Retail Sales Surge Pushes Back Bank Of Canada Rate Cuts

Table of Contents

Strong Retail Sales Figures Fuel Economic Optimism

Recent data reveals a significant increase in Canadian retail sales, exceeding expectations and fueling optimism about the country's economic health. This growth offers a compelling counterpoint to concerns about a potential recession. Understanding the drivers behind this surge is crucial for interpreting its implications.

-

Significant Growth: Retail sales jumped by X% in [Month, Year], compared to a Y% increase the previous month and significantly outpacing the Z% forecast by economists. This robust growth indicates a healthy level of consumer confidence and spending power.

-

Sectoral Breakdown: The increase wasn't evenly distributed across all sectors. The automotive sector showed particularly strong growth (A%), driven by [mention specific factors, e.g., increased new car sales, pent-up demand]. The furniture and home improvement sectors also performed well (B%), suggesting continued investment in housing despite a cooling market. Conversely, the clothing sector experienced more moderate growth (C%), possibly reflecting changing consumer priorities or seasonal factors.

-

Underlying Factors: Several factors could be contributing to this surge in consumer spending. Stronger-than-expected employment numbers and modest wage growth have likely boosted disposable income. Pent-up demand from the pandemic, coupled with government stimulus measures in certain areas, may also be playing a role.

-

Nuance and Contrasting Data: While retail sales are strong, it's important to acknowledge other economic indicators. The housing market, for instance, is showing signs of weakness, indicating a potential divergence in economic performance across different sectors. This complexity requires a nuanced understanding of the overall economic picture.

Bank of Canada's Response to Robust Retail Data

The unexpectedly strong retail sales figures complicate the Bank of Canada's decision-making process regarding interest rates. The Bank's primary mandate is to maintain price stability, typically defined by an inflation target of around 2%. Robust retail sales data, however, could signal increased inflationary pressure.

-

Inflationary Pressures: Strong consumer spending can fuel demand-pull inflation, putting upward pressure on prices. The Bank will carefully analyze whether the recent retail sales surge translates into sustained inflation above its target range.

-

Delayed Rate Cuts: The robust retail sales data significantly reduces the likelihood of imminent interest rate cuts. The Bank may opt to maintain its current interest rate or even consider further increases if inflationary pressures intensify.

-

Impact of Delayed Cuts: Delayed or avoided rate cuts will impact borrowing costs for consumers and businesses. Higher interest rates can lead to reduced consumer spending and investment, potentially slowing economic growth. This creates a trade-off between controlling inflation and maintaining economic momentum.

-

Bank of Canada Statements: Recent statements from the Bank of Canada indicate a cautious approach, emphasizing the need to monitor economic data closely before making any significant policy changes. They are likely to prioritize assessing the persistence of the retail sales surge and its implications for inflation.

Potential Implications for Consumers and Businesses

The Bank of Canada's response to the retail sales surge will have significant implications for both consumers and businesses.

-

Consumer Borrowing: Higher interest rates increase the cost of borrowing for consumers, impacting their ability to finance purchases like houses, cars, and other big-ticket items. This could lead to a slowdown in consumer spending in the future.

-

Business Investment: Businesses may postpone investment and expansion plans if interest rates remain high, as borrowing costs rise. This could have a dampening effect on overall economic growth.

-

Mortgage Rates and Housing Market: Higher interest rates translate directly to higher mortgage rates, impacting the housing market and potentially further cooling already slowing activity.

-

Economic Uncertainty: The interplay of strong retail sales and other economic indicators creates a degree of uncertainty, making it challenging for both consumers and businesses to make long-term financial plans.

Alternative Economic Factors Affecting Rate Decisions

The Bank of Canada's interest rate decisions are influenced by a multitude of factors beyond just domestic retail sales.

-

Global Economic Conditions: Global economic slowdown or recession in key trading partners can negatively impact the Canadian economy and influence the Bank's policy decisions.

-

Commodity Prices: Fluctuations in commodity prices, particularly oil, significantly influence inflation and economic growth. High oil prices can fuel inflation, while low prices can boost consumer spending but decrease revenues for energy producers.

-

Supply Chain Disruptions and Geopolitical Risks: Ongoing global supply chain disruptions and geopolitical instability can impact inflation and economic growth, complicating the Bank's assessment.

-

Canadian Labor Market: The strength of the Canadian labor market, including employment rates and wage growth, plays a crucial role in determining consumer spending and overall economic health.

Conclusion

The unexpected surge in retail sales has significantly altered the outlook for interest rate cuts by the Bank of Canada. While robust consumer spending signals a healthy economy, it also presents challenges regarding inflation control. The Bank's future decisions will be a delicate balancing act, considering various economic factors beyond just retail sales data. Understanding the interplay between these factors is crucial for businesses and consumers alike.

Call to Action: Stay informed about the latest developments in Canadian economic policy and the potential impact of Bank of Canada rate cuts (or the lack thereof) on your financial planning. Follow reputable financial news sources for updates on retail sales and interest rate decisions. Understanding the implications of these announcements is key to making sound financial choices in this dynamic economic environment.

Featured Posts

-

Nine Killed In Katsina Attack Policeman Among Victims

May 27, 2025

Nine Killed In Katsina Attack Policeman Among Victims

May 27, 2025 -

Analyzing Renee Rapps Leave Me Alone A Possible Jab At Sex Lives Of College Girls

May 27, 2025

Analyzing Renee Rapps Leave Me Alone A Possible Jab At Sex Lives Of College Girls

May 27, 2025 -

Avrupa Merkez Bankasi Nin Tarifeler Hakkindaki Uyarisi Detaylar Ve Analiz

May 27, 2025

Avrupa Merkez Bankasi Nin Tarifeler Hakkindaki Uyarisi Detaylar Ve Analiz

May 27, 2025 -

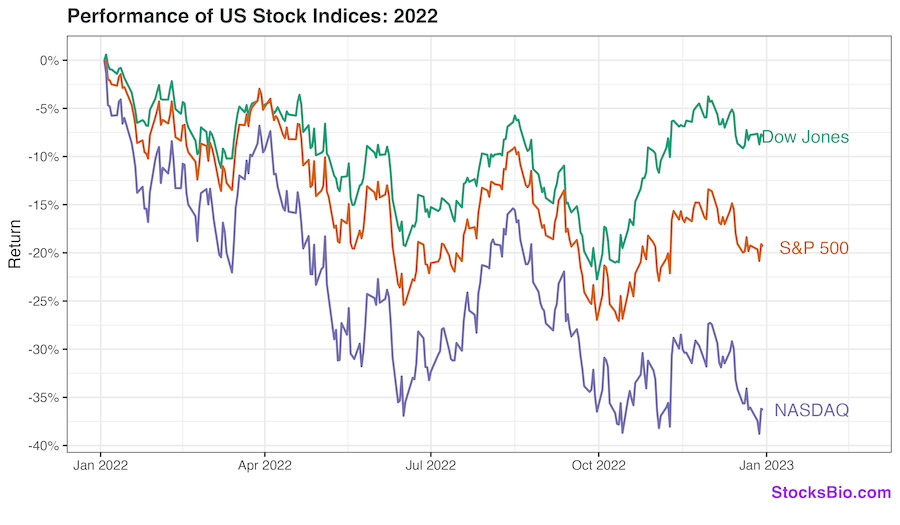

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 26

May 27, 2025

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 26

May 27, 2025 -

The Future Of Romulans Analyzing Character Returns After Ian Holms Controversial Alien Performance

May 27, 2025

The Future Of Romulans Analyzing Character Returns After Ian Holms Controversial Alien Performance

May 27, 2025