Retail Sales Surge Pushes Back On Bank Of Canada Rate Cuts

Table of Contents

Robust Retail Sales Figures Exceed Expectations

Retail sales in Canada experienced a remarkable upswing in [Insert Reporting Period, e.g., July 2024], posting a [Insert Percentage]% increase compared to the previous month/quarter. This significant jump far surpassed economists' predictions and signals a robust consumer spending environment. Several factors contributed to this surge. Increased consumer confidence, fueled by [mention specific contributing factors, e.g., strong employment numbers, government stimulus], played a major role. Additionally, a rise in discretionary spending across various product categories further boosted the overall sales figures.

- Strong Performing Sectors: The automotive sector witnessed particularly strong growth, along with [mention other sectors, e.g., electronics, home improvement].

- Geographical Distribution: While the sales increase was widespread, [mention specific regions showing stronger or weaker growth]. This regional variation provides valuable insights into the diverse economic landscapes across the country.

- Year-over-Year Growth: Compared to the same period last year, retail sales showed a [Insert Percentage]% increase, highlighting a sustained period of growth.

- Supporting Economic Indicators: The positive retail sales figures are further supported by strong employment data, indicating a healthy and active labor market.

Implications for Bank of Canada Monetary Policy

The Bank of Canada's current monetary policy aims to balance inflation control with sustainable economic growth. The central bank has been considering further Bank of Canada rate cuts to stimulate economic activity. However, the robust retail sales data challenges this rationale. Such strong consumer spending suggests a more resilient economy than previously anticipated, potentially pushing inflationary pressures upward.

- Inflationary Impact: The increased consumer spending could lead to higher demand-pull inflation, eroding the Bank of Canada's efforts to maintain price stability.

- Bank of Canada Response: Given these figures, the Bank of Canada might choose to maintain its current interest rates, delay further cuts, or even – a surprising possibility – consider a rate hike.

- Differing Opinions: While the majority view suggests a pause or delay in rate cuts, dissenting opinions within the Bank of Canada and among economists exist, highlighting the complexity of the situation.

Market Reactions and Investor Sentiment

The robust retail sales figures sent ripples through the financial markets. The Canadian dollar experienced a [mention change, e.g., slight strengthening] against major currencies, reflecting increased investor confidence in the Canadian economy. Bond yields also reacted, indicating [mention change, e.g., a slight increase] reflecting expectations of a less accommodative monetary policy.

- Canadian Dollar Exchange Rate: The strengthening of the Canadian dollar suggests increased investor confidence in the Canadian economy.

- Borrowing Costs: The possibility of stalled or even reversed Bank of Canada rate cuts will impact borrowing costs for both consumers and businesses.

- Future Growth Predictions: The current trend of strong retail sales suggests continued economic growth, but the uncertainty surrounding future Bank of Canada rate cuts adds a layer of complexity to these predictions.

Alternative Economic Indicators to Consider

While retail sales provide a valuable snapshot of consumer spending, it's crucial to consider other economic indicators for a complete picture. The employment rate, housing market data, and manufacturing output all play significant roles in informing the Bank of Canada's decision-making process. Economic forecasting is inherently complex, and relying solely on one indicator can lead to inaccurate conclusions.

Conclusion: The Future of Bank of Canada Rate Cuts in Light of Retail Sales Growth

The significant increase in Canadian retail sales has injected considerable uncertainty into the anticipated trajectory of Bank of Canada rate cuts. The robust consumer spending indicates a stronger-than-expected economy, potentially influencing the central bank's response and impacting various sectors of the Canadian economy and financial markets. Further analysis of the Bank of Canada's response to the recent retail sales surge and the implications for future rate cut decisions is crucial. Stay informed about upcoming economic data releases and Bank of Canada announcements to better understand the future trajectory of interest rates and their impact on the Canadian economy. The implications of this retail sales surge on future Bank of Canada rate cuts are far-reaching and deserve close monitoring.

Featured Posts

-

Hamiltons Impact The New Formula 1 Regulations Explained

May 26, 2025

Hamiltons Impact The New Formula 1 Regulations Explained

May 26, 2025 -

Najbogatiji Penzioneri Sveta Otkrijte Grad Sa Najvecim Brojem

May 26, 2025

Najbogatiji Penzioneri Sveta Otkrijte Grad Sa Najvecim Brojem

May 26, 2025 -

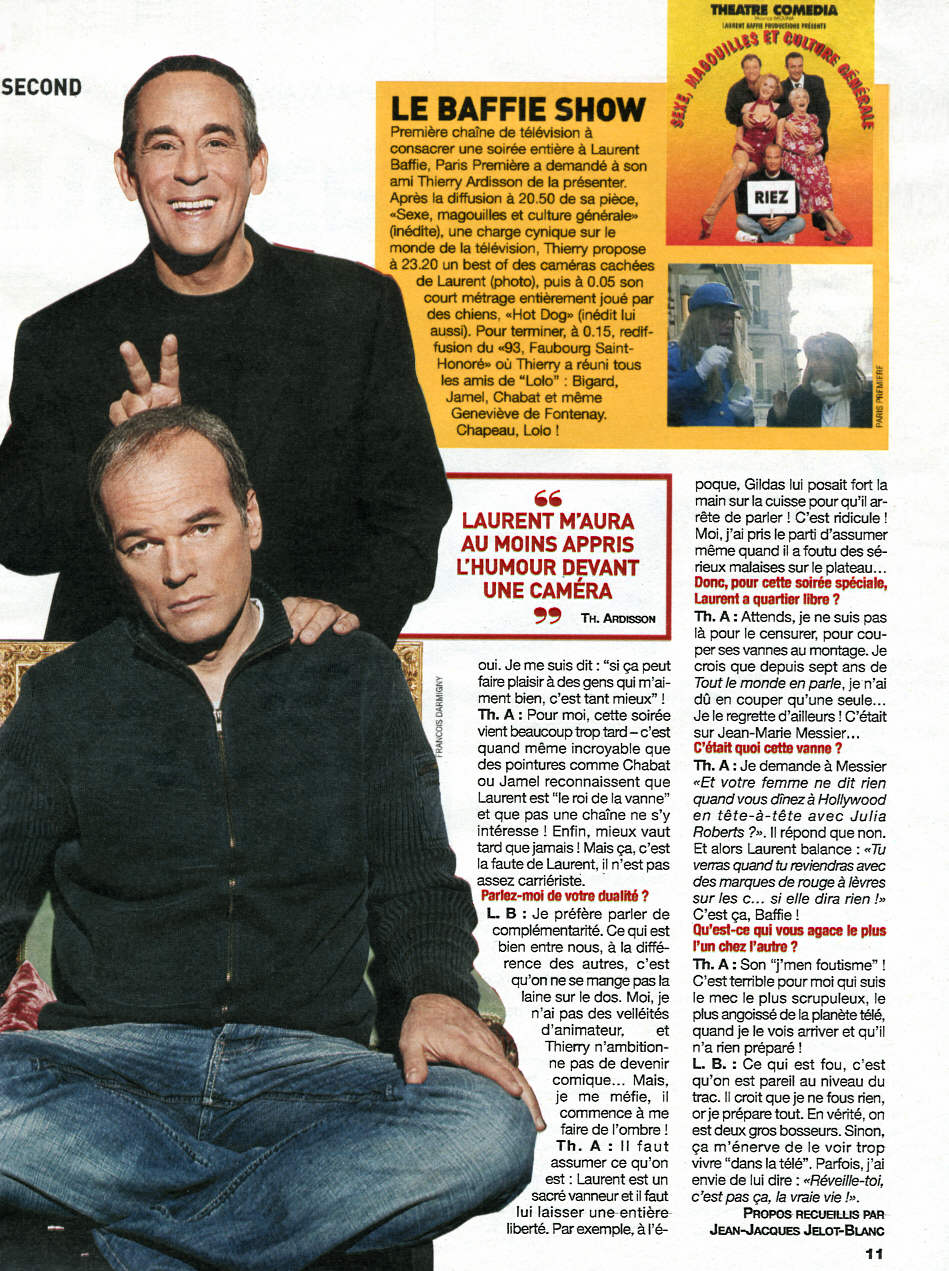

Thierry Ardisson Et Laurent Baffie Une Dispute Memorable

May 26, 2025

Thierry Ardisson Et Laurent Baffie Une Dispute Memorable

May 26, 2025 -

Beyond 40 Examining The Careers Of Formula 1 Icons

May 26, 2025

Beyond 40 Examining The Careers Of Formula 1 Icons

May 26, 2025 -

Toothless And Red Death A Size Comparison From The New How To Train Your Dragon Poster

May 26, 2025

Toothless And Red Death A Size Comparison From The New How To Train Your Dragon Poster

May 26, 2025