In Aging

Apr 29, 2025

The Link Between Brain Iron Adhd And Cognitive Decline In Aging

Apr 29, 2025 -

Secure Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

Secure Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025 -

Update On Louisville Mail Delays Union Leaders Statement

Apr 29, 2025

Update On Louisville Mail Delays Union Leaders Statement

Apr 29, 2025