Republican Tax Plan Unveiled: Key Details Of Trump's Vision

Table of Contents

Proposed Individual Income Tax Changes

The Republican tax plan proposed sweeping changes to the individual income tax system, aiming to simplify the tax code and reduce the tax burden on individuals.

Lowering Individual Tax Rates

The plan proposed significantly reducing the number of individual income tax brackets, resulting in lower tax rates for many Americans. While the exact rates varied depending on income level, the general aim was to simplify the system and make it more beneficial for taxpayers.

- Lowered Top Tax Bracket: The top individual income tax bracket was significantly reduced, although the precise percentage varied depending on the specific proposal.

- Reduced Tax Rates Across Brackets: Tax rates across all income brackets were generally lowered, aiming to provide tax relief for a broad swath of the population.

- Elimination of Certain Deductions: To offset the revenue loss from lower tax rates, some deductions and credits were eliminated or modified. This impacted the tax liability for some taxpayers, particularly those who previously itemized deductions.

Standard Deduction Increase

The plan included a substantial increase in the standard deduction. This benefited lower- and middle-income taxpayers, many of whom previously itemized deductions, by simplifying their tax filings and potentially lowering their overall tax liability.

- Increased Standard Deduction: The standard deduction was significantly raised for both single and married taxpayers. This meant more taxpayers could utilize the standard deduction instead of itemizing.

- Impact on Tax Liability: The increase in the standard deduction lowered the taxable income for many, leading to a reduction in tax owed.

- Effect on Itemized Deductions: The increased standard deduction made itemizing less advantageous for many taxpayers, simplifying the tax filing process for a larger portion of the population.

Child Tax Credit Expansion

The Republican tax plan also proposed expanding the child tax credit. This aimed to provide greater financial relief to families with children.

- Increased Credit Amount: The proposed plan increased the maximum amount of the child tax credit.

- Expanded Eligibility: Potential changes included expanding the eligibility criteria, allowing more families to benefit from the credit.

- Refundability: Some proposals suggested making the child tax credit partially or fully refundable, allowing low-income families to receive a refund even if they owed no taxes.

Corporate Tax Rate Reduction

A central component of the Republican tax plan was a substantial decrease in the corporate tax rate. This aimed to boost business investment, job creation, and overall economic growth.

Lowering the Corporate Tax Rate

The plan proposed a significant reduction in the corporate tax rate from the previous rate of 35% to a much lower level, making the US more competitive with other nations.

- Reduced Corporate Tax Rate: The proposed rate was significantly lower than the previous rate, aimed at increasing corporate profitability and competitiveness.

- Impact on Corporate Profits: This reduction was expected to increase after-tax profits for businesses, potentially leading to increased investment and expansion.

- Potential Downsides: Critics argued that a drastic reduction in the corporate tax rate could lead to reduced government revenue, potentially exacerbating the national debt.

Impact on Business Investment

Lower corporate taxes were projected to stimulate business investment and capital expenditures.

- Increased Investment: Businesses with higher after-tax profits were expected to invest more in expansion, new equipment, and research and development.

- Job Creation: The increased investment was anticipated to lead to job creation and economic growth.

- Potential for Stock Buybacks: Some argued that the tax cuts might lead to an increase in corporate stock buybacks rather than investment in job creation.

International Tax Implications

The plan also included changes to international taxation, aiming to encourage the repatriation of overseas profits.

- Repatriation of Profits: Incentives were proposed to encourage multinational corporations to bring their profits earned overseas back to the United States.

- Territorial Tax System: Some proposals suggested shifting to a territorial tax system, which would only tax profits earned within the US.

- Impact on Multinational Corporations: These changes significantly altered the tax landscape for multinational corporations operating in the US.

Potential Economic Effects of the Republican Tax Plan

The Republican tax plan's potential economic effects were widely debated, with various predictions and analyses offered by economists and government agencies.

Projected Economic Growth

Proponents argued that the tax cuts would stimulate economic growth, increase job creation, and reduce inflation.

- Stimulus for Economic Growth: The tax cuts were predicted to boost economic activity through increased consumer spending and business investment.

- Job Creation: Increased investment and consumer spending were anticipated to generate new jobs.

- Inflationary Pressures: Some economists warned of potential inflationary pressures due to increased demand.

Government Debt and Deficit

Critics expressed concerns that the tax cuts would significantly increase the national debt and budget deficit.

- Increased Deficit: The substantial revenue loss from the tax cuts was projected to increase the federal budget deficit.

- Long-Term Sustainability: Concerns were raised about the long-term sustainability of the national debt due to the reduced government revenue.

- Offsetting Measures: The plan might have included provisions aimed at offsetting some of the revenue losses, but these were often insufficient to fully address the concerns.

Income Inequality

The potential impact on income inequality was another point of contention.

- Disproportionate Benefits: Critics argued that the tax cuts would disproportionately benefit high-income earners, potentially worsening income inequality.

- Trickle-Down Economics: Supporters argued that the tax cuts would stimulate economic growth that would ultimately benefit all income levels ("trickle-down economics").

- Mitigation Measures: The plan could have included provisions to mitigate the impact on income inequality, such as targeted tax credits for low-income individuals.

Conclusion

The Republican tax plan under President Trump represented a dramatic restructuring of the US tax code. By prioritizing significant tax cuts for individuals and corporations, it aimed to fuel economic growth and benefit American families and businesses. However, the plan's long-term effects, notably concerning the national debt and income inequality, require continuous assessment. Understanding the key details of this Republican Tax Plan, including the Trump Tax Plan's impact on tax cuts and tax reform, is crucial for informed civic engagement. Further research and analysis of the plan's long-term consequences are essential for a complete understanding of its true impact on the US economy. Stay informed about ongoing debates and developments regarding the tax policy.

Featured Posts

-

The Future Of Reproductive Health Over The Counter Birth Control And The Post Roe Landscape

May 15, 2025

The Future Of Reproductive Health Over The Counter Birth Control And The Post Roe Landscape

May 15, 2025 -

Analyzing The Potential Of Kim Outman And Sauer In The Dodgers Organization

May 15, 2025

Analyzing The Potential Of Kim Outman And Sauer In The Dodgers Organization

May 15, 2025 -

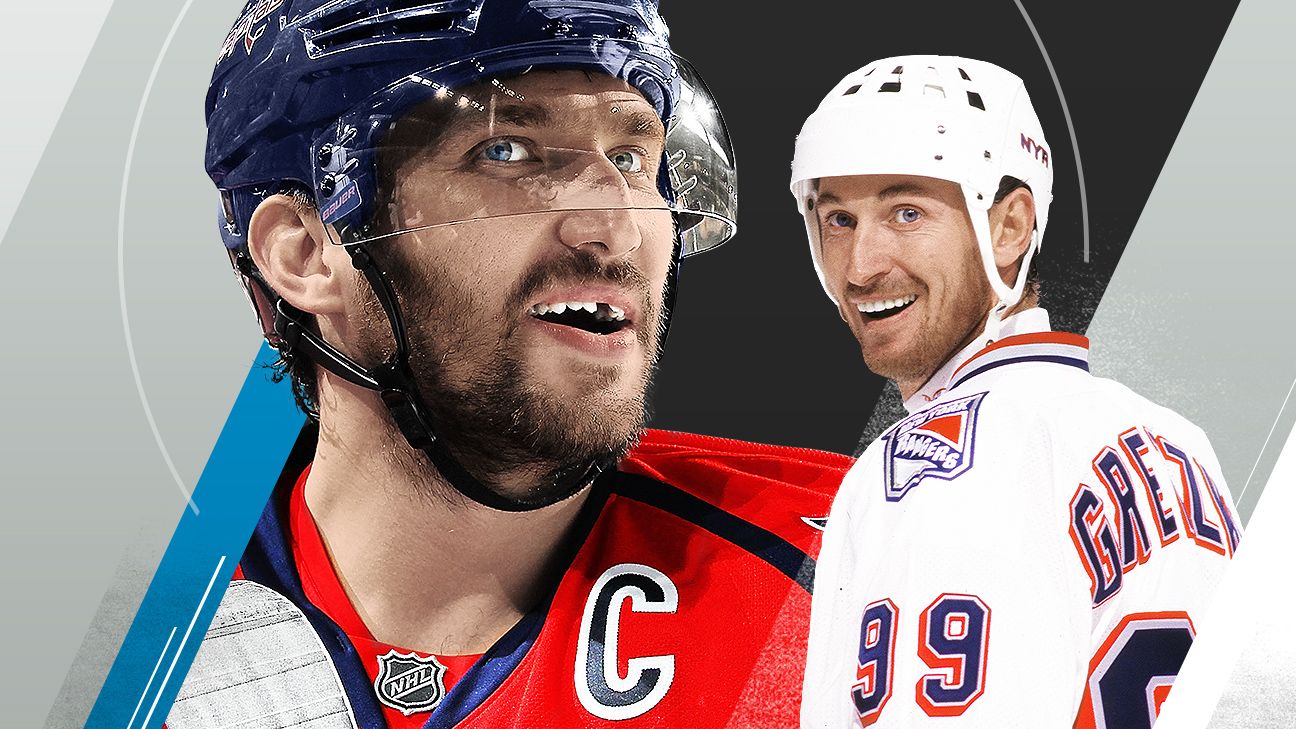

Ovechkin Scores 893rd Goal Closing In On Gretzkys Nhl Record

May 15, 2025

Ovechkin Scores 893rd Goal Closing In On Gretzkys Nhl Record

May 15, 2025 -

Choisir Un Filtre A Eau Protection Efficace Contre La Pollution De L Eau Du Robinet

May 15, 2025

Choisir Un Filtre A Eau Protection Efficace Contre La Pollution De L Eau Du Robinet

May 15, 2025 -

Analysis Joe And Jill Bidens First Public Appearance Following Their Time In The White House

May 15, 2025

Analysis Joe And Jill Bidens First Public Appearance Following Their Time In The White House

May 15, 2025